Financial Institution SAVINGS accounts Show Available Balance & Not ONLINE balance when reconciling

Currently running Version 8.1.1 (Build 801.56891.100) of Quicken Classic Deluxe. MAC OS Ventura 13.7.5.

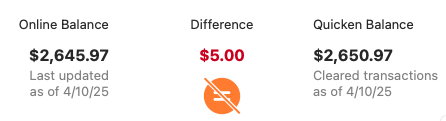

My Credit Union recently Updated their online and mobile software. It took about 2-3 days before Quicken and Credit Union fixed downloads and connects. All was fine until I did the monthly balance, which usually takes just a few minutes. For over 15 years I have always used the default ONLINE BALANCE when balancing. Now when I go to our 3 SAVINGS accounts it has the available balance and not the ONLINE BALANCE. The credit union keeps $5 off the available balance as some sort of practice. I have contacted the Credit Union Tech Support or the Credit Unions VENDORS for this software.to see if they are at fault. But Quicken still sees the 3 savings account online balance as $5 lower than the actual ONLINE balance. This does not happen on Sharedraft (Checking) or Money Market accounts.

Yes I can balance If I choose to use a method I haven't had to in 15 years, that of putting in the ending balance from the paper statement. But this should be able to be fixed. Some setting is not right…

Only SAVINGS account does this happen….

Thanks..

Comments

-

Hello @Tom11,

Thank you for sharing your experience. To better assist with this issue, please provide more information. Which credit union is this happening with? When did you first notice this issue? You mentioned that you spoke to the financial institution about this problem. What did they say? Were they able to assist at all?

I look forward to your reply!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

LBS Financial Credit Union, Which is Long Beach Schools Financial Credit Union. First noticed during first reconcile after LBS Financial Credit Union updated their ONLINE and MOBILE software. I have sent messages to LBS Financial Credit Union, and they said they were going to contact their vendor (software?). Currently CU, no help.

Thanks..

0 -

Thank you for your reply,

This is most likely being caused by information the credit union or their vendor is sending to us. If you navigate to Help>Report a Problem and send a problem report with log files attached, then I'll be able to confirm what data is being sent to us.

In the meantime, if you need to reconcile the accounts, you could probably add a $5 transaction to those savings accounts to represent the $5 that is there, but held in reserve by the credit union.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Tom11 - as @Quicken Kristina mentioned, I think it is common for a CU to hold 5 or 10 dollars in reserve. I have learned from personal experience that they aren't always consistent on how they show it in the account and if they include it in their transaction files for Quicken.

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 248 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub