How to track YieldStreet Alternative Income Fund

[YieldStreet does not support Quicken in any way. All entries must be done manually.]

YieldStreet calculates the value of the fund by the NAV (net asset value), which changes daily, times the number of shares owned.

For example:

A $30,000 investment might represent 3188.90 shares at a NAV of $9.41.

The value of the investment changes daily as the NAV changes, up or down.

The NAV is drastically reduced when a quarterly distribution is announced.

The number of shares owned changes only when a deposit, withdrawal, or div reinvest happens.

I don't need daily tracking. I would be OK with making manual entries each quarter when my dividend reinvestment is posted.

What specific entries will I need to make?

Will I need to create a fictitious security for these shares? How would I update its value to match the NAV?

Answers

-

UPDATE:

I tried creating a fake mutual fund name YSAIF. Then I entered two deposits of $30,000 and $5000.

I also entered three dividend reinvestments of $478.39, 486.13, and 494.01.

Everything worked nicely, EXCEPT:

The number of shares is displaying correctly as 3885.419

Because today's NAV is 9.2906, the market value is displaying correctly as $36,097.87.

But, the cost basis of these shares is showing in Quicken as $36,458.53 for a loss of ($360.66).

The cost basis should actually be $35,000 for a gain of $1,097.87What have I done wrong?

How do I convince Quicken that I paid nothing for the shares that were reinvested?I've tried using Add Shares instead of Reinvest Dividends, but Quicken won't allow a share price of zero.

-1 -

You've got the cost basis calculations incorrect. The correct cost basis should include what your paid for those reinvested shares.

A Div reinvest is no different that if you'd been sent a check and returned it with the instructions to "buy more". In either case you've got a purchase which increases your cost basis.

Q's cost basis calculation is correct and, overall, you've got a loss.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

I'm sorry but your comment makes no sense, dude.

I've paid $35,000 into the fund. My market value is now $36,097.87. That's a gain, not a loss.

I paid nothing for those additional shares. They came to me in the form of a dividend.-1 -

Your cost basis (which for taxes) isn't your "return on investment".

As far as the IRS is concerned a Reinvestment of a Dividend is a Dividend, and then a buy of that security at the current price.

Whereas you might view this as "I only bought the one $35,000". What you really did is buy $35,000 and then buy again on each dividend.

BTW in a perfect world the NAV would drop exactly equal to the dividend paid. EDIT: and note that your investment is basically reinvesting that amount in the security so that you are back to where you started before the dividend was paid. Of course, this isn't a perfect world, and the NAV price will move around causing this not to be a perfect match.

Think of it as if you owned a business. It is worth $100,000; you choose to take out $10,000 out of the business. You now have a $90,000 business with $10,000 of cash. The drop in the NAV is recording the drop in the value of the business. And also note that the IRS would consider the payment of $10,000 as income paid to you, just like the dividend. In a taxable account you will pay taxes on every dividend you receive.

Signature:

This is my website (ImportQIF is free to use):0 -

You're trying to make something complicated that is actually really simple. Money in - money out.

Would anybody else like to chime in?

Let's think of this investment as a mutual fund. I buy into it with $30,000 at a NAV of 9.4066 which gets me 3189.25 shares.

Over time the fund pays dividends of $1458.53. Each time a dividend is paid, the share price decreases.

If I took that money in cash, I would have a gain (taxable or not) of $1458.53

If I elected to cash out of the fund today, I would still have those 3189.25 shares valued at the current NAV of 9.290606 which gets me $29,630.07, a loss of $369.93

I now I have $31,088.60 in my pocket on a $30,000 investment, a gain of $1,088.60.So, what is my cost basis? Obviously, it is $30,000

Reinvestment of those dividends would not turn that gain into a loss. It would actually increase the gain.So, experts, what am I getting wrong?

Remember, I didn't come here to ask about tax implications. I just want Quicken to display my gains as gains.

Do I need to abandon the DivReinv entry and start using two entries, one for the dividend and one for the purchase of additional shares?-1 -

@Wiley Won what it boils down to is reinvested dividends increase your cost basis because they are treated as new purchases of shares. @NotACPA also noted this in his answer.

In your example then the correct cost basis is calculated as such -

Event

Amount

Initial Purchases

35,000.00

Reinv Div

478.39

Reinv Div

486.13

Reinv Div

494.01

Cost Basis

36,458.53

1 -

@Wiley Won Your understanding of Cost Basis is just plain wrong.

As you'll discover whenever you sell that security, and end up paying Cap Gains taxes on your $35K instead of the correct $36,458.53.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP-1 -

[Removed - Disruptive]

-1 -

Multiple responses here have told you that reinvesting dividends ADDS to your cost basis.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Sure, I get that, but …. where did the money come from for those three purchases? I would agree with you if it was new money being brought into the account, but that isn't the case. To me, the total cost of those three reinvestments was Zero.

According to your analysis, I would post a loss on the sale and pay no taxes.

When, in reality, I made money. This investment is a winner, not a loser.I think I've been expecting Quicken to treat the ReinvDiv function as both income and an expense, but it doesn't do that. It seems to only look at the buy side of the transaction without accounting for the dividend being income.

Here is what the Holdings screen looks like (as of last week, before the recent $5000 contribution):

Name……Quote/price….Shares………Market Value….Cost Basis……Gain/Loss

YSAIF…….9.1798…………..3347.241….$30,727.00………$31,458.53…..-731.53

Do you see why this is just wrong? The investment has actually made $727.00. It has not lost anything.

All the numbers are correct EXCEPT the Cost Basis. That should be $30,000.00. Then all would be fine.How do I get Quicken to show the gain?

-1 -

@Wiley Won if you break down the reinvested dividend into it's component pieces, you will be able to see where the new money comes from. A reinvested dividend is really two different transactions -

Cash dividend - this dividend is a payment to you.

Buy - this is for the purchase of shares with the cash dividend you received.

The new money is the cash dividend that was given to you but then immediately used to buy additional shares of the fund. A cash dividend is given to you for you to use for any purpose you wish. With dividend reinvestment you agreed to repurchase shares of the fund with the cash dividend given to you.

A lot of banks, including mine, show reinvested dividends as two separate transactions - a cash dividend and a purchase of shares. It makes it clear that income was earned and then used to buy more shares.

For a clearer picture on Quicken, you can also do a cash dividend and a purchase of shares, instead of the dividend reinvestment.

1 -

@Wiley Won financial terms are defined, you can't just come in and change them because they don't suit what you want to see. Your basic problem here is trying to change the definition of Cost Basis, and that is just not going to happen.

Here is an article on Cost Basis, notice what they say about reinvesting the dividends:

What you want is "return on investment" that isn't the same thing.

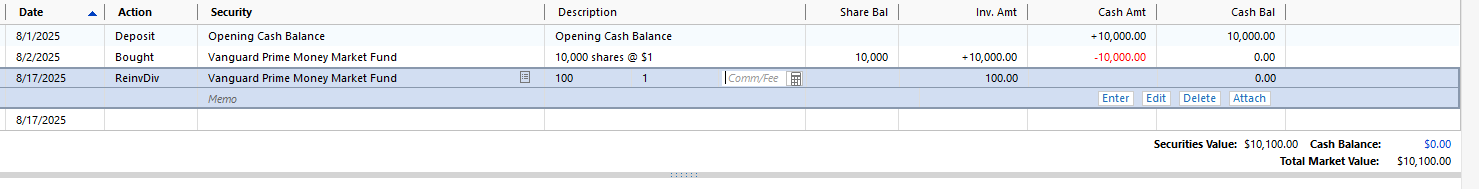

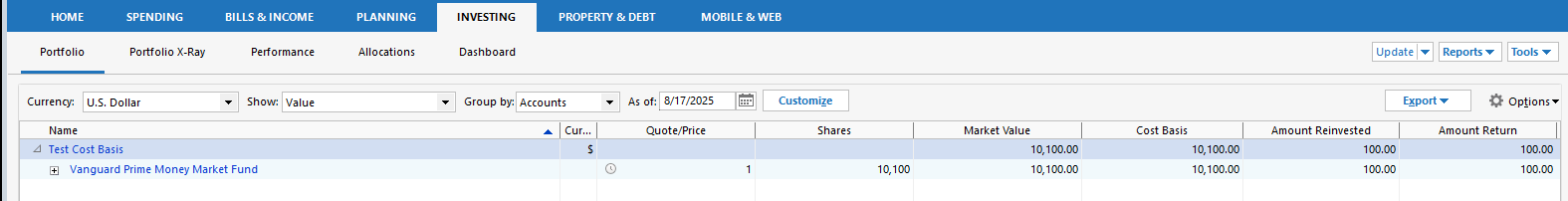

To keep this simple I'm going to use and example where the NAV doesn't change. Below a buy of $10,000 followed by a $100 dividend that gets reinvested.

The Cost Basis is $10,100 and the Amount Returned is $100.

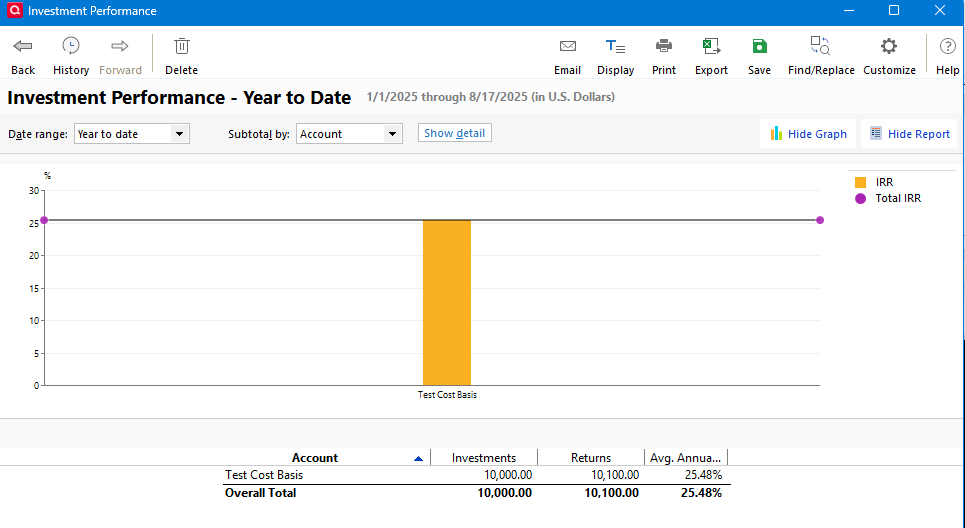

I pull up the Investment Performance report:

Now you see the starting $10,000 and the ending $10,100.

Signature:

This is my website (ImportQIF is free to use):0 -

And to make it clear why Cost Basis is defined that way.

You buy a security for $10,000 in a taxable account.

You get a dividend for $100. This year you will have to pay taxes on that $100 whether you reinvest it or not. And now you reinvest that $100.

Later you sell the security for $10,100.

If you use $10,100 - $10,000 as your Cost basis then you would have a gain for $100 and owe taxes on that. But WAIT! you already had to pay taxes on the $100 dividend when it was paid. So, if you calculate Cost Basis this way you will have paid taxes on the $100 twice!

That is why the cost basis is $10,100. You wouldn't pay any more taxes on the sale of the security at $10,100.

Signature:

This is my website (ImportQIF is free to use):0 -

I followed your advice. I added entries for the three dividends and changed the Add entries to Buy.

The results are exactly the same on the Holdings screen.Name……Quote/price….Shares………Market Value….Cost Basis……Gain/Loss

YSAIF…….9.1798…………..3347.241….$30,727.00………$31,458.53…..-731.53

Why does Quicken insist that I have a loss when, in the real world, I have a gain?

I guess why I'm having so much trouble with this is because it isn't logical. If I participate in this fund for 10 years, I will earn 40 quarterly dividends, my "cost basis" will grow every time, and my so-called "loss" will grow larger and larger. At tax time, if I use Quicken's numbers, I will owe nothing because I have a huge loss to declare when, in reality, I made a ton of money. How does that make any sense?

0 -

At tax time, if I use Quicken's numbers, I will owe nothing because I have a huge loss to declare when, in reality, I made a ton of money. How does that make any sense?

At tax time you will have two things that will contribute to what you pay in taxes.

The first is the dividends. The second is the "gain", which is calculated using the cost basis. If the dividend isn't included in the cost basis you will be paying taxes on both the dividend and the gain caused by those reinvestments.

Signature:

This is my website (ImportQIF is free to use):0 -

@Wiley Won the different way to show dividend reinvestment (cash dividend and purchase) on Quicken should yield the same results. It's just a different way to show the reinvested dividend transactions, that breaks it out to it's component pieces.

Your comment here explains why funds that pay dividends are so attractive -

If I participate in this fund for 10 years, I will earn 40 quarterly dividends, my "cost basis" will grow every time, and my so-called "loss" will grow larger and larger. At tax time, if I use Quicken's numbers, I will owe nothing because I have a huge loss to declare when, in reality, I made a ton of money.

At tax time you would be paying taxes on the dividends as income, no matter what. The gain or loss that is calculated from cost basis, only comes into play when you sell the fund.

In fact you want the dividends to increase your cost basis as much as possible to offset the capital gains if and when you sell the fund. The smaller the capital gains, the less the taxes.

Don't worry that the fund shows a loss. That is an unrealized loss. Your unrealized gain or loss will always fluctuate over time. (and hopefully won't always be a loss). And again, it only comes into play when you sell the fund.

In the meantime you are benefitting from the quarterly dividends which is real income.

0 -

Your "so-called loss" is an actual Unrealized Capital Loss. It isn't an Realized Capital Loss until you sell.

You bought YSAIF five times, for $30,000, for $5,000 and then once each for the 3 dividends. Each buy added to your cost basis.

And, because of how mutual fund dividends work, which reduce the total assets of the fund thus reducing the Net Asset Value of the fund, if you take the cash and DON"T reinvest, your share balance remains the same but at a lower value … and the dividend in your pocket takes the total back to where it was.

If you DO reinvest, you've now got more shares, but at a lower NAV and thus your total remains the same.

If you look at Q's "Portfolio" and click on the + adjacent to the fund name, you'll see on a lot-by-lot (i.e., purchase by purchase) basis, which purchases you made, the NAV of each lot/purchase and the Gain/Loss for each lot/purchase.

And, to answer something you asked earlier, the money came from the dividends that you received. And, even though in an earlier post your cited $9.1798 as the quote for the fund, I'll absolutely guarantee you that earlier purchases were made at a higher price, which is why you're now showing a loss.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP1

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub