R48.8 - I really like the NEW "Income by Security" report, BUT it has problems (edit)

I really like the income by security report. For people that have securities that are paying a lot of dividends or interest it gives a much better picture of what your actual return on investment than other reports that only show prices.

But I have run into a number of bugs, which seem to be limited to the legend.

Let me stated that I have customized the report by accounts and securities, just in case it matters.

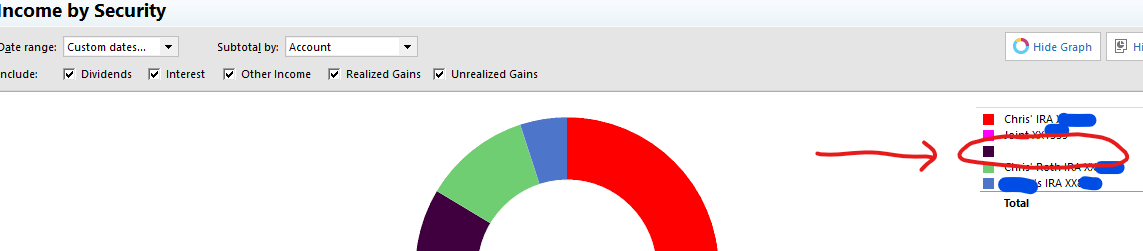

Bug #1: When selecting to Subtotal by: Account one my accounts displays a blank in the legend.

Bug #2: Cash security type is wrong in the legend. Note that this is in a regular savings account with the intent set to investment.

Bug #3: from above just changing to Include all dates, the legend got "wiped out" and only includes "No Type" (cash), but not Mutual Fund:

Signature:

This is my website (ImportQIF is free to use):

Comments

-

If I subtotal by account and select all 6 "Include" checkboxes at the top, my graph vanishes altogether.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0 -

I don't seem to have the problems that either of you have. I do like the report except that one thing I wish they would have done is included the beginning market value and/or the cost value and then calculated the income as a % of either of these. I think even better would be an average daily cost over the period, although I am not holding my breath on that one. The reason for this is something like my Fidelity Government Cash Reserves where it says I earned 10.73% (I wish!). It gets this because the balance at the end of the period was much lower than it was at times during the period. That may be an extreme example but it will also skew results on stocks when you have buys and/or sells during the period.

Overall nice report though.

Quicken Windows user since 1993.

0 -

From my experiments, it appears that the problems that @Chris_QPW is seeing are related to a Banking account that is set with an Account intent of Investing.

The Account Intent issue affects other Investing reports as well, but in different ways.

It would certainly be nice if we could change the Account Intent and have the change be refelected correctly in the reports.

QWin Premier subscription1 -

I wouldn't doubt that the Account Intent of a savings account set to investing will cause problems (it does in other reports too), but I'm seeing more than that. I changed the intent on the one account like that to Savings, and I'm not including it when I filter for accounts and securities later on.

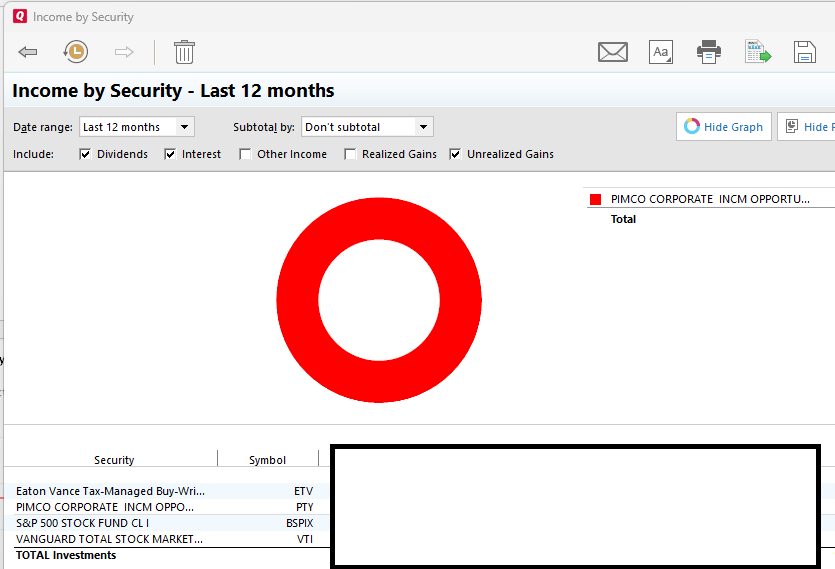

Here is with no filtering of accounts or securities and set for the last 12 months (I believe year to date is the default, but it only says "custom").

As you can see it is correct at this point. Now I'm going to restrict it to only active investment accounts and securities (the "number securities" are weird ones Chase creates for sweeps).

Still OK.

Next I notice weird things with selecting the other check boxes. This is what happens with "Unrealized Gains".

Signature:

This is my website (ImportQIF is free to use):0 -

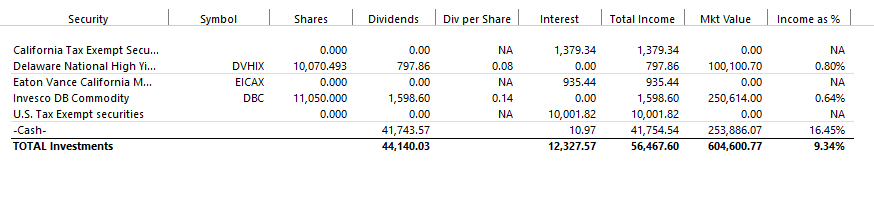

I am getting a "cash" line in the Security column with an amount shown in the Dividends column. I dont know where this amount comes from and I can't drill down to see the detail

0 -

[Edited to fix formatting]

0 -

That is odd. You might want to subtotal by account and adust the dates to see where it is coming from.

QWin Premier subscription0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub