What’s Going On Between Fidelity and Quicken?

Comments

-

I am also on EWC+ and still nothing downloading.

0 -

Like some others, my Fidelity download via EWC+ didn't work out as planned. Rather that ReinvDiv and SoldX they came down as Dividend and Removed. There were no securities tied to either, just the "adjustment". So this through off my holdings and totals. After spending quite a bit of time manually adjusting the entries, I simply gave up and restored a backup from 3 weeks ago where Fidelity was still DC (zzz-Netbenefits). After re-authorizing all my accounts and reconciling them, everything looks good again. The Fidelity transaction came down as ReinvDix/Soldx with the proper security assigned. My holding and totals now match once more.

I just don't understand how it works for some and not others. Even more confusing, how it could appear to work for any given download, and be completely different another time. Mine should be simple, I have 2 401Ks from past employers so no more contributions, no withdrawals, the only transactions are the dividend distributions back into the account and fees. Some distributions are monthly, some quarterly.

So I'm staying on DC until forced over.

0 -

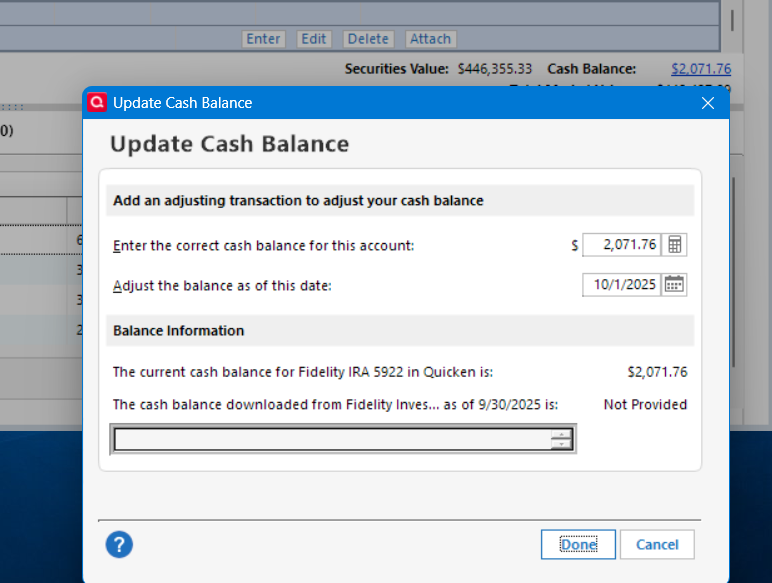

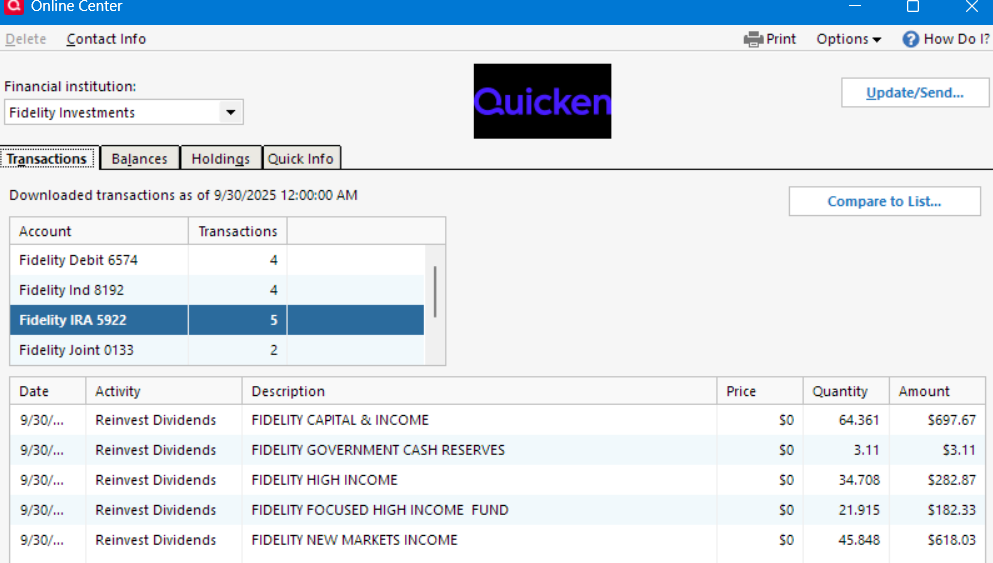

After updating to Quicken version, R64.30, instead of showing the correct cash balance ,the Update Cash Balance popup now shows:

Fidelity Government Cash Reserves is no longer listed Online as the core MMF Cash Balance but is treated as a separate security. It was working correctly as of 9/30/2025 prior to this morning's download on 10/1/2025.

There is no Reset option in Account Details either.

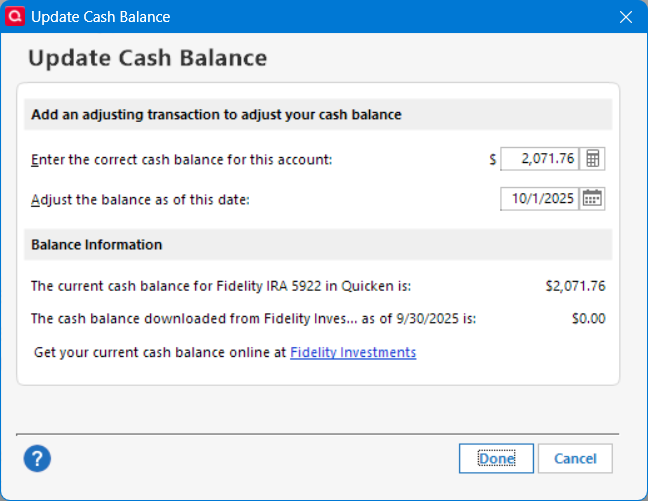

I downloaded from Fidelity again and got different Update Cash Balance pop-up with wrong cash balance from Fidelity.

How do I get Quicken to recognize FDRXX as the core MMF for this account? There is no CASH REPRESENTATION button and there is no Reset Money in the Account Details.

As a test, I restored a backup from 9/26/2025 and it correctly displayed FDRXX as the Cash Balance core MMF for the IRA account and SPAXX as the core MMF cash balance for all the other accounts. Then I downloaded transactions to Fidelity, and FDRXX in the IRA account no longer listed as the core Cash Balance and instead as a separate security. So Fidelity/Quicken broke the treatment of FDRXX between 9/26 and 9/27 for my data.

Deluxe R65.29, Windows 11 Pro

1 -

Note that @Jim_Harman's suggested method for doing a Roth IRA conversion is also applicable to doing a normal IRA distribution. Just that instead of the receiving account being a Roth IRA it will be a checking or saving or other taxable account. In all cases it is critical that the primary transaction is a deposit transaction in the receiving account, not in the IRA account. Works like a charm with the Tax Reports and Tax Planner so that the total taxable distribution is properly captured.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

When I go to reconcile, I also get 0.00 as the value for the amount downloaded from Fidelity.

In addition, when i do an update, I do not get any data downloaded as of 9-25-2025 when I converted to Web Connect +.

I also, see shares when i reconcile rather than cash and do not have a CASH blue button to select to choose cash or shares option to report.

I signed out and signed back in as suggested with no success.

0 -

I spoke with Quicken support earlier today. After a few checks on their end, they told me everything is working as it should and that I should wait a day to see if those transactions download. To be honest, I can't recall a time when you have to wait two days after a transaction had occurred in Fidelity and is cleared to be downloaded by Quicken.

0 -

I see Sept Interest earned and some Dividends from stock in all my Fidelity accounts Dated 9/30/2025. These dollars also appear in my "CORE" line item in the "Positions" tab. However just did a OSU for Fidelity accounts and NO transactions were downloaded. IF EWC+ is going to be two days late, then let all us customers know that is how it will work. I will try again after 12am EST to see if that makes a difference.

UPDATE - OSU failed to download 9/30 transactions after 12:40am EST (10/2/2025)

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram0 -

The unpredictability and instability of the current EWC+ implementation does not instill trust in the Fidelity downloaded info and will constantly require double checking the downloads with the Fidelity website which sort of defeats the time saving aspects of using Quicken. I am looking forward to when these issues are resolved and Quicken treats the Fidelity EWC+ connection with similar reliability as the Fidelity DC connection. Until then, I hope the DC connection will remain usable.

Deluxe R65.29, Windows 11 Pro

2 -

I am on EWC+. I have Fidelity Brokerage and Retirement accounts. All dividend and interest transactions for 9/30/2025 were downloaded via OSU and correctly posted this morning at 8:30am EST .

0 -

Great, but why are some users getting transactions and others (like myself) not?

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram0 -

Same with me. If I disable/reenable then I'll either get a new duplicate account or I'll download duplicate transactions. Some days do download, but then I'll miss things again. I've resorted to manually entering everything. Have called Fidelity but they pretend to be hearing this for the first time. It's fun watching my bonds be priced at $1 today, at $100 the next, and back to $1 the day after that.

0 -

Thanks, this will help.

Sorry this is off topic, but if there is a better place to have this dialog, I am happy to go there.

Do you know if this method also records the gross distribution as "Income" on the Income&Spending reports? I really want to get to a Gross Income vs Gross Expense to show a profit or loss like any business or individual would do. The profit would represent what I can add to savings, and the Loss would represent what I need to reduce savings by to accommodate my expense over income. Seems Like a simple answer, but all the reports I run do not show total Income correctly (I have tried all the advanced settings or Include or exclude transfers). Some reports show realized gain, but these tend to be reinvested in their account and not really disposable income. The Expenses actually seem pretty spot on.

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram0 -

I converted to EWC + on 9-20-2025. My accounts use complete tracking method. I have a CMA with one MM (SPAXX) which is the core where I've had several cash management transactions. I also have a taxable brokerage account with one MM (SPAXX) which is the core. I have completed a few CD transactions in this account. I have an IRA and Roth IRA with each having one MM (FDRXX) which is the core. I have two test accounts that were created on 09-24-2025 that parallel the live account. One was created from scratch and the other from a template of the live file. I originally created my first test file from a template of my live file on 8-20-2025. This file helped me immensely to clear several hurdles prior to going live. The file got corrupted from the fiasco that we recently experienced with the cc 901 errors. So, I deleted the file. As a precaution, I always update the test files prior to updating my live file. After each update, I check the Online Center holdings tab to ensure that my online brokerage holdings are in agreement with each Quicken account. Also I check Online Services tab for the Reset MM cash options box. I make backups everyday. Very time consuming. Every morning I cross my fingers that everything will update ok. Like so many other people, including yourself, I have spent countless hours nursing my accounts. The only thing that needs improving is for the CD's to show more than 2 decimal points. To answer your question, I believe it may have to do with the type of account and the complexity. It seems the 401k accounts are having quite a few problems. Also, thanks to everyone's input, this Community forum has been a tremendous help to me. I consider myself very fortunate to have survived thus far.

Hopefully, things will become more stable in the near future.

1 -

Even after following Quicken’s suggestions, virtually nothing works correctly with Fidelity. After de-authorizing and re-authorizing an account, Quicken never recognizes the account again. It just hangs after entering all the requested information. WILL THIS EVER GET FIXED? It’s been months with invalid information. This is seriously hurting Quicken’s reputation and a disaster for those of us having used Quicken for over 20 years!!

0 -

I have the same problem. I have reauthorized my accounts (Brokerage, Netbenefits, Professional Managed) every day for a week. Still not getting the correct downloads. Occasionally, it will download a generic transaction "Dividend" or "Fee", but security is not identified. I have also been using Quicken for 20+ years.

0 -

I see other similar posts, but no central post we should be following with a timeline/updates on a resolution. I would also appreciate instructions on how to download the missing transactions from Fidelity once a fix is in place. Manually entering missing instructions cannot be the answer!

0 -

This is a warning for those Quicken users with any type of Fidelity Investment accounts.

When you update balances, DO Not, I repeat DO Not select to reauthorize your Fidelity Accounts. Just continue with "update" . If you click Reauthorize, you will be sorry!

Back on August 1, I was asked to reauthorize & found out it was a disaster. I followed the web community and Quickens support suggestions for 3 weeks with no luck. I finally called Quicken for help. The agent reviewed all my online settings and told me everything was set up correctly. The only thing I could do was download a saved back up from July 27, 2025, before the problems began. It got me back on track with accurate downloads for Fidelity using the Z and DC accounts, however, it took 2 whole days to manually download transactions from July 27 to the end of August for ALL other accounts I have in quicken. I'm still using the back up from July 27, 2025 and found my transaction downloads accurate. Except I mistakenly ( "should have known better") reauthorized my accounts for Chase and JP Morgan. I am ignoring all "fix it" suggestions from Quicken and downloading directly from the bank web site.

I've been using Quicken since 1999 and it was great until about 7 yrs. ago and then problems with updates, crashes, duplicate transactions etc. began. With this latest Fidelity debacle and now with Chase I'm losing confidence in Quickens ability to meet my needs.

0 -

The IRA distributions (whether normal or Roth conversions) will show up in the Tax Summary and Income/Expense reports as Transfers in, not as Income. (Technically, IRA distributions are not actually income. They are really just transfers of assets from the IRA account to a taxable account. They are only considered income by the taxing authorities and only for tax purposes.)

They will show up in the Tax Schedule Report as 1099-R income.

In the Spending reports they show up for me as income (actually, as credits/deposits).

In the Cashflow Report they will be listed under Inflows.

There is an Improvement Idea that Quicken has said is Planned. This would be a good place to review previous posts and to add you own. You can view it here:

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

I see Sept Interest earned and some Dividends from stock in all my Fidelity accounts Dated 9/30/2025. These dollars also appear in my "CORE" line item in the "Positions" tab. However just did a OSU at 5:33pm pst Thur Oct 2nd) for Fidelity accounts and NO transactions were downloaded. In addition, I did not get a couple of Citi Cards transactions from 9/30/25 that show as posted on Citi Website.

UPDATE 10/2/25

So, I found out my downloads were not processing, the OSU Summary did not display any of my EWC+ accounts. I deleted runtime.dat, didn't help, I then did an account update of just my CITI cards, and new transactions downloaded. I then performed a full OSU and my Fidelity Accounts downloaded all 9/30 & 10/1 transactions. HOWEVER, most of my Fidelity Accounts did not process MMF interest/dividends correctly. Quicken wanted to record as Reinvestment vs Cash Interest/Dividends. I manually changed these to match what was in Fidelity. Made some backups along the way. Finally decided I would Deactivate my Fidelity Accounts and Reauthorize, hoping I would get the option of selecting how I want Cash managed. Did not get that option. When I select Cash Balance, I do not see the option for managing Cash. Performed another OSU and my 10/2/25 Fidelity transactions downloaded.

Guess I will have to wait another month to see if my Cash is being managed correctly.

VERY FRUSTRATED !

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram0 -

I am having the same issues with Fidelity. Although re-authorization was done, I continue to get no updates even though one update goes through the process. Every once in a while an update will occur on one account, but not the other. As of today I have had no updated information for a few days even after multiple tries each day. Quicken, please advise!

Update 11:30am, tried the update for prices (prices for non-public investments) and it worked? The update process has become very haphazard?

0 -

I am having similar problems. Download of some transactions from Fidelity but not others of the same date. It's now compounded by a freeze of the downloads in multiple accounts (posted in another thread) which can only be stopped by closing the program in Task Manager.

0 -

Same problem here as well. Someone from Quicken should be telling us what is going on, if this problem is being addressed, and when it will be resolved.

0 -

I spent some time with Quicken support regarding my issue that they weren't downloading end of month transaction from Fidelity. They had me change some code in a file, send them screen shots to prove that I did that along with screenshots of my register in Quicken showing no transactions and a screenshot of Fidelity's activity page showing the transactions they are missing. In the end, they told me everything was working just fine and that I should just wait a day and try again. What? So I did. Still nothing. So I went through each of my accounts and reactivated them. That was a 40 minute process because every time I would activate one account and went to do the next one, Quicken would match the next account with the previous account I just did. Over and over again. All despite selecting the proper account in Fidelity to match.

Flash forward a few more days and some stock purchases and yet again, Quicken does not download those new transactions. Maybe it's just me but this is becoming problematic and I feel the quality of the product is going in the wrong direction.

0 -

I've had zero transaction updates from Fidelity for almost a week now. Quicken support tells me there isn't an ETA for resolution.

0 -

FYI, I now have 3 out of 4 accounts updating, but my fourth account (international brokerage) is still not updating. QW support tells me it will be another 3 wks or so before the next (last?) Fidelity server is connected.

0 -

10/3/25 -

My Fidelity brokerage account downloads correctly.

My Fidelity NetBenefits 401K account still not updating. There are no new transactions, just price updates that are not downloading.

[Removed - Rant/Language]2 -

Quicken saga continues:

Quicken R64.30 27.1.64.30 - (using updated EWC+ connection method) - Recent download from six Fidelity accounts (at 5:00 pm ET USA) shows different amounts in Quicken vs online Fidelity accounts — all accounts in Quicken show at least $300 or so less than what is available at Fidelity. The same new connection method (not Direct Connect) was working fine to update accounts up to October 1, 2025. Can anyone from Quicken provide insight into what has changed?

This discussion thread MUST be the longest (15 pages and adding more every day!) on this discussion board!

Update at 6:18 PM ET on October 3, 2025: One of the stocks (total quantity) was not updating, resulting in the discrepancy. A manual update of the stock quantity fixed the issue. Big question for Quicken: Why is Fidelity NOT updating the number of stocks?

0 -

Look at the Online Center in Quicken to see the last download date time of the account. I have found that the EWC+ connection has almost a 2 day delay in the data. This may be the cause.

Deluxe R65.29, Windows 11 Pro

0 -

For me, the EWC+ connection is downloading reinvested dividends for some securities as Deposits with no security assigned and a BOUGHTX for the security. Therefore, Quicken is not correctly monitoring for taxable transactions.

Deluxe R65.29, Windows 11 Pro

0 -

Quicken Premier R64.30 on W11. With this many separate topics with a vast amount of posts, mostly expressing frustration with Quicken and Fidelity downloads, I request that tech support post a single topic about support's knowledge of what the problem is, what is being done to remedy the bugs and advice on how to deal with the issue until it is really fixed. I am fortunate that my Fidelity accounts are relatively inactive with no transactions since July. I am on EWC connection method and market values are being updated but I fear things will go haywire the next time there is an actual account transaction. I am following the suggestion of others to "skip" the repeated re-authorization prompt as I have done it too many times. Should I deactivate downloads for Fidelity in the meantime in order to avoid the calamity others have experienced? I have used this product for decades and now I am wondering if it is time to switch to some other financial app. Has anyone had experience with Mint? Empower? Others?

2

Categories

- All Categories

- 59 Product Ideas

- 34 Announcements

- 239 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub