Net change in cash is not reconciling to Income minus Expenses?

When I compare the Cash account balance at the beginning of the year 1/1/2024 to the end of the year 12/31/2024 there is a net change of ($14,748). The cash account is only used to book income and pay expenses. When I ran the Quicken Income and Expense report for 1/1/2024 to 12/31/2024 the net difference of Income minus Expenses $652. I expected to see a net change of ($14,748). On a cash basis the net income minus expenses should equal the net change in cash for the same period. There is no cutoff issue.

Is there something in Quicken I am overlooking or not understanding?

Thank you for any thoughts!

Using Quicken Deluxe R61.21/Build 27.1.61.21 on Win 10 enterprise

Answers

-

Hello @CHess1201,

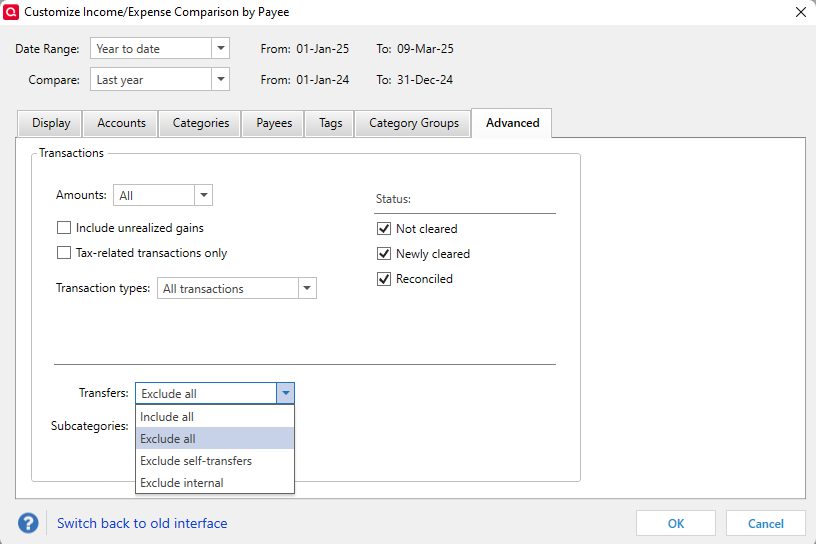

Thank you for letting us know you're encountering this issue. To clarify, is the Cash account itself showing the correct balance and transactions? If it is, then the way the data is documented or the settings on the report may be the culprit. For example, if some of the transactions in your cash account are transfers (that need to be included in the report), then you may want to click the gear icon near the upper right of the report, and in the customization window that comes up, select Advanced, then make sure you have a selection for Transfers that will include the transfers you need to reflect in the report.

If the Cash account itself is not correct, then you would want to check for missing or duplicate transactions.

I look forward to your response!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Hi Kristina,

Thank you for your reply.

Yes, cash transfers are included in the cash account, and I confirmed the Cash balance at 12/31/2024 is correct. (The Fidelity item listed below is a transfer and is included in the cash balance asof 12/31/2024).

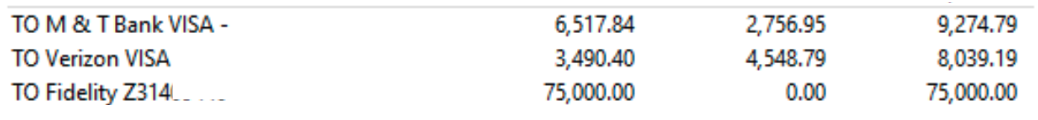

It's the Income and Expense Report that I believe is the problem—specifically expenses. The Income does tie out. I see the below three items listed as "expenses" in the report but they not expenses. The VISA items are a cash payment (and included in the cash balance) but the VISA charges are included as a Category expense in the report. By including the VISA payments as an expense, the report expenses are doubled. Similarly, the Fidelity item is an asset transfer from one cash account to another and is not an expense.

1/1/24 - 6/30/24 7/1/24 - 12/31/24 Total

Maybe Quicken cannot natively do what I am trying. I can download the Income & Expense Report to Excel and modify it by adjusting any expenses for items in the example above.

Any thoughts?

Thank you!

[Edited - Removed Personal Information]

0 -

Thank you for your reply,

If the issue seems to be certain expenses (credit card payments) being counted twice, then to troubleshoot this, please check how those transactions appear in Quicken.

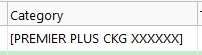

Typically, if both the payment account and the credit card account are in your Quicken, they would show as transfers, which should not reflect as income or an expense. A transfer transaction should show the account the transfer was to/from in brackets in the Category column.

If one of the accounts is not in your Quicken, and you still need the transaction to show as a transfer, you can edit the category to show as a transfer back into the same account (as a way to force Quicken to see the transaction as a transfer).

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 52 Product Ideas

- 35 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 507 Welcome to the Community!

- 676 Before you Buy

- 1.4K Product Ideas

- 55.1K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 827 Quicken on the Web

- 122 Quicken LifeHub