How to record partial Bond Call?

hi,

My Gov Agency Bond was partially called.

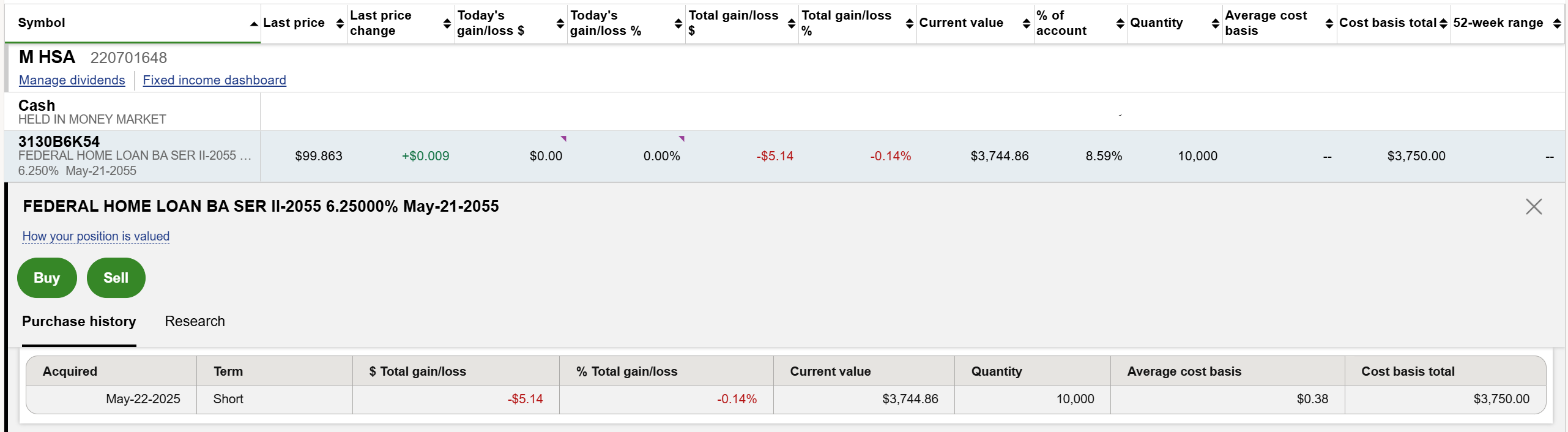

I bought 10000 for $10,000.00

The $6250.00 was called and I got back this as Principal. My cash position in my Fidelity account was increased by $6250.00.

The $3750.00 remains for this Bond / CUSIP.

How to record this partial call correctly in the Quicken?

There are my current issues:

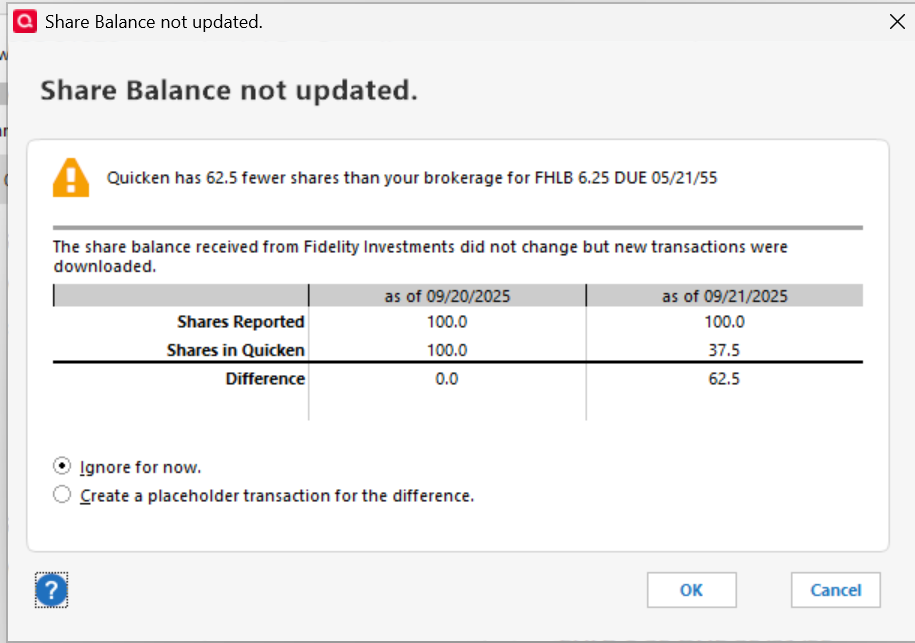

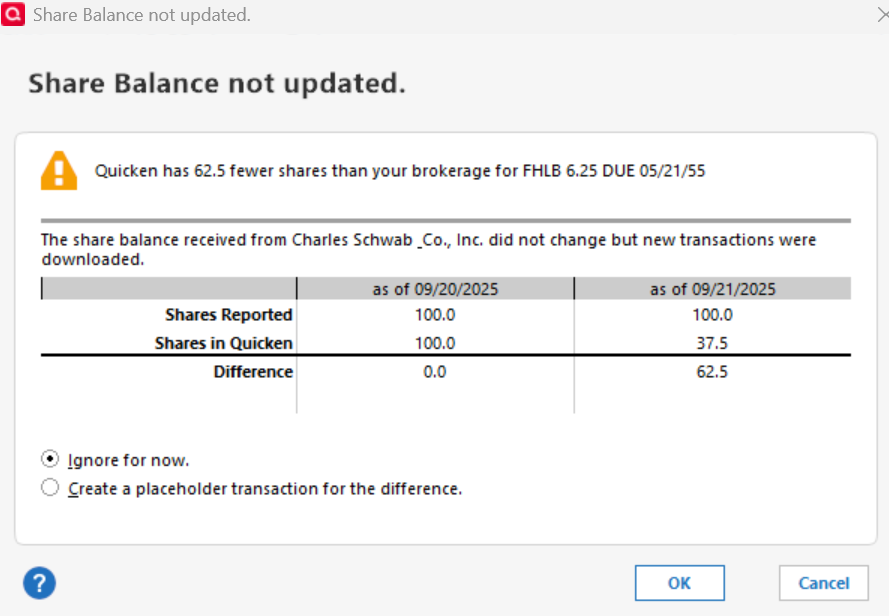

- The Fidelity, as well as Schwab all reports the same original number of shares as 10,000.00, if I record this as 6250 bonds Sale then I have Securities mismatch

- The Fidelity, as well as Schwab all reports new share price as just $0.375, instead of original $1.00/share. This leads to incorrect performance related calculations, it shows 62.5% Losses, while there are none.

This is 1st time for me such partial Bond call of the principal.

How to properly record this?

Yes, I called Fidelity and Schwab, both Fixed Income specialists responded this is how it works on Fixed Income side, when the share price gets lowered, while number of shares remains the same. They (Fixed Income) don't track performance in Stock traditional way.

tnx

Comments

-

That's the oddest damn thing I've ever heard. I would have suggested a sale of $6250 of bonds.

What agency? Might it be something like a GNMA, where the accounting is weird anyway?

And, what's the Bond/CUSIP? I'd like to do some research via my Fidelity account.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Date Aug-21-2025

Symbol 3130B6K54

Symbol description FEDERAL HOME LOAN BA SER II-2055 6.25000% 05/21/2055

TypeCashAmount $6,250.00

Best Regards0 -

this is how I see it at my Fidelity

Best Regards0 -

Sorry, but after researching the bond at Fidelity (I'm their customer also) I still don't understand what's happening.

Have you got an Account Rep at Fidelity? You might try asking them what's going on, because I haven't been able to figure it out.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Per your graphic, the Cost Basis of the bond was also adjusted. SO, maybe, a Return of Capital transaction would work.

Take a backup before you try that … just in case.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP1 -

Yes, there is a "factor" involved here - something Quicken can't handle - where the price is quoted in the normal fashion - the 100 base - and then a factor is multiplied against that "quote" to get the market price. Before the call the factor was 1, now it's .375

I'd guess you need to enter a Return of Capital for the dollar amount called, leaving the number of shares alone, and manually make entries for the actual current market price.

1 -

I can't really explain it either, but I'll offer some comments.

You said "I bought 10000 for $10,000.00". It would be more likely you bought 10 $1,000 bonds for $10,000. But then in Quicken's normal processing you would have bought 100 'shares' at $100/share for $10,000. And then your Fidelity snip shows your Quantity as 10,000 but at a price close to $100/(???). All that is sort of variations of the same and built around a concept that Bonds are priced based on $100 face value units. It can just get confusing as to what one really owns.

Now it seems that you got back $6,250 of your initial $10,000 purchase but Fidelity is still saying you own the same number of units that you originally bought. In Quicken, it would seem to be a simple Return of Capital transaction for $6,250. That will leave you with the same number of units (100 shares) with a total basis of $3,750 as shown on your snip and with $6,250 in cash. The catch there is that ongoing, your units need to be priced around $37.50 per unit, not the $99.863 that Fidelity is showing. Yet you also indicated in your original post that Fidelity is reporting the price at $0.375 (per $1.00 unit). If that is the case (vs the $99.863 or $0.99863), you should be fine with the RtrnCap Quicken transaction.

Speculating, maybe this is how the Fed Home Loan Bank is handling an oversubscription to their 30-year 6.25% bonds — by giving back to the buyers 62.5% of their investment.

1 -

Thank you for all your replies.

Yes, the Return Of Capital fixed some, number of Shares are the same as at both Schwab and Fidelity, The Price per Share is also the same as reported.

But, Investing Portfolio Performance shows this as substation loss as -62.5% , while there is actual gain due to Interest Income distribution.

So from performance side the Return Of Capital is calculated as a Loss.

My question remains.

Or, is this Quicken issue to incorrectly calculate the Return Of Capital?Best Regards0 -

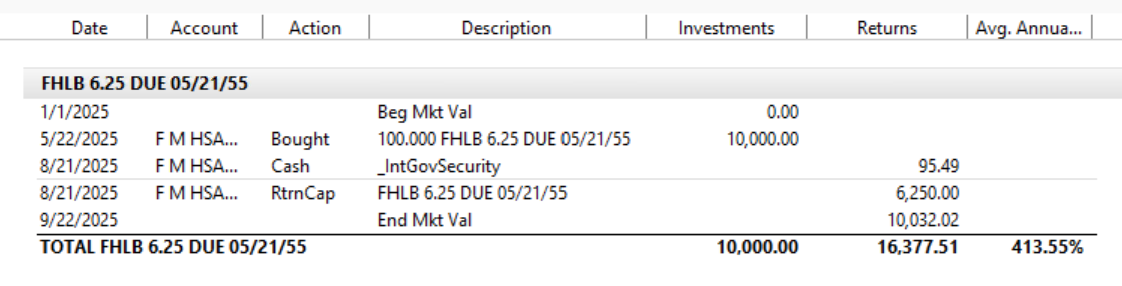

I suggest you an investment performance report as a more explicit calculation. I’d do it for current year 1/1/25 - 12/31/25 and include both the bond and cash (no security). You might then look at it not subtotaled and subtotaled by security.

1 -

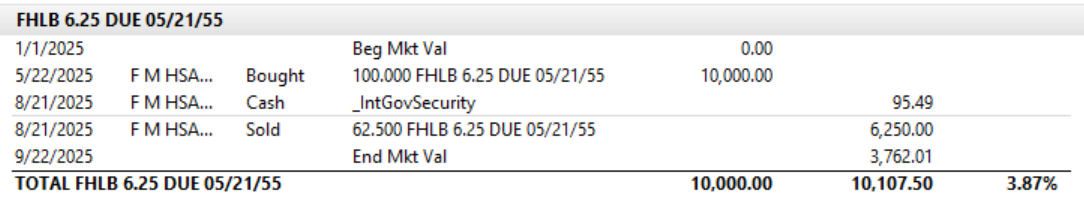

The Investment Performance YTD report even worse

For simplicity I select just 1 Fidelity account.

Sure, I wish to have 413% YTD return, but it is closer to 4% at best IMHO.

What to believe?Best Regards0 -

@NotACPA were you able to get anything from Fidelity for partial called principal?

I asked Fidelity rep and was told this is Fixed Income specific.

When I spoke to Fixed Income specialist I was told that the way it has worked on Fixed Income side, even I that resulting numbers don't show correct performance, answer was other tools need to calculate this in such Fixed Income specific way.

Almost exact the same from Schwab.

The Fixed Income is dedicated team with own rules, Trading team is for Stocks, ETF, Funds, API and UI team accommodate Trading team and in some limited way that fixed Income / Bond space.

Go figure …Best Regards0 -

I didn't talk to anyone at Fidelity, I just researched the bond.

And, in your most recent graphic, the value of the bond is no longer $10k+. It's 10K times the approx .375 current price … which is why your return is over 400%. You've got $6250 cash plus an approx $3750 bond.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP1 -

Re: the investment performance report —

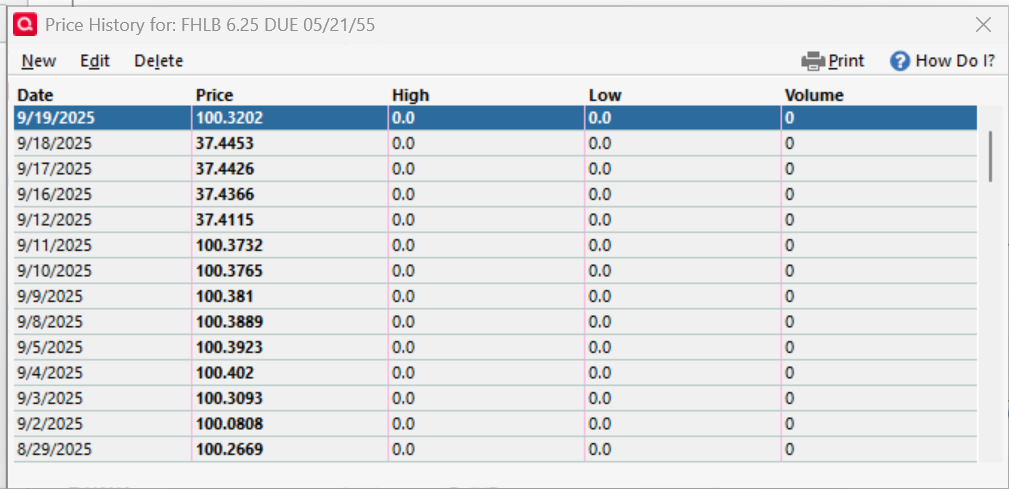

As @NotACPA pointed out, your ending value of $10k is wrong. Likely you have a bad price entry for 9/22/25. Bad as in 99.something rather than 37.something.

Further, it appears you chose a year-to-date time frame. For that less than a year period, the calculation ‘assumes’ the performance in the short period compounds for the a full year. Still further, that your actual start date was May 22. So likely the 4-month return looks like 163% compounds two times to 433%.

Fix the ending price and change the time frame to be 5/22/25 to 5/21/26 and you should get a more reasonable return value.

My real point in pointing you this direction was to show how the RtrnCap value was being included in the Avg Annual Return calculation.

Gain/loss is a different calculation that as you see does not include distributions such as dividends, interest, or in this case RtrnCap.

1 -

thanks for your prompt replies

yes, the Quicken updated this Bond price from $0.375 to current market $1.0xx that distorted performance calculations.No, I can't disable price updates for specific, or I don't want to as I'd like to track it.

This Bond is traded on secondary market and with current rates going down that Bond price is going above original $1.00 , so I might even Sale it for appropriate premium or upon cash needs.As result I don't know what is less evil for this situation?

- Use Return Of Capital

- Use Sale

- any other option?

tnx

Best Regards0 -

No, Quicken did not update the price to $1. Your brokerage (1 of the 2) reported that $1 price to Quicken with your download from the brokerage. Quicken has no way to independently access bond prices.

I really don’t understand what has taken place here. You say the bond is moving into premium pricing so I assume you are seeing values over the $1 rate. But clearly (?) your expecting to only get 37.5% of that when you sell (right?). Nothing I’ve seen before.

1 -

Yes the Quicken updated the price, ether by itself or some broker reported it.

Regardless the price was updated to real current market price for the CUSIP.

This is distorted the reporting.

The $37.4xxx was correct for the "Return Of Capital", but is fake for real market price.

When this Bond will mature it will mature at the $100.

I don't see a point to fight market price.

As result I went back to "Sale Bond" action, with that all reports show more correct value.

So, I'm back to share balance reporting issue that I tried to fix

Which is less evil for me.

Best Regards0 -

Actually this situation is even worse as Fidelity reports Price at $37.x, and Schwab reports at $100.x

So based in what order my Quicken gets updates that Bond price got changed ether to $37 or to $100.

But the Schwab reports 100 shares as well as Fidelity

Best Regards0 -

"Actually this situation is even worse as Fidelity reports Price at $37.x, and Schwab reports at $100.x"

Yep, this difference between the two FIs has been noticed before. You could move all instances of this bond in your file to Schwab and simply change the download price by multiplying it by .75 or move all instances of the bond to Fidelity.

I'd go the route of a Return of Capital because that's exactly what it is and unless the FHLB makes another partial call that factor will remain at .75. (This is a much easier situation that folks that have Mortgage Backed Bonds since the "factor" can change every single day!) You could do your downloads in a specific order so you don't even have to do any math. Download Fidelity, make a note of the actual quote, download Schwab, then change their quote to the correct one.

1

Categories

- All Categories

- 56 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub