How do you sync Quicken with Financial Institution's data

Answers

-

Placeholders compensate for missing or incorrect investing transactions by forcing Quicken’s share balance for a security to match a specified value on the date of the Placeholder. This is usually the share count downloaded from your financial institution (FI).

Because transactions are missing or incorrect, Quicken will not be able to compute the cost basis or performance for the affected securities. You will see asterisks in the Portfolio views for this data.

Often Placeholders are due to rounding errors in the downloaded data, so for example you will see a Placeholder that adjusts the share balance by .0013 share following a dividend reinvestment. In this case you can adjust the number of shares in the Reinvest transaction so that the Placeholder is zero, then delete the Placeholder.

Placeholders also prevent new transactions like Div, Bought and Sold prior to the security’s Placeholder date from affecting the account’s cash balance. It does this by creating a linked Cash Balance Adjustment just before the affected transaction. Deleting one of these will delete them both. This shows up as N/A in the Cash Amt column of the transaction list.

To allow the cash balance to change when entering missing transactions that affect the cash balance, you must first delete all the Placeholders for this security that have later dates than the transaction you are entering. Because of this, if you are entering a series of missing transactions it will be easiest to work in reverse chronological order.

Always back up your data file before changing historical transactions.

QWin Premier subscription0 -

I got a break from family matters to take a quick look at this thread. Most of what you've said I knew. What is new to me is the part about placeholders affecting the account’s cash balance. I will take that into account when a proceed with my deep dive into the transactions.

About rounding: it appears to me that Quicken rounds and the financial institutions truncate when fractions of cents are involved. I've seen this in calculations of market value when fractions of shares are involved. Not the same situation you talk about but it does bring up the question: What do you mean by "rounding error"? Who is in error?

This business about placeholder entries is a valid issue and I intend to keep that in mind during the deep dive but I don't see how it is related to the issue that started this thread which was based on the fact that Quicken thought the account had X shares of WFMIX, Allspring Spec Md Cp Val I, while the FI said it had X shares of ESPNX, Allspring Spec Sm Cp Val I; and Quicken thought the account had Y shares of JSMGX, Janus Henderson Triton I, while the FI said it had Y shares of JCAPX, Janus Henderson Forty Fund Class I; and Quicken thought the account had Z shares of OIEJX, JPMorgan Equity Income R6, while the FI said it had Z shares of HLIEX, JPMorgan Equity Income FDI. These were the only securities with holding errors. Note that each of the mismatches had similarities in the names but the same number of shares.

Finally, the account in question is an IRA managed by the FI. The FI makes trades all the time without my input. The only time I have input is when I ask for a distribution (once a year) and then they decide what to sell to get enough cash to make that distribution. So I am not entering transactions in Quicken other than to respond to the disconnects in share numbers detected during one step update (maybe I am not providing the correct response). I am counting on one step update to keep up with it all

Thanks

Jim

0 -

I have started my deep dive into the transactions and I have uncovered some important things but they are not related to the issues that started this thread. Asking what the community thinks: should I start a new thread or go pretty far off topic here?

What I have found has to do with problems with placeholder transactions.

Thanks

Jim

0 -

If you have specific questions about Placeholders, it is probably best to start an new discussion with an appropriate title.

QWin Premier subscription0 -

I did that and q_lurker made a post to it that had a discussion about CUSIP and that allowed me to connect some dots about this discussion that I hadn't connected. (I thought CUSIP was some kind of identifier assigned internally by Quicken so that it could keep track of securities. Boy, was I wrong!) So I went back to a Quicken data file that was a restoration of my qdf prior to me making any updates to resolve the mismatch. And lo and behold the security list entry for WFMIX had the CUSIP for ESPNX, the entry for JSMGX had the CUSIP for JCAPX, and the entry for OIEJX had the CUSIP for HLIEX.

I had 2 accounts with all three of those securities: the IRA and an old 401K which I've kept for its history. Those securities were in the old 401K long before they were bought in the IRA. When the purchases were made by the IRA, Quicken noted it already had these securities in its list and used the names and symbols from its security list for the securities in the IRA. This explains how the IRA got the mismatch, it does not explain how the old 401K got it. I also do not know which of these securities the old 401K really had.

Recall that I created a duplicate copy of my qdf and made different corrections in each. In one I did a security edit changing the name and symbol of each of the securities. Three rather simple updates. This resulted in modifying the three securities in both accounts. In the other I did the brute force way of editing each of the transactions (changing name and symbol) for those securities only in the IRA. This resulted in ESPNX, JCAPX, and HLIEX securities in the IRA but those securities had no CUSIP. (If they did it would duplicate the CUSIPs of WFMIX, JSMGX, and OIEJX.) I think that is going to be a problem the next time the IRA sells or purchases any of these securities. So, I think the edit security fix is the better fix for my situation.

However, I discovered these mismatches by doing an exhaustive comparison of the holdings in Quicken vs. the holdings shown in the FI. I only did that because the bottom line account balance was different in Quicken from what was shown in the FI. The only reason the account balances did not match is because, when updating share prices, the stock symbol is used rather than the CUSIP.

So, is there a way to get Quicken to verify that the CUSIP matches the name and stock symbol? Looking for just a yes/no answer rather then Quicken trying to fix it. If they do not match, how would Quicken know which is right? In the IRA case the CUSIP was right. I do not know about the old 401K case.

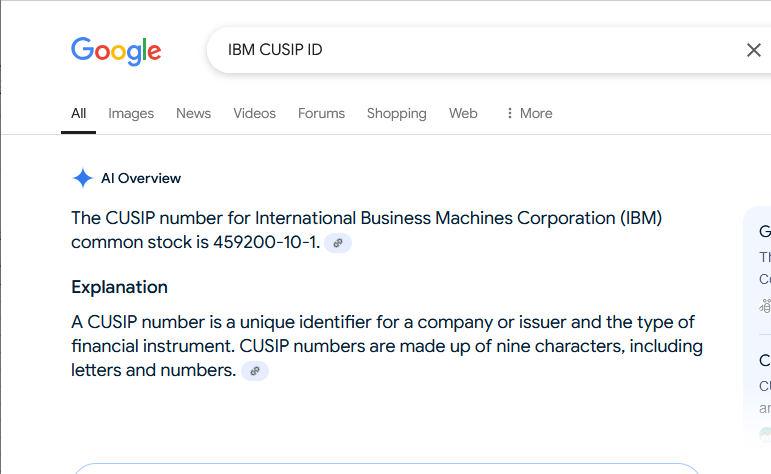

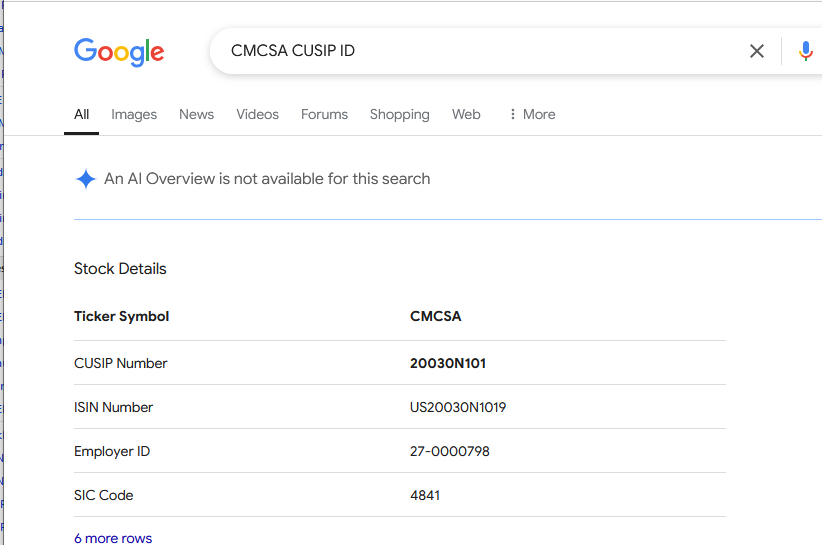

Is there a way to look up the CUSIP of a symbol? I have Googled some symbols and sometimes I get an "AI Overview" with the answer but sometimes I do not. None of my FIs' statements have the CUSIPs of the securities I hold.

Thanks

Jim

0 -

So, is there a way to get Quicken to verify that the CUSIP matches the name and stock symbol? Looking for just a yes/no answer rather then Quicken trying to fix it. If they do not match, how would Quicken know which is right? In the IRA case the CUSIP was right. I do not know about the old 401K case.

Is there a way to look up the CUSIP of a symbol? I have Googled some symbols and sometimes I get an "AI Overview" with the answer but sometimes I do not. None of my FIs' statements have the CUSIPs of the securities I hold.

The CUSIP is supplied by the FI and is used to match securities in Quicken with your holdings at the FI.

The first time a downloaded transaction references a previously-unknown security, Quicken will display a dialog asking if it should create a new security or match it to an existing one. The existing one it recommends is often a poor choice (often a similarly named one), and some folks probably just click through the prompt and use what Quicken recommends. To clear the match:

- From the portfolio tab, find each mismatched security and click on it.

- The Security Detail View window opens. Click the button "Edit Details" in the middle left of the window.

- The Edit Security Details window opens. Uncheck the check box "Matched with Online Security".

The next time that security is referenced in a download, you'll get the dialog mentioned above asking how to match it or create a new security. [Thanks to @jtemplin for the above.] Make sure you are matching the downloaded security with the correct security in Quicken

This will correct downloads going forward, but to correct previous incorrect entries, you must change any incorrect security names.

To look up CUSIP numbers, you can Google <Ticker symbol> CUSIP ID.

QWin Premier subscription1 -

I have never seen a dialog "asking if it should create a new security or match it to an existing one". And there are lots of securities in the IRA that were "previously-unknown" securities at the time the IRA bought them starting in June of 2024. I am guessing now that Quicken simply guessed wrong when the 3 were first bought by the old 401K. I am using Quicken Classic Premier. Was that feature available in Dec 2018 when the 3 were first bought? If it is a relatively new feature that would explain how the problem occurred with those. But that would not explain the lack of prompts for new securities in June of 2024.

Googling "<Ticker symbol> CUSIP ID" works sometimes

At the moment it seems to be working for me for stocks but not mutual funds. I have seen it work for mutual funds. Looking for something that reliably works.

Thanks

Jim

0 -

To Jim Harman, my apologies. I have seen a dialog "asking if it should create a new security or match it to an existing one." I now realize that is what must have happened.

Taking one of the 3 securities as an example, when my IRA purchased HLIEX, JPMorgan Equity Income FDI, it popped up the dialog with the existing OIEJX, JPMorgan Equity Income R6 from an unrelated 401K as the suggested match. It was close enough to fool me and I said yes. What Quicken did was change the CUSIP of the existing security to that in the transaction from the IRA. So the security had symbol, name of OIEJX, JPMorgan Equity Income R6 but the CUSIP of HLIEX, JPMorgan Equity Income FDI.

Since that time, the unrelated 401K no longer exists since my employer at that time switched its 401K manager but I still have the account around in my hidden accounts.

My fix was to edit the symbol and name in the security so that it matched its CUSIP. But that appeared to also "fix" the old defunct 401K. But today, I selected the old 401K to look at some things and, with that account still selected, did a one step update and I got a popup "asking if it should create a new security or match it to an existing one". The new security was OIEJX, JPMorgan Equity Income R6 with a suggested match of HLIEX, JPMorgan Equity Income FDI. (OK, guess what made me realize my mistake!). This time I selected to create a new security. Now both securities exist in the security list with their correct CUSIP. It should be noted that I had previously done one step update after making the security edit without having the old 401K selected and it did not popup any dialogs "asking if it should create a new security or match it to an existing one."

But this did not restore the old 401K. To do that, I think I am going to have to edit each of the old 401K transactions on JPMorgan Equity Income FDI to JPMorgan Equity Income R6. And then do that 2 more times for the other two securities with the same issue. I did get all 3 dialogs during the one step update.

Thanks

Jim

0

Categories

- All Categories

- 42 Product Ideas

- 36 Announcements

- 227 Alerts, Online Banking & Known Product Issues

- 21 Product Alerts

- 497 Welcome to the Community!

- 677 Before you Buy

- 1.3K Product Ideas

- 54.4K Quicken Classic for Windows

- 16.5K Quicken Classic for Mac

- 1K Quicken Mobile

- 814 Quicken on the Web

- 115 Quicken LifeHub