Taking RMD from Traditional IRA

Using Quicken Classic Premier. Account type is Traditional IRA.

Trying to remove money from the account and have the RMD withdraw appear in my Tax Planner. I can't seem to get this to work.

I made a new category and labeled it RMD. I set it as Income. Set it as tax reporting 1099-R Total IRA taxable distribution.

I added a new line to the IRA account as a 'withdrawl' and set the category to RMD. It doesn't apprear in the Tax Planner.

Can someone please tell me what I am doing wrong? And possibly how to fix this? thank you.

Answers

-

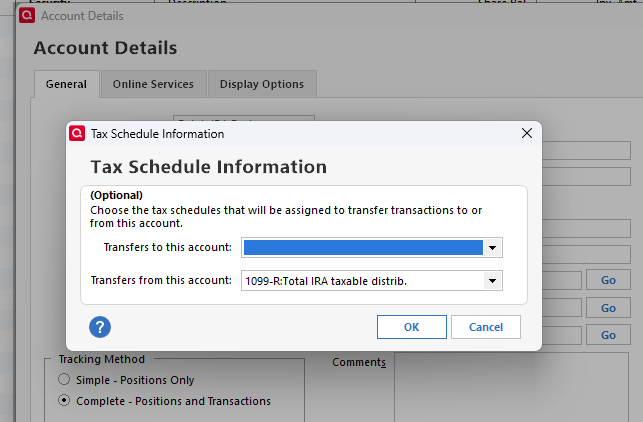

Check the Quicken account details for the IRA. I had to identify the withdrawal like this.

0 -

Set the Tax attribute of your IRA to show withdrawals as "1099-R: Total IRA Gross Distribution", and get rid of that

RMD category.Then, transfer the cash from your IRA to a taxable account and record a split in the taxable account with the amount of the withdrawal being a positive number (and a transfer from the IRA) and any taxes withheld as a negative number (with a tax category) to reflect the net deposit into the taxable account.

Q can't record ANY tax transactions in a non-taxable account, which is why the tax withheld must be done in the taxable account.

You don't need the RMD category because anything withdrawn from a non-taxable account (once you're subject to RMD) counts as RMD. Even QCD;'s count as part of your RMD.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP-1 -

@NotACPA -

Set the Tax attribute of your IRA to show withdrawals as "1099-R: Total IRA Gross Distribution", and get rid of that RMD category.

I agree that the RMD category needs to be removed (or not used).

But I believe the correct Tax Schedule for withdrawals from IRA accounts needs to be 1099-R:Total IRA taxable distrib. and not to 1099-R:Total IRA gross distrib.

Using 1099-R:Total IRA gross distribution does capture the gross transfers in the Tax Summary report but it is not captured in Tax Planner as taxable income….at least not for me. It also is captured in the Tax Schedule report as a "gross distribution" but not as a "taxable distribution." I think this distinction is needed because an IRA gross distribution is not necessarily taxable and to correlate with the IRS 1099-R tax form Box 1 which is for "Gross Distribution" and Box 2 which for "Taxable Distribution." There are reasons why the IRS makes this distinction in the 1099-R form and why we need to enter both numbers in our tax returns.

Using 1099-R:Total IRA taxable distrib. for the IRA account Tax Schedule ensures that the correct taxable amount of the IRA distribution is captured as taxable income in both of these Tax Reports as well as in Tax Planner.

Unfortunately, 1099-R:Total IRA gross distribution is the default set by Quicken and, IMO, Quicken needs to change it to 1099-R:Total IRA taxable distrib.

Q can't record ANY tax transactions in a non-taxable account, which is why the tax withheld must be done in the taxable account.

I believe this statement is true regarding transfers out from an IRA register into a taxable brokerage account.

But transfers set up in an IRA register going into taxable Spending accounts (i.e., Checking, Savings, Cash, etc.) are properly captured by Quicken in the Tax Reports and Tax Planner. So, this works well with IRA distributions when there is no tax withheld.

The need to enter the RMD transaction in the taxable Spending account instead of in the IRA account becomes necessary when there is income tax withheld by the brokerage.

@Lakedaisy - Following is how I have been managing my IRA distributions for several years and it works really well.:

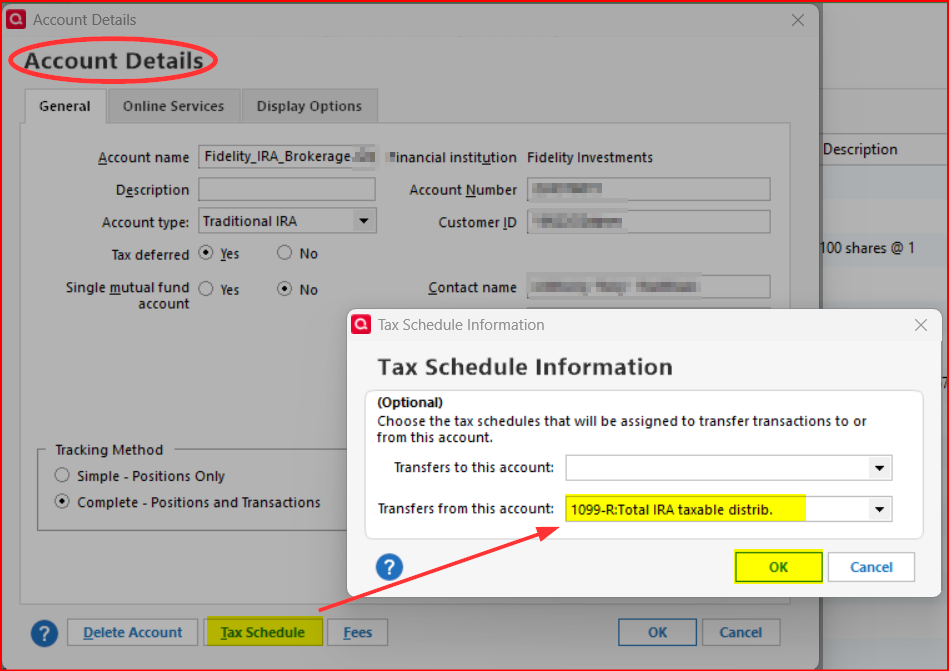

Make sure the Tax Schedule for the IRA account for Withdrawals is set to 1099-R:Total IRA taxable distrib. and not to 1099-R:Total IRA gross distrib.:

For whatever category you use for the withheld tax, make sure it has the correct Tax Line Item associated with it. It should be associated with 1099-R:IRA federal tax withheld.

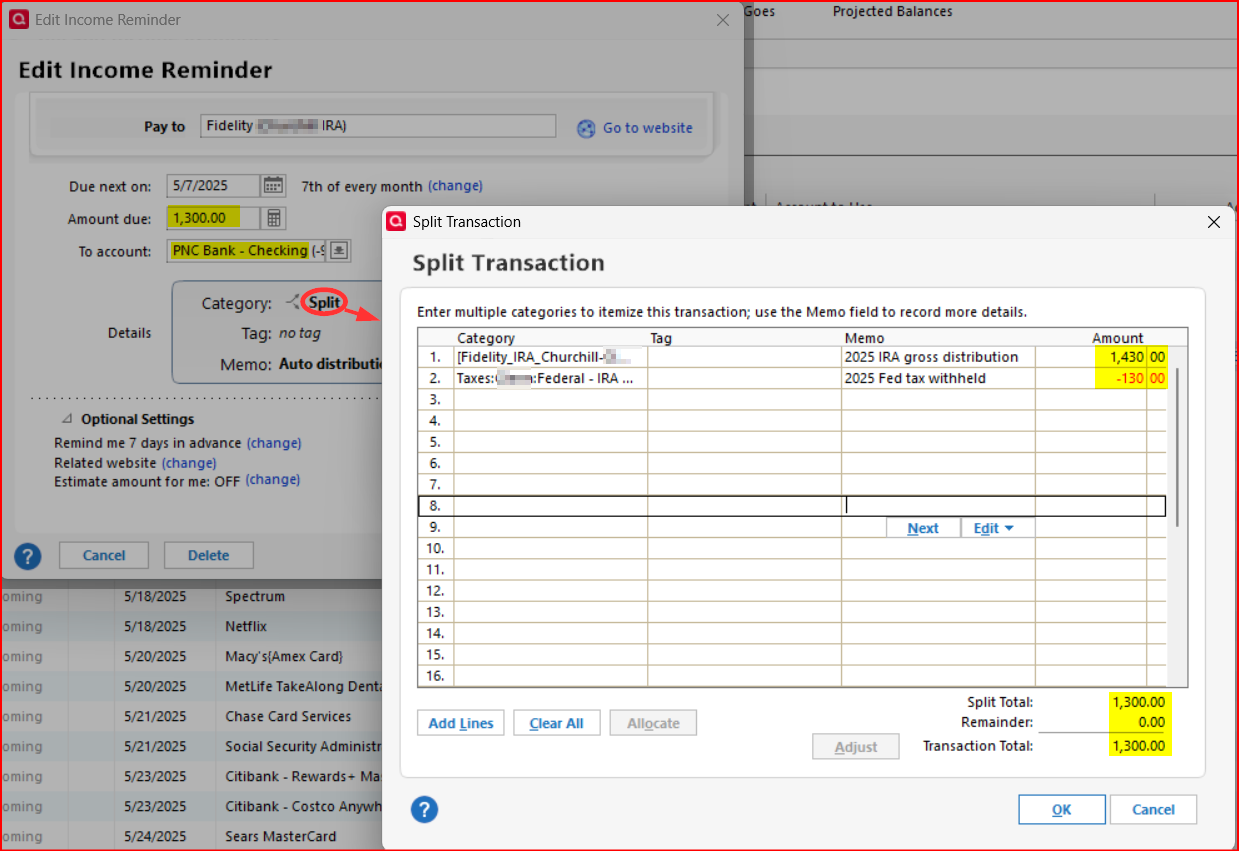

Then enter a split category deposit transaction into the RECEIVING account, not into the IRA account:

- DEPOSIT AMOUNT: This needs to be the amount of the net deposit (after tax is withheld).

- 1ST SPLIT CATEGORY LINE: This needs to be a transfer from the IRA account for the total distribution amount (before tax is withheld)….a positive dollar amount.

- 2ND SPLIT CATEGORY LINE: This needs to be for the tax withheld category you opt to use. It needs to be for the amount of the tax withheld…a negative dollar amount.

- The total of the Splits needs to match the total of the Deposit Amount.

I have scheduled monthly distributions from an IRA so I set up an Income Reminder for that. Here is how I have it set up:

The final steps to take in the IRA account register:

- If the downloaded RMD distribution transaction is a Sell transaction with cash transferred to your checking account: Change it so the cash is deposited to the IRA account balance.

- If the downloaded RMD distribution transaction is a withdrawal of cash from the cash balance of the IRA account: Delete it (so the cash stays in the IRA account).

- If the downloaded tax withholding transaction is a Sell transaction with the cash expensed to the income tax category: Change it so the cash is deposited to the IRA account balance.

- If the downloaded tax withholding transaction is a withdrawal of cash from the cash balance of the IRA account: Delete it (so the cash stays in the IRA account).

- Be sure not to delete the transfer transaction that was entered into the deposit account. This is the transaction that will remove the RMD cash from the IRA account.

By setting up your RMDs like this they will be properly captured in the Tax Reports and Tax Planner.

This process looks more difficult than it really is. Once you have familiarized yourself with the process and/or have set up the Income Reminder(s) like I have it will not look so complex and cumbersome. After I set up my recurring Income Reminder (which I let Quicken automatically enter into my checking account each month) I spend no time on this process….except when I want to change the distribution amount or do a special distribution.

There is a Product Improvement idea to address this process. The status of this idea is "Planned" so that is good. Hopefully it will be implemented sooner rather than later.:

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

I don't use the Tax Planner, and my answer was based upon my Q settings. I've got a quite elaborate spreadsheet that incorporates more that I need than the Tax Planner provides.

And my "Gross Distribution" and "Taxable Distribution" have always been the same … so I wasn't aware of that distinction.

SO, @Boatnmaniac's advice is probably correct for Tax Planner users.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Thank you to everyone for your replys.

I can't the RMD to work. Now I have everything messed up. Going to try to find a backup that's not messed up and restore it. I'm not going to try this anymore. But, thanks to everyone.

Quicken user since 19860

Categories

- All Categories

- 49 Product Ideas

- 35 Announcements

- 225 Alerts, Online Banking & Known Product Issues

- 18 Product Alerts

- 505 Welcome to the Community!

- 673 Before you Buy

- 1.4K Product Ideas

- 54.9K Quicken Classic for Windows

- 16.6K Quicken Classic for Mac

- 1K Quicken Mobile

- 824 Quicken on the Web

- 120 Quicken LifeHub