How is investment return calculated?

I have both a Roth and Traditional 401(k) account through my employer. Both accounts are invested in the same index fund and both get bi-weekly contributions. One account had a significantly larger total value at the beginning of the year and gets a slightly larger contribution each paycheck. I understand the account with a larger starting balance and larger contributions will have a larger return in absolute terms for the year, but shouldn't the % return be the same?

Is this a case of, perhaps, poorly entered transaction information on my part? Perhaps this is more of a conceptual question that I'm not understanding.

Answers

-

Let's start with "What Q product are you running?"

Your profile reads Windows, but you posted in a Mac forum.

Also, I'm assuming that both the Roth and the 401K are set up in Q. Is that correct? If so, how are you recording the cash transfers into those accounts and the security purchases? Graphics would be helpful.

And, are you recording those purchases on the same dates and using the same investing reports?

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

@NotACPA Super embarrassing! Sorry. First time back in a long while.

I’m using the most recent release of Quicken Classic for Mac.

Both accounts are setup in Q as manual accounts and I created securities for my 401(k) holding.

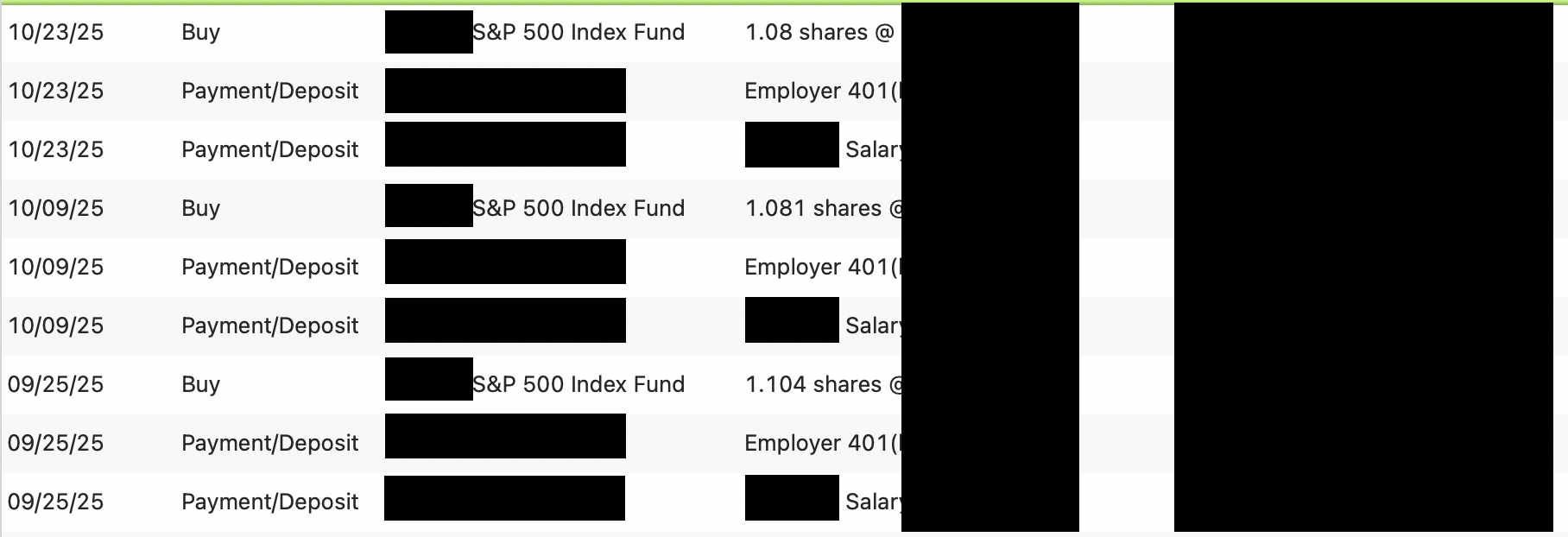

The cash deposits are automatically entered as income every two weeks. The security purchases are manually entered to match exactly what my 401(k) provider, in my case Fidelity, shows.

The transactions are all recorded on the same dates. The total return values that I’m looking at and referring to in this post are the values found at the bottom of the graph on the “Portfolio” tab when looking at the investment accounts.In this image the top two accounts have the exact same return YTD despite having different starting balances. They had no contributions this year. The second two accounts are my two 401(k) accounts which have had the same investment holding and the same contribution schedule all year.

0 -

@sneff30 , have a look at gain/loss (%). You can choose it through the second symbol in the top right corner of your portfolio tab.

Are the return numbers here different. What about cost basis and market value ?

0 -

The Gain/Loss (%) values are different as I would expect. These accounts are different ages and have old retirement accounts rolled into them. I only expect the return values for this year to be the same since they have had the exact same investment holdings the entire year.

0 -

What about cost basis and market value for YTD option ?

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub