Gain Loss Calculations in a tax deferred account

I posted this in another discussion but figured a new discussion may be helpful. It related to an HSA but could be relevant to any tax deferred or brokerage account.

I'm tracking my HSA as two separate accounts. First, the cash portion as a checking account. The Investment portion I set up as a brokerage account. The brokerage account is identified as "tax deferred" but more accurately should be shown as tax exempt. When I run an "account overview", Quicken shows reinvested dividends as part of the "cost basis" and uses that cost basis to calculate Gain/Loss. This results in understating the investment Gain/Loss significantly. I know this would make sense in a taxable account where you pay taxes on dividends annually so that the Gain/Loss represents capital gains (avoiding double taxation where dividends that have already been taxed as such are taxed again as capital gains) BUT in this context it makes no sense to me. If I invested $2000 5 years ago, the fund paid $350 in dividends over the past 5 years and is now worth $2,100. My 5 year gain is $100 ($350 in dividends less $250 in unrealized losses). Quickens Account Overview shows Gain/Loss as a Loss of $250. I'd like a setting where reinvested dividends do NOT increase the cost basis for purposes of calculating the Gain/Loss of the individual investment. Perhaps I am doing something wrong in my transaction entries or set up. Any thoughts would be appreciated

Comments

-

The calculation of the Gain/Loss number as shown in the brokerage Account's Holdings is exactly the same irrespective of the tax attributes of the Account. In all cases it's shown as (value of position - cost of that position = gain or loss). So I don't really understand where you're coming up with your "understatement" statement.

The gain/loss figure doesn't "care" that some of the cost basis arose from dividends - dividends that you reinvested - or if the cost came from "new money", it's simply a picture, at a specific point, of "here is what your holding is worth, here's what that position cost you, here's the difference."

You are correct that the dividends represent a form of "income" to you, but it's income that you chose to use to purchase more stock, increasing your number of shares and increasing your cost. It works exactly the same in your after tax or tax deferred Accounts.

0 -

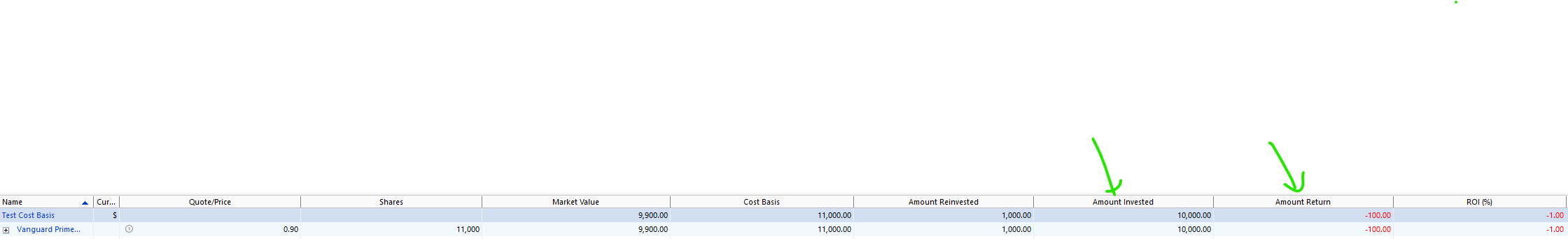

You are looking for "Amount Invested" + "Amount Returned" which you can see on the Investing tab → Portfolio.

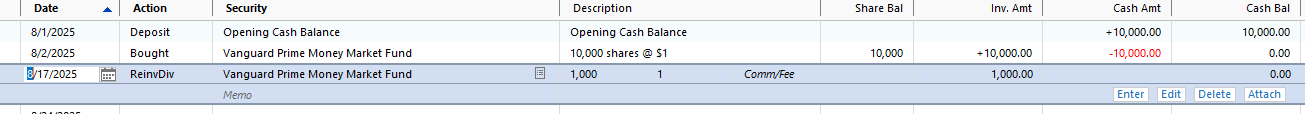

Example, security with a price of 1 until I changed the price to .9 today with these transactions:

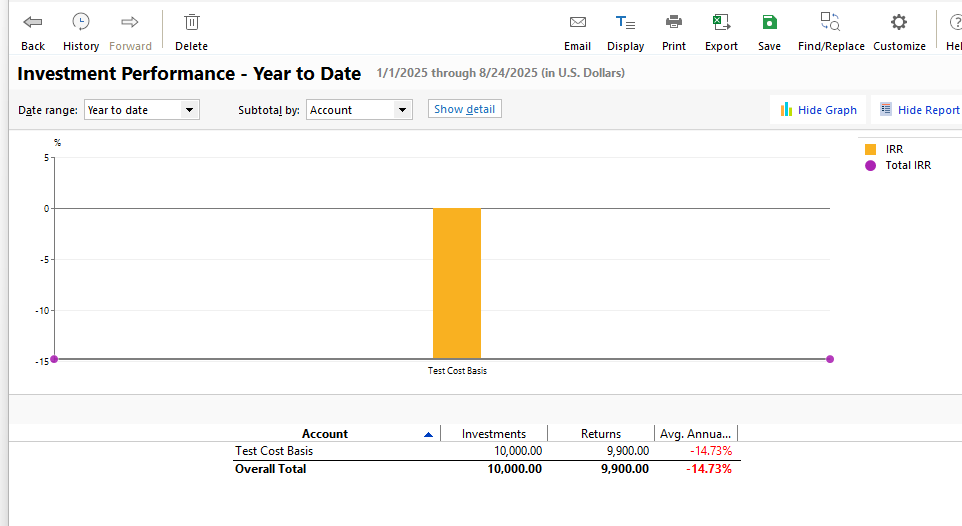

Or the Investment Performance report where you include unrealized gains:

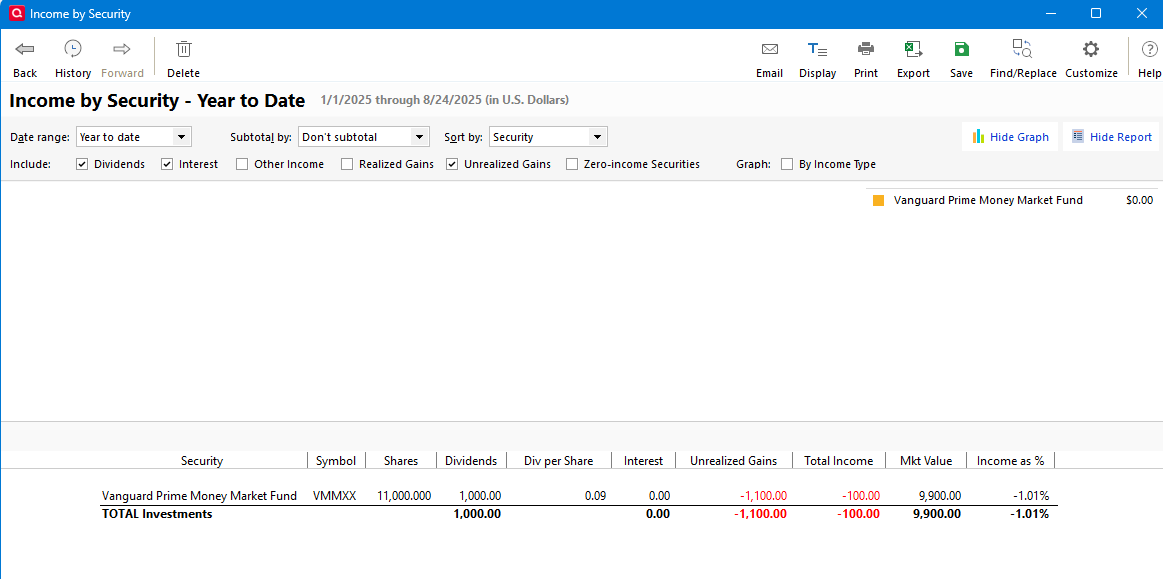

Or if you have Premier there is the Income by Security where you can include the unrealized gains.

Signature:

This is my website (ImportQIF is free to use):0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub