Why does Quicken need access to so many things from bank and broker?

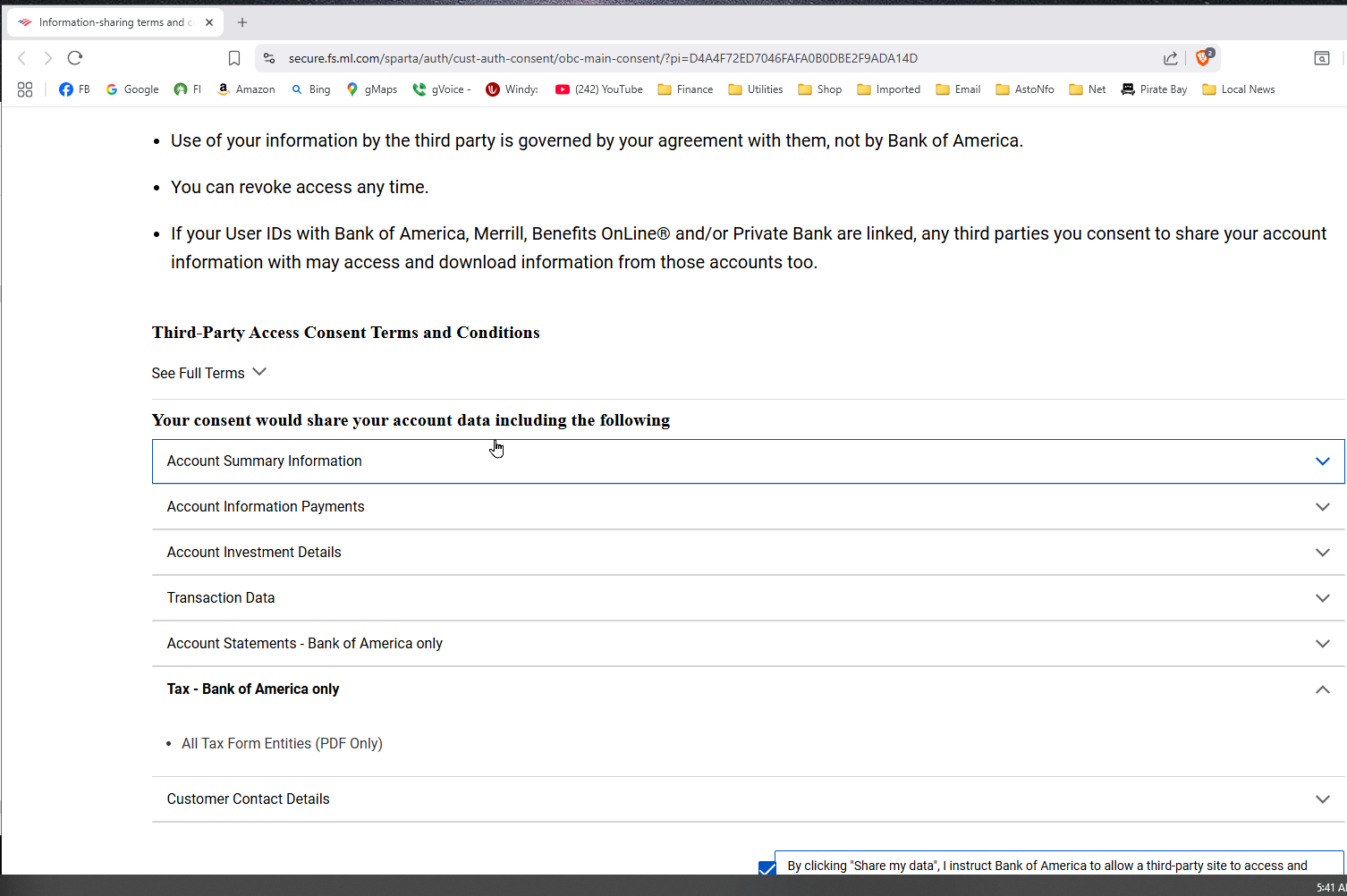

Since the renewals of bank access authorization I'm a bit concerned in how much info Quicken requires given none of the items are optional. Why tax data, or account payments or statements or contact info? Seems Quicken should only need transaction details. Especially when I've opted out of using bill pay have turned off placeholders, have tried to turn of auto fill without success. Ive found the less I let Quicken mess with my data the more free time I have not looking for orphaned transfers , duplicate or deleted transactions.

I don't recall in the past Quicken needing my tax data. So why now? According to BOA the authorization means Quicken can share or sell the data to data brokers

[Edited - Readability/Language]

Answers

-

Hello @JB,

Thank you for reaching out to the Community with this concern. The screenshot you provide is from Bank of America's website, and appears to be information that they would show when connecting your Bank of America account(s) to any 3rd party application, not just Quicken. That is the most likely reason that it lists information that Quicken shouldn't need.

To see what information Quicken does collect and how that information is used, I recommend reviewing Quicken's privacy statement:

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub