How to allocate 2024 tax payment made in 2025 - For planner purposes

I underpaid my 2024 taxes and paid them during tax return in 2025. I categorized them as Federal Tax in Quicken. In tax planner, quicken is considering them as tax withheld for 2025. Is there a way to allocating the amount to 2024 taxes without changing the date of the transaction?

I would prefer NOT to create a new category for underpaid taxes as well.

Answers

-

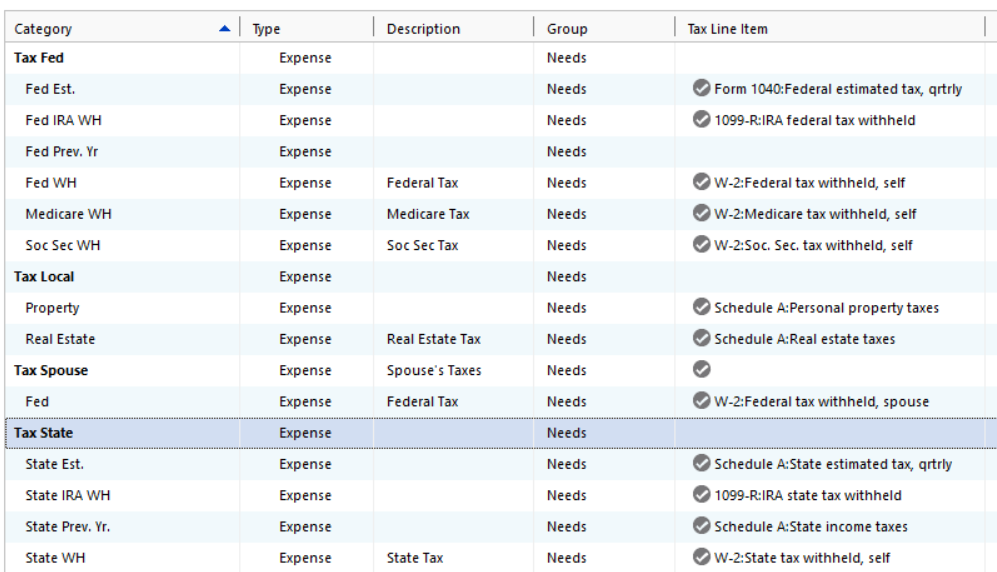

Here are my Categories for taxes

The "WH" Categories are for withholding. The "Tax Fed:Fed Prev. Yr" Category is for last year's taxes paid this year. It has no tax line item because these payments are not deductible. Note that state taxes for the previous year are deductible.

Your report settings will be different depending on whether you want to know "What was my tax liability for 2024?" or "How much did I pay in taxes during 2024?" The best way to find out your total tax liability for a year is to review your tax return.

If you don't want to make any changes to your Categories or existing transactions, you could enter a negative adjustment in the Tax Planner for the 2024 tax payment that were categorized as 2025 withholding. Go to the Withholding - Self line or wherever the payment was recorded and enter the adjustment in the detail section at the bottom.

QWin Premier subscription0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub