When Will Quicken Update The New 2025 Standard Deduction and Tax Changes?

When Will Quicken Update The New 2025 Standard Deduction and Tax Changes from the One Big Beautiful Bill?

Best Answer

-

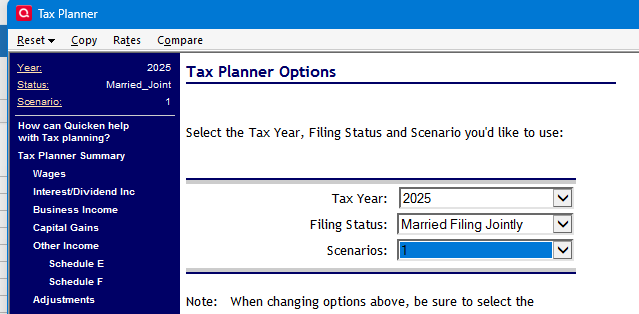

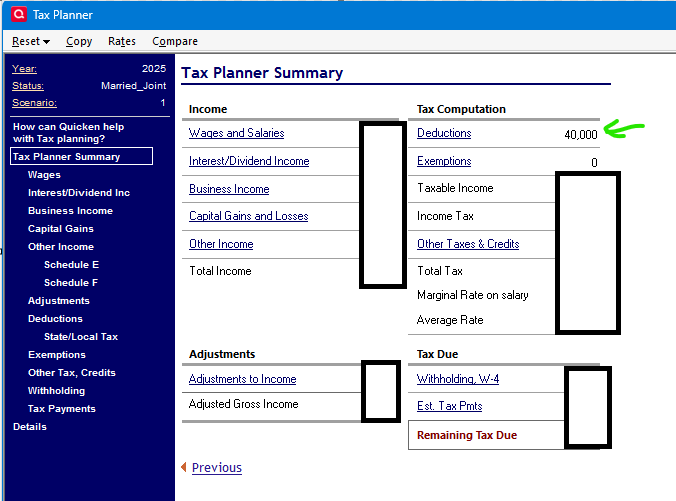

Here are the steps I took, select Scenario, select Scenarios: 1

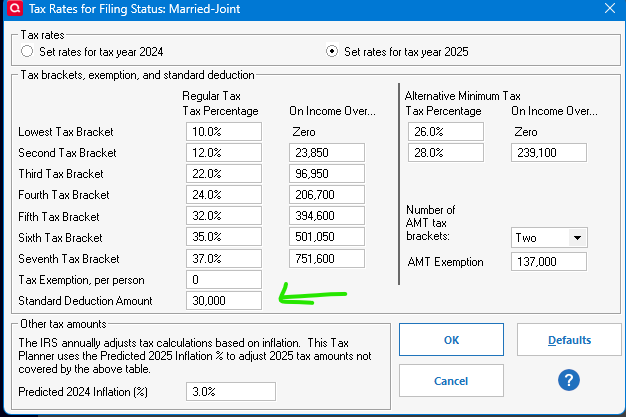

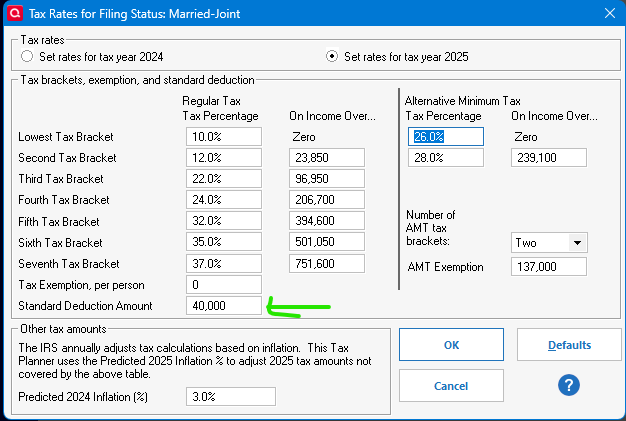

Select Rates:

Signature:

This is my website (ImportQIF is free to use):5

Answers

-

Based on experience from prior years, any updates to the Tax Planner will not be available until near the end of the year, when the changes have been finalized. In the meantime, we can make manual entries to reflect the anticipated changes.

For example, if your income is such that you will qualify for some or all of the additional $6,000 Senior deduction (12,000 for MFJ), you can enter the amount on the Other Adjustments line in the Adjustments to Income section.

If you would like to see the changes sooner, you should create an Idea post requesting that.

QWin Premier subscription3 -

For example, if your income is such that you will qualify for some or all of the additional $6,000 Senior deduction (12,000 for MFJ), you can enter the amount on the Other Adjustments line in the Adjustments to Income section.

Good suggestion, @Jim_Harman

Let's wait until the end of the year, to get the final version of the numbers. By that time, the wind coming out of D.C. may have changed direction again.Everything else with respect to planning for the future these days is like looking into a crystal ball.

😁

3 -

No way to change the standard deduction.

0 -

If you change from the Projected Scenario to one of the numbered ones, you can change the rates to your hearts content by selecting the Rates menu item.

Signature:

This is my website (ImportQIF is free to use):1 -

+1

I would like for the "Estimated Taxes and Form W-4 Worksheet" to take into consideration the new SALT deduction, since I am in California.

-Andy

0 -

Sorrry Chris,

Cannot change the Std. Deduction with any Scenarios. Thanks for trying!

0 -

Here are the steps I took, select Scenario, select Scenarios: 1

Select Rates:

Signature:

This is my website (ImportQIF is free to use):5 -

Thanks Chris,

Missed that step. By the way, love your website. Been using it for about 4 years to get updates!!

1 -

Need the change in SALT reflected.

0

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub