Lifetime Planner-entering IRA withdrawals

I am currently retired, my spouse is working for another year. I've got most everything entered into the LTP and/or the tax planner, but I don't see a clear indication in the LTP where to enter current and anticipated IRA withdrawals. Do they go in as 'other income'? Or some other way? LTP seems to assume that IRA withdrawals won't start until we are both retired.

Comments

-

Yes, Assuming you have sufficient taxable account balances to meet your expenses, LTP assumes that IRA withdrawals start (and taxable account withdrawals stop) at your retirement age assumption set in "about you". However, LTP will begin taking IRA withdrawals earlier than your retirement age if you've exhausted your taxable accounts. An idea was generated to change the order of account withdraws based on user preference. See and vote here:

In terms of how LTP handles these IRA withdrawals, including RMDs, the feature automatically calculates the needed IRA withdrawal. So, if you report your IRA withdrawals, as "other income" you will be double-dipping since LTP is already doing that for you. As far as the RMD calculation, please note there is currently an issue. An idea was generated to change the order of account withdraws based on user preference. See and vote here:

https://community.quicken.com/discussion/comment/20473151#Comment_20473151?utm_source=community-search&utm_medium=organic-search&utm_term=lifetime+planner

0 -

LTP seems to assume that IRA withdrawals won't start until we are both retired.

It is worse than that. I don't really have a use for LTP personally, but if I did, this is an area where it is so wrong for our situation it is basically useless.

Created these accounts to test with.

Savings $100000

Brokerage $20000

Traditional IRA $30000

Traditional IRA Spouse $40000

Roth IRA $50000

Roth IRA Spouse $60000

Picked dates to try workaround for this year it would show partial, and I wanted a full year, so make me retired already and her in two years, but not old enough that I might run into LTP's wrong RMD year at 70 1/2. Also set to future money just to remove inflation from the numbers.

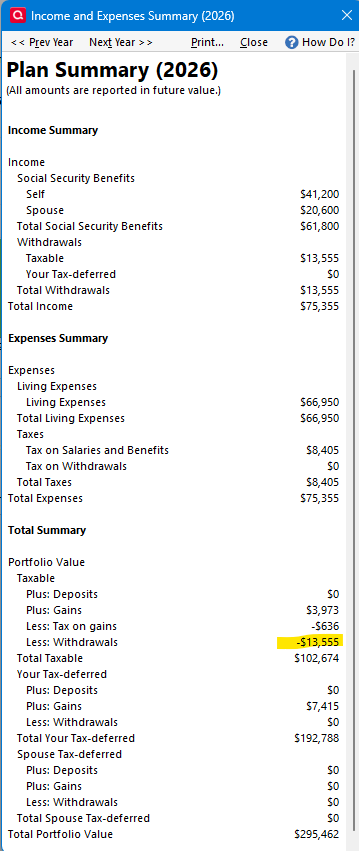

Give a $60,000 income with $65,000 expenses so that it will force some withdraws.

Not surprising no withdraw from her tax deferred IRAs but notice none from mine either. It is all coming from that taxable accounts. Which would be Savings and the Brokerage accounts.

But you sort of assumed that once your wife retires it will start doing that, let's make both retired and see:

Nope, that isn't it. I noticed I made a mistake on "hers", which might pertain to what you are seeing. You will notice the gains for her accounts is zero. That is because I forgot to go into the Investment account details (I was thinking that creating the account with her as the owner would do this, but that isn't the case):

This fixes where the numbers appear, but as you can see even with both set to retired, no money is withdrawn for expenses from tax deferred accounts.

So, clearly the LTP expect you to exhaust your taxable accounts first.

I believe it is taxable, then Roth, and then a the last traditional, unless the RMD kicks in.

This is of course not ideal for a lot of people. To force it to start using the IRAs you would have to exclude the taxable accounts. At least that is what I think, let's test it.

OK that's true, now which IRA accounts? Roth or Traditional? Well, you will notice above that there isn't any tax on a withdraw, and since there isn't any taxable accounts where you wouldn't pay tax on withdrawing from them, then clearly this time it took the withdraw from the Roth IRAs.

Excluding the Roth IRAs.

Signature:

This is my website (ImportQIF is free to use):1 -

I'm with you. The LTP is interesting, I suppose it has some value in the planning stages—but it does have a lot of limitations. At the end of the day, it's telling me that it's going to work—the details are weird. Just the idea that as far as it's concerned you retire on your birthday in a particular year is the first annoyance.

It's more of an exercise to see if I can get it to sort of match the projections that came from my fiduciary financial planner. It sort of does. Well enough to be somewhat useful

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub