Schwab MMF and Quicken reports

I am running R65.17 on Win 11. I have Schwab's sweep fund (SWGXX) in both IRAs and cash-linked brokerage accounts. Dividend income from SWGXX shows up in the investment income reports for the IRAs but not for the brokerage accounts. Any suggestions?

Comments

-

So I believe you're saying that income from SWGXX is recorded as "dividends" in all the Schwab Accounts' Transaction Lists (Registers), with the only difference being that the cash in the non-IRAs is being immediately "swept" to Schwab bank accounts, and that the dividend income is not being reported any Investment Income Report you generate, either for all Accounts or individual Accounts?

Is that correct?

0 -

Tom, here's what appears to happen: I download transaction in all accounts. The transaction involving SWGXX is downloaded, but without a value. I manually input the value in the deposit field of transactions.

I have reports that sums investment income by account (reports/investing/investment transactions/); on report (date range: year to date, subtotal by: account, sort by: security). The report lists each transaction that consists of investment income (in my case, dividends) and I have customized the report just to show date, account, action, security, and "cash+invest"). In this report, SWGXX dividends are listed in IRA accounts and the sum of the account income agrees with my Schwab account statement. For the cash linked brokerage account ([Schwab account XYZ]-cash), where SWGXX transactions are downloaded and I manually provided dividend value, the transactions don't appear in my investment income reports. I validated and repaired my file. The investment income reports in a backup file from 10/15/25 do contain SWGXX income in brokerage accounts. This weekend I spent quite of bit of time reconciling credit card accounts so I'm reluctant to bring the backup file up to date and use it. I'd rather live without SWGXX income in my reports than to replicate the past week's work.

0 -

- "…The transaction involving SWGXX is downloaded, but without a value. I manually input the value in the deposit field of transactions."

So, ignoring the "no value" aspect of the downloads - a problem in itself - the issue comes down to the transactions properly going into the IRA Accounts (with an Action of "Div" I'd think), which show up on the Investment reports, but are "improperly" going directly into the linked bank Account for the regular brokerage Accounts, and are ignored by the Investment reports? (I got that impression from your use of "deposit field" since "deposits" are a column heading in bank Accounts.)

Since none of my brokerage accounts at Schwab are linked to the Schwab Bank account I'm at a bit of a loss. I'd think that the transactions would show up in the linked accounts as "DivX" Actions to be immediately whisked into the linked bank Account, but I could be wrong.

On the other hand you say that an earlier file DID show those transactions? Where they recorded in the same way as they are "today?", i.e., bypassing the brokerage Accounts and going directly into the bank Account? If they were recorded in the same manner but showed up on reports, that could suggest an update program change of some sort, maybe inadvertently.

Let me see if some other SuperUsers who DO have real-world linked bank accounts for investment accounts can cast some light here.

0 -

I don't currently have any brokerage accounts that use linked cash accounts, but checking some old accounts, they work exactly how you describe @Tom Young.

The thing to realize is what is really happening is that the transactions are all downloaded into the brokerage account, but when Quicken sees a "cash transaction" then it pushes that cash to the linked cash account. In the case of a Dividend that should be a DivX. As you said if the action is a "Deposit" that going to be a transfer to the linked cash account. And since transfers are neither expense nor income, they certainly will not show up on a report for Dividends.

The fundamental problem is that it seems the transaction is recorded incorrectly. Most of the time I would say that this is a financial institution problem, but in this case, I suspect a new feature added to Quicken recently might be at fault. Quicken has recently allowed more "Money Market Funds" to be designated as "cash". This was always possible when the financial institution flagged it in some way that Quicken picked up, but recently the Quicken developers did something that allows Quicken to treat more securities like this.

I suspect that SWGXX has been set to be treated as cash in that brokerage account, messing Quicken's translating it into a DivX.

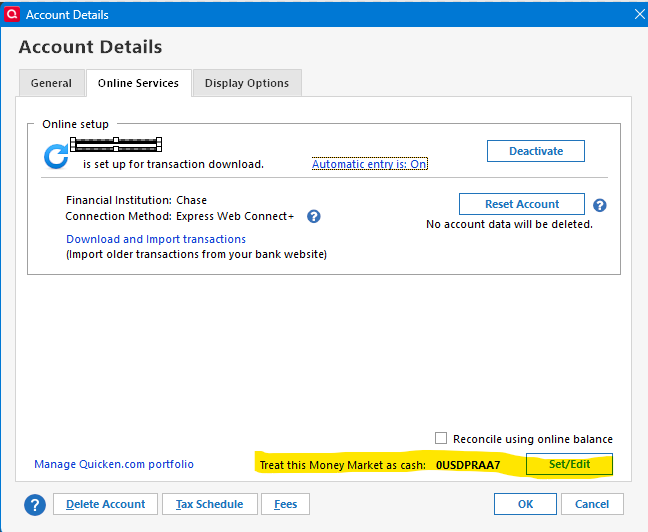

If my theory is correct, you should see this for SWGXX in the Account Details → Online Services tab:

Try selecting the Set/Edit and then Customize and select the option to treat it as a position.

Signature:

This is my website (ImportQIF is free to use):0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub