zzz-Fidelity Updates

Comments

-

For EWC+, trades and and cash are almost 2 days old. Note the example on the prior post. EWC+ logs trades and cash balance at 12am on 9/25/2025 while DC logs it at 9/26/2025 3:30am.

Deluxe R65.29, Windows 11 Pro

1 -

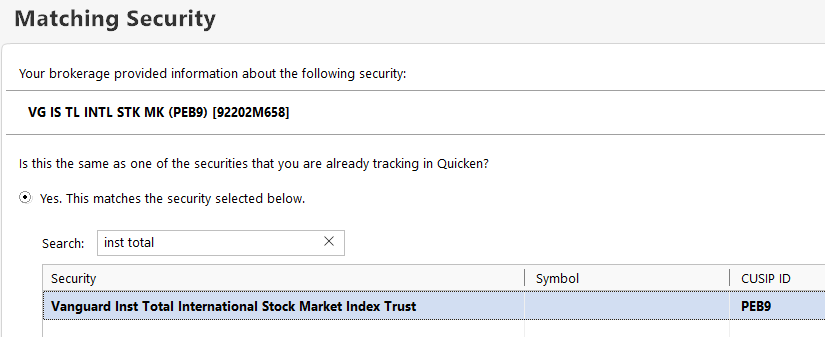

Quicken has lost over 5 years of prices for one of my non-public 401(k) funds, probably because I didn't answer the question right posed when Quicken thought one of my securities was renamed due to the EWC+ transition.

0 -

Quicken isn't loading any transactions for my Fidelity Trust after tax for the past 6 days, so this isn't a day or two delay.

For another 401k account Quicken downloaded all contribution / Buy transactions, but all came without proper Security, so I had to select the Security for each manually.

This new EWC+ is so broken for me.

Best Regards1 -

@SKna

This is not a known issue for Quicken. The support rep you talked to clearly confused it with the money market/cash account issue that is tied to brokerage accounts. The credit card awards account is an FDIC account that belongs under banking and is not related to a brokerage account.

I called today and the support guy told me to report it to Fidelity (like that is my job). I requested a supervisor, walked through the issue, and she opened a formal bug with development (ticket 11974368). This was like a 2 hour call.Clearly this is not something that has been addressed.

3 -

100%. This is excellent advice.

I don't think anyone knows how long it will take for problems related to EWC+ to be fixed (we're on 35 pages of comments now) Even when one person (or even Quicken) says they are fixed, a dozen others come in over the next few days showing they are still broken. Remaining on DC seems like a solid choice. I'm planning to wait until I see month or so of stability without complaints before switching. This is really a mess.

That said, it's such a pleasure and relief to see Quicken working correctly. I depend on this software, and having it be reliable and stable is extremely important. It's really a great tool. I hope this EWC+ update didn't break it and that the software team can get things on track.

1 -

Yesterday I was no longer prompted to switch. Smart of Quicken to remove the prompt until they have this issue definitively fixed.

2 -

I am shocked - today (Sept 30th) all my Fidelity Options updated correctly. My stocks and cash have been tracking properly for the past 30 days

0 -

After recovering a backup file after the problems of the weekend, this morning's update seems to have worked and all transactions downloaded correctly. Pricing in my Netbenefits Fidelity proprietary funds updated for yesterday closing prices.

However, no pricing in my Brokerage for California Muni Bonds as of the 6:20am PDT OSU today for yesterdays closing prices. Any suggestions?

Converted to EWC+ on 9/20.

0 -

Same for me, but back prompting again today.

0 -

I'm pleased and grateful that Quicken is allowing us to finish our third quarter reconciliations before being forced to convert. End-of-quarter is stressful enough without software issues.

As a side benefit, finishing a detailed reconciliation immediately before converting should make the conversion itself simpler and more accurate.2 -

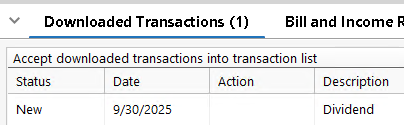

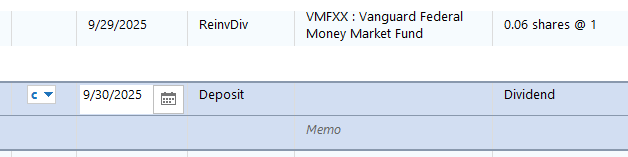

I recently was forced to switch to EWC+ for my 2 NetBenefit accounts. Today, for the first time since the switch, an account downloaded a dividend transaction; and it was downloaded as a cash dividend deposit into the account instead of the correct reinvested shares transaction. This triggered the unequal share totals popup. I was forced to log onto Fidelity website to get the reinvested shares total and enter that into Quicken manually. I have "Complete - Positions and Transactions" checked under Account Details. EWC+ downloads do not appear to be accurate and complete for my NetBenefit accounts. :(

2 -

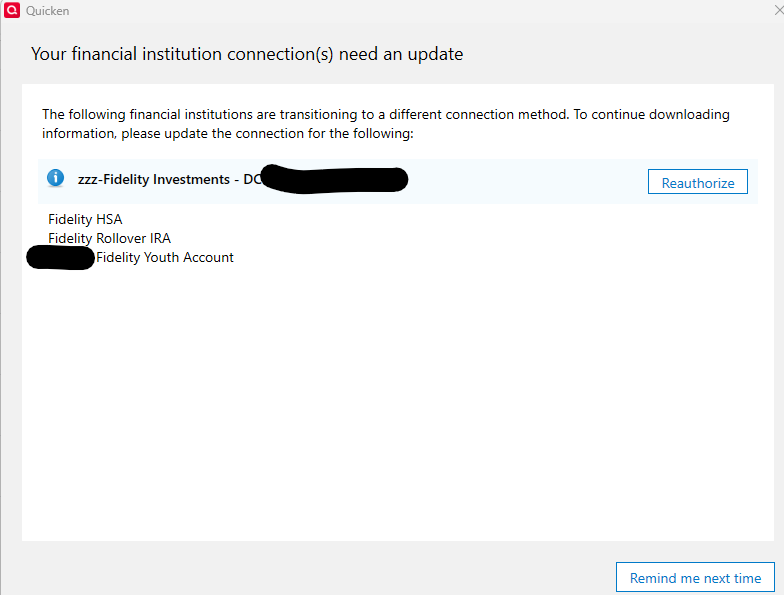

When you say you were forced, are you saying that there was no option to "Remind me next time"?

Barry Graham

Quicken H&B Subscription0 -

When I clicked remind me later and tried another OSU the pop-up requiring switch to EWC+ appeared again - so an endless loop was created. I had no choice but to do the EWC+ switch.

0 -

When I click Remind me next time and continue the same OSU, the current OSU completes and it doesn't prompt me again until the next OSU,

I am posting this in case you decide to roll back to a backup, or for others that haven't migrated yet.

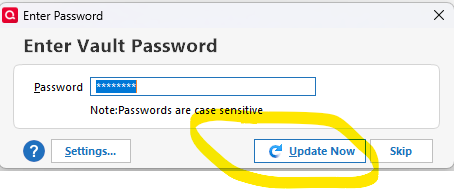

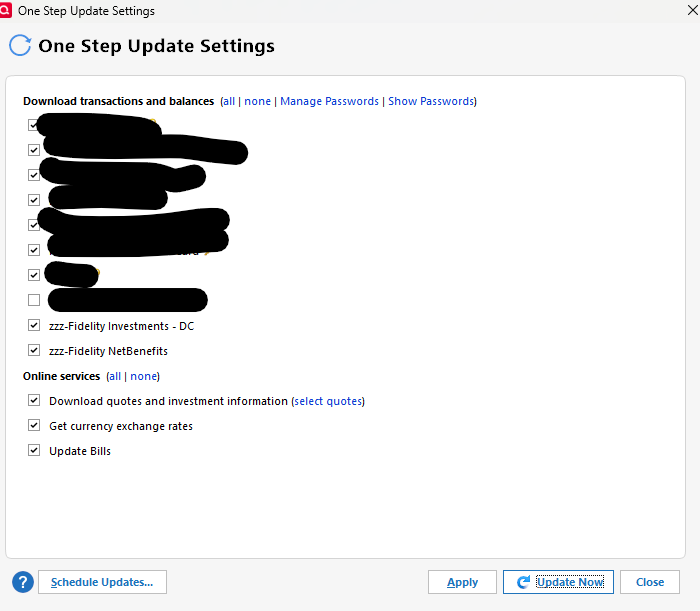

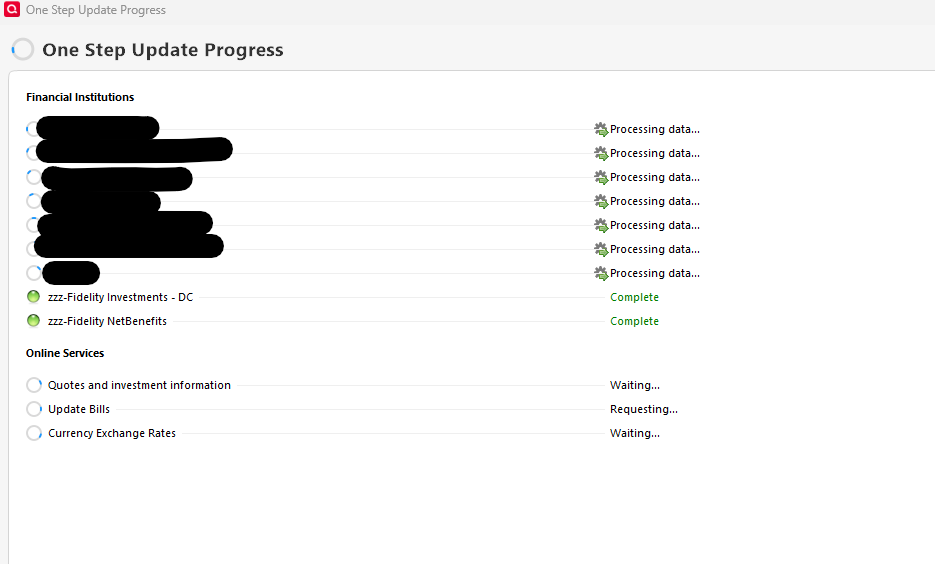

If you are saying that you did everything that I show below and it still didn't let you proceed, then it would appear that you really had no choice but to proceed.

On this first screen I pressed "Remind me next time" and proceeded as shown

Barry Graham

Quicken H&B Subscription0 -

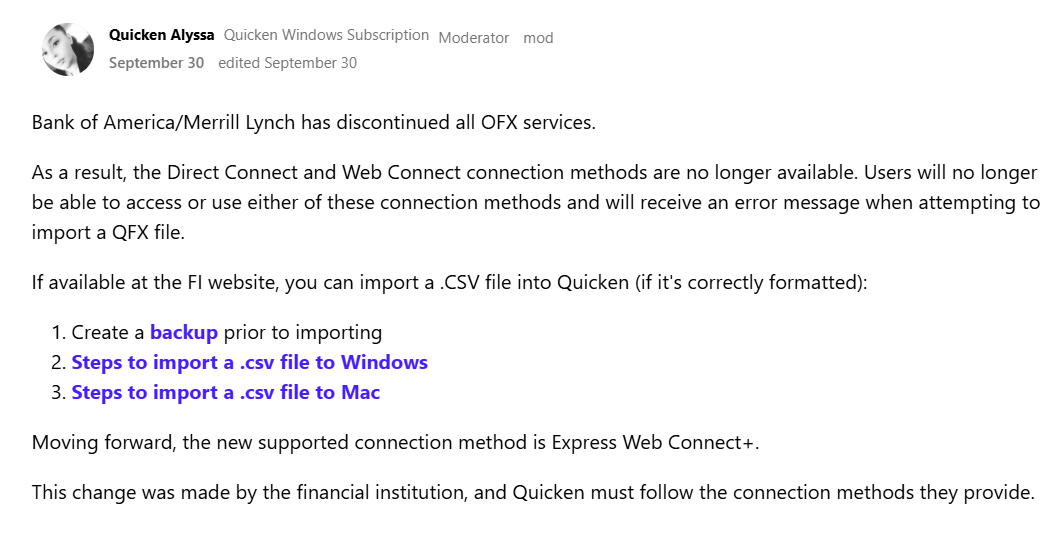

Another large financial institution moving to EWC+, the new standard format. "This (and other past and current EWC+) change was made by the financial institution, and Quicken must follow the connection methods they provide".

0 -

Hopefully, Quicken and all the in-betweens have enough savvy to negotiate, work together and implement a seemless migration for the client.

Deluxe R65.29, Windows 11 Pro

1 -

So this is odd. There was a dividend paid on one only stocks Monday it finally showed up in my download yet none of the trades in two diffenent account from Friday have even been posted in the download.

Not sure what to make of all of it.

0 -

I've noticed that transaction downloads with EWC+ connection are delayed by nearly 2 days.

Deluxe R65.29, Windows 11 Pro

0 -

Same here. I was forced to make the switch because my Fidelity Investments accounts were getting a CC-901 error when I hadn't switched my NetBenefits to EWC+ at the same time.

0 -

Sad to say there's been no improvement on this dividend as deposit/Complete vs. Simple issue over the last month.

-1 -

At first I thought that my non-public 401(k) funds were not downloading prices again, but then after opening the accounts containing them and answering questions such as this, the prices were good.

0 -

But then the asset class for this one had reverted to Unclassified! Glad I noticed this before doing a rebalance.

0 -

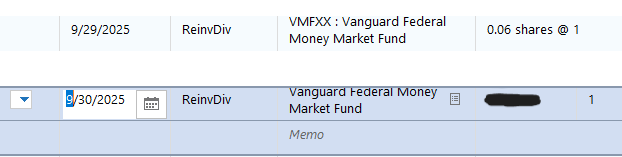

Here's my experience with this kind of transaction. The account is set to Complete investment tracking. After download:

After accepting:

This was incorrect, as the security was not identified. So I tried to edit the transaction to correct it to a ReinvDiv. I had to hit Enter/Done 3 times, and then my edit did not even take effect; the transaction remained as before. I needed to delete it and enter my own ReinvDiv:

0 -

For my 401(k) BrokerageLink account, Quicken is not giving me the option to treat the core money market fund FDRXX as cash. It seems to ask me about SPAXX for other accounts at random times, without mentioning which account it's asking about.

0 -

Interestingly, today (Oct 2) I got 9/30 transactions on reinvested dividends on all 6 accounts. So a day late but received them.

Still nothing though on the transactions from the last Friday September 25th. I am guessing I will have to enter those manually.

0 -

Today Quicken downloaded transactions to my IRA as Unidentified Security rather than FIGXX (money market fund). Does it not know how to handle money market funds that aren't the core fund?

0 -

I had the same issue as @EvDob . Dividend distributions came down as "deposits " with no security assigned despite account using "Complete Transactions". After viewing my Fidelity account online, I was able to figure out where the dividend went and correct it in Quicken. I compared my holdings and they matched finally.

After all of the connection issues, reauthorizing and now manually correcting downloaded entries, I decided to punt. By that I mean I restored a backup from 3 weeks ago prior to switching to EWC+, After re-accepting weeks of transactions in my other accounts, the Fidelity transactions came down properly and reconciled with little effort. Fidelity now shows zzz-Fidelity Netbenefits and will stay there until I'm kicked off.

0 -

EWC+ downloaded a sale of one of my funds in my 401(k) to pay fees, but now there's no memo to indicate that it's fees like there was with DC. (And both connection methods incorrectly have the action as Sold instead of SoldX.)

0 -

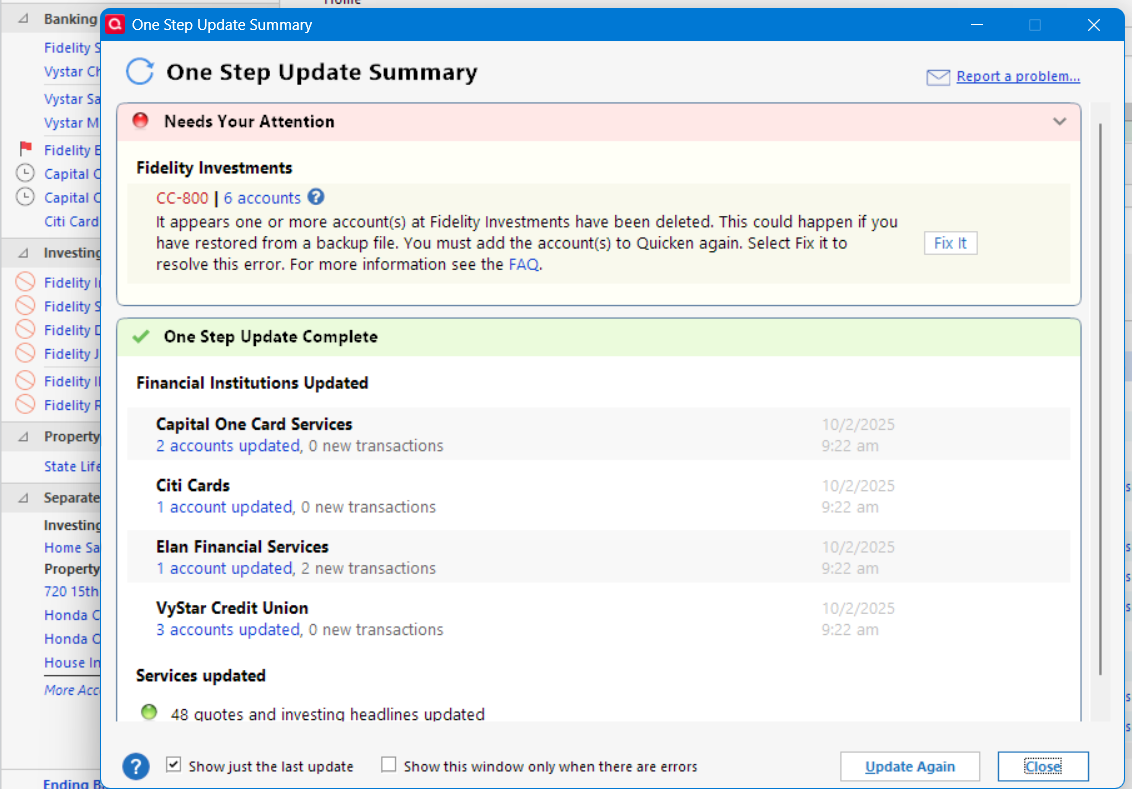

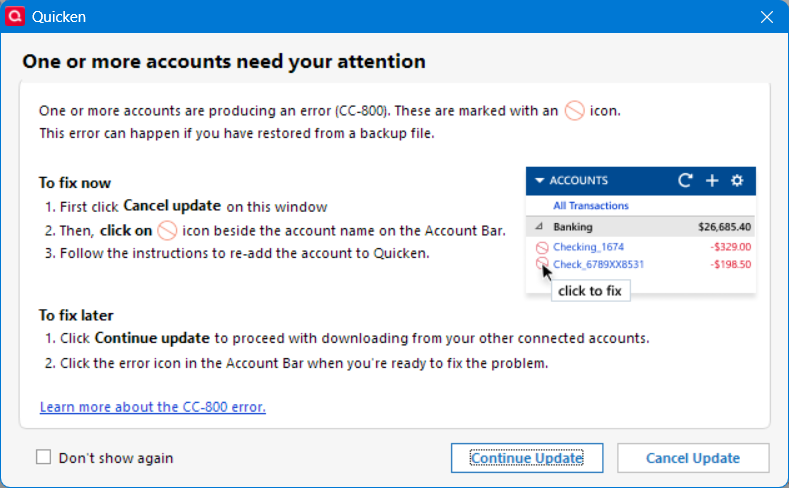

This morning's OSU download of the EWC+ connection, produced this result

Such unreliable and unpredictable behavior from the Fidelity EWC+ connection.

When I selected Update Again, I got:

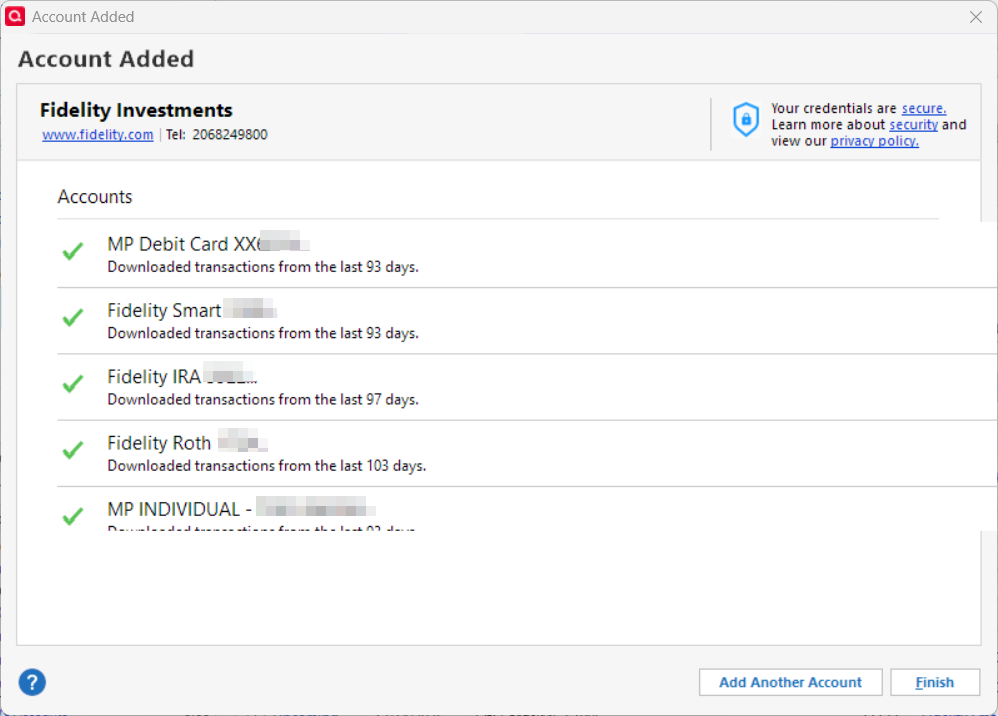

I followed the instructions and selected the icon beside the account name. Quicken entered the process to add Fidelity accounts again and successfully ( I think) reconnected the Fidelity accounts:

It proceeded to incorrectly download a reinvested dividend as a Deposit (not a DIVX) into the linked cash account and int the corresponding investment account it downloaded a BOUGHTX transaction. This scenario totally wrecks an tax planning for dividend income.

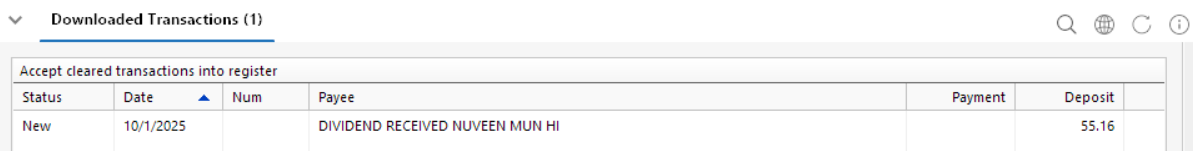

Linked cash account:

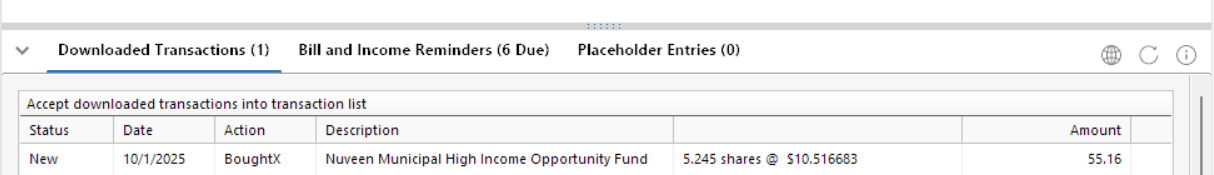

Investment account:

It appears Quicken doesn't know what to do with reinvested dividend income for linked cash accounts using EWC+.

For the DC connection, reinvested dividends for a linked cash account were correctly treated as ReinvDiv in the investment account.

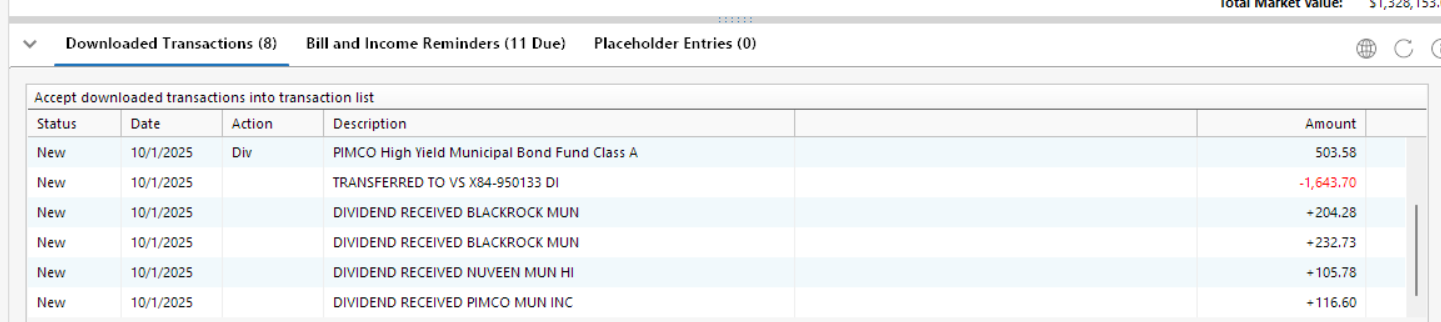

For a regular Fidelity investment account (non-linked cash), most dividends were downloaded with cryptic Desciption (note the Blackrock div to 2 different securities) and no DIV actions:

The DC connection correctly downloaded all dividends with the DIV action for the proper security name.

For the TRANSFERRED transaction using EWC+ there is no Action applied.

For the DC connection, the TRANSFERRED transaction is correctly downloaded with a Withdraw action applied.

It appears the EWC+ connection is downloaded $ amount and cryptic descriptions and not applying actions or assigning securities to the download.

And the still existent problem that FDRXX is not recognized as a core MMF for an IRA account remains.

For me, EWC+ connection is not nearly ready for production use.

Deluxe R65.29, Windows 11 Pro

2 -

Today a 401k account on EWC+ downloaded a series of share sales from each of the account's funds that were done to cover quarterly bookkeeping fees that Fidelity charges for the account. The fees were recorded in Quicken as a commission on each sale so there was net zero cash added to the account cash balance. The fund / security for each sale was correctly identified (no unidentified securities). After these downloads were reconciled Quicken said the share totals were all in agreement. This is encouraging.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 237 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub