Do all Categories have to be either Income or Expense with QMac ?

I want to set up transfers between my business and personal account but the Category set up appears to require any category to be designated either income or expense. Am I missing something? Any ideas appreciated.

Best Answer

-

You may find it clearer to make the Transfer column visible in your registers. In the Transfer column, simply select the account for the transfer. Leave the category field blank. (Quicken will automatically fill it with the transfer using the syntax "Transfer:[account name]".)

A transfer between accounts is neither income nor expense.

Using a category of just "Transfer" makes money appear or disappear from the account without moving it to another account.

Quicken Mac Subscription • Quicken user since 19931

Answers

-

Yes, all categories need to be either income or expense, but transfers don't need to be categorized so that shouldn't be an issue.

Could you be more specific about what you're trying to do?

0 -

If your business account is in the same Quicken file as your personal account, then you just use the Transfer category with the transfer account being one or the other of those accounts. Entering the transfer in one account automatically creates the matching transfer transaction in the other.

If the business account is in a separate file, Quicken or otherwise, and you simply want the funds to disappear from within Quicken, then use the Adjustment category to reduce or increase an account without the transaction being categorized.

Quicken user since 1990, MacBook Pro M2 Max on Tahoe 26.2 (and Win 11 under Parallels Desktop)

0 -

the catch is…. you can't have a [Transfer] AND a [Category] for the same single transaction …

So… you might need to create 2 transactions - one for the "withdrawal" and one for the "deposit"

0 -

Thank you all for your helpful comments. Unfortunately, Quick for Mac requires an assignment of either Income or Expense to all categories, INCLUDING "Uncategorized"! So not inserting a named category for my transfer transactions doesn't help because Quicken Mac requires even that mandatory auto-filled category be either income or expense. In answer to one of your questions about specifically what I am doing, I often transfer funds from a brokerage account (not tracked in Quicken) to my Quicken tracked checking account. I would prefer these transfers not be characterized as income or expense. I also transfer funds between two accounts that are tracked with Quicken but the same problem exists: must have a category or uncategorized and all of those are either income or expense. I presume I am out of luck on this issue but appreciate any ideas you all may have.0

-

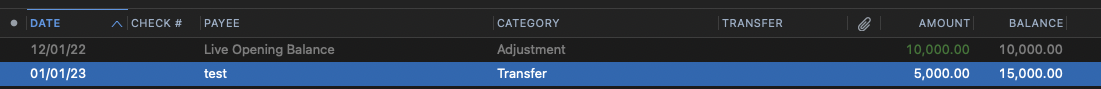

@Guy To transfer money between two accounts that are tracked in Quicken, put Transfer into the Category field along with the name of the account at the other end of the transfer, then it won't be logged as Income or Expense. Here's an example of an incoming payment on a credit card account coming from a checking account:

For money coming in from an account not tracked by Quicken, you could use the Transfer category without specifying an account name. Add a note in the memo field explaining where the money came from for future reference:

Quicken Mac won't let you create a Category that is neither Income nor Expense, but there are a few built in categories like Transfer that are neither one. You can take a look at the Categories window to find them.

0 -

Thanks Jon! This is much closer to what I need. I'll just use the "Transfer" category from now on. In my Quicken I cannot modify the Transfer category or its one subcategory of "Credit Card Payment" but just using the Transfer word alone without an income or expense status will do the job. Thanks much.0

-

You don't need to create subcategories like "Transfer:[Checking]", you can append any Quicken account name to a transfer like that.

0 -

You may find it clearer to make the Transfer column visible in your registers. In the Transfer column, simply select the account for the transfer. Leave the category field blank. (Quicken will automatically fill it with the transfer using the syntax "Transfer:[account name]".)

A transfer between accounts is neither income nor expense.

Using a category of just "Transfer" makes money appear or disappear from the account without moving it to another account.

Quicken Mac Subscription • Quicken user since 19931 -

@Jon "Could you be more specific about what you're trying to do?"

Transfers are arguibly one type that are neither income or expense, especially when moving money to/from savings accounts. But in income & expense reports they cancel out across the accounts so that's not too big of an issue.

But we need a third category: "Contributions". Money I contribute to my 401(k), HSA, IRA, Roth IRA, ESPP, etc. When I run my P&L report I want to be able to be able see how much I contributed to my egg nest, to such accounts, vs. how much I really spend on goods & services. After all the money contributed are not regular "expenses" (transactions in exchange for goods and services).

Today I manage that using expense Categories (I have only 2 top categories, "Contributions", and "Spending", with all other expenses as sub-categories of "Spending"). But it's just a workaround. My middle school kids started to use Quicken and are confused by this Contribution-as-Expense-Category workaroud when the look at the P&L with two sections "Income" and "Expenses".

Logically, a personal P&L will look like this:

Income

Contributions

Expenses

====

Net Income or (Loss)

The difference between "Contributions" and "Transfers" would be that Quicken would show one leg of "Contributions" in a P&L across all accounts. While "Transfers" would cancel each other out across accounts and thus won't show up in P&L.

0 -

@Socrate Your "contributions" fall into the broader bucket of savings. Whether you put money into an IRA or a Savings account, you're moving cash from one place to another. That's why it wouldn't typically be on a P&L/Income & Expense report — it's not an expense. But from your budget or cash flow stnadpoint, it feels like an expense, and in any case, it's understandable you'd want to see this on some reports.

Fortunately, this is easy to do! Create a new report: Reports > New > Summary Report. Leave the default settings : Row=Category, Column=Time, Time Interval=None. Click Continue to Customize. Set your date range, and then click on Accounts > Selected Accounts. By default, all accounts (except Separate accounts) are included, but you'll want to de-select Investing > Retirement, which will de-select your various retirement accounts. Now click the Advanced tab, and click the radio button for "Include selected Transfers with accounts outside of report". Click OK. The report will have the normal Income and Expense sections, and below Expenses will be a Transfer section. Here, you'll see "TO IRA", "TO HSA", etc. showing the amount you transfererd from your non-retirement accounts to (and from) your retirement accounts. And the net transfers are reflected in the bottom line total. So this is basically what you described wanting, although the order and labels are slightly different.

Quicken Mac Subscription • Quicken user since 19930 -

@Socrate, It's really quite simple.

Use of an INCOME category means that you're richer.

Use of an EXPENSE category means that you're poorer.A TRANSFER is neither. Just as moving your wallet from one pocket to another leaves you neither richer noor poorer.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

@NotACPA You're correct, of course, but this user wants a report which isn't correct from an accounting viewpoint but which better reflects their cash flow. I have explained how this can be done in Quicken Mac in my post above.

Quicken Mac Subscription • Quicken user since 19930 -

@jacobs, I'll try the reporting method you suggest.

@notACPA, agree with what you said. With one exception. TRANSFER is simply that, moving from a pocket to another. Like from checking to savings and back. TRANSFERS net to zero and from a P&L point of view they don't count.

However, contributions to 401(k), IRA, HSA, etc. are different. Are not simple transfers. Money I put in these accounts I cannot take out until I retire. It's not the same as a savings bank account. HSA I can only pay myself if I have qualified expenses. 529 you cannot touch for many years either. That's why these contributions are not simple transfers. And making those contributions don't make me poorer, either, therefore from a logical point of view are not expenses.

From a family P&L point of view, I want to be able to see how much I contribute (make me richer long-term) vs how much I expense on goods and services.-1 -

If you move $1000 from checking to your IRA you still have $1000.

Your "contribution" is a Transfer, that you can't take it out is immaterial. They're simple transfers.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

And because "transfers" cancel each other out (net to zero), when you run a P&L across all your accounts it looks like you didn't saved anything in the IRA, and it looks as if you still have the $1000 cash. I am not sure that you realize how important contributions are (next to investments) to build wealth, and how important is to distinguish them from ordinary transfers (back/forth from checking to/from savings) and from discretionary spending.0

-

How would you classify the purchase of a CD? You can't, immediately, get that money back either.

And, in your latest post you're confusing P&L reports with Net Worth reports. Your TRANSFER would show in your Net Worth as being in the IRA. An investment is NOT an expense.

Regarding what I realize … read my signature line!

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP1 -

@Socrate @NotACPA I feel like you're going around in circles here. Everyone acknowledges that transfers to savings are not expenses from an accounting standpoint. But transfers to dsavings/retirement can feel like an expense from a cash flow standpoint.

@Socrate In your most recent post, you keep trying to say there's a difference between a transfer to a retirement account and an "ordinary transfer" to a savings account. But there isn't any difference from an expense or cash flow standpoint. Someone could choose to build wealth investing in a bank savings account, in CDs, in an investment brokerage account, in precious metals, or in a retirement account, but from a bookkeeping stanpoint, they're all the same.

But it's understandable you want to be able to see these transfers or see the increase in value of your IRA account. As @NotACPA says, you can see the increase in the value of your IRA in a Net Worth report. A Net Worth by Year (or quarter, or month) report can show you the changing value of the IRA account over the time period and intervals you select. And if you want to see your transfers to the IRA account on an expense report (even though they aren't truly expenses), I've explained how it is easy enough to do that in Quicken Mac.

I don't think we need to keep going around about this. 😀 Quicken is fortunately flexible enough to show what's "right" by accounting standards as well as what's "right" for any investor's personal tracking needs.

Quicken Mac Subscription • Quicken user since 19931

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub