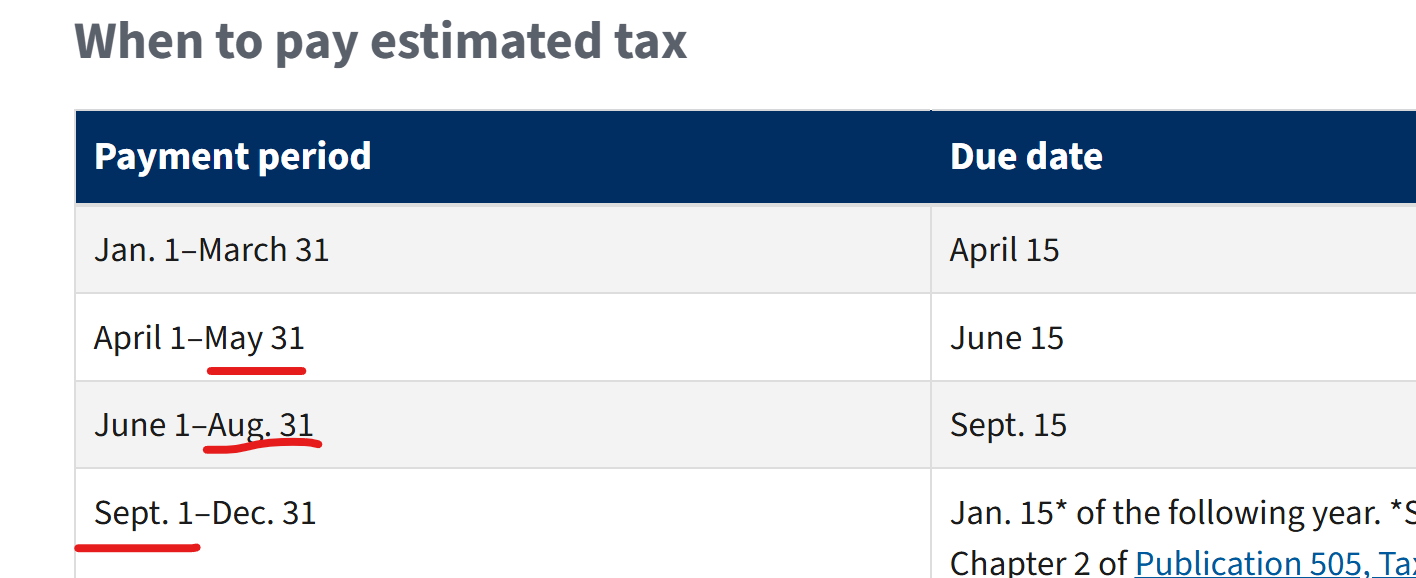

Standard Definition of Calendar Quarter vs. IRS Quarter Definition

a calendar quarter is typically defined as every 3 months (Jan-Mar, Apr-Jun, Jul-Sep & Oct-Dec). The IRS has defined it for tax purposes as 3 months, 2 months, 3 months & 4 months:

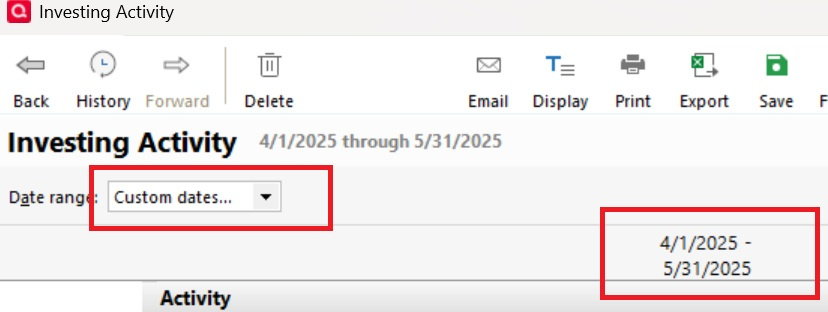

The Investing Activity report shows a quarterly breakdown of activity (Dividends & Realized Gains) and I have been trying to use this to pay estimated taxes for the year based on my accounts activity.

Does anyone have any suggestions or is there a way to show this information in the IRS period requirements? or do I manually set dates and look at it simplistically? (I like the column view by Quarter, but it is off when looking at IRS payment dates).

Answers

-

You just need to select custom dates and put the period dates in

0 -

@Beijing Mac I don't think there is no way to show the IRS Quarters in one report. You would need to create four separate reports, one for each IRS Quarter. You can set a custom date range for your report, but you cannot set up a report with variable intervals.

0 -

thanks for the replies. it's interesting that an investing activity report which defaults to a quarterly view to show income, obviously intended to support payment of quarterly taxes on income, is not aligned with the IRS definition of quarters. Maybe this would be an improvement for Quicken to have that as a view option. I do like the look of the columns by quarter, hence why I asked if anyone was aware of this if it was an option. but alas, seems we are not able to have that, yet.

0 -

@Beijing Mac for most people who pay estimated taxes, the estimated quarterly tax payments are calculated on annual income and then split into four equal quarterly payments. So they would never need a IRS quarterly report as you describe.

The only time where IRS quarters come into play with estimated taxes is if income fluctuates or is uneven throughout the year. Then the annualized income installment method is used, but it's not very common.

That all being said, that could be why you don't see a demand for this functionality in Quicken reporting.

0 -

I'm not sure the report is intended to support payment of quarterly taxes as much as to track investment income, which is paid by calendar quarter.

Also to avoid penalties when paying estimated taxes, you usually only need to pay enough during the year to cover your total taxes due, the payments do not need to match your income for each period.

Disclaimer: I am not a tax advisor. Consult your tax advisor for reliable information.

QWin Premier subscription1 -

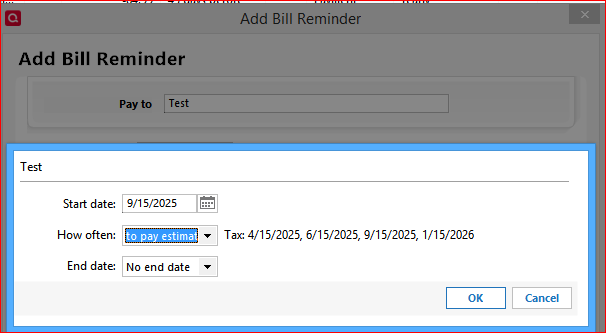

Not sure if this has been mentioned before, but there is a special interval for Scheduled Reminders, to pay estimated taxes. It sets up a reminder with the necessary due dates:

0 -

@UKR yes but unfortunately that is only for scheduling reminders for estimated tax payments. There is no equivalent schedule for reporting.

0 -

First off, I agree that the most common approach is four equal payments, but moving beyond that …

My viewpoint is biased by having worked through an underpayment penalty many years ago. That process considering when ('quarters') income was received and deductions were incurred was really year to date based. That is, in determining if there was an underpayment for the second 'quarter', one looked at income and deductions from 1/1 through 5/31, determined what estimated tax was due and then what estimates had already been paid. So as I understand it, one looks at data 1/1 through 3/31, then 1/1 through 5/31, then 1/1 through 8/31, and finally for the whole year.

The other aspect here is that the Investing Activity report only addresses investment accounts, not your other spending accounts.

I can see why you like the Investing Activity report for a snapshot view of part of the picture, but I believe you may be better off with a series of Tax Schedule or Tax Summary reports for the applicable 'quarter' end dates. An Income/Expense by Category report with monthly columns might also be valuable tool.

I am not sure why 'manually setting dates' ties to a 'simplistic' look. Not anything simplistic about approaching estimated tax payments from this direction.

2 -

Another thing to consider is if you withhold on any income you receive, it counts towards your tax liability and lowers your estimated quarterly tax payments. I do not pay any estimated taxes. Withholding covers my tax obligation. This way I am assured that the taxes are paid when the income is earned.

0 -

I will point out one trap that most people don't think of when they think they can just calculate their estimated taxes per IRS quarter and pay that. And that is if you don't tell the IRS otherwise by filing additional forms the IRS will assume that your income is uniform throughout the year.

So, for instance using simple amounts. Say the total tax owed is $1000. The IRS is going to assume that you have paid at least $250 in each quarter (if you paid more that would carry to the next quarter) if you don't file the extra forms to tell them otherwise.

So, lets imagine you had no income in the first quarter, so you decide not to pay any estimated taxes in that quarter, but made the $1000 up in the 3 remaining quarters.

The IRS will consider that you under paid in that first quarter.

Signature:

This is my website (ImportQIF is free to use):2

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub