Biweekly Mortgage Payment Support

This is tough but should be doable.

My mortgage is through Rocket Mortgage, an Intuit company. I pay half my monthly note every two weeks. This way, twice a year, a full biweekly payment is paid strictly to principle. That occurs whenever there are three payments in the same calendar month. I think this is pretty standard.

The problem is that when I make the first payment of the month (always on a Friday in my case), it doesn't affect the loan. The mortgage company "holds it" until the full payment has been received. So the loan balance should not change. On the second payment, the two payments are now credited to the loan. However, the payment occurs early, on the thrid or fourth Friday of each month. In the month when there are three Fridays, that last payment of the month is credited as going towards principle. This involves a huge hassle to get it right.

I created a category I called Mortgage Accrual and the payment accrues to that account. I have a loan bill reminder the originates with the loan account in my Quicken file. But it doesn't work like it should. Obviously, Quicken has no mechanism to "pay" my mortgage out of the Mortgage Accrual category. Instead it creates a transaction to pay it from my checking account. So, I end up cutting that transaction from my checking and pasting it into the loan. Then I have to diddle with the split because I need the funds to come out of the Mortgage Accrual "account" and get applied to the loan. Also, I have to adjust the interest payment because things are being done that Quicken doesn't understand. Finally, I go in and adjust the next payment date so that the bill reminder will post on the proper date.

Given that this is a common occurrence in the mortgage industry and given that both Quicken and Rocket Mortgage fall under the same Intuit umbrella, why is this so hard? The method I'm using came straight out of my Accounting 101 class forty years ago. Sure, Quicken isn't a double entry accounting system, but it can almost act like one.

Thank you everyone who reads this and feels the same frustration I do. Please vote for this.

Peter

Comments

-

Actually Quicken has been separate from Intuit for several years now.

Since your mortgage is actually only due once per month, you might be able to simplify things and keep your money earning interest for you a little longer if you change the actual payment schedule to monthly and make two manual principal-only payments per year.

QWin Premier subscription1 -

The problem is that when I make the first payment of the month (always on a Friday in my case), it doesn't affect the loan. The mortgage company "holds it" until the full payment has been received

And that's the reason why I'd like to suggest that you only make one payment per month, when a full payment is due.

If you want to save money on interest and pay off the loan early, add an "Extra Principal" payment amount to your monthly payments. This will be handled properly by the loan wizard in Quicken and you'll see how much time and money you save on your loan.

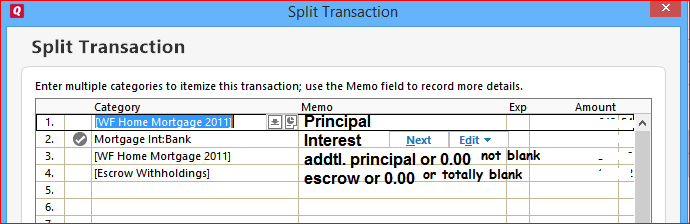

Here's an example how your Split loan payment transaction should look like after adding an extra principal amount to your payment:

1 -

What benefit is it TO YOU to make a payment where the lender gets your money for 2 weeks and you get nothing in return?

I concur with the prior comment to either 1) just make an additional manual payment, or 2) add a bit extra to the existing payment.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0

Categories

- All Categories

- 59 Product Ideas

- 34 Announcements

- 239 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub