How can I set up an account for a fixed single premium annuity?

Win 10 Pro; Quicken R62; Build 27.1.62.16- For some time I had other fixed annuity accounts, but when their bonuses expired, I switched to a different company. I tried to enter the new acounts under annuities, but they were set up as stock accounts with a value of $1 per share. These function more like regular bank accounts. Even when I made 4 entries, three deposits and one withdrawal, the amount deducted did not reconcile with the statement. HELP, please.

Best Answers

-

You are very welcome, the majority of the steps to set up a non-IRA account will be similar.

- Go to the Add Account screen and select Offline Account.

- Choose Other Investment Account.

- On the next screen, you'll be asked for the account type. Choose Other here.

- Then, you'll be prompted for:

- Account Name: Enter a name that will help you easily recognize the annuity, such as "Fixed Annuity - [Provider Name]".

- Used for: Choose Personal since it’s a personal investment.

- Currency Type: Choose USD or whatever currency your account is in.

- Click Next to continue and set up the account.

Recording Transactions

Once the account is created, here's how to record transactions:

- Opening Balance (Initial Premium):

- Enter a Deposit for the initial premium amount.

- Use a category like Investment:Fixed Annuity Contribution (or create a custom one).

- Memo: "Initial single premium deposit."

- Recording Interest and Bonuses:

- When interest or bonuses are credited, enter a Deposit for the amount.

- Use a category like Interest Income or Investment:Income.

- Memo: "Annual interest earned [Year]" or "Bonus credit."

- Recording Withdrawals:

- For any withdrawals (such as RMDs), enter a Withdrawal transaction.

- Use a category like Transfers: [Receiving Bank Account] or a custom category like RMD Distribution.

- Memo: "Non-IRA annuity withdrawal [Year]."

I hope this helps!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

What occurs when following the link in my signature? It should take you to this FAQ. I have included the instructions below.

To receive the email digest go to your Community profile by clicking on your profile icon/picture at the top right corner and then select Account and privacy settings (under your name). To the right you will see notification preferences and select that. Towards the bottom you will see the Weekly Email Digest Settings where you can opt in or out.

I hope this helps!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0

Answers

-

Hello @b.a.teller,

It sounds like you’re trying to capture the behavior of a fixed single premium annuity in Quicken, but the default setup treats it more like an investment account — which isn’t quite right for the way these accounts actually behave. Let’s dig a little deeper to get a clearer picture of what you need.

Could you describe a bit more about how the annuity functions day to day? For example, do you receive periodic interest payments or are you just tracking the principal value until maturity? When you say it behaves more like a regular bank account, do you mean it has a stable balance with interest accruing periodically, or that you only touch it occasionally for deposits/withdrawals? Also, how does the provider report the account on statements? Do they show interest earned, market value, or just a guaranteed return on a fixed balance? Finally, you mentioned the withdrawal didn’t reconcile — was that because of unseen fees, interest accrual timing, or something else?

Let me know!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

Thank you for responding. A single amount is deposited; the co. offers a bonus that is pro-rated for the length of the account; and interest is added. Once a year, a withdrawal is made for my IRA minimum distribution from the IRA; I have a second non-IRA acct. as well from which I am not currently making withdrawals. The yearly statement shows interest earned; that years' bonus amount; and for the IRA, the amount paid out for the RMD. The accounts were opened last year. That's all! It should be very simple, but it is not!!! The total after the withdrawal resulted in an inacurate balance. Previously I had the same type of accounts that I was instructed to open as annuities, but it made it very difficult to record the transactions accurately because there was an insurance fee. When they reached the end of their bonus periods, they were transferred to these new accounts.

I am so frustrated with all of the Quicken errors, after 35 years, I wish there was another program I could use!

-1 -

Hello @b.a.teller,

Thank you again for following up and for sharing those screenshots — they’re very helpful in understanding exactly where things are getting off track. Based on what you’ve described, it sounds like the best way to track your fixed single premium annuity—especially within an IRA—is to treat it more like a cash-based investment account rather than using Quicken’s stock/share model.

Here’s how to set up and manage this type of account in Quicken using the current interface:

Setting Up the Account

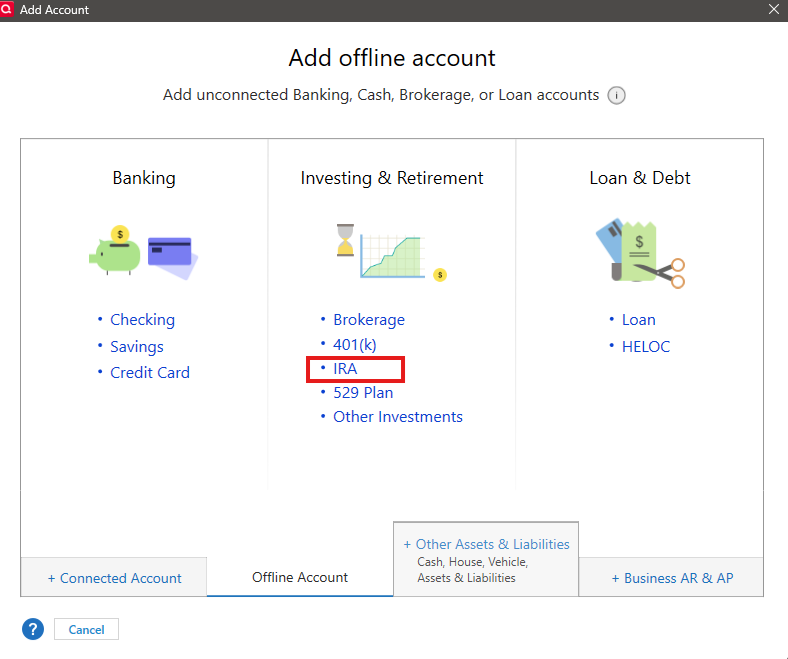

- Go to the Add Account screen and select Offline Account.

- Under Investing & Retirement, choose IRA.

- On the next screen titled “How would you like to track your investments?”, select Complete Investing (this gives you full transaction and position tracking, which you’ll need to accurately record interest and withdrawals).

- Enter your most recent statement’s ending date.

- Leave the Cash and Money Market fields blank unless your provider explicitly breaks these out.

- Click Next to finish setting up the account.

Recording Transactions

Once your IRA account is created, you’ll use the account register to track deposits, interest earned, and withdrawals. Here’s how to do that:

1. Opening Balance (Initial Premium)

- Enter a Deposit transaction for the total amount of your initial premium.

- Use a category like Investment:Fixed Annuity Contribution or create one that fits your personal setup.

- Add a memo such as “Initial single premium deposit.”

2. Recording Interest and Bonuses

- When interest is credited or bonuses are applied, enter a Deposit transaction.

- Use a category like Interest Income or Investment:Income.

- Include a memo such as “Annual interest earned 2024” or “Bonus credit.”

3. Recording Required Minimum Distributions (RMDs)

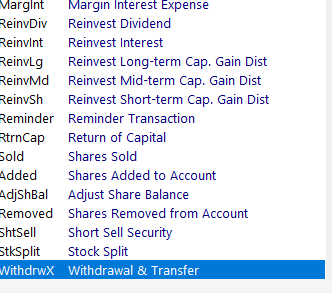

- Enter a WithdrwX transaction for your RMD when it occurs.

- Use a category such as Transfers:[Your Receiving Bank Account] or a simple custom category like RMD Distribution.

- Include a memo like “IRA RMD 2025.”

Optional: Using a Custom Security (Not Required)

If you prefer to see the annuity represented as an asset in your portfolio views:

- Go to Tools > Security List > Add Security.

- Name it something like “Fixed Annuity – [Provider Name]”.

- Set the security type to Other and uncheck “Download Quotes.”

- In the IRA register, record a Buy transaction for the full dollar amount at $1 per share.

- You can reflect future interest as either reinvestments or as adjustments to the market value.

However, based on your description, it may be simpler to treat the account as a cash ledger and enter deposits and withdrawals directly without tying them to a security.

You can also review this FAQ on Tracking Annuities in Quicken for Windows.

I hope this helps!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

Thank you Jasmine. How should I enter the non-IRA acounts?

Barbara

0 -

You are very welcome, the majority of the steps to set up a non-IRA account will be similar.

- Go to the Add Account screen and select Offline Account.

- Choose Other Investment Account.

- On the next screen, you'll be asked for the account type. Choose Other here.

- Then, you'll be prompted for:

- Account Name: Enter a name that will help you easily recognize the annuity, such as "Fixed Annuity - [Provider Name]".

- Used for: Choose Personal since it’s a personal investment.

- Currency Type: Choose USD or whatever currency your account is in.

- Click Next to continue and set up the account.

Recording Transactions

Once the account is created, here's how to record transactions:

- Opening Balance (Initial Premium):

- Enter a Deposit for the initial premium amount.

- Use a category like Investment:Fixed Annuity Contribution (or create a custom one).

- Memo: "Initial single premium deposit."

- Recording Interest and Bonuses:

- When interest or bonuses are credited, enter a Deposit for the amount.

- Use a category like Interest Income or Investment:Income.

- Memo: "Annual interest earned [Year]" or "Bonus credit."

- Recording Withdrawals:

- For any withdrawals (such as RMDs), enter a Withdrawal transaction.

- Use a category like Transfers: [Receiving Bank Account] or a custom category like RMD Distribution.

- Memo: "Non-IRA annuity withdrawal [Year]."

I hope this helps!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

Where does one sign up for the email digest? The link doesn't offer that opton…

0 -

What occurs when following the link in my signature? It should take you to this FAQ. I have included the instructions below.

To receive the email digest go to your Community profile by clicking on your profile icon/picture at the top right corner and then select Account and privacy settings (under your name). To the right you will see notification preferences and select that. Towards the bottom you will see the Weekly Email Digest Settings where you can opt in or out.

I hope this helps!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0

Categories

- All Categories

- 49 Product Ideas

- 34 Announcements

- 244 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 514 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.5K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 125 Quicken LifeHub