Over 65 Tax Exemption

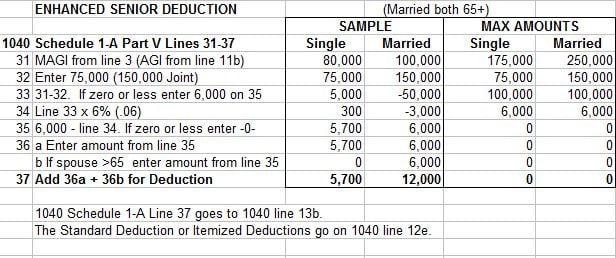

Looking at the 2026 Tax Planner, I am having a difficult time understanding how Quicken is calculating the over 65 tax exemption. It appears to add the $12K for married couples fine, if you do not exceed the $150K threshold. But, if you do go over that limit, the deduction does not appear to be calculated based on the IRS rule invoked. It is suppose to be decreasing the $12K by $.06/dollar over the limit. I have this calculation in an Excel s/s, and the two calculations do not match. Since Quicken does this calculation "behind the scenes", I cannot see how they are doing the actual calculation. Has anyone else experienced an issue with the deduction calculation?

Comments

-

Are you running the latest Quicken version (R65.29)? The calculations may not be correct in earlier versions.

QWin Premier subscription0 -

Yes,I am running the latest and greatest!

0 -

FYI - On a joint return the phaseout is calculated separately for each person, so the 6% phases out for each spouse. Here’s one spreadsheet I made. I think I have another one too.

I'm staying on Quicken 2013 Premier for Windows.

0 -

The calculation in the planner matches the IRS calc by reducing the $12K amount by $0.12 for every dollar of AGI over $150K. There is also the $2K charity deduction to consider in 2026 so don't let it throw you off. And double check your spreadsheet is correct.

0 -

Ah, so the $0.06 is per person, ergo that $0.12 for a married couple. Thank you both for your answers. I will go through my calculations again!

0 -

So, I guess there is still a small issue since Quicken does not calculate MAGI.

0 -

Ah, just found out that you do not need to add the non-taxable portion of social security fot MAGI. That makes the Quicken tax function correct sinceit only uses AGI!

For the New Federal Senior Tax Deduction

No, the nontaxable portion of your Social Security benefits isnotadded back when calculating MAGI for the new temporary federal senior deduction (up to$6,000for single filers or$12,000for joint filers for the 2025-2028 tax years). For this specific calculation, the MAGI is generally your Adjusted Gross Income (AGI) plus only a few specific items like excluded foreign earned income.0

Categories

- All Categories

- 52 Product Ideas

- 34 Announcements

- 247 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 514 Welcome to the Community!

- 680 Before you Buy

- 1.5K Product Ideas

- 55.5K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 832 Quicken on the Web

- 126 Quicken LifeHub