Capital One - Register issues post account reauthorization

May 6th I was prompted to reauthorize my Capital One accounts. I did. And now I have an issue with the credit card accounts register balance. The transactions download and are correctly posted as charges or credits but the balance is wrong. If the balance on the credit card is $1000 and a $10 charge is posted, the balance becomes $990 and not $1010. Conversely for credits. The issue occurs only with the credit card accounts and not the savings/checking accounts. I had hoped this problem would correct with a subsequent update - but one week on this problem persists. I didn't see any other post about this but there is one recognizing multiple Capital One account reauthorization requests.

I have Quicken/Windows.

Problem started when I reauthorized my Cap One accounts on May 6th

Anyone else having this problem or know if a fix is in the works?

Answers

-

Hello @Letty,

We appreciate you taking the time to let us know about this issue!

To better assist you, I’d like to gather a few more details:

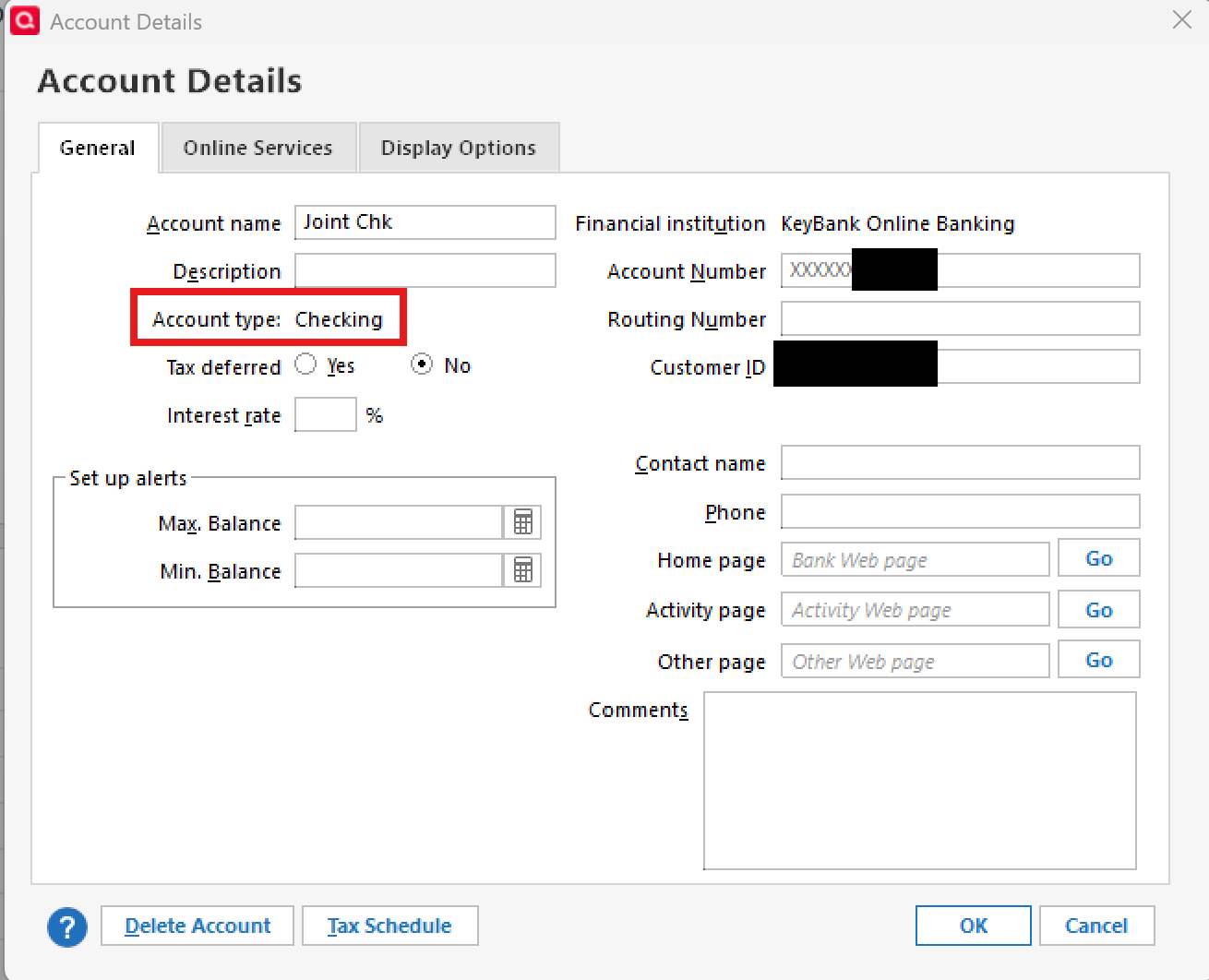

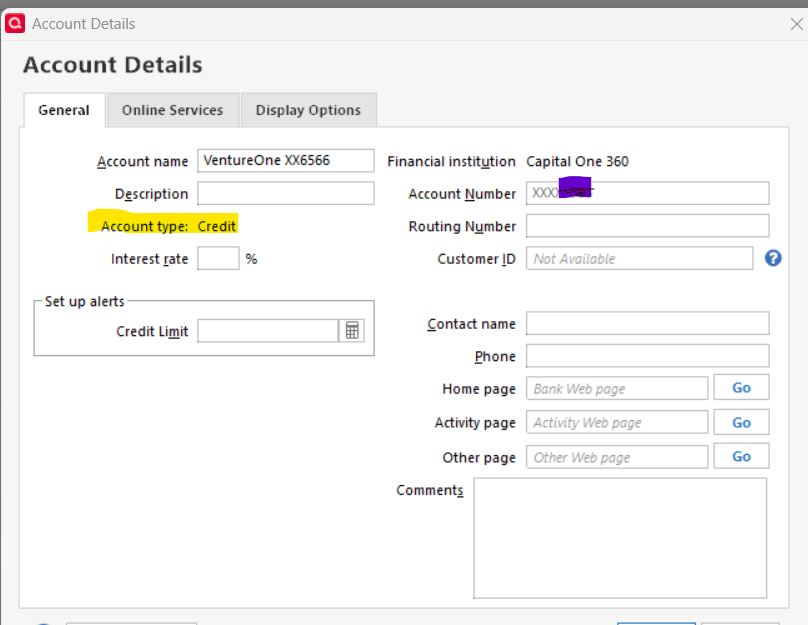

- Right-click the affected account, select Edit/Delete Account, and let us know what Account Type is shown in the Account Details window.

- Where is your Quicken data file stored? Is it on your local hard drive (C: Drive) or a cloud-based/external drive (e.g., OneDrive, Dropbox, USB, etc.)?

- Have you attempted any troubleshooting steps so far? If so, what were they?

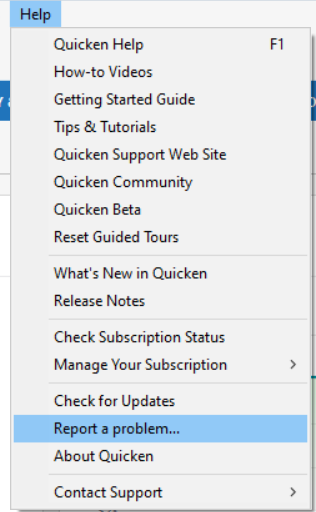

- Please also send us your log files by navigating to Help > Report a problem, so we can review them internally.

In the meantime, I recommend trying the following steps:

- Deactivate the account in Quicken:

Follow the instructions in this support article. - Unlink Quicken from Capital One:

Sign in to your Capital One account online.

Click your profile picture in the top left, go to Security, then find and select Linked Apps. Locate Quicken and click Unlink. - Reactivate the account in Quicken:

Follow the instructions in this support article to reactivate.

While reconnecting, please ensure the Account Type is accurately showing as Credit Card when linking.

Let us know how it goes or if you run into any issues along the way!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

Thanks. I followed your 'deactivate-unlink-reactivate' steps but the same issue persists. Both Cap One credit card accounts are impacted. And yes, both accounts are account type credit card. Screen cap of one attached.

Quicken is installed on my C drive. I had previously attempted another reauthorization because I kept getting prompted to.

I have also sent the log files by completing the Help>Report a Problem

0 -

Thank you for following up with those details.

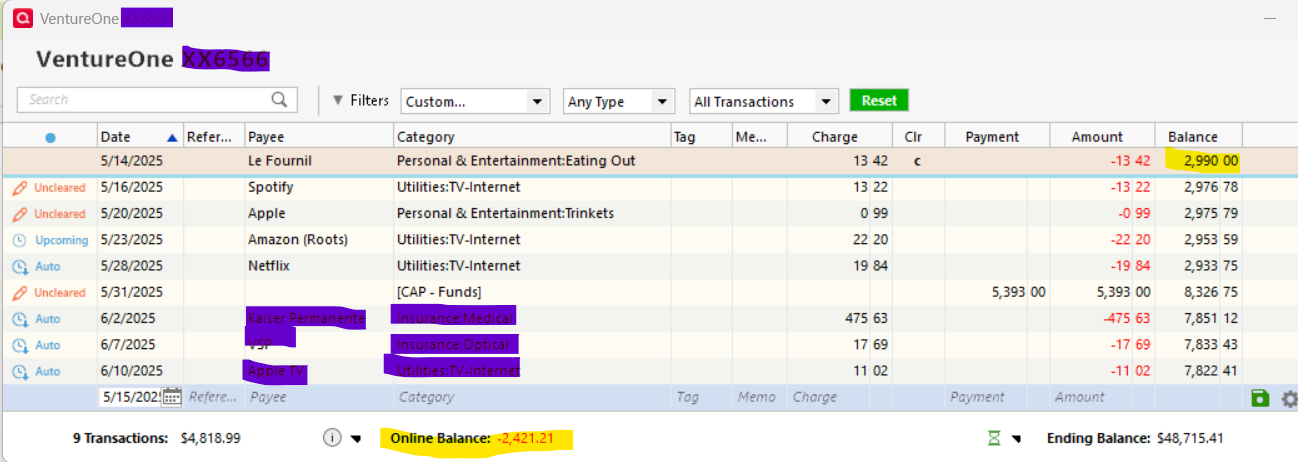

While we look into this, could you also provide a screenshot of your register so we can better understand what you’re seeing?

Thank you!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

Anja. Here it is. You can see that the register balance is not the same as the online balance. And the subsequent charges show the balance going down not up. And the projected end of month payment increases the balance versus reduces it. Thanks……

0 -

Thanks for sharing the screenshot.

It looks like your register balance is off by $46,294.20 compared to the online balance. This kind of discrepancy is often caused by an adjustment, duplicate entry, or another manual input that throws off the register. I recommend reviewing your register to see if anything stands out around the time the balance went off track—possibly an overpayment or incorrectly entered transaction.

To help troubleshoot, here are a few suggestions:

- Clear filters you have on the register, as they could be hiding key details (green Reset button at the top of the register).

- Once filters are cleared, please send a new screenshot so we can get a better view of the full register.

- Additionally, if you have a backup from before May 6th, I recommend that you try restoring it to see if the balance matches up better.

Alternatively, you can also reach out to Quicken Support directly so they can take a closer look and help resolve it faster.

Let me know what you find!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

Anja, To clarify, the screenshot I sent was for the period May 13 to end of May. I actually had some manually projected monthly payments to my credit card for the remainder of 2025 which accounts for that ~$46k balance.

I did plow through the 2700+ transactions and identified two uncleared charges that I deleted as well as an uncleared transfer from another account. I deleted that too and was surprised to see that it didn't change the balance of the account that the funds had been transferred from?? Anyway, all to say that not only did this correct the credit card account balance but it also corrected the issue that the charges and payments were inversely impacting the credit card balance.

So this issue is fixed BUT I do want to point out that it is not unusual for there to be a balance mis-match after Cap One account reconciliations. This issue has happened many times but never before did it change how a payment/charge impacted the account balance. There is definitely something quirky that happens with some of the Cap One account reconciliations that cause these inexplicable balance mis-matches that then force the need to add a one time manual adjustment to the balance. My 2c :(

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 237 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub