Quicken is incorrectly treating Fidelity cap gains as dividends for non-IRA account

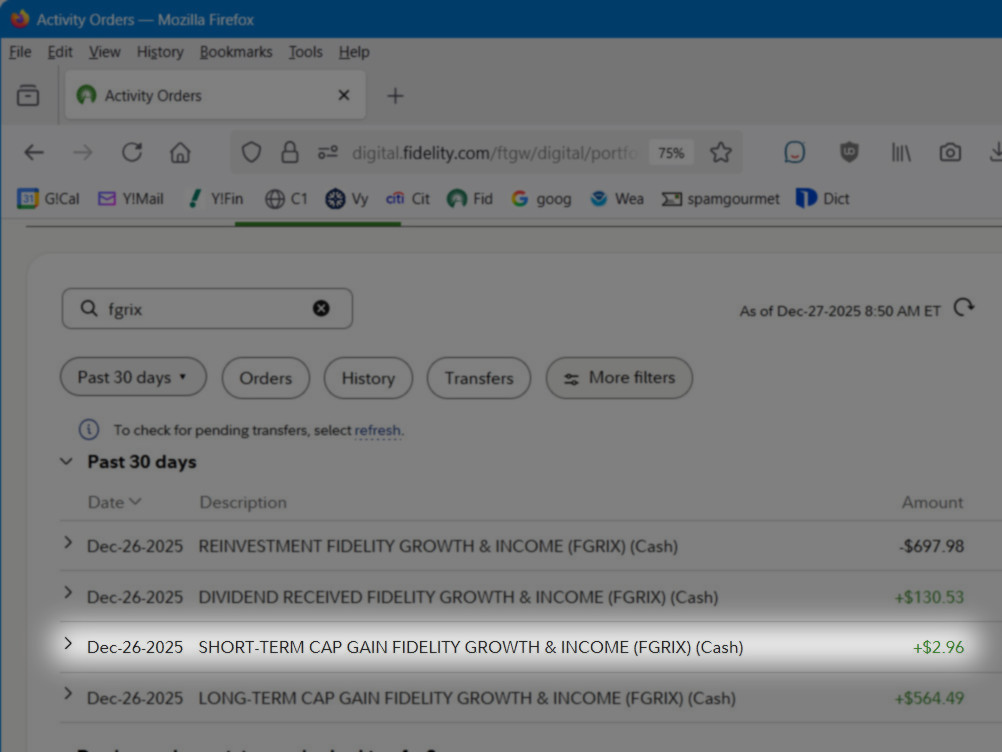

Fidelity activity has always presented cap gains in its transaction activity as Type=Dividend (per Fidelity support) with the Description showing Long or Short Term Cap gain. Somehow, Quicken's DC connection to Fidelity was able to correctly determine an Action of long or short term cap gain from this. EWC+ has lost that ability and is treating cap gains distribution as Dividends.

I submitted a Problem Report to Quicken after speaking to Fidelity support about this.

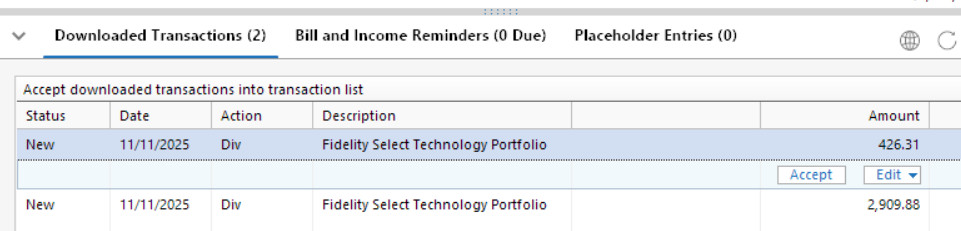

Here's an example of what Fidelity shows in its transaction Activity:

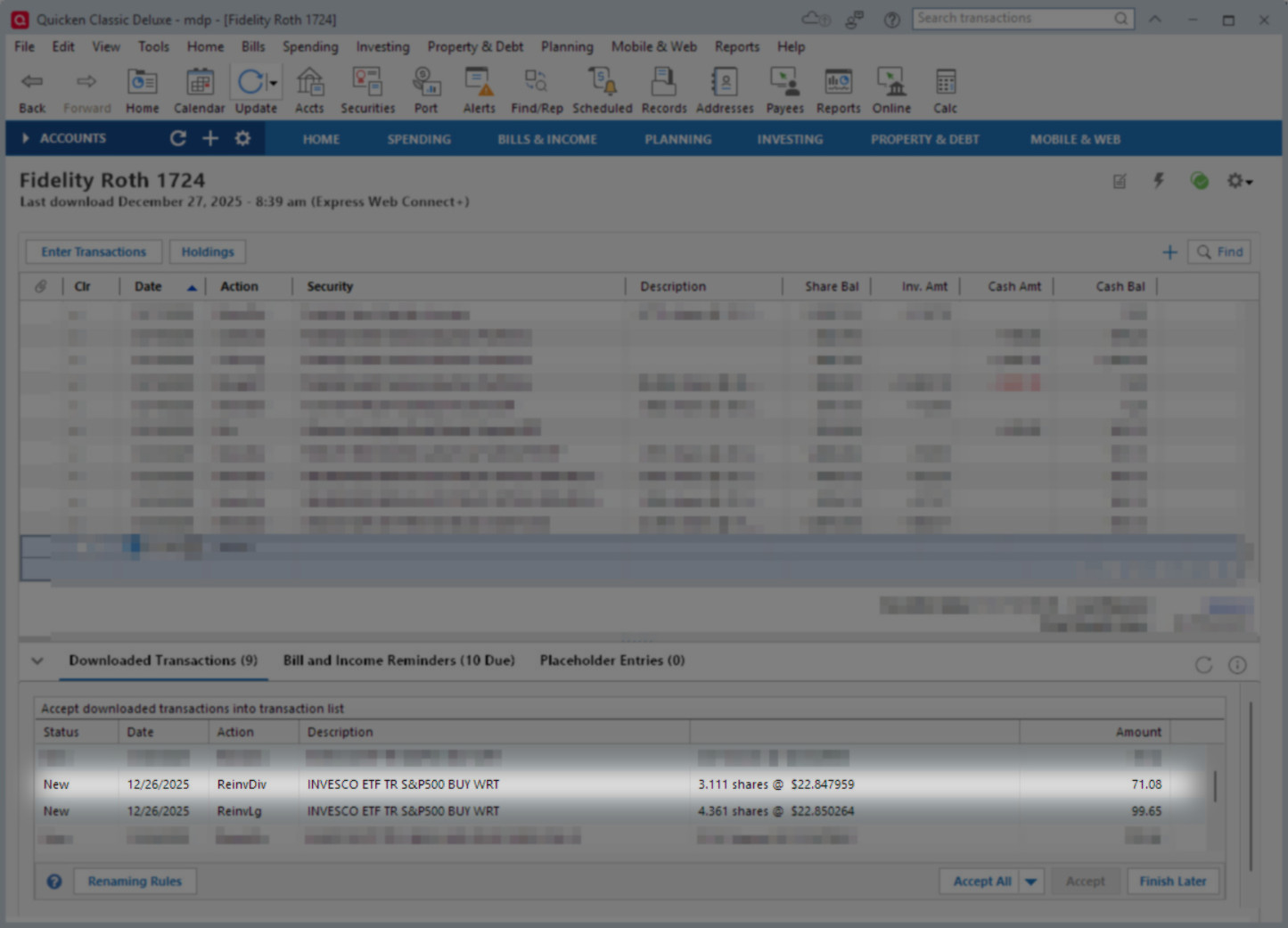

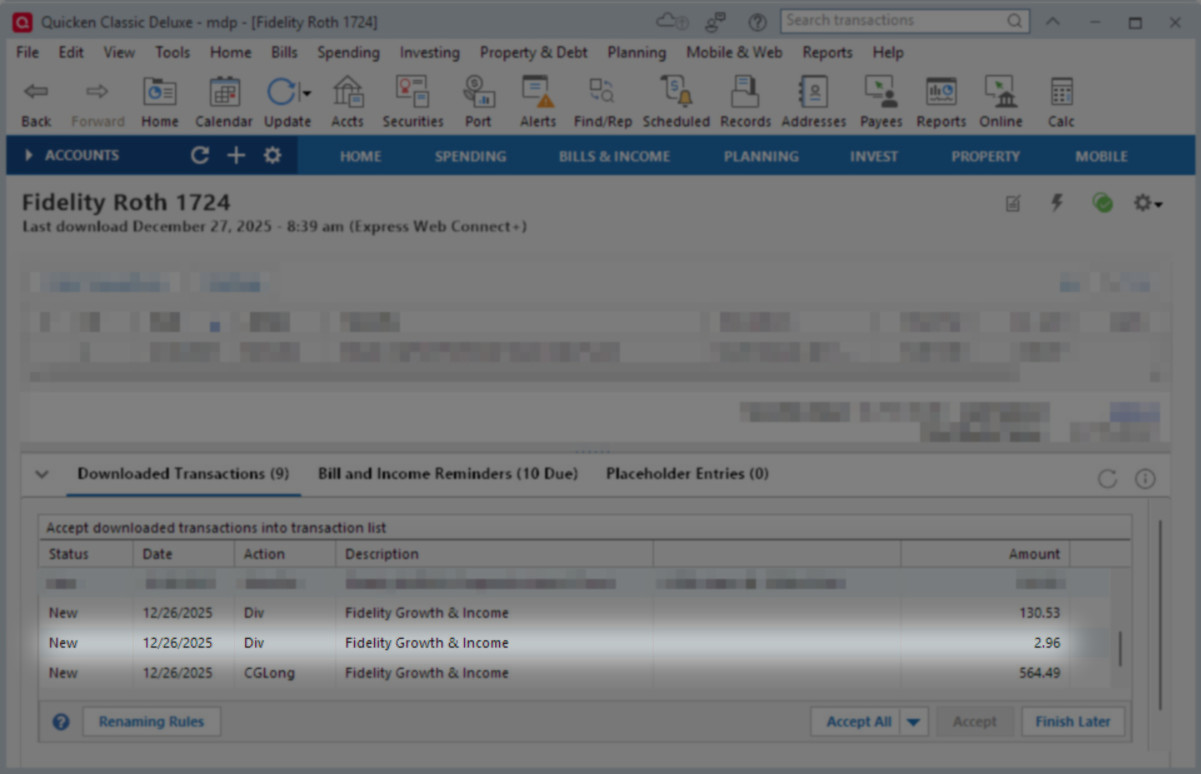

and here's what Quicken downloaded:

With the DC connection, Quicken correctly set the Action to be CGLong or CGShort accordingly.

Any suggestion to get Quicken to properly set the Action for Fidelity Capital Gains?

Deluxe R65.29, Windows 11 Pro

Answers

-

In 2 different IRA accounts, mine & wife's, I'm seeing the same thing.

Also applies to Select Consumer Discretionary that also paid a CGLong on 11/11, but was reported as a Div.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Today I received my first CG txn since migrating to EWC+ and I can confirm the same problem. In my case it happened with Fidelity Large Cap Stock FLCSX. Interesting that all the reports here are with Fidelity branded funds, although I suspect the problem will occur with all brands. I submitted a Problem Report.

I'm running r64.25. Is anyone seeing the same with 64.35?

0 -

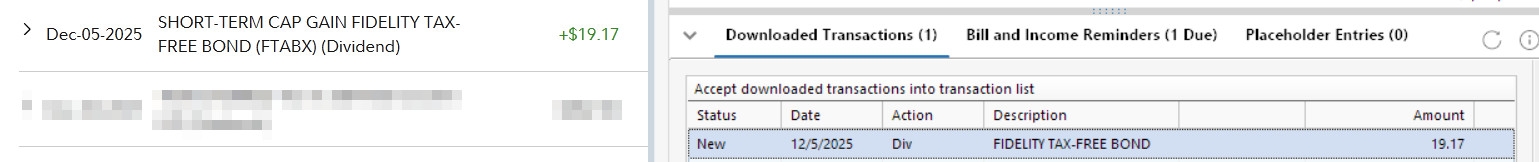

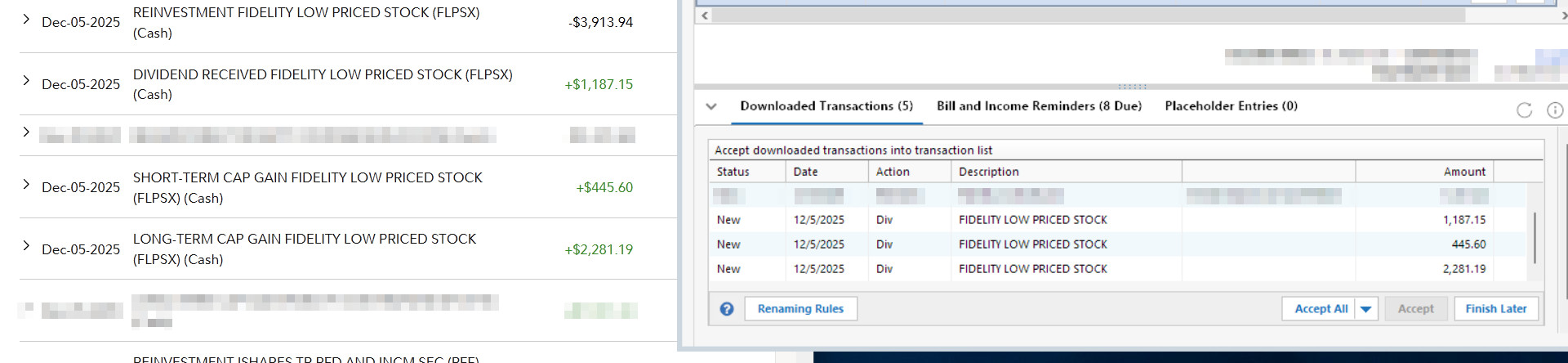

I've updated to R65.17 and this problem still exists. Left side of pic is Fidelity website. Right side is Quicken download. I submitted a problem report.

It is also happening for IRA accounts:

Deluxe R65.29, Windows 11 Pro

0 -

Latest download this morning correctly designated Action of ReinvLG and CGLong for Fidelity mutual funds in my Roth Account.

There appears to be improvement (possible resolution) with this issue.

Deluxe R65.29, Windows 11 Pro

0 -

Update: Quicken is still treating downloaded Short Term Capital Gains Distribution as Action=Div instead of CGshort for Fidelity.

Long Term Capital Gains Distribution had the correct Action=CGLong in Quicken.

This used to work correctly with Fidelity DC connection.

Deluxe R65.29, Windows 11 Pro

0 -

I'm seeing the same problem in both IRA and taxable accounts. Quicken fixed this problem with ML downloads earlier this week (was happening with both LT and ST CGs). I was hoping they'd fix Fidelity before CG season is over.

0 -

I see the same issue with Long and Short term Capital Gains distributions in all account types at Vanguard.

The workaround is to accept the downloaded transactions and then edit them to be CGLong, CGShort, ReinvLg, or ReinvSh. If you enter the correct transactions before accepting the downloads, they will not match and you must delete the downloads and mark the manually entered transactions as Cleared.

QWin Premier subscription1 -

I had CGLong transactions download correctly, from Fidelity, on 12/12 and 12/19. 3 different IRA accounts, 5 total transactions.

Also, in another file for a club where I'm the Treasurer, a CGShort and a CGLong correctly downloaded on 12/5 and a CGLong correctly downloaded on 12/19.

All from Fidelity using EWC+

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

-

For today's transaction downloads, Quicken incorrectly treated a Short Term Capital Gains distribution download of NBOS for a Fidelity account as a ReinvDiv instead of correctly treating it as ReinvSh. This issue does not appear resolved.

Deluxe R65.29, Windows 11 Pro

0 -

I updated to R65.29 and the problem still occurs. I have reported this problem again.

Deluxe R65.29, Windows 11 Pro

0 -

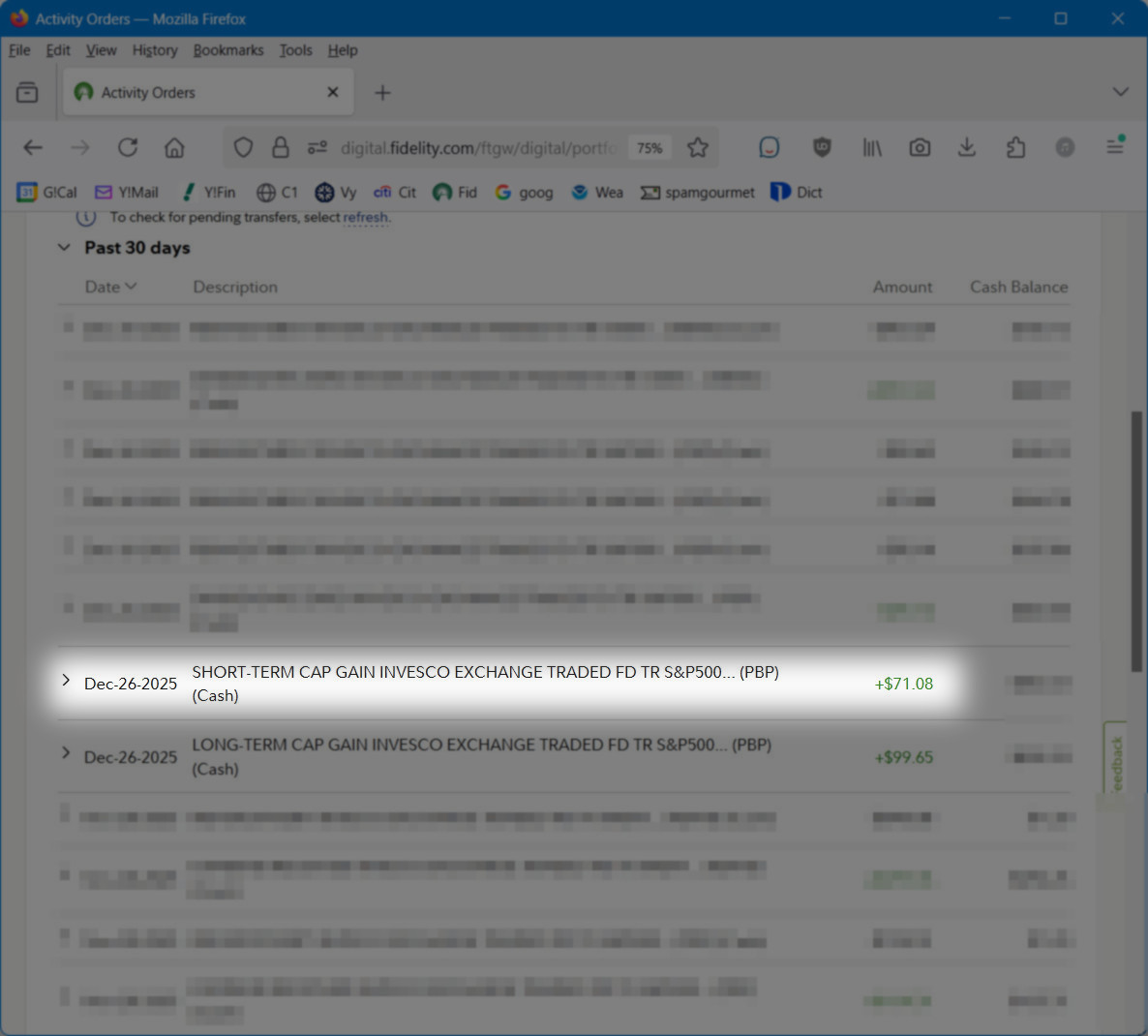

Well, 2 steps forward followed by 1 step backwards.

In 2 accounts, a CGShort that Fidelity paid 12/26 (Select Financial Services) download as a Div in IRA accounts.

There was also a regular Div paid on that fund, so the 2nd Div transaction was pretty obvious.

I realize that the specific action doesn't really matter in IRA accounts … but I like to keep things accurate.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub