HSA Investment account online setup

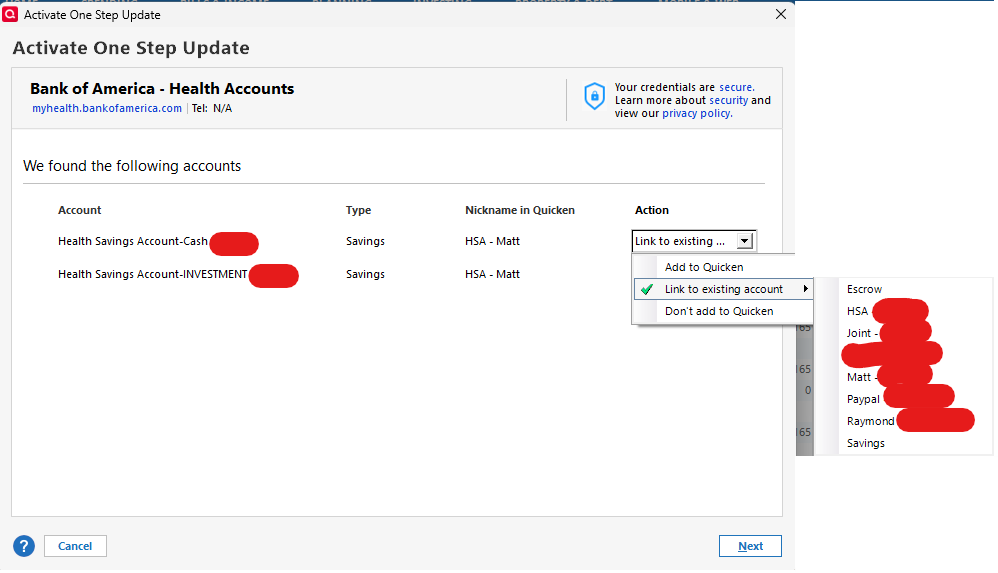

HSA Investment account online setup links the investment account to a quicken savings account type. Therefore, I cannot link my Quicken Investment HSA Account to use online.

Answers

-

I notice that "Link to Existing" was the action for both accounts. Have you already created these accounts in Q?

If so, try taking a backup and then linking the HSA-Investment account to the Investment account in Q. If that doesn't work, you can always restore from the backup.

Also, 2 accounts at BofA have to be 2 accounts in Q … but I notice that you have the same nickname for both … which also might be the issue. You can't link 2 accounts at a bank/brokerage into the same account in Q?

Also, what Q product are you running? Do HELP, About Quicken for this info.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Both accounts have already been created in quicken. 1. a savings account 2. an investment account.

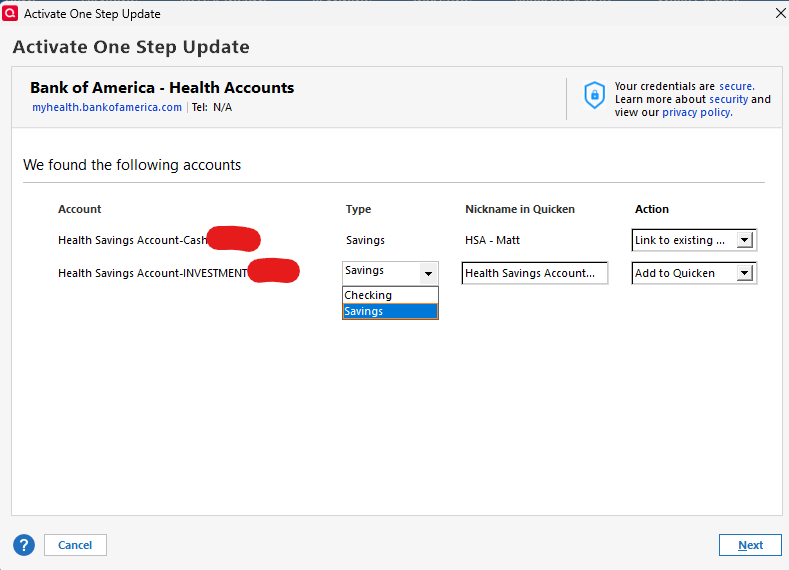

I am unable to link my investment account because the dropdown of available accounts is filtered to only show savings/checking accounts.

When choosing to add-to-quicken, the type option available is only saving/checking. Neither allows for investment transactions (equity/fixed income). So creating a new savings account for the HSA investments is not a viable option.

0 -

I have a cash only HSA and an Investment HSA that I set up long ago. I created both of them as Investment Accounts as I never planned on taking distributions out of the cash only Account, so for all practical purposes it was an "investment" Account, with the lowest allowed balance.

Quicken has never had (and still doesn't have as far as I know, though I'm a bit behind on "updating" versions) any "HSA-specific Account Type so I don't understand your inability to use an Investment Account Type - tax deferred - for you investment HSA. At a guess "Bank America" per se doesn't have investment accounts, even if they're marketed as such. Bank of America is a bank, so I'm guessing that any "Bank America" investment account is really lodged in their Merrill Lynch arm as ML is a broker. Maybe that's the problem here?

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 248 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub