Need help changing to one-step update for Merrill Lynch bank accounts

For many years I successfully downloaded ML bank transactions and imported the file into Quicken. ML no longer supports this so I need to change to one-step update, but have not been successful.

I only need checking account transactions - I don't use Q to track investments.

When I set up my ML accounts originally. I had to set up an investment account linked to several checking accounts.

- With one-step update, do I still need the investment account, or just the checking accounts? Can I delete the investment account?

- How do I deactivate/delink the checking accounts without loosing 15 years data?

- Can I use my existing ML checking accounts for one-step update, or do I set up new accounts. If new accounts, how do I get the data from the existing accounts into the new accounts?

I am sure someone out there is familiar with ML and an expert on Quicken. ML has been absolutely no help.

Thanks

Bill

Comments

-

Hello @Bill Gulledge,

Thank you for reaching out! To answer your questions:

- Yes, you will likely need to have it set up like you did before, with the investment account and linked checking account.

- Backup your Quicken file. Then, deactivate the accounts by following the instructions in this article:

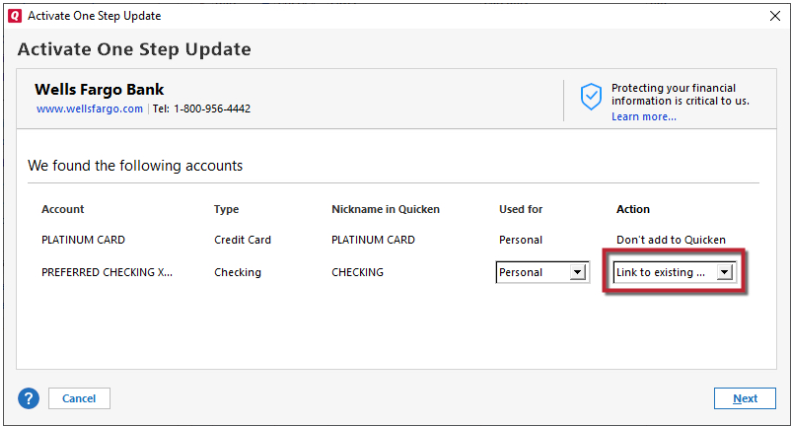

- You should be able to use the existing accounts. When you connect the accounts, navigate to Tools>Add Account and follow the prompts. After authorizing on the financial institution website, go back into your Quicken. The add/link screen should come up. On that screen, make sure to carefully link your accounts to the correct Nickname in Quicken.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Thanks Kristina

Several questions so I get this correct: Actually I have 8 investment accounts and could ( but I don't) write checks from each of them. I really only write checks against one investment account, and for now only need to download checking account transactions for that one investment account.

- Do I deactivate both the ML investment account and its associated ML checking account?

Do I deactivate them one at a time or both at once? - Same question for re-activating - do I reactivate the investment account and its associated checking account?

- Do I need to somehow "link" the checking account to its associated investment account, once re-activated?

- With one-step update, can I specify the time period for downloaded

transactions— e.g. "prior month" or will one-step update just download everything? - If I need to repeat a download, — e.g. for "prior month," will it allow me to download the same transactions a second time?

Thanks for your patience and help.

0 - Do I deactivate both the ML investment account and its associated ML checking account?

-

Thank you for your reply,

To answer your questions:

- If the checking account is a linked checking account, then deactivating the investment account it's linked to will deactivate both of them.

- Reactivating one should reactivate both.

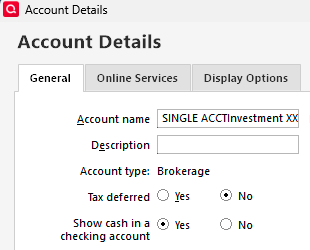

- They should already be linked in Quicken. You can check this in the investment account's account details (Tools>Account List, then click the Edit button next to the investment account).

- One Step Update will download all the transactions the financial institution makes available.

- Usually, Quicken is able to tell what has already been downloaded and won't download it again, however, when changing connection types, there is a risk of duplicate transactions.

- No, Quicken normally does not redownload transactions which have already downloaded once. If you need to redownload for some reason, you may need to restore a backup from before the download happened, then do the download again.

Please let me know how it goes!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Hello @Bill Gulledge,

I haven't seen a response in a while. Do you still require assistance?

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I think I am down to 1 remaining issue. On the Budget vs Last yr report, a strange line labeled

"Everything Else" prints in the Income Section with a budget value of -$31,015 but no value un the actual column. The -$31,015 is not included in the Total Income budget number. I don't know what the -$31,015 is, where it comes from, nor how to get rid of it. Any ideas?

Thanks for following up.

Bill

0 -

Thank you for your reply,

The "Everything Else" line showing up on reports, and not letting you remove it, is a known issue. If you haven't already done so, I recommend bookmarking the Community Alert linked below to receive notifications of any updates, once available, and to know when the issue is resolved.

For an explanation of what "Everything Else" is, please see this help article: .

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

How will I know when the "Everything Else" problem on budget reports is fixed?

0 -

Thank you for your reply,

If you bookmark the Community Alert linked in my earlier post, then once the alert is updated to show the issue is resolved, you should receive a notification. If you have notifications set to allow emails, you should receive an email notification. Otherwise, you should see the notification when you click the bell icon near the upper right.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub