Fidelity money market fund redemption transactions missing from IRA

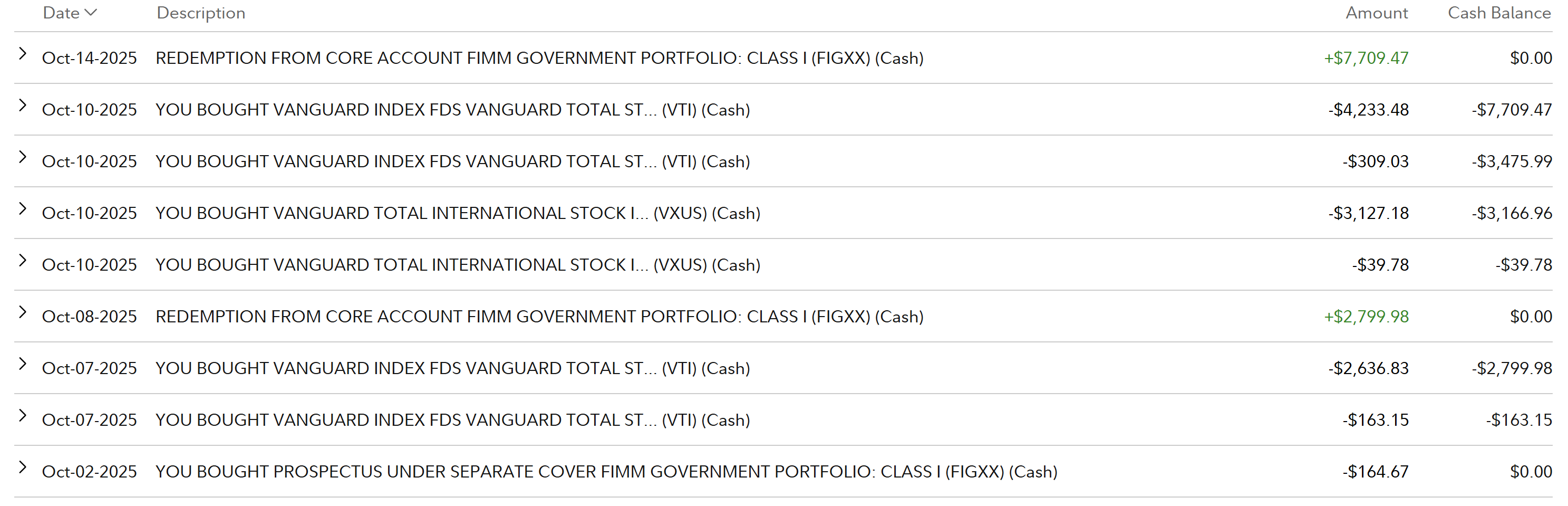

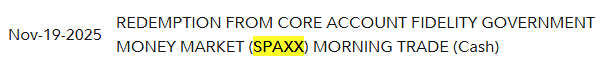

I've been using EWC+ for a while. Since 10/8 there have been 2 redemptions from my FIGXX money market fund that haven't been downloaded in my Roth IRA. I have SPAXX as my core money market fund, treated as cash, and that works, but when there are no shares of SPAXX to pay for trades, FIGXX gets redeemed. Here's what's on the website:

I believe the Bought transaction for FIGXX was downloaded.

@Quicken Kristina let me know if you need another problem report, or will my existing reports suffice.

Comments

-

Hello @EvDob,

Thank you for reaching out! To start troubleshooting this issue, please provide more information. Are the redemptions reflecting in your cash balance, but not downloading as transactions into Quicken? Are there any transactions they may be inappropriately matching with (same security/description and amount, but different date, for example)? Have these transactions been entered into your Quicken register manually, or are they not in your Quicken at all?

I look forward to your response!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Kristina yes, the redemptions are reflecting in the cash balance (now zero) but not downloading. I don't have Quicken "automatically add to investment transaction lists" so if something got downloaded, I'd see it in the download window and I'd notice if there were inappropriate matches. I did enter the transactions manually after I discovered they were missing.

1 -

Thank you for your reply,

Are there any other transactions involving FIGXX, and if so, do they download properly, or do they just change the cash balance without any corresponding transactions downloading into Quicken? Is there any chance that the transactions did download, but were deleted? Do you have FIGXX in any of your other Fidelity accounts, and if so, does it download correctly in those other accounts?

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Kristina there are no other recent transactions with FIGXX in my IRA other than the ones shown above. I believe the Bought transaction did download. It's very unlikely the transactions were downloaded but deleted.

I do have FIGXX in my 401(k), and there were Sold transactions that downloaded correctly. I think it may just be the redemption transactions with the issue.

1 -

Thank you for your response,

I forwarded this issue to the proper channels for further investigation and resolution. Thank you for already sending logs.

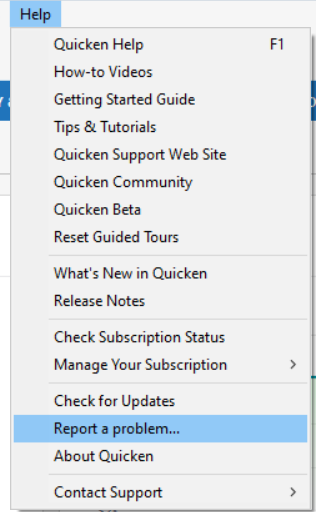

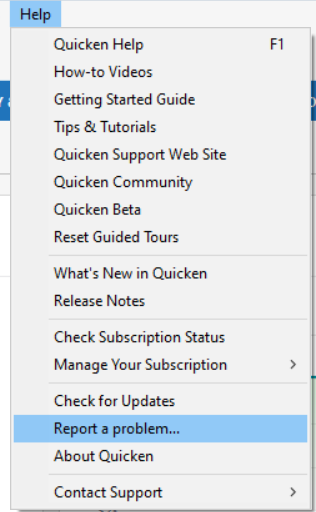

If anyone else is also encountering this issue, please navigate to Help>Report a Problem and send a problem report with log files attached. Please include screenshots showing the transactions on the financial institution website and showing that they are not in your Quicken.

Thank you!

(CTP-15049)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I am having the same issue with FZDXX that auto sells to cover withdrawals/other transactions. I get a message after accepting other transactions in the account that my share balance for fzdxx doesn't match. I believe the buy transactions are downloading, just not the sell transactions. This is a similar scenario to the original post that spaxx is the core/cash position and when there isn't enough, fzdxx sells to cover.

REDEMPTION FROM CORE ACCOUNT FIDELITY MMKT PREMIUM CLASS (FZDXX) (Cash)

1 -

Here's an old report of the same thing, first post on page 38

[Edited - Enabled Link]

0 -

Hello @Dan,

Thank you for letting us know you're seeing the same issue. If you would like to contribute to the investigation, then please follow the instructions for sending a problem report with log files attached from by earlier post.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

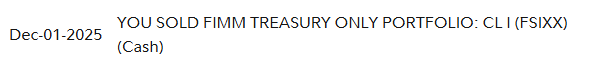

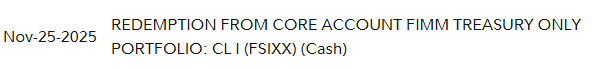

Starting 9/1/25 I have the same problem: automatic sell transactions of FSIXX do not download. I called Fidelity Quicken support and was told that they see those transactions going out to Quicken in the correct format.

1 -

Hello @Toolworker,

Thank you for letting us know you're also impacted by this issue. If you'd like to contribute to the investigation, please send a problem report with log files attached, and include CTP-15049 in the description on the problem report. To send a problem report, navigate to Help>Report a Problem.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Kristina I had already sent a problem report, but sent another one referencing CTP-15049.

One possible clue: The Fidelity app describes the missing transactions as "REDEMPTION FROM CORE ACCOUNT FIMM TREASURY ONLY PORTFOLIO: CL I (FSIXX) (Cash)". But FSIXX is »» NOT «« the core fund for this account; that is SPAXX. Is Fidelity flagging this as a core account or cash account transaction?

0 -

Thank you for the follow-up,

Thank you for the additional information and for sending the problem report. I added it to the ticket, so that our teams know you're also impacted by this problem.

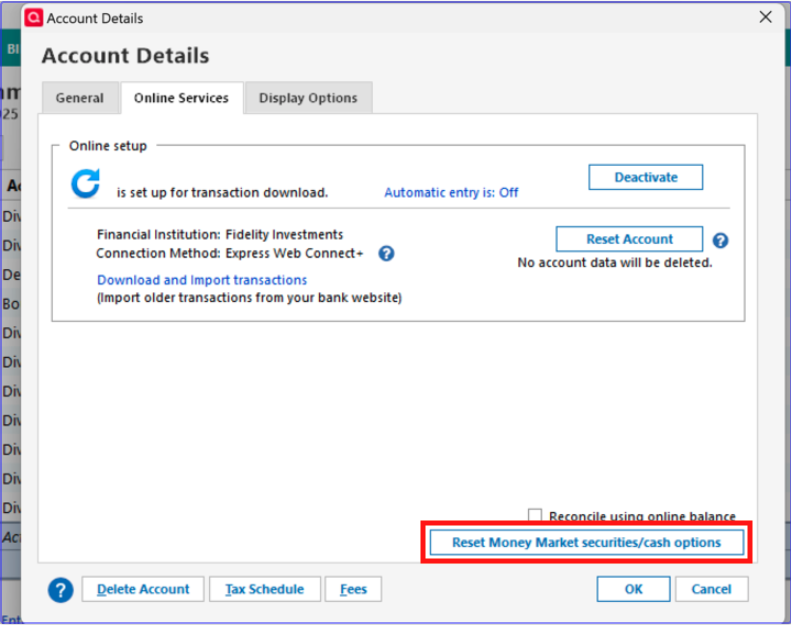

It's possible that the fund is being seen as a core fund. When you reauthorized/connected the account, did you get a pop up asking about tracking FSIXX as cash or a security? If you suspect that may be the problem, you can backup your file, then navigate to Tools>Account List, click the Edit button next to the problem account, choose the Online Services tab, then click the Reset Money Market securities/cash options button.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Kristina I have a lot of Fidelity accounts. Most of them, including this one, do not have a MMF designated as cash. So Fidelity must be coding transactions in the core MMF (SPAXX) as cash when sending to Quicken, so that Quicken doesn't enter them as transactions.

I have put in a Sell order for FSIXX. Monday after market close we will see if the transaction will be displayed as "CORE ACCOUNT" in the Fidelity app. I predict that it will not, and that it will download to Quicken. If so, that will demonstrate that the automatic sell transactions generated by Fidelity are coded differently on the Fidelity side than the manual sell transaction that I created, and also that Quicken is treating them differently. So we will see.

The Fidelity-generated sell transactions for FSIXX are not being treated exactly like the Fidelity-generated transaction for the core MMF SPAXX. The cash from the FSIXX sales does not get added to the linked cash account in Quicken, but the cash from SPAXX sales does. But if my theory is right, that'll be Fidelity's problem.

0 -

@Quicken Kristina Here's the evidence. Fidelity appears to be incorrectly characterizing Fidelity-generated sales of non-core MMFs, to cover a transaction, as core account sales. Quicken does not show these sales in the register, which is incorrect.

This is the Fidelity-generated sale of the core (cash) MMF SPAXX to cover a transaction. It is labeled CORE ACCOUNT. It was not shown in Quicken, which was correct.

This is a sale I ordered of the non-core MMF FSIXX. It was shown in Quicken, which was correct.

This is a Fidelity-generated sale of the non-core MMF FSIXX to cover a transaction. It is labeled incorrectly CORE ACCOUNT. It was not shown in Quicken, which was incorrect.

So go see what Fidelity sent you for this last transaction. I'll bet it was flagged as core.

The captures above are from the activity register displayed in a browser logged into my Fidelity account.

(I said above that there was no core/cash MMF designated for this account. But I must have changed it because:

But this should be irrelevant, because FSIXX is not in any event the core MMF.)

1 -

@Quicken Kristina I think @Toolworker has nailed it for CTP-15049. I see the same thing for missing SoldX transactions triggered by Fidelity:

"REDEMPTION FROM CORE ACCOUNT FIDELITY MMKT PREMIUM CLASS (FZDXX) (Cash)"

I'm going to try to reach out to Fidelity electronic channel support directly to point this out — but your engineers should be pounding on their counterparts door at Fidelity. This is the last remaining problem (for me) with the EWC+ transition debacle that started in July.

Update:

I called Fidelity Electronic Channel Support (ECS) and gave them full details and the URL of this thread. The rep said other customers could call in and reference "Fidelity internal article for Quicken integration dated 10/16/2025 - Fidelity Electronic Channel Support 800-544-7595" to help pile on to let engineers know others are seeing this problem. But @Toolworker, again thanks for noticing this in hindsight obvious error on Fidelity's end.

1 -

Thank you for your replies,

Thank you for providing that additional information. I added it to the ticket to ensure our teams will see it.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Kristina Can you please post a publicly digestible form of what engineering has discovered? Have they identified the root problem and able to reproduce it? If so, is it what it appears above — an issue in the Fidelity data? Any hopes on when we can expect this final fix?

0 -

Thank you for the follow-up,

The tickets that I can see and update are for tracking issues. They do not provide any in depth information from the devs. I can see that the ticket is open and in work. There are no new updates. Unfortunately, our teams do not give ETAs, so I cannot tell you when a final fix is expected.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Thank you for the fast reply. Can you please ask your devs to post something more detailed on this? This is the last remaining EWC+ problem of which I’m aware, and it’s been present since July.

0 -

@Quicken Kristina Here's another problem. A transfer of shares between two of my Fidelity accounts downloaded as a purchase in the destination account and no change in the origin account.

Is this a known problem?

On Dec. 2 I transferred part of a position in Broadcom from account A to account P.

Today I updated in Quicken. No transaction downloaded for account A. The transaction appeared in account P as a purchase of the shares.

I deleted the purchase and entered the transfer by hand.

Then in Online I compared the holdings to the online portfolio. Account P compares correctly. However account A still has the pre-transfer number of shares, which of course is wrong.

It's all correct in the app. Just not in Quicken and in whatever server has the account portfolios, which I assume is Quicken's since Fidelity's server has it right.

0 -

Thank you for your reply,

For that separate issue, I recommend that you contact Quicken Support directly for further assistance, as they have access to tools we can't access on the Community and they're able to escalate as needed. The Quicken Support phone number can be found through this link here. Phone support is available from 5:00 am PT to 5:00 pm PT, Monday through Friday.

I apologize that I could not be of more assistance!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I'll just report it through the Quicken program. I'll save any remaining Quicken hours for entering all the missing MMC transactions by hand, if and when that bug gets fixed.

0

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 512 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub