Quicken downloading duplicate transactions

I have a Citibank checking account and a line-of-credit attached to that account. Out of the blue, for the last month or two, transactions for my checking account are also downloaded (incorrectly) to the checking line of credit ("checking+", they call it). This worked correctly for years and nothing changed. But now, every time I download new transactions into my checking account, duplicates of these transactions are also downloaded into checking+ and I have to delete them.

What is going wrong here? Is it a bug on the Quicken side or the Citibank side? I changed nothing and it used to work, so it's not user error.

Comments

-

Hello @Permutations,

I believe this could be due to a change/error with the way the information is being sent through the connection between Quicken and Citi Bank.

First, I suggest deactivating and reactivating all Citi Bank accounts to see if this may resolve the issue. You may follow the instructions below. It is recommended to save a backup before proceeding (just in case).

- Open the Account List in Quicken (Tools > Account List OR Ctrl + A)

- If present, select the Show Hidden Accounts checkbox at the bottom of the Account List

- Edit each account with this financial institution to Deactivate (or Remove From One Step Update) on the Online Services tab

- Click on the General tab and remove any info displayed in the Financial Institution, and Account/Routing Number fields. Note: The account must be deactivated first before these fields can be edited.

- When finished, close the Account List

- Close, then re-open Quicken

- Navigate to Tools > Add Account

- Walkthrough this process as if you were going to add a new account, providing the login credentials and answering any security questions/processes presented until you reach the screen where Quicken displays the Accounts Discovered at the financial institution

- Very carefully LINK each of the found accounts to the appropriate account you already have set up in Quicken.

Please let me know how it goes!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

@Quicken Jasmine I did what you suggested, and now it's even more messed up. Now when I go to link the accounts, it doesn't even LIST the line of credit as something to link to. Also, it calls this a "checking" account instead of a "credit" account. It's correctly listed on the Citibank site as a credit account, so this is a Quicken bug.

0 -

@Quicken Jasmine It gets weirder. When I reconnect the business account, it finds the personal line of credit. There's a bad bug somewhere.

0 -

@Quicken Jasmine There's no way to fix this. When I reconnect my personal accounts, Quicken lists both the checking account and line of credit as checking, and puts them in the same existing account. When I reconnect my business account, for some reason the personal accounts also come up, but both as credit accounts. I tried various ways of doing one then the other, but nothing works. Now the line of credit isn't even listed in one-step update. I hope the checking transactions go to the right place. I don't have any new transactions, so I can't tell.

This is definitely a Quicken bug. I wish they'd fix it!1 -

@Quicken Jasmine Last follow-up… I found Checking Plus (personal account) under my business account in One Step Update, but the balance was that of my checking account - just all screwed up. So I removed Checking Plus from downloads. If I use it, I'll enter the info manually.

I still wish Quicken would fix this. It used to work. Is there a way to submit this as a bug report?0 -

Hello @Permutations,

Thank you for providing more information, though I do apologize for my delayed response.

Would you mind telling me which instance you are using and which connection method? Also, are they the same as they were before you disconnected?

Let me know!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

Would you mind telling me which instance you are using and which connection method? Also, are they the same as they were before you disconnected?

I don't understand what you're asking. What do you mean by "instance"? What do you mean by "connection method"? Is there some connection method besides the internet?

In case by "instance" you mean "version":

Version: R60.15

Build: 27.1.60.15

There was a recent update. I don't recall the exact timing.

I connect using One Step Update from my computer.0 -

Hello @Permutations,

The instance would be from the list located in my previous screenshot. For example, the instance highlighted in blue is "Citi Bank", a different instance below it is "Citi Cards". The connection method would be what you are using to connect to Citi Bank (Direct Connect, Web Connect, Express Web Connect, etc.). You can see the connection method by clicking the "Advanced Options" button that you can see in my screenshot which is located on the specific instance you are attempting to connect to. You can also see the connection method of already added accounts by navigating to the specific register > Clicking the settings (gear icon) in the upper right corner > Edit Account Details > Online Services > Connection Method (see screenshot).

I hope this helps!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

Why am I digging up this information for you? It has not changed. Is this a bug report?

0 -

Hello @Permutations,

This information is relevant to investigating this issue further for you in hopes of working towards a resolution.

Thanks!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

Personal accounts (checking and checking+, theoretically)

Financial Institution: Citibank

Connection Method: Express Web Connect+

Business accounts (checking and - incorrectly - checking+ from personal checking)

Financial Institution: CitiBusiness Banking

Connection Method: Express Web Connect

No change in either.0 -

Hello @Permutations,

Thank you for providing more information and I do apologize for the delay in my response.

I invite you to review this FAQ regarding duplicate transactions to see if it may assist in resolving the issue. You can also find the instructions below. It is recommended that you save a backup before proceeding (just in case).

Step 1: Add the Downloaded ID column to your register

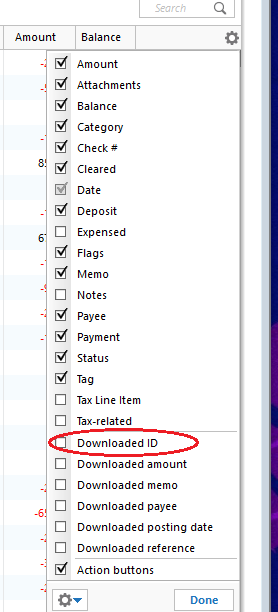

- Click on the Register Columns gear icon at the top right of the account register.

- Place a checkmark next to Downloaded ID, then click Done. (If you use Two-Line Display, you will need to select Downloaded ID and Downloaded reference)

- Review the Downloaded ID. This is the unique identifier for each downloaded transaction. It is used by Quicken to determine which transactions have been downloaded and which ones need to be downloaded.

Step 2: Determine which of the following situations is causing duplicate transactions

Mismatched manual and downloaded transactions appear in the account register.

If the duplicate and manual transactions do not have a Downloaded ID, then the downloaded transaction was not properly matched to the manual entry.

Solution: Delete the manual entry.

- Right-click the manual entry.

- Select Delete.

- Confirm by clicking Yes.

Downloaded transaction appears twice, with the same Downloaded ID.

Solution: Set the register for the affected account to Single-line display.

- Press Ctrl + 2 on your keyboard.

- Delete the duplicate transactions.

- Set the register back to Two-line display by pressing Ctrl+2 again.

Downloaded transactions appear twice, with different Downloaded IDs.

If your bank and/or their service provider is making changes to how they present data to Quicken, there is the possibility that they may transmit the same transaction with two different IDs.

Solution: Contact the Online Banking Support for your bank (Tools menu > Online Center > Contact Info) to request they escalate to their OFX team or service provider in order to resolve this issue for all their Quicken customers.Transactions are downloaded through Quicken AND a manual download from your bank's website, resulting in different Downloaded ID numbers and duplicate data.

Solution: Don't mix your methods for getting transactions from your bank. If you want to download from the website, try to stay with that method. If you decide later that you want Quicken to update automatically rather than manually downloading yourself (or vice versa), be aware that you may encounter duplicate transactions on that first download after the change. You will need to manually delete the duplicate transactions.

Please let me know how this goes!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub