Accrued interest handling when buying bonds?

Fidelity downloads the bond purchase, and an accompanying payment to the bond seller for accrued interest. However, it's interpreting the accrued interest payment as a MiscExp with the _Accrued Int category.

I don't think this will correctly account for the accrued interest being part of the cost basis of the bond, relevant at time of sale.

Has anyone else dealt with this? Thanks.

Comments

-

Accrued interest is not part if the cost basis of the bond. Fidelity/Quicken are handling it correctly.

Quicken Windows user since 1993.

0 -

"When you buy a bond in the secondary market between coupon payments, a portion of the coupon payment and taxable income may belong to the seller. In this situation, the purchase price may also include past interest payments. The seller of the bond must report the accrued interest as ordinary interest income, while the buyer will reduce the cost basis of the bond to account for the interest that belongs to the seller." Emphasis mine, source Schwab .

If the accrued interest paid from buyer to seller doesn't get accounted for as an adjustment to the cost basis, then where does it get reported?-1 -

It is interest. If you pay it, it reduces your interest income since you will receive the full 6 month interest payment. The accrued interest you pay partially offsets that so that you only get what you earn after buying the bond.

Quicken Windows user since 1993.

1 -

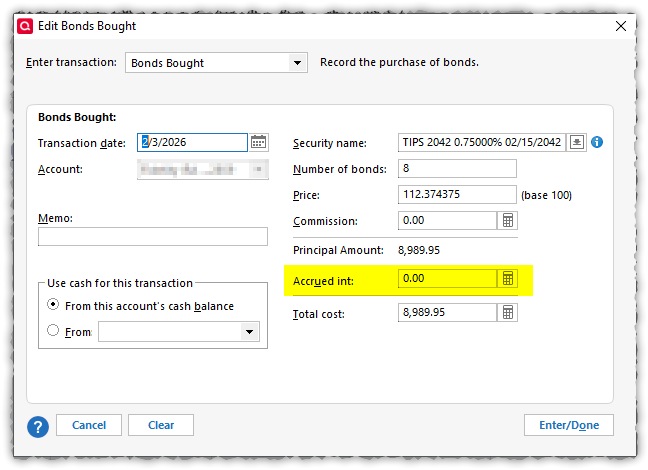

Okay, I get that via Pub. 550, but I still think the basis in the bond purchase transaction received by Fidelity should include the accrued interest, which it doesn't:

-1 -

Nope. Also, I did an AI search as to whether accrued interest paid on the purchase of a TIPS bond should increase the basis and this was the response:

"Accrued interest paid when purchasing

TIPS (Treasury Inflation-Protected Securities) on the secondary market does not increase the bond's cost basis, but rather acts as a reduction to the interest income reported on the first payment date. The initial cost basis consists of the purchase price excluding accrued interest, plus broker commissions"

Quicken Windows user since 1993.

1 -

IF accrued interest impacted the basis of the bond, it would impact the CapGain/Loss when you sell or redeem.

It's the NET interest that you receive that's properly impacted.

What you're trying to do, perhaps unintentionally, is change Int income into Cap Gain/Loss income, which is taxed at a lower rate.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

@bmciance see, my AI says the opposite: "The buyer’s basis in the bond is increased by the amount of accrued interest paid." and "The accrued interest payment to the seller is not a deductible on your Form 1040; instead, it increases your cost basis." which seems consistent with the Schwab article. That's what got me started on teh inquiry.

@NotACPA Yes, exactly. Per the Schwab article, it's supposed to factor into the CG, and is not (negative) net interest for the buyer.

If that's not the correct handling, then what is the purpose of the accrued interest entry on the Buy Bonds dialog?0 -

Further from Perplexity:

"Interest Income Adjustment

When your broker reports the full first coupon payment on Form 1099-INT (including the pre-purchase accrued portion), you report the gross amount on Schedule B, line 1, then subtract the accrued interest paid to the seller below the subtotal, labeled "Accrued Interest." This nets your taxable interest to only the post-purchase period, avoiding tax on interest you prepaid to the seller.

Cost Basis TreatmentThe accrued interest is part of your total purchase price (dirty price), which forms your cost basis under Publication 551: "The basis of stocks or bonds you buy is generally the purchase price plus any costs of purchase." Some sources note the buyer treats the accrued portion "as a return of capital by reducing basis," but IRS guidance clarifies the full outlay—including accrued interest—is added to basis."

0 -

@Tom Young has the accurate understanding of the rigorously correct way that Accrued Interest charge should be handled which differs from the way Quicken does it. I'll invite him to explain, should he choose to do so. But it is also not as an adjustment to the cost basis. I have found the way Quicken does handle it is acceptable to me, though if the end of the year comes between the purchase and the next interest received, I make adjustments.

0 -

@Laird B , as far as the purpose of the Accrued interest on the Buy Bonds dialog, it is for cash reconciliation. If you use that dialog and enter an amount in Accrued Interest Quicken creates a second entry for that amount. Only the amounts prior to the accrued interest (I.E., the "principal amount") in that dialog are included in the cost basis of the bond.

Quicken Windows user since 1993.

0 -

@Laird B Please report back when you get your 1099-Int a year from now. I'll wager, on a "dollars to donuts" basis that it'll show your interest received as being NET of the accrued interest you paid on this transaction. Just as the seller's 1099-Int will show both the interest directly rec'd while owning the bond and the accrued int that you paid at time of purchase.

Quite simply, it makes no sense for the buyer to have received interest while you have a Capital txn of some sorts.

And, AI has frequently known to be wrong. This is but another instance.

And, the "costs of purchase" that you cite refers to commissions and fees, not accrued interest that you owe to the seller.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

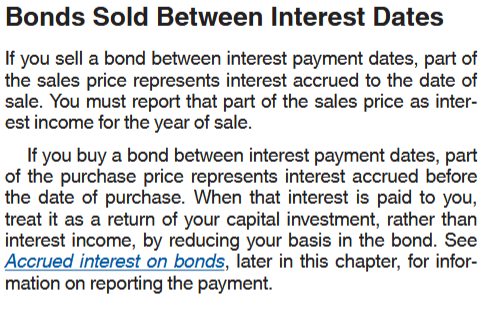

Actually, I'm going to have to withdraw a bunch of what I wrote earlier. Per IRS Form 550:

So, when @Laird B buys the bond that accrued int IS added to basis … only to be subtracted back out upon 1st int payment.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Hmmm...is that new? It doesn't make sense but of course it's the IRS so it doesn't have to make sense.

Quicken Windows user since 1993.

1 -

Note that mathematically, and as a practical matter, if you buy a bond between interest payments, and receive that 1st interest payment within the same tax year … it really doesn't matter if it goes to basis or reduces interest … because both get zeroed out within that tax year.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub