Question About Asset Allocation and Expected Return Regarding Bonds

So, I've started playing around more with the Asset Allocation tab. And comparing it with portfolio visualizer categories. And I realized that most of the money market funds (SPAXX, FRGXX, etc) have a significant portion of their downloaded asset breakdown in bonds. This is incorrect, but it got me thinking about why Quicken might do this, because it has to be deliberate.

So I'm wondering, does Quicken do this because by assigning the domestic bonds category to these funds, it is accounting for expected returns it would not otherwise account for? Meaning in the internal calculation of the expected return, does leaving these funds as Cash or a custom category reduce the calculated expected return value?

Answers

-

Money Market funds, DO typically hold some intermediate term bonds in addition to the shorter duration debt instruments, which technically are also bond/debt instruments.

You haven't explained why you believe this is incorrect.

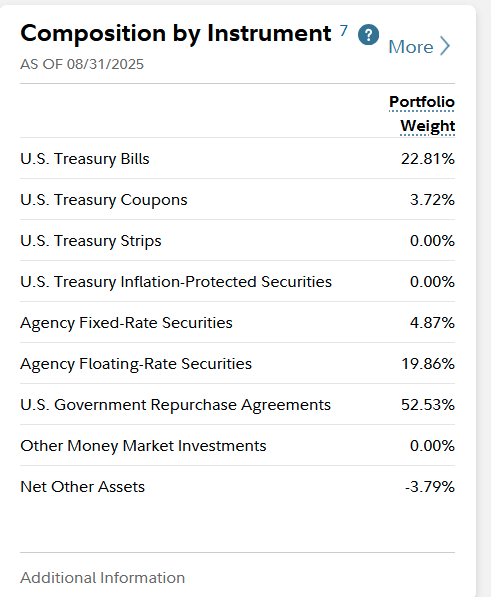

And, per Fidelity's website, here's the composition of FRGXX. Note that there's almost 80% that would be deemed "bonds".

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Why? Quicken is getting that info from third party data supplier. That supplier may have SPAXX (and the others) as holding Domestic Bonds, or they might be showing the MM holding a different class that Quicken does not have built in, and Quicken programmers considered Domestic Bonds the best fit. (I added SPAXX to my test file and found it currently downloads as 29% Domestic bonds and 71% Cash.) It is not a 'decision' on Quicken's part to somehow account for expected returns.

You have the option to not download asset class for these MM funds. I have mine set to maintain the Asset Class Cash. Edit Security Details to control that setting.

Perhaps this discussion will also be helpful.

1 -

Quicken's asset allocation data is downloaded from the quote provider. Depending on the maturity of the fund's holdings, they may classify its allocation as partly cash and partly bonds.

Because the share price is fixed at $1.00, I override the downloaded asset classes for money market funds and set them to 100% Cash.

Quicken's Expected risk and Expected return calculations are a bit of a mystery, and I suspect they have not been updated in years. You could experiment in a test file by creating a security and setting its allocation to 100% of each asset class to see the expected risk and return assigned to each class. Then by adjusting the mix, you might be able to figure out how the calculation works or at least plot the results. For background, check Wikipedia for "Modern portfolio theory"

QWin Premier subscription0 -

I also overrides the downloaded asset class to cash, for the same reasons @Jim_Harman does. Given the focus MM funds have on "not breaking the buck", it's the only option that made sense to me.

Marc

0 -

Yeah I actually think I was wrong about this…sorta. But I was looking at how other entities categorize things. Anyway, it's not important. @Jim_Harman 's idea of testing how allocation affects the expected return is a good idea, but also after messing with it a little, I can conclude that it is most likely a waste of time because he's right, it probably hasn't been updated in years and is inaccurate anyway. It's too bad you can't customize the expected return. But there are plenty of other tools for that elsewhere I suppose. It doesn't surprise me the Quicken team hasn't prioritized fixing tiny features like this one.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub