Employer 401(k) Match

JoeG2042

Quicken Mac Subscription Member ✭✭

I recently migrated from Quicken for Windows to the Mac version. BIG change, but I am getting used to it and like it.

One thing I can't figure out, other than via a phantom deposit, is how to handle a 401(k) match from my employer into the 401(k) account I track in Quicken. The 401(k) account shows negative cash unless I update. In the Windows version paycheck setup, you could account for this within your check.

I understand there is no Paycheck Wizard in the Mac version, but this seems to be a hole that could be filled.

One thing I can't figure out, other than via a phantom deposit, is how to handle a 401(k) match from my employer into the 401(k) account I track in Quicken. The 401(k) account shows negative cash unless I update. In the Windows version paycheck setup, you could account for this within your check.

I understand there is no Paycheck Wizard in the Mac version, but this seems to be a hole that could be filled.

Tagged:

1

Answers

-

I use a scheduled phantom deposit to cover the gap, transaction is "Personal Income:Employer Match"1

-

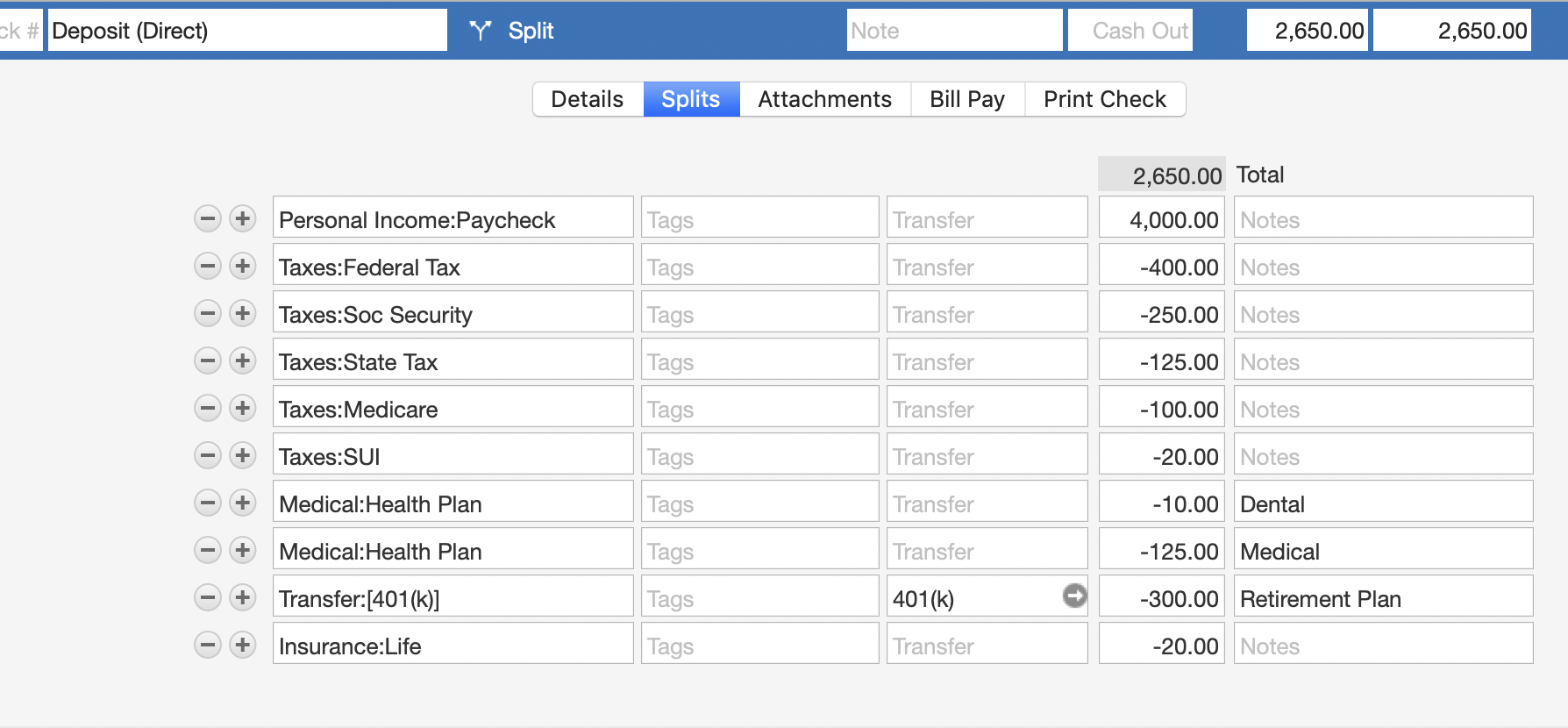

Here's another approach you can use. First, I should ask if you already have your paycheck set up in your checking account for the amount of your net pay, with split lines for your gross pay and all the deductions from it? (Which, as I understand it, is basically what the Windows version's paycheck wizard does.) For example, here's a dummy paycheck where the gross pay is $4,000 and net pay is $2,650:

This example shows an employee payroll deduction of $300 being transferred to a 401k account. And you need to create the employer matching contribution, which can be done with two additional split lines in the paycheck transaction. The first is to create the employer match; the second is to transfer that amount to the 401k account.

If you want to see the employer match as income when you run reports, then use a category like Wayne suggested above: "Personal Income:Employer Match".

If you do not want to see this as income on your reports, then use a special category called "Adjustment". Using Adjustment means the amount will not be counted as income or expense in reports; it's a way to create income or expense out of thin air.

Quicken Mac Subscription • Quicken user since 19930 -

The issue with this approach is that it artificially inflates your gross pay.

The Windows version of Quicken has a wizard and when you enter things like a 401k contribution, it allows for an employer match that doesn’t impact gross pay.0 -

> @Wayne Dibble said:

> I use a scheduled phantom deposit to cover the gap, transaction is "Personal Income:Employer Match"

This is what I will do.0 -

No it doesn't. You're recording gross pay exactly as shown on your pay stub. In the sample I posted above, gross pay is $4,000.JoeG2042 said:The issue with this approach is that it artificially inflates your gross pay.

For the employer match, I suggested two options. The first adds to income if you want to see it as such; use a subcategory of Personal Income which is not marked as "tax related", so it won't show up on a tax report (because the employer contribution is not reported income), but will show up on a Quicken report of your income. The second option creates cash in the 401k account from the employer deposit, but does not show up as income on any reports.Quicken Mac Subscription • Quicken user since 19930 -

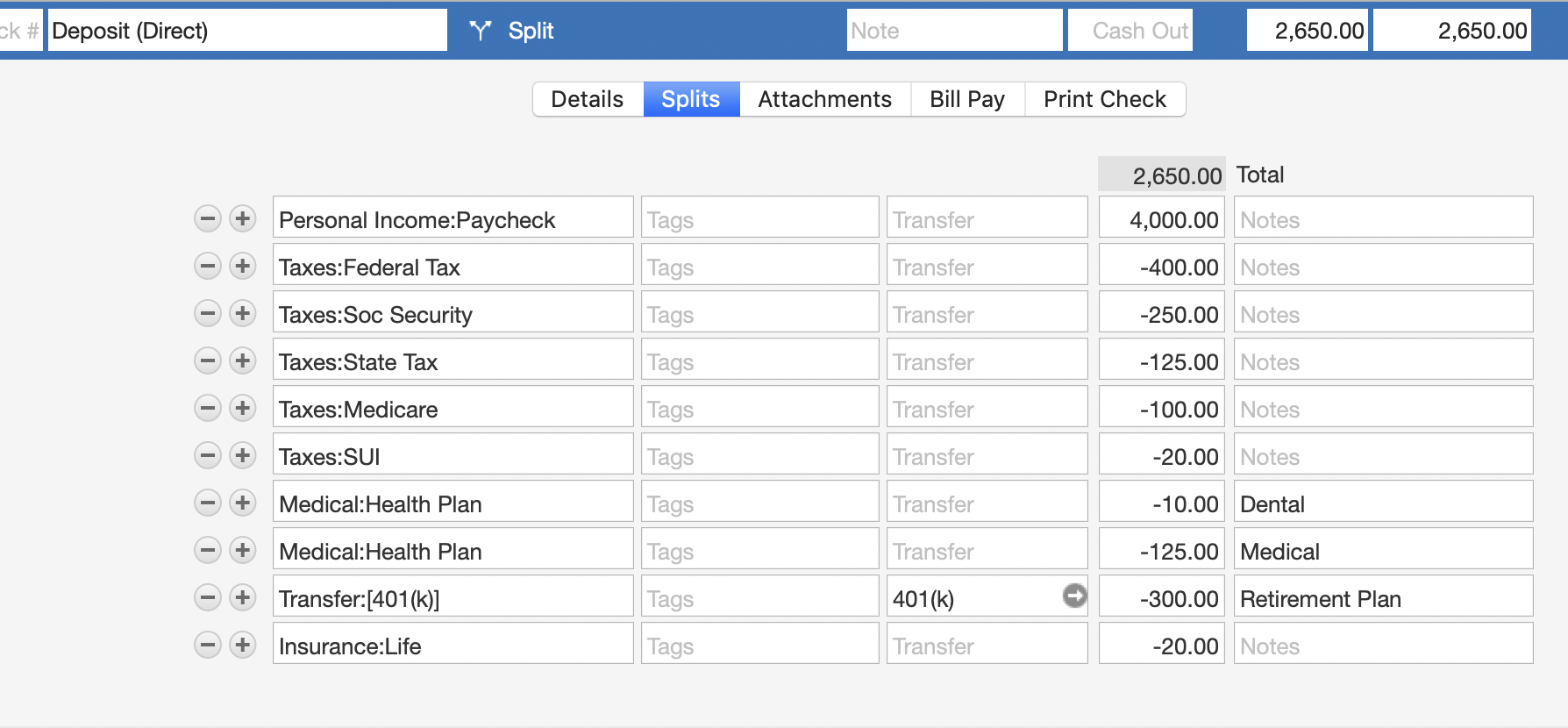

Maybe this will help. Here is what Quicken Windows is doing under the covers (it creates a split).

And the categories:

So, Quicken Windows is in fact doing exactly what @jacobs is suggesting.Signature:

This is my website (ImportQIF is free to use):1

This discussion has been closed.

Categories

- All Categories

- 59 Product Ideas

- 34 Announcements

- 239 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub