Tax Reports Should Contain current 1040 tax schedules, such as 1, 2 and 3

Comments

-

I'm having the same frustration. Quicken has Form 8829 as a Tax-Related Category and includes *most* of the Tax Line items... but not Line 19 "Rent."

It's a real head-scratcher as Form 8829 is specifically for "Business Use of Your Home."

Insurance, Repairs & Maintenance, Utilities all have their own Lines. But the only option for Rent is to stick it in Other Expenses. Far from ideal.

Rent has been on the IRS form for years... why hasn't Quicken added it? Or why can't they allow us to edit these Tax-Line Item categories ourselves?

I get that keeping up with the tax code and all the form changes is a big task. Line 19 was Line 18 a few years ago. I don't expect Quicken to necessarily be on top of that, but "RENT" as a general category, SHOULD BE THERE.

In my case, I don't need it to sync up or export to TurboTax either... I just need to accurately print a Tax Schedule report to send to my accountant and the basic line items that are on those IRS forms YEAR AFTER YEAR should really be in the Quicken category list or we should be able to add them ourselves.0 -

So frustrating year after year, when foreign taxes paid can't get categorized or even listed in the tax planning area. Why can't a manual entry for a new tax line for credits be done? Actually I don't see any tax lines available for credits listed.0

-

Note: in making these changes, I think it is much more important to match the current layout of the tax forms than those of previous years, and it is not necessary for Quicken to have different layouts depending on which year is shown in the report.QWin Premier subscription0

-

Working with TurboTax, is a big part of why I use Quicken. Otherwise, I could just use a fancy spreadsheet. Up to date Schedules and tax categories and appropriate mapping between the programs is critical.1

-

Quicken Home and Rental Property should be able to Tag / Copy more than 15 properties to export to schedule E.1

-

Suggest update your list to include Sched to IRS 1040.

For business owners, there's no provision for assigning a tax line to Health Ins Premiums paid (Reported on Sched 1).

You do offer "Schedule C: Insurance, other than health". Seems reasonable to include a line for health insurance IAW IRS guidelibes.

Thanks

0 -

This is a great idea, good suggestion!1

-

Please look into adding all 1098 forms to the Tax Line Items as they all include tax breaks. There are some 1098 missing. At the very least, since it's not really tax software then maybe allow the user to add tax line items. Thank you.

0 -

For individuals holding a mortgage, it would be very helpful

0 -

If you are looking for the home mortgage interest deduction: That form is already provided in Quicken….there's actually 2 different ones (one for where you receive a 1098 form and one for where you do not receive a 1098 form).

What I don't see is a default category for Mortgage Interest. So might want to create a new category or subcategory for that and during that category creation process click on the Tax Reporting tab, check the box for Tax related category and then select the Schedule A tax line item from the drop-down. Or if you already have a category you use only for the Mortgage interest, you can edit that category to assign one of these Sch A tax line items to it.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

Please add Schedule 1, 2, 3 to tax-related items.

0 -

Please add Form 1040, Schedule 1 line items to tax categories in Quicken Classic Business & Personal software. This is a form used by many taxpayers, and there is no excuse this is not part of the tax planning function of this software release.

1 -

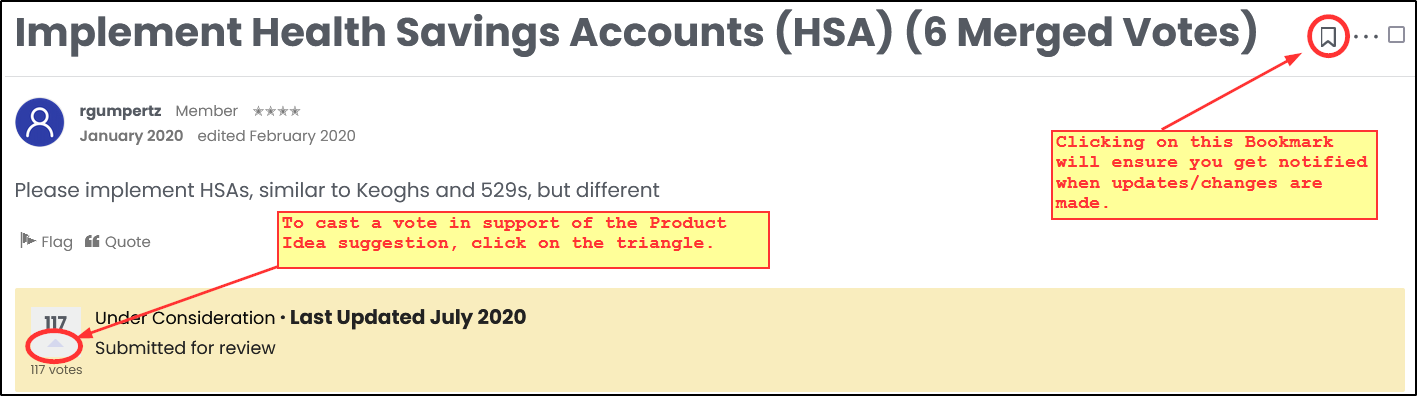

@Randy 415 , @RMShortley - If you did not up-vote this product idea (at the bottom of the 1st post in this thread,) please do so now. Generally, ideas need to get about 50 up-votes before the Development Team considers them for addition to their development plan. Go to the 1st post in this thread and then click on the button that is shown in the circle in the following example picture.:

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 239 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub