Old and New Account Crossover Oddities

I'll try to make it clear…

At some point, somehow, Citi card started a 'new account' in Quicken. Maybe when there was trouble with the Citi link. (?) This was in Feb this year and I only have one credit card so it used the same account from Citi online.

Everything was fine until I got a notification today that I had to reauthorize one of my Citi accounts. (I have savings as well under different login.) I failed to identify which account, but used the 'Reset account' button and logged into my credit card account and I went through the process.

I get back to the register and all the transactions from the time it converted to the new account were added to the old account! The newest account still looked good and the balance matched online.

So… why not delete the unnecessary transactions added to the old account, right? Which by the way, I had deactivated months ago when the new account was created.

So I group-selected about 15 transactions and deleted them, again from the old account.

Now, the balance on the new account is messed up! I have yet to trace and track the transactions but I don't know what's going on. I would have thought they were all duplicate transactions and deleting wouldn't be an issue.

Sometimes, this Quicken….. why would it reactivate a deactivated account without prompting me… or did I miss it when resetting?

Any insight would be appreciated and also how to best resolve to create the least amount of rebuilding on my account.

Thanks in advance!

Comments

-

Hello @gt00tx,

Thank you for sharing your experience.

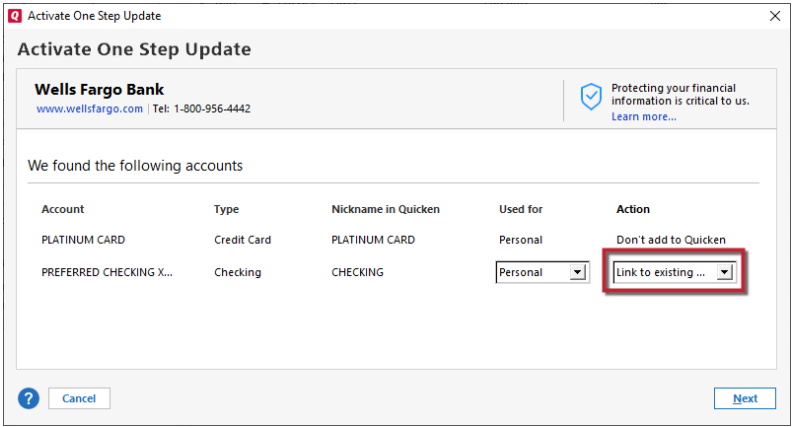

It is possible for a deactivated account to get reactivated when you reauthorize an account. While Quicken is generally good about seeing the correct account to link to, sometimes it does guess wrong, which can cause the wrong account to get connected.

At the end of the reauthorize process, you'll see the Add/Link screen in Quicken. It's always a good idea to double check that screen to make sure Quicken is seeing the correct account to link to, and to verify that it is linking the account, rather than adding it as a new account.

It is strange that deleting transactions from the old account would impact the balance in the new account. There are a couple things that may have happened to cause that.

If the transactions were transfers between the two accounts, then deleting one side of the transfer will automatically delete the other side.

If you accidentally deleted from the wrong account, that could also cause the issue. If that is what happened, then you should be able to recover the transactions from the account you meant to delete them from, and move them to the correct account.

Depending on how much of a mess this issue left you with, perhaps the simplest fix for this issue would be to restore a backup from before the issue started, and when you get the reauthorization prompt, at the end of the process, double check to make sure Quicken is seeing the correct account to link to.

I look forward to your response!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Thanks Kristina…

I'm sure I wasn't paying attention and clicked to Link the old account… ugh…

I didn't intentionally transfer between these accounts. I don't know what Quicken might have automatically done.<shrug>I think since I only deleted about 15 transactions, I can trace the ones that impacted the new account. I will deactivate the old account again. I would delete it but I like to have the history. Bad feature for Quicken to not be able to see the deactivated account and not include it. Oh well…

I appreciate your response!

UPDATE: So… I find that since the conversion to the new account, apparently I have not reconciled since February. :-/

I did some reconciling and only found one transaction that missing that threw things off. I also went back to the old account and change the category for any transfers to the new account.0 -

Thank you for the follow-up,

What you can do to prevent that old account from accidentally getting reconnected in the future is mark the account closed. For information on marking an account closed in Quicken (which has no impact on the real account at your financial institution), see this help article:

Warning - Marking an account closed in Quicken for Windows is permanent. The only way to undo it is to restore a backup from before you marked the account closed. It's a good idea to make a backup of your Quicken file before marking the account closed.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub