Barclays GM Card, new account setup oddities after hand off from Marcus (Goldman Sachs)

I have a GM Credit Card since/from the early 1990s. GM recently handed off the credit cards from Marcus, a CC brand name used by Goldman Sachs, to Barclays.

The actual, official handoff date was 25 August 2025 per multiple hardcopy mailings and emails from GM & Marcus.

I received and activated the new Barclays branded GM Card and created an online account. Everything fine so far. In fact, extra credit goes to Marcus and Barclays for making Marcus PDF statements available back one year, directly from the new Barclays online account. Maybe that's normal but I never saw this before.

The oddity: When I added the new Barclays account (early September, a few weeks after the cut over date), the opening balance transaction is dated 20-Jan-2025. I would have expected this to be some date in August 2025, because the Marcus card was active and usable through 25 August.

The additional oddity, I have two additional entries, dated 21-Jan and 13-Feb, one for a charge and one for a payment. Both these two entries were in the Marcus account when it was active, and both were cleared and reconciled.

I don't get how there can be such obvious mistakes in this — account entries dated eight months before the account actually existed. You'd think there would be rules and checks against something like this.

This is mostly a rant and observation.

I only have one question in this, do I modify the opening balance transaction date to show the actual opening date, or do I leave it as is from what was populated in the account setup process? I already voided the two transactions because they were duplicates and already existed in the Marcus account.

Comments

-

Hello @Retired Coal Miner,

Thank you for sharing your experience! The opening balance transaction is a balance adjustment automatically created by Quicken. You should be able to edit the date without causing any issues in the account. I recommend that you backup your Quicken file first, just in case.

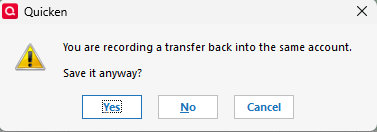

Note: When you save your edit to the opening balance transaction, you may see a message come up saying that you are recording a transfer to the same account.

If you see that message, click Yes. Documenting it as a transfer into the same account is a way to ensure the opening balance is not counted as an income or expense transaction.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub