Migrating your Discover Card to Capital One

🤔This may not work for everyone, however it did for me. If you don't have a Capital One account, create one online at CapitalOne.com. If you do have a current account, you'll use it. (Note: I didn't deactivate or close Discover on Quicken.) Open Quicken and click on the + at the top left above the account balances in the account bar. Search for this financial institution = Capital One Card Services. Use your Capital One sign-in. A box will pop up for you to authorize Quicken's access to your Discover account info through Capital One. Check the Discover box. You will then be returned to Quicken. Link to your existing Discover Card account on Quicken in the pop-up box. It will automatically update. Done. In the "account details" box for that account on Quicken, Discover was automatically replaced with Captital One.

As of today, Jan 26, 2026, the banking side of Discover hasn't yet moved but will not update through Quicken, however, the Discover sign-on still works to view your banking accounts and transactions online at Discover.com. ☺️

Comments

-

Similar experience but 1st time I tried add account was only option. Cancelled attempt and then I had to deactivate Discover Card from online access with zzz- Discover Card and go through set up to select link to existing Discover Card account.

1 -

Thanks this worked for me.

1 -

Hello All,

Thank you for sharing your experience and letting us all know what worked for you!

This information will definitely be helpful to others experiencing the same.

Thanks again!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Since I had a Capital One Card, I had to deactive my Discover account on Quicken as advised. The Discover Card account now says Captial One Services, but my Discover transactions that posted yesterday in Capitol One did not download. I updated account again, but transactions still did not download. I guess my next step is to manually export.

0 -

Thanks! That seems to have worked. Wish Quicken had been proactive in telling us how to handle this.

My system then got hung up saying Syncing Quicken and Quicken Cloud and showing an arrow that it is downloading transactions. After letting it run for several minutes, I ended the task in Windows (Ctrl-Shift-Esc), and restarted Quicken. All seems well now..

1 -

Did the same and everything works. Deactivated my Discover card account. "Added" a new Capital One account. Capital One then asked for data sharing approval. Ok'd that. As I had a previous Capital One account, Quicken gave me the option to link it to my Discover account. Everything downloads normally since then.

1 -

This is what worked for me

Right clicked discover account on left hand list, clicked edit, switched to online services tab and then deactivate button.

Then following the initial poster's steps, the link to existing option appeared.1 -

the Post says "As of today, Jan 26, 2026, the banking side of Discover hasn't yet moved but will not update through Quicken, however, the Discover sign-on still works to view your banking accounts and transactions online at Discover.com."

However, I was able to Reauthorize my Discover Banking and Credit Card today (1/28/2026).

1 -

Worked perfectly the first try! Thanks

1 -

How do I move Discover savings accounts to Capital One? I set up new Capital One account for my Discover Card perfectly. I need help with Online banking, IRA and CDs.

0 -

Hello All,

Thank you for continuing to update this discussion. I am glad to hear that some of you have gone through the process successfully!

We were given the directive to have customers use the Discover instance, unless you have received communication from your bank to switch to Capital One. Have you tried migrating your accounts using the Discover instance, rather than Capital One? If not, I would try that. Here are some steps to accomplish it:

- Create a backup of your Quicken file first.

- Deactivate all Discover accounts in Quicken(including the one you moved to Capital One).

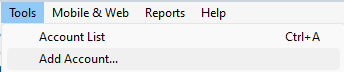

- Select the Tools menu and select Account List....

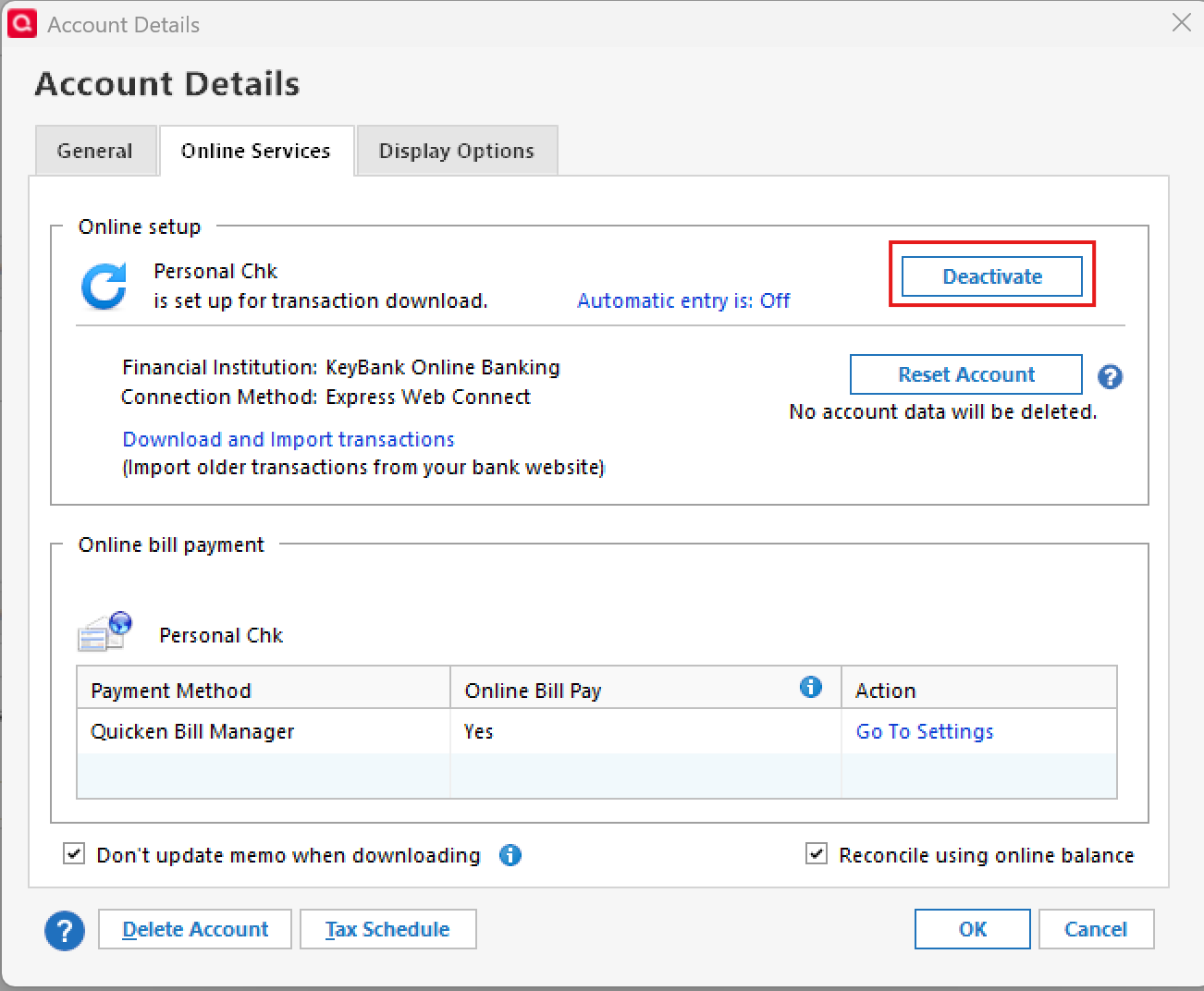

- In the Account List, select the account you want to deactivate, and then click Edit.

- In the Account Details window, click the Online Services tab.

- Click Deactivate next to the service you want to disable.

- Click Yes to the message confirming if you want to disable this service. Note: If you do not receive this message, additional information is available below.

- Click OK to the confirmation message.

- If you have an investment account that is linked to a cash account, you need to deactivate the online services from the investment account, which will automatically deactivate the linked cash account.

- Important: If you are deactivating/reactivating an account to fix an issue, you'll need to deactivate all the accounts with the affected financial institution that you have activated in Quicken (including hidden ones). Once they're all deactivated, then you can follow the steps to reactivate.

- Revoke Quicken’s third-party access from the Discover website.

- Reactivate the accounts in Quicken.

- Go to Tools > Add Account.

- Select the bank for the deactivated account(s). If prompted, select the connection method.

- Enter your credentials and click Connect.

- When the list of located accounts appears, choose LINK next to each account you want to reactivate.

- Click Next, then Done on the last prompt.

Let us know how it goes!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub