zzz-Fidelity Updates

Comments

-

This article explains the different connection types. In this case, Fidelity is going from DC to EWC+, which uses a different protocol and inserts an additional layer thru a third-party aggregation service.

0 -

If you want to track your money market fund shares, then enter a Bought transaction for the 5 shares.

-1 -

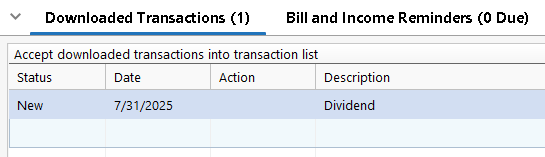

One of my 401(k) accounts has downloaded this transaction without any security noted:

Is this what happens for Simple investment tracking? I do have Complete tracking set for the account. Do I need to change to Simple and back to Complete to fix it? Will that mess anything up?

0 -

[Removed - Duplicate Post]

0 -

This is another issue. Now the Direct Connect option is only allowing Simple Tracking.

Barry Graham

Quicken H&B Subscription0 -

That's not going to resolve this issue. I don't want to track the money market fund shares for the cash balance and have to update the share balance every time the cash balance changes. I never had to up until this cutover. This is another issue caused by this migration.

Barry Graham

Quicken H&B Subscription1 -

They rely on beta testers like me, except this wasn't tested by Beta testers.

Barry Graham

Quicken H&B Subscription0 -

The picture you posted is of the downloaded data section below the account register. If you click on that transaction in this section you should be able to see more transaction details in the account register. Or you can right click on that transaction and click on Edit to see all of the transaction details. Let me know if either or these things show you the information you want to see.

Quicken Classic Premier (US) Subscription: R66.12 on Windows 11 Home

0 -

Hello @BrittMayo,

To answer your question, the change from Direct Connect to Express Web Connect+ is a fairly large change behind the scenes. The way the connections work and the format the data is sent in is different. For more information on the connection methods Quicken uses, please see this article:

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

-1 -

@Boatnmaniac, no, neither of those shows me any more information (except that it's about to enter a Deposit transaction).

0 -

Thank you, @Quicken Kristina. It is unfortunate that all the data formats have to change, since that causes a lot of work for you and a lot of possible types of errors for us; however, it does help to understand what you are facing.

On my other question, is the issue regarding CDs transferring in improper units and with improper prices suitably documented, reported and recognized? That would be a showstopper for many of us.0 -

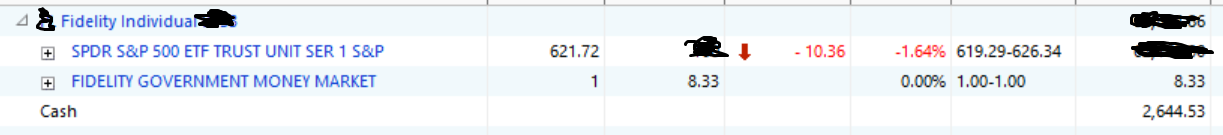

Before the conversion, SPAXX (Fidelity Government Money Market Fund) was my Fidelity brokerage cash account and the balance was cash in Quicken. After the conversion, SPAXX is now tracked as a new mutual fund and maintains a separate balance from the cash. Does anyone know how to tell Quicken that SPAXX = Cash?

1 -

I had a similar question above. This needs to be addressed ASAP.

Barry Graham

Quicken H&B Subscription1 -

Thank you for your reply @BrittMayo,

Yes, it has already been reported for further investigation and resolution. It is one of the issues being investigated in CTP-13955.

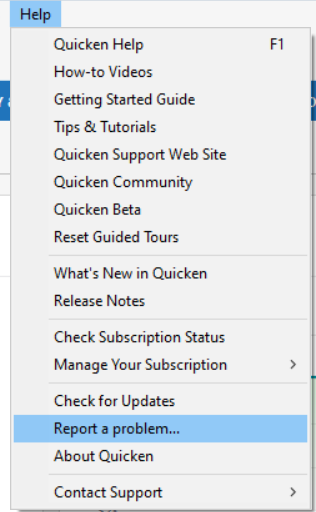

If you would like to contribute to that investigation, please navigate to Help>Report a Problem and send a problem report with log files attached. Including screenshots showing how those problem CDs show up on the Fidelity website would be helpful also. Please make sure to put ATTN CTP-13955 in the subject line.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

-1 -

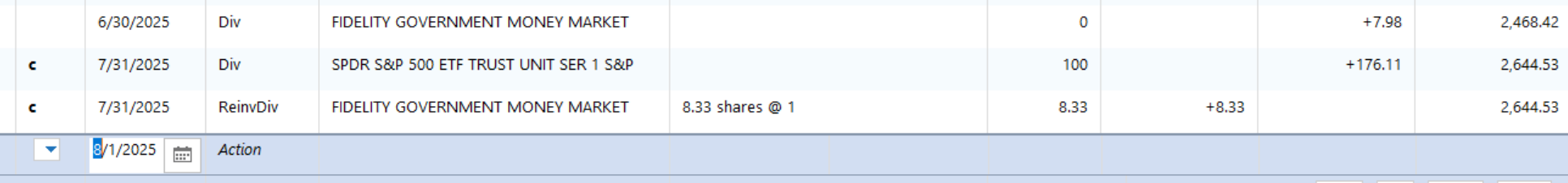

Also, the end of month dividend transaction for a fidelity bond fund came in rounded to 2 decimal places vs. the 3 places that Fidelity uses. So when I accepted the transaction as it was presented to me, I received an error indicating my Quicken balance was off vs. the Fidelity balance.

1 -

Same here- I went back and edited one of the transactions to fix this.

Barry Graham

Quicken H&B Subscription0 -

And furthermore, I also have a 401(k) from Fidelity that changed over to the new connection method. In this 401(k), I have three funds that reinvested dividends yesterday (7/31) and also a contribution was recorded. The Fidelity web site shows all of these transactions dated 7/31. Quicken only shows one of the three dividends and it just appears as "Dividend" without identifying which fund it's from and without including the number of shares purchased (reinvested) for the dividend. If I were to accept this transaction, I don't think it will be handled properly. So I will enter the transactions manually. But it would be nice if the Quicken/Fidelity teams got these issues fixed. Thanks.

0 -

I have a similar issue - we get paid on July 31st and the money is transferred to Fidelity the same day for our 401k. The contribution from my company is incorrect shown, as is the conversion into shares - only one of the stock transactions (our of 4) is shown.

Barry Graham

Quicken H&B Subscription0 -

DC is only allowing Simple Tracking? This is not something I've seen anyone else post.

There has been an issue with EWC+ only allowing Simple Tracking but I haven't heard anyone posting about that for the last few days.

Quicken Classic Premier (US) Subscription: R66.12 on Windows 11 Home

0 -

I converted the account back to DC because I had to deactivate and reactivate and DC was no longer available. I manually pasted the whole zzz string in the FI field and it worked, but then it changed it to simple tracking and when I hover over the "Why" button it said - wait for this - that EWC+ only supports Simple Tracking - but it's not EWC and EWC+ DOES support complete tracking.

The reason this has only just been reported is that nobody else has tried to convert from EWC to DC today - it's just started happening in the last 24 hours.

Barry Graham

Quicken H&B Subscription0 -

I "rolled back" today as well. I restored a backup from before my switch, then reset my accounts. It preserved the DC connection and renamed it to zzz-Fidelity Netbenefits.

While on the EWC+ connection, the account did show "Complete Tracking", but the downloads lacked the usual detail. One was an admin fee. DC would show it as a SOLDX and give the details on shares, etc. Under EWC+ it was WITHDRAW and only listed the value. I was able to edit the transaction to change to SOLDX and populate the fields but don't really want to to this every time. I also had a dividend distribution that also didn't match the previous transaction's format.

Once I rolled back and ran OSU, the same fee came down as SOLDX with the proper details. The dividend showed Reindiv like all the other before it.

Also, it's no longer prompting me to switch so I'm going to stick with DC for now.

0 -

FWIW, I tested another app (one that uses Yodlee as an aggregator, I believe) and when it pulled in Fid tbill data it messed up the units of shares and per-share price, off by a factor of 100 in this case.

0 -

Right: this isn't just auth: it's an all-out change of protocol: DC was OFX file transfer (more or less). EWC+ is (IIUC) FDX which is a completely different thing.

There are (potentially) up to four orgs involved here: Quicken, Intuit (historically, Quicken's aggregator), Akoya (Fidelity's preferred/co-owned? aggregator) and Fidelity. Without some real concrete information, it's hard to say who is responsible for what, though arguably all that are involved are responsible for testing (better than they did).

It appears that Fidelity is the forcing function here: all signs are that they (and a lot of other FIs) want to kill OFX support. I can kind of understand why. It's and old and crufty spec: I'd guess the code supporting it is equally archaic. But googling will lead to lots of critism of FDX, both technically (slow, chatty protocol) and org (controlled by FIs/pretty unfriendly to innovation). And reddit has complaints from various personal finance tools going back to 2023.

Things I'm curious about (but doubt we'll know):

- Is one of the orgs above translating FDX to OFX before Quicken sees it and doing that lossily.

- Where the share rounding is coming from: Fidelity, one of the aggregators, or Quicken. Similar for the bond (CD, tbill) units. Pretty clear either the raw data sent is wrong or someone is misinterpreting it.

- I'm just guessing here but I wonder if the dupe transactions are happening because Quicken simply looks for an existing transaction for each new one it downloads and adds it if it doesn't match. And the downloaded txns now don't match exactly. (I know I've had the opposite where I've lost CC transactions when I make two identical charges at almost the same time: one seems to get supressed as a dupe.)

0 -

Hmmm….that was an innovative approach that I've not heard before. I don't know of anyone who has been able to reconnect their Fidelity accounts to DC by going through the Add Account process.

The only way that I know for sure works to get the DC connection to work, again, is to restore a recent back up file from before when you reauthorized to EWC+.

The DC connection in that restored back up file should still be functional and every post I've seen by those who have done this have said it works well.

The main issues with this is that all of the EWC and EWC+ connections for other financial institutions in the restored file will have been broken and will need to be set up, again.

If you get prompted, again, to reauthorize Fidelity make sure to look toward the bottom right of the prompt popup. There will be a link there that says, "Remind me later." Click on that link and the popup will go away and you can continue using Fidelity's DC connection….with Complete Tracking….until at least 8/20.

Quicken Classic Premier (US) Subscription: R66.12 on Windows 11 Home

1 -

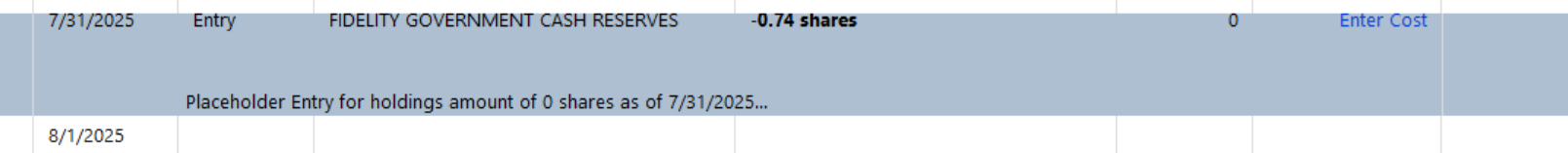

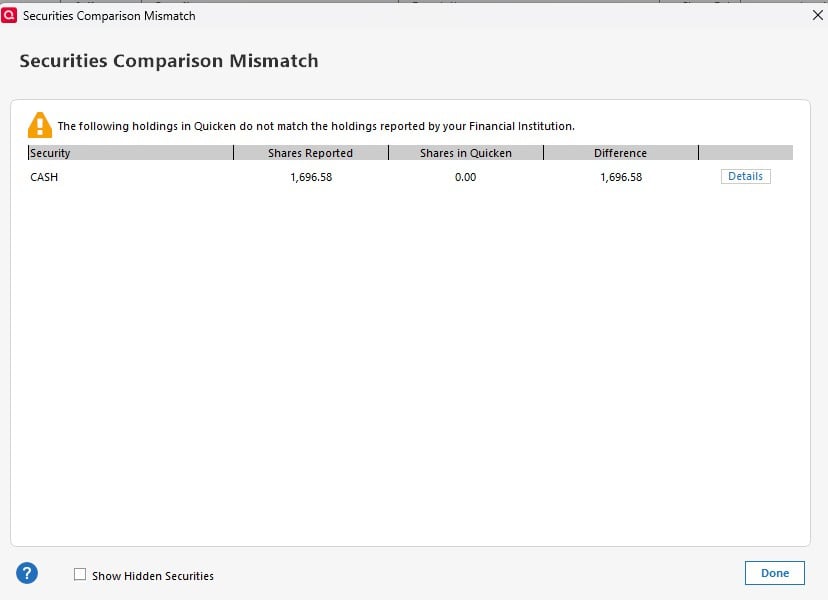

I encountered a similar problem. after updating Fidelity accounts (Individual, IRA, Roth IRA etc) after being prompted to reauthorize (from Direct Connect to EWC+), it really messed up my Fidelity accounts on Quicken. I have noticed 2 major issues:

1) It created a placeholder for a Fidelity Government Cash Reserves (FDRXX) on my Roth IRA account. It shows a holdings amount of 0 shares2) It messes up the download of the transactions related to the dividends of the Fidelity Government Cash Reserves (FDRXX) and the Fidelity Government Money Market Fund (SPAXX). During the reauthorization, I checked the recommmed method of converting the Money Market Security to Cash Balance (i.e. not tracking the cash related securities) However, the transactions downloaded still showing the Reinvest type (instead of DIV type), as a result, my accounts on Quicken show partially cash balance, and partially in security. (note: before the coversation from Direct Connect to EWC+, I didn't experience this problem, and all the cash securities were treated as cash, not securities by Quicken and during download.

0 -

Earlier this week Quicken changed the way it downloads updates from Fidelity. I received the option to assign the cash balance to a money market fund. Unfortunately I clicked YES. It did not ask me the name of the money market fund. No new fund shows up in the portfolio list. Now when I download updates it puts up a window indicating I have cash in my brokerage account that is not in Quicken (the account screen does list the same cash balance). Have googled how to fix this but getting nowhere. That account does not have the "Reset Money Market securities/cash options" button on the Account Details Online Services page. I guess that is what I somehow activated to cause this. Short of restoring a week old Quicken data file, how do I fix this? Why doesn't the new money market show up? Thanks.

0 -

Similar to others, all trading transactions along with dividend downloads, etc. are rounding to the hundredth place instead of the thousandth place as recorded by Fidelity. I manually corrected the transactions and reported the problem through the "share your feedback" feature with screenshot in Quicken, so hopefully this will be fixed soon.

0 -

Did you reauthorize your Fidelity accounts to the EWC+ connection method? You can confirm your connection method?

If so, this is a known issue (among others) with the EWC+ connection and many (including me) are posting about it in this forum. Last night I had a discussion with a key member of Quicken's Development Team about this issue (and others that exist with EWC+) and he confirmed that Quicken, Fidelity and Intuit (the aggregator) are aware of the EWC+ issues (including this one) and have made it a high priority with several people assigned to resolve them as quickly as possible. I was not provided any estimated resolution date other than to say they are working to resolve them before the 8/20 EWC+ hard cut-in date.

You should report it to the Quicken team via Help > Report a Problem. Please be sure sure to attach a sanitized data file and attach all the log files if you are comfortable doing so. It will assist the Development Team.

At this time there is no fix for it short of restoring a backup file from before when you reauthorized to EWC+. If you restore a backup file:

- It will have the DC connection intact.

- If prompted to reauthorize, again, decline it by clicking on the "Remind me later" link at the bottom right of the prompt popup. (I suggest doing this every time this prompt comes up until the EWC+ issues are resolved or until we are forced to migrate to EWC+ which is currently scheduled for 8/20.)

- All of your EWC and EWC+ connections will have been broken so they will need to be set up, again, via Add Account or Set Up Now.

Quicken Classic Premier (US) Subscription: R66.12 on Windows 11 Home

0 -

This past week I got messages from both Merrill and Fidelity that there was a new connection method for download. I followed the instructions for both. Everything seemed to work well but when using update those accounts do not update. They either fail to download transactions that are there when I check the respective website or a simple "dividend" is download where the transaction was more detailed. Everything was fine before the transition. All bank downloads continue to be fine.

0 -

Boatnmaniac - Yes the first thing I had to do was log into Fidelity and accept all kinds of stuff to allow the download of my transactions. So that is what I did. I will work on sending Quicken a problem report. Thank you for the heads up !!!

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 248 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub