BJ's Credit Card Duplicate Transactions downloaded

Comenity Bank was the owner of BJ's credit card. In Feb 2023, we were informed that any payments made for this credit card should be sent to Capital One after Feb 26, 2023, because CapOne had acquired BJ's CC.

The problem I've run into is that I set up a new account for Capital One and linked it to CapOne.

I've downloaded TRX's from Capital One a few times since late Feb.

I took a closer look at my Quicken credit card accounts for Capital One and Comenity and now realize that my Quicken account for Capital One downloaded 20+ transactions from Jan & Feb 2023, which are duplicates of TRX's previously downloaded to my Quicken Comenity Bank Bj's credit card account.

My questions are:

(a) is this the typical scenariothat results in the Quicken old and new CC accounts ending up with duplicate TRXs?

(b) Are there better ways of handling this than the following…

-manually remove the duplicateTRXss from the new (or Old) quicken account

-merge TRXs from the old Quicken account into the new one, and manually (??) delete or void the duplicates?

Thank you!

FishRB

Answers

-

Hello @fishrb,

Thank you for reaching out to the Community and telling us about this issue. I'm sorry to hear you're running into this problem. From what you are describing, it sounds like you added it into your Quicken as a new account when you changed the connection method. That does greatly increase the odds of duplicate transactions since it sees it as a new account and doesn't compare to the existing register in the old account.

If you want everything consolidated into one account, probably the simplest way to do it is:

- Backup your Quicken file.

- Delete the newer account since its essentially an unneeded duplicate.

- Verify that the old account is deactivated (Tools>Account List; if the account says "yes" in the Transaction Download column, then it thinks its still connected). If it thinks its still connected, then deactivate it.

- To reconnect under the new financial institution, go to Tools>Add Account.

- Search for the correct Financial Institution.

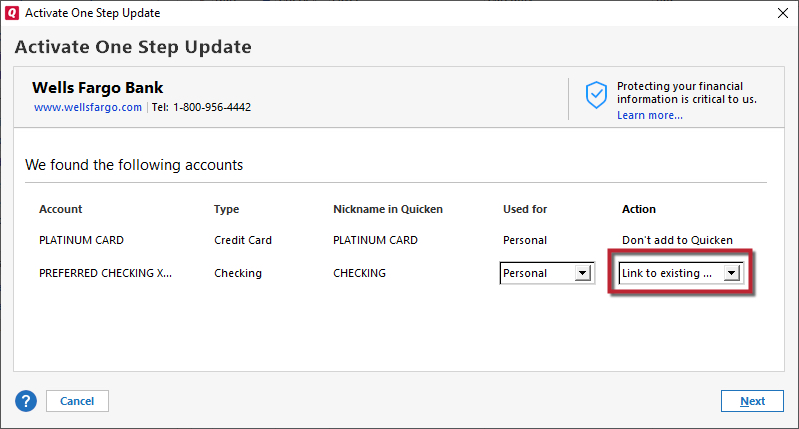

- Follow the steps to connect the account. Once at the Add/Link screen in Quicken, make sure to choose Link to Existing in the action column and then select the correct account for it to link to.

That should prompt it to download into the old account and will decrease the odds of duplicates downloading. There is still a chance of duplicate transactions any time that you deactivate and reconnect accounts, so its a good idea to check for them and delete any you find.

Thank you.

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 67 Product Ideas

- 35 Announcements

- 222 Alerts, Online Banking & Known Product Issues

- 21 Product Alerts

- 633 Welcome to the Community!

- 673 Before you Buy

- 1.2K Product Ideas

- 54.1K Quicken Classic for Windows

- 16.4K Quicken Classic for Mac

- 1K Quicken Mobile

- 813 Quicken on the Web

- 115 Quicken LifeHub