Shares don't update

Answers

-

Hello @Grammy605,

Thank you for contacting the Quicken Community, though I do apologize that you are experiencing this error.

What version of Quicken are you running? You can see this by going to Help > About Quicken. What financial institution are these mutual funds with? Could you please tell me the Connection Method for this account? You can see the Connection Method by navigating to Tools in the upper-right corner > Account List > Edit > Online Services. How long has this error been occurring?

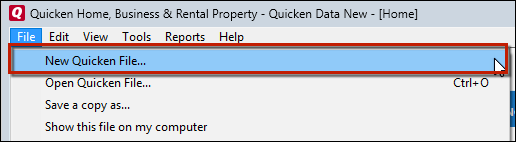

To start, I suggest creating a test file and adding the mutual fund account(s) to see if the same error occurs with the total number of shares not updating. It is recommended to save a backup before proceeding with troubleshooting steps in the event that you would like to return to your original starting position. Below are instructions on how to create a test file:- Choose File menu > New Quicken File.

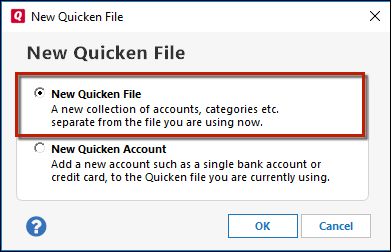

- Select New Quicken File.

- Click OK.

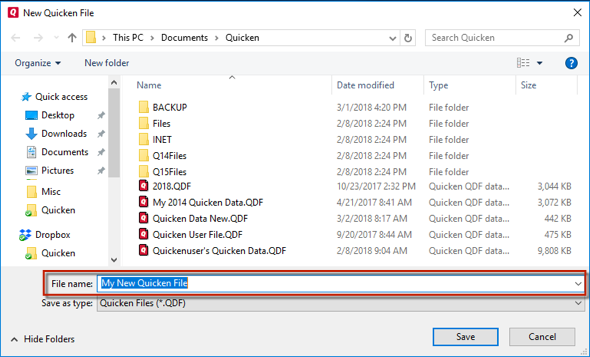

- In the File name field, enter the name of the new file, then click Save. Use a name like "Test File" to tell it apart from your main file.

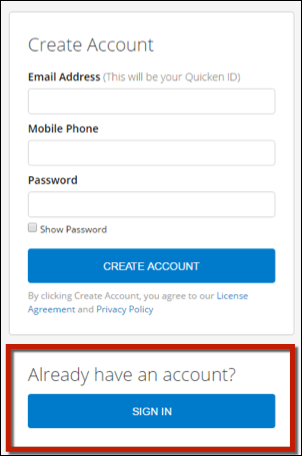

Don't use any of these characters: * ? < > | " : \ / (asterisk, question mark, left and right-angle bracket, pipe, straight quotation marks, colon, BACKSLASH, FORWARD SLASH). Also, don't add the .qdf extension; Quicken does that for you.- Sign in with your Quicken ID. If you are prompted to create a Quicken ID but already have one, click Sign In under the Create Account prompt.

- Select to not use Mobile.

- Click Add Account to start adding accounts to the new file.

After adding accounts, see if you are experiencing the same problems in this test file.

Please let me know how this goes, I look forward to hearing your response.

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

@Grammy605,

The situation you describe can be caused by one or more Placeholders in the account for the affected security, with a later date than the transaction you are entering. To further confuse matters, the Placeholders may be hidden.To make placeholders visible, go to Edit > Preferences > Investment Transactions and make sure the Show hidden transactions box is checked.

Placeholders will have a gray background in the account’s transaction list (register) even if they are not selected, and will have “Entry” in the Action column.

Placeholders compensate for missing or incorrect investing transactions by forcing Quicken’s share balance for a security to match a specified value on the Placeholder date. This is usually the share count downloaded from your financial institution (FI).

Placeholders also prevent new transactions like Bought and Sold prior to the Placeholder date from affecting the account’s cash balance. This shows up as N/A in the Cash Amt column of the transaction list.

For information on resolving placeholders, please see this FAQ:

QWin Premier subscription0 -

Jasmine, thank you, but the account is not connected. I stopped subscribing to the service, so I am manually entering all transactions.0

-

Jim, I will try this and see if it will solve my problem. Thank you.0

-

Jim, this solved my initial problem, but I see more. I will continue working on it, but right now I don't see any more placeholders in the account.0

-

Again, thanks. I am working through the account (right now in 2016) and I think I see other issues that I can resolve.0

-

So - is this the same "mutual fund" you have posted about in your other thread - or another/different problem ?Grammy605 said: Jasmine, thank you, but the account is not connected.

I stopped subscribing to the service, so I am manually entering all transactions.

It really helps us to share ALL the info at the beginning....

0 -

This is a different problem. This is a problem with an account for Fidelity and it does have two mutual funds in the same account.0

-

It would appear that I was able to fix my original problem with Fidelity (by removing all placeholders), but now I have a different problem that I can't figure out. First: Fidelity doesn't give you the number of shares for each dividend, STG, LTG, etc. It only gives you the total shares for all. (so, for example: Div: $186.40, STG: $605.48 & LTG: $5904.05; Reinvestment: 63.547 shrs @ $105.37.) So I do the calculations, but the exact shares don't always match up. If there is a way to enter that into quicken a different/better way, I would love to know how. But this is my real question: at the end of May 2018 my share balance is reflected in Quicken and is correct. In August there was a 10:1 split. After I enter the split, it doesn't show a balance for that entry nor any entries following. I do appreciate your help. I am trying to share all the information and to be clear, but maybe I don't always know what you need nor how to describe it accurately.0

-

If the individual reinvested shares don't download, you might be able to get them from Fidelity's website. If not, you can click on Enter Transactions and pick Income to enter the various income amounts then enter the combined reinvestment as one Bought for the total number of shares, using up the cash from the income. It will come out the same for tax and performance purposes.

To see what is going on with the split, please click on Holdings and set the As of date to just before and after the split. What do you see?QWin Premier subscription0 -

First, I am entering manually, nothing downloads right now. Fidelity's online statements don't show anything different. I guess I don't know where else to look on-line. That is a good suggestion for entering the reinvestments. I will try that. The holdings are correct before and after. It's just not showing up on the "ledger."0

-

Clarification: if I enter the dividend, STG and LTG dollar amounts, then the total shares can just be added next to any of the Div, STG, LTG dollar amounts?0

-

Actually, I just tried that and Quicken insists I have to share amounts for each of the income amounts. So I must have misunderstood.0

-

I am assuming that the distributions are all from the same security and that your cash balance starts at zero.

- In your Fidelity account, click on Enter Transactions

- In the dropdown menu at the top, select the Inc - Income option

- Select the security name and enter the dollar amounts for the distributions you received next to the corresponding categories.

- Click on Enter/Done when you are done entering the distributions.

- The Cash Bal column should show the total of the distributions you received.

- Click on Enter transactions again and select Buy - Shares Bought

- Enter the total number of shares that were purchased (63.547 in your example) and the total cost that shows in the Cash Bal column.

QWin Premier subscription0 -

Thank you . . . I actually looked for the income option, but somehow overlooked it. Of course, that worked perfectly. Thanks. Now the only problem left is how to handle the split that stopped the reflection of share balance from that point forward.0

Categories

- All Categories

- 43 Product Ideas

- 36 Announcements

- 228 Alerts, Online Banking & Known Product Issues

- 21 Product Alerts

- 497 Welcome to the Community!

- 677 Before you Buy

- 1.3K Product Ideas

- 54.4K Quicken Classic for Windows

- 16.5K Quicken Classic for Mac

- 1K Quicken Mobile

- 814 Quicken on the Web

- 116 Quicken LifeHub