Need help with manually entering and tracking a stock so that it reconciles

@NotACPA, @Tom Young Thank you both for your assistance on your response to my question regarding the manual entry of stocks from back in August! Sorry for the delay, I didn't get any alert like I normally do when someone replies to a question. Your insight fixed my problem! Thanks again!!

I do have one follow up…It appears that you can capture the fees associated with reinvesting a dividend on a stock in two ways. The first way is to enter the fee in the "Commission" box when you make the dividend reinvestment entry in the "Reinvest - Income Reinvested" dialog box. Then when you click done, Quicken separates the fee out into a new line in the register indicating that $1.50 has been "transferred" and it shows the $1.50 in the cash amount column and then says in the memo field that "$1.50 paid as fee." The alternative way is to enter the dividend in the "Reinvest - Income Reinvested" dialog box without entering anything in the "Commission" box and then after you click "Enter/Done," you can go back and enter the fee in the "Comm/Fee" box in the same register entry as the dividend reinvestment. The second way does not create a separate entry.

Is one of the options I listed above preferred and if so why and what are any impacts to choosing one over the other?

Thanks!!

Comments

-

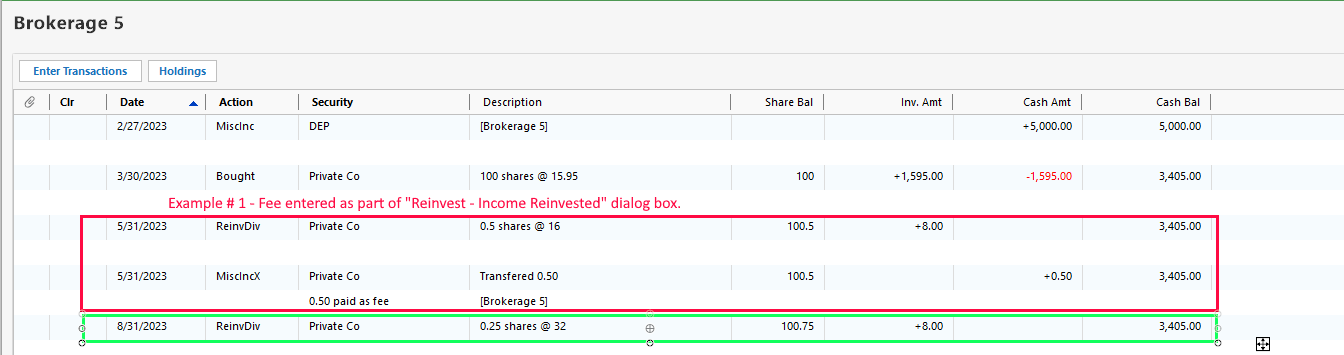

It has been so long since I've had to account for dividend reinvested programs that have a fee or even been charged a commission of a trade that, at first, I couldn't even follow your first example; I just don't remember Quicken working that way. But I did try to mimic your first example with and came up with this as shown by the entries in the Red box.

(The 8/31 entry represents the first step of your second example.)

As I said, I don't remember Quicken working that way "back in the day" but this may be the way the Quicken programmers decided to handle the change in tax law that took place in 2018, (presumably to expire after 2025), where fees weren't deductible when reporting dividends but are included in the basis of the newly acquired stock.

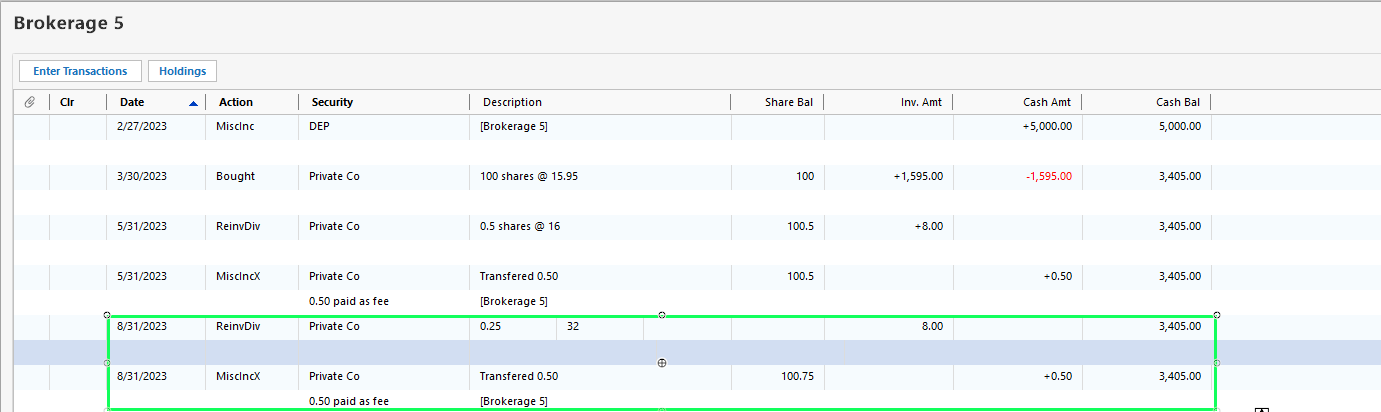

When I completed the second step of your second example - first entering only the gross dividend and the number of shares, then editing that transaction after posting to add the fee - I didn't see the difference you've reported as the second entry showed up, as before:

The difference between what you're seeing and what happens in my file may come down to running different versions, or something. And, if that tax law change actually does expire I'd expect Quicken's handling of the situation will change again.

Since I'd expect the actual accounting to be the same under each entry mode you've described - is it? - I think it's entirely your preference as to what method you'd choose to use. I do find this "showing two entries for one event" somewhat cluttered and IF both methods result in the same accounting THEN I'd probably choose your second method of entry.

1 -

Thanks @Tom Young! I appreciate you taking the time to work through the questions!!

1

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub