What is the difference between what Quicken gets based on the method of getting the data

This is an offshoot from

What is the difference between what Quicken gets with Direct Connect vs. Express Web Connect Plus vs. manual download of qfx files? I know those are different ways of getting data into Quicken and I am not interessted in an explanation of what those differences are. What I am interested in is what the differences are in format and content of the data and the justifcation for those differences.

It would make sense to me that the data would be the same regardless of how acquired. Then you'd have one way to generate the data and one way to process the data; just different ways of getting the data from the financial institution to the Quicken app. However, based on the above referenced thread, that cannot be the case. There are too many differences in results reported based on how the data is acquired.

Thanks

Jim

Comments

-

Timing, when the data gets pulled, could be a significant difference.

With Direct Connect, you're requesting the data NOW, whereas with EWC(+), the FI sends the data when they want to Q's servers and you're actually downloading from Q's servers … not the FI itself.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Thanks but that is not the kind of difference I am looking for. The differences in results that I have seen myself or seen reported cannot be attributed to timing.

For example, I have 2 Merrill Lynch IRAs both of which were created 4 years ago from a rollover of a 401K. Each of those IRAs has a small amount of cash which earns interest that is posted to the account at the end of each month. Until I switched from Direct Connect to EWC(+) in July of this year none of the IRAs had any interest payments posted in Quicken. (They are in the ML generated statements. So now I am looking at the prospect of hand entering 49 interest payment transactions into each of the IRAs.) With EWC(+), I have gotten interest posted for both July and August to both IRAs. I have downloaded (not processed in Quicken) qfx files from months prior to July, looked at them in Notepad, and they do contain transactions of interest payments. And yes, I do and have always done OSU at least once a week for many years. Most of the time it is done after the markets have closed or on a weekend.

Another example, in additiont to the 2 IRAs, I have an ML brokerage account that also has cash that earns interest each month. That account has all the interest payment transactions from before and after the switch to EWC(+). But the transactions after the switch to EWC(+) look markedly different from those before. How could this be if the Direct Connect interest transactions look the same as the EWC(+) interest transactions? (Well, they could look identical but Quicken could decide to process them differently - but that doesn't make sense to me.)

Thanks

Jim

0 -

Regarding Direct Connect. The FI is SOLELY responsible for the content of the download. Via Direct Connect, Q sends a message that's, essentially, "Send me what you've got", and the FI replies.

Using EWC(+), either Intuit screen scrapes OR, the FI has developed an API that allows Intuit to obtain the data. In either case, it's posted on Intuit's servers until Q requests it. SO, this could be either an Intuit responsibility OR an FI responsibility.

re: your brokerage account. HOW do those transactions look different? Screen shots (JPG or other graphic format please) would be helpful.

BTW, I first mentioned timing because I've had several instances where the EWC feed was pulled before the FI had finished posting for the night … so transactions didn't download until a day later, although with the correct as-of date.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

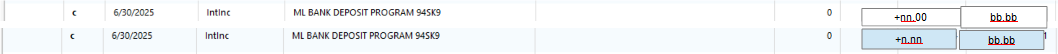

Berfore EWC(+) i.e. Direct Connect:

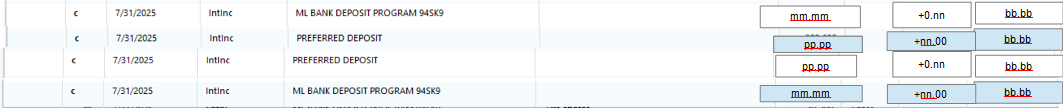

After EWC(+):

A little explanbation: the account has two cash holdings (ML BAMK DEPOSIT PROGRAM and PREFERRED DESPOSIT) that are whole dollar shares. With Direct Connect I got two interest transactions: one that had the combined whole dollar amount of the interest and 1 that had the combined change of the interest. After EWC(+) I got whole dollar and change interest transactions for each of the two accounts.

Associated with the transition to EWC(+) was the addition of the two cash accounts to the holdings without subtracting the combined values of those two holding from cash. (Those two holdings have existed for some time.) So cash was amost double counted in the balance making the balance of the account wrong and driving me to start the referred to thread. The above screen shots are in that thread.

Base on your second post here, it seems that it is possible for the data to be different based on how it is getting to Quicken. I take it that the FI is soley responsible for both the Direct Connect data and the qfx file data. Unless you know what the FI is doing, you can't guarantee that the data content of the two are the same. Since Quicken has some say as to what goes into the EWC(+) data, you can't say that it is the same as the Direct Connect data unless you know what the FI is doing.

Thanks

Jim

0

Categories

- All Categories

- 60 Product Ideas

- 36 Announcements

- 223 Alerts, Online Banking & Known Product Issues

- 21 Product Alerts

- 704 Welcome to the Community!

- 672 Before you Buy

- 1.2K Product Ideas

- 53.9K Quicken Classic for Windows

- 16.4K Quicken Classic for Mac

- 1K Quicken Mobile

- 812 Quicken on the Web

- 115 Quicken LifeHub