zzz-Fidelity Updates

Comments

-

However, on a different EWC+ NetBenefit 457b account a monthly withdrawal yesterday was recorded as a series of simple cash withdrawals from the account. No fund / share sale details were downloaded. This resulted in an incorrect negative cash balance in the Quicken account and incorrect fund / share totals. I had to go to the Fidelity website and manually enter all the sale details into Quicken. VERY DISCOURAGING that this is still NOT WORKING after all this time.

2 -

Yup, me too, 401k account shows two "dividend" transactions, no security info probably because Quicken uses a link from the main Fidelity page login where detail is not readily available, as even I must click the down arrow to access the security details. However, if I go to my 401k account from the Netbenefits website, the dollar and share values are viewable without digging. Should I be using a different login for Quicken OSUs for the Netbenefits account so I can get all the relevant detail? Is there a separate "Netbenefits" thread where I should be posting instead?

0 -

ONGOING 10/2/25 Fidelity Net Benefits - not supporting Complete investing at the moment — Quicken

Here is link to Quicken Anja's post acknowledging Net Benefit not supporting Complete Investing. She says there is an open ticket for this problem.

3 -

I am having the same problems with Fidelity that everyone else is having. Quicken is a business, right? I mean, they now even charge an annual fee for their "service". You'd think they'd be able to put the resources in place to figure this out. I'm beginning to thin that the title of this thread—"Ongoing 10/2/25 Fidelity Net Benefits" should be changes to "In Perpetuity".

0 -

I'm still using DC. My NetBenefits download for my 401k downloaded a dividend with a security name. This has never happened before. The transactions and balances are correct. Then the same thing happened with my IRA. Until now the money market funds names were hidden with DC.

Barry Graham

Quicken H&B Subscription1 -

This issue using EWC+, where DIV actions are missing and the transaction is treated as a deposit instead and the security is missing, is occurring for regular Fidelity accounts and not just Net Benefits accounts. EWC+ is not ready for regular use.

Deluxe R65.29, Windows 11 Pro

1 -

Today only one out of five non-public funds in my 401(k) accounts failed to download yesterday's price with EWC+.

1 -

None of my non-public 401k funds have downloaded prices since 10/1 on EWC+

1 -

An update on my Fidelity transition:

I moved my accounts to EWC+ on Sep 20, 5 days before the then announced forced cutover. I wanted to do it on my terms, rather than face a no-way-to-go-back situation. I didn’t use a test file. I had a few minor problems (duplicate transactions, placeholders), but nothing earth-shattering, and they were easily corrected after going to backups a couple of times. Of course, as we all know, Quicken moved the forced date back with no new one specified, so … I transitioned early unnecessarily. So it goes.

I have 4 accounts:

1 – Brokerage 1 - self-directed, all holdings set to reinvest, 2 MMs – SPAXX and FZDXX.

2 – Brokerage 2 – FI managed, no reinvestments, 1 MM - FDRXX

3 – IRA 1 – self-directed, all holdings set to reinvest, 1 MM – FDRXX

4 – IRA 2 - self-directed (by spousal permission), all holdings set to reinvest, 1 MM – FDRXX

A few EOM and other transactions have come through this week. Here’s where they stand:

Acct 1 – 11 div/reinvest (incl FZDXX), 1 MM div (SPAXX), 1 buy. All txns downloaded and posted as they should have whether New in Quicken or pre-entered and matched. Quicken shows only the SPAXX holding as Cash (i.e., FZDXX is treated as a security). Fidelity site and Fidelity balance in Quicken show SPAXX+FZDXX as Cash. This is how its always been. So far, Securities and Cash numbers tie out.

Because there was not enough cash in SPAXX to cover the buy, I currently show a negative balance there in both Quicken and on the Fidelity Portfolio Positions page (Fidelity should automatically sell enough funds from FZDXX to cover the shortfall in SPAXX). In addition, the entire $ value of the purchase (not just the shortfall) has also been deducted from the Total Cash Balance in some places but not others. The Fidelity site shows different numbers in different places, so it’s a little hard to follow. The Portfolio Positions page displays it right; the Balances page doesn’t. I hope/expect this will all be resolved by tomorrow, or next Tuesday at the latest (Fidelity doesn’t send data on Mondays).

Acct 2 – 10 div (inc SPAXX), 2 buys, 1 sale. All txns downloaded and posted as they should have whether New or pre-entered and matched. Quicken and Fidelity (both in Quicken and on website) show FDRXX as Cash and all numbers tie out

Accts 3 & 4 – (Note: Neither IRA is a NetBenefits account) - 1 div/reinvest and 1 MM div (FDRXX) each – all came through normally. Quicken and Fidelity (both in Quicken and on website) correctly show FDRXX as Cash and all numbers tie out.

Fidelity Cash Representation numbers in Quicken in the brokerage accounts appear to be a day behind in updating. I suspect the same for the IRA accounts, but I haven’t seen enough to confirm that.

I’ve read that some foreign dividends/taxes/misc fees have not posted correctly. I’ve not had any come through yet, so I can’t comment on that.

Bottom line - my experience, SO FAR, is that EWC+ is working as it should. I’m cautiously optimistic that it will continue. I write this with the intent of letting those of you who are still struggling with this transition know that there is light at the end of the tunnel.

3 -

I was having same problem of no pricing on non-public funds in my netbenefit account as well as pricing for Calif Muni Bonds in my brokerage account. Last weekend (after making a fresh full backup just in case), I did an account reset ("Edit Account Details > Online Services > Reset Account") and this fixed it. Timing on the prices is different than before EWC+ as it used to show up around 8:30pm PDT (when they show up on Fidelity's website as well), but now it shows up sometime in the middle of the night as I don't update again until around 6:00am PDT and the prices for yesterday show up. Muni Bonds never showed up until the next morning so this hasn't changed.

Good luck.

0 -

Thank you for the detailed update. We are in the same camp.😊

0 -

I had been working with a "DC" file and an "EWC+" file just to check things out. I'm not sure what I did but I messed up my "EWC+" file and made a copy of the "DC" file and converted it. It only asked me about Fidelity Investments and not Net Benefits. The first time I converted (a couple of weeks ago) it asked me about both. Now my non 401K accounts are downloaded using "EWC+" while the 401K accounts are using "DC". I did try to deactivate/reactivate the 401K accounts yesterday but they still use "DC". Have the Net Benefits accounts been stopped from setting up an "EWC+" connection?

0 -

That would be a good thing since NetBenefits regular 401(k) accounts (not BrokerageLink accounts) are not working well. They are acting like you've selected Simple investment tracking even if you use Complete tracking. @mrzookie has no problem with EWC+ because he has no NetBenefits accounts.

1 -

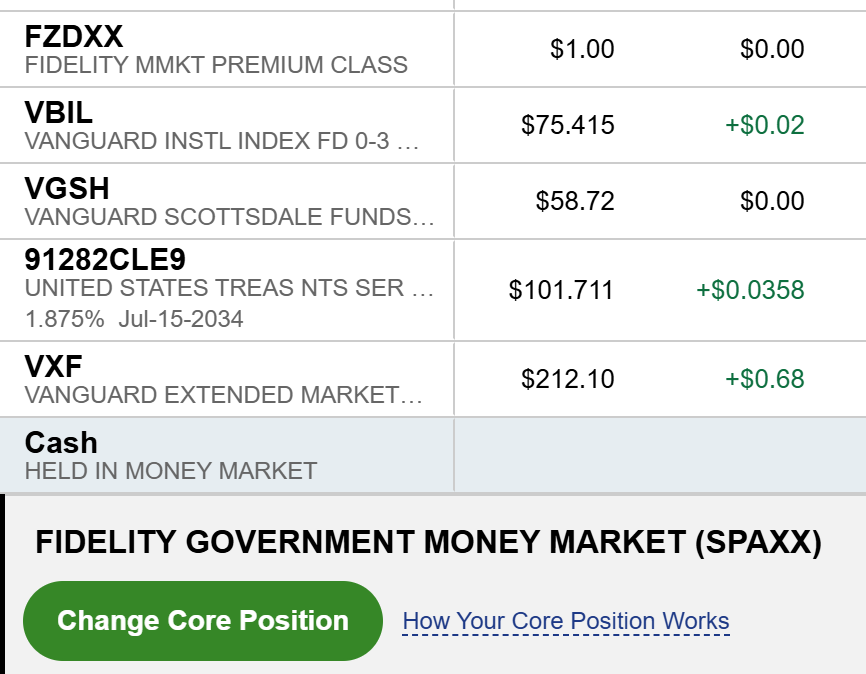

@mrzookie said, "Fidelity site and Fidelity balance in Quicken show SPAXX+FZDXX as Cash."

This depends on where you are in the Fidelity site. The Account Positions page shows SPAXX as Cash separate from FZDXX. And that's how I'd prefer Quicken to handle things—SPAXX (or any other core position) as cash & FZDXX as money market fund shares.

0 -

I have been following ALL of the threads regarding the Fidelity cutover. I can now report that I have successfully switched to the new connection method, but it took some work, especially for my oldest account. Here is what I had to do:

- I tried an initial cutover in July. It was a disaster. Cash balances and CD values were all wrong. All accounts had the simple view instead of complete. I was able to quickly go to a backup I had made.

- I realized that the cash balance piece would be an issue, so in August I changed all of my account cash balances and money market funds to FZFXX for non-IRA and FDRXX for IRA accounts. These seemed to be the money market funds with the best chance of converting cleanly.

- When the CD pricing issue was fixed, I decided to try converting again. I planned to convert on a Sunday when there would be no new transactions or prices to download and I would have time to clean up any issues. So, I converted last Sunday, 9/21.

- Before the conversion and after each step in the process, I did a backup with a time stamp, keeping a record of each step.

- I was able to connect each account up cleanly. This was helped by having the last four digits of the Fidelity account number as part of the account name in Quicken. Check.

- Then I went into each account one by one. For each of them, I was asked if I wanted to count cash separately or as a security. I counted it separately. All accounts except one converted cleanly and still had the complete view vs. the simple view, so that was great progress.

- There were new duplicate transactions in each account going back a month. I deleted them all as I was previously up to date on transactions and this was a Sunday, so no new transactions. Check.

- Comparing the accounts one by one to the Fidelity site, the cash lined up and the total value of the accounts came within a dollar of lining up. I figured out the difference was due to CDs now being priced with 2 digits after the decimal point vs. 3 previously. Check.

- Then I got to work on the one rogue account. Cash was way off and Quicken asked to put in a special transaction to adjust it. Turns out it was both a visible and a hidden transaction which I had to find the setting to be able to see it. This account was originally set up in Quicken in 1994 with cash being handled as a security. Then, in 2008, I think the way cash was handled was changed. So, all of this history was problematic. It took 2 hours, but I figured out that I had to help Quicken to get the cash history right. Quicken tried to be helpful by removing an Add and a Remove transaction from 1994 and 2007 respectively. I don’t know why it did this. I put them back in as Xin and Xout transactions from the same account. Then I adjusted the cash balance adjustment and the hidden transaction values and changed the dates back to that 2008 date to get everything back in line. Now the cash and total balance of the account lines up all the way back. I documented all of this in the Account Details page to help with any future issues. Check. All of this work probably helped to fix an issue that had been hiding in the account all along.

- All of the accounts have the correct cash and total balances. Prices and transactions are now downloading correctly. The CD prices are off by that 3rd digit after the decimal point which I hope gets fixed. So, all looks good.

- After all of this, I wished it had been a simple transition. I understand that it really shouldn’t be this hard. But in my one problem account there was so much history that Quicken was just not able to figure out how to convert the cash correctly over time. But I am convinced that some minor preparation did help the other accounts to convert cleanly.

8 -

I tried resetting my 401k NetBenefits account this AM and yesterday's non-public traded fund prices still do not download. I will try again later :(

1 -

I just tried to update my NetBenefits 401k with non-public traded funds with last night's (Friday) closing prices. I, too, didn't get the updated prices. In the past weeks, I have gotten the updated prices from Friday by Saturday morning. It is now 8:45AM Pacific time. More than enough time for Quicken to get the prices. I don't care if Quicken contracts with a third party for this information. I pay Quicken for this (via the subscription fee) and I hold them responsible.

0 -

Just did my daily OSU and like others did not get yesterday's price updates for my non-public Fidelity funds in Fido Netbenefits. However I did get my California Muni Bond prices updated in my brokerage account.

My impression is that things often don't work right on EWC+ during the weekend.

0 -

No price update here either. Had to resort to copying from Fidelity website. Luckily it's only 5 funds for me.

0 -

I finally got my non-public NetBenefits 401k Friday prices updated at 2pm EST today.

1 -

More EWC+ errors: I just discovered in my HSA a transaction that actually took place in my 401(k), and there was a missing ReinvDiv transaction from 9/26. So it's not just NetBenefits that's not ready for prime time.

0 -

Also when I changed a ReinvDiv to a Div transaction (trying to fix money market shares when not given the choice to represent as cash), the share amount remained increased by the same amount as in the former ReinvDiv. So you think you're fixing things, but they actually remain the same. Needed to delete the ReinvDiv and add a new Div.

0 -

After trying again to get yesterday's closing prices for my NetBenefits 401k without success, I tried the "Reset Account" on the "Online Services" tab of "Account Details". After re-authorizing Quicken at Fidelity, it did finally download the closing prices for yesterday. 🤬

0 -

Thanks for the update. Just got my non-public funds updated as well. 2:30pm PDT. On EWC+ since 9/18.

0 -

Thanks for those detailed notes!

When you mention duplicate transactions were downloaded, did they download to the bottom area where you can decide whether to accept each transaction or not? Or like I read about another conversion with a different financial institution, did it download directly into the register regardless of your download setting?

0 -

The transactions downloaded properly to the bottom area, not directly into the register. So, I could go through one by one and delete them.

1 -

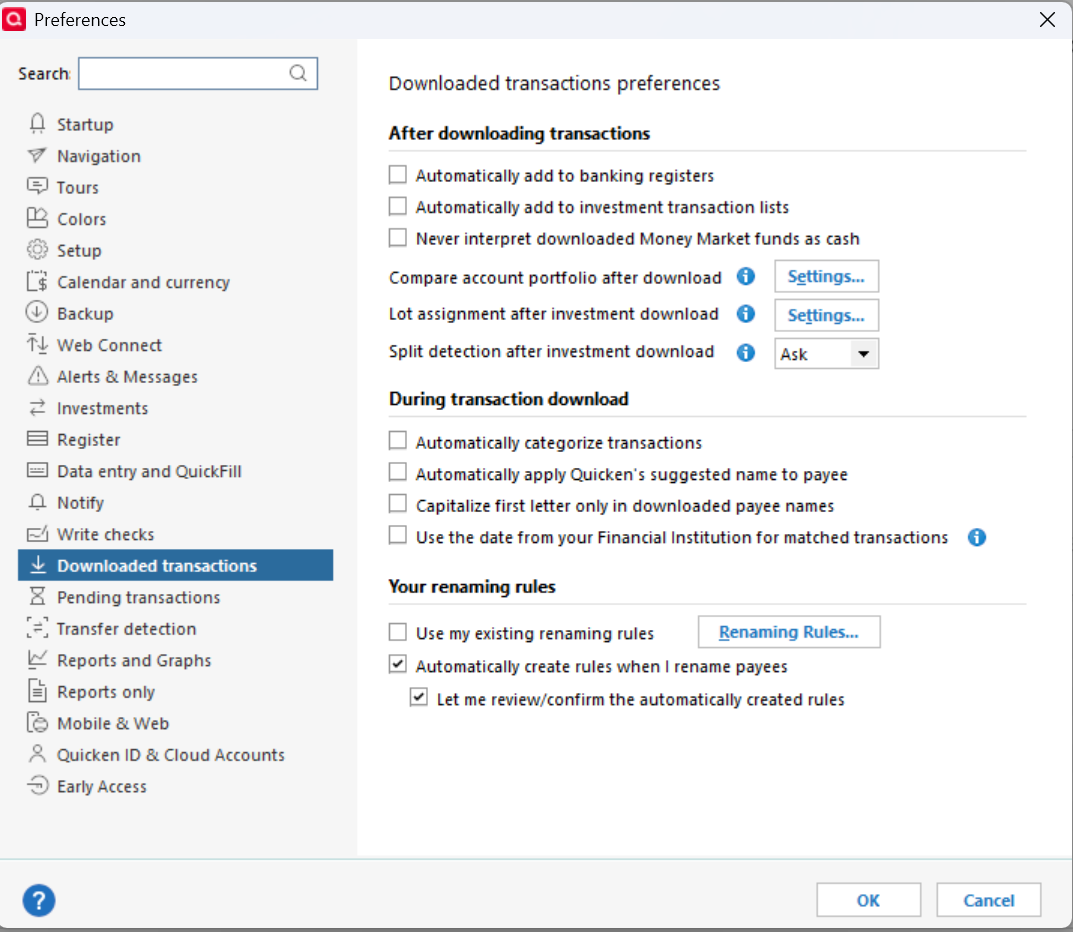

In order for the downloaded transactions not to be automatically entered, two option in Preferences need to be unchecked: "Automatically add to banking registers" and "Automatically add to investment transactions lists". I don't believe that this is the default. Just FYI.

4 -

Thank you both. I am a long-time user and have that set to not automatically add toninvestmenta transactions or banking.

I just saw a post from someone transitioning connection methods and I just wanted to verify this setting still took priority during the move.

Thanks

0 -

I got one Security reported with different ID, that was downloaded before for years from Fidelity 401k.

As result it doesn't match to existing and Quicken shows way off number of shares vs online.

How to address this issue?

Move all existing transactions to use new Security? How to do this for all existing at once?tnx

Best Regards0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 237 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub