Fidelity IRA account multiple problems with balance, cash, realized gains/loss, add shares

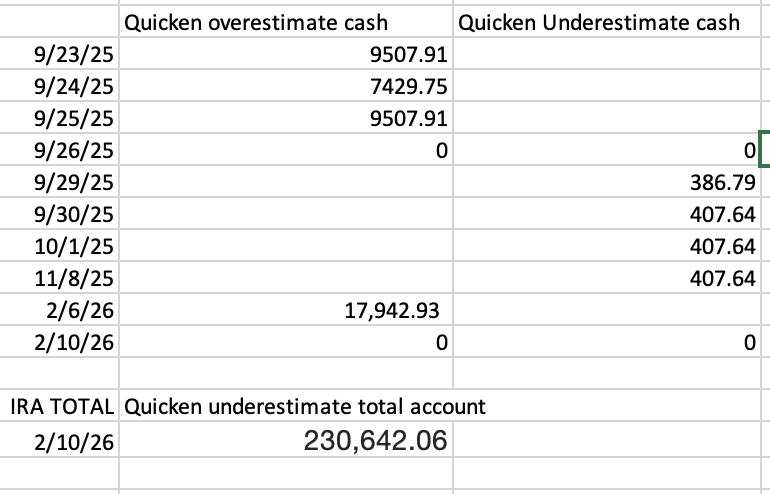

Quicken overestimated my IRA cash balance today by 17942.93. The last time I looked closely at this was 11/8/25, when Quicken was short 407.62 due to cash (a long time problem). Today, Quicken is overestimating cash by 17942.93. Quicken Portfolio tab has the 78,036.16 in FDRXX and the 17,942.93 listed as cash, but that second amount is not in Fidelity

11/8/25 | 2/6/26 | |

|---|---|---|

Account total quicken short | 407.64 | |

Fidelity Cash Balance | 17805.09 | 78,036.16 (FDRXX) |

Quicken Cash Balance | 17397.45 | 95979.09 |

Difference | 407.64 | -17942.93 (Cash in Quicken) |

To look for where the extra 17942.93 is coming from, I downloaded the transactions from 11/8-2/7 from Fidelity and imported them into Excel to compare to Quicken. No way to export the transactions directly from my Quicken IRA transaction tab so I created a transaction report for that account and those dates and put in spreadsheet. Then, I found these problems:

2/6/26 | Investments:Realized Gain/Loss | 0 |

|---|---|---|

2/4/26 | Investments:Realized Gain/Loss | 5,752.48 |

12/31/25 | Investments:Realized Gain/Loss | -2,596.11 |

12/31/25 | Investments:Realized Gain/Loss | -3,659.91 |

12/3/25 | Investments:Realized Gain/Loss | 10,591.06 |

12/3/25 | Investments:Realized Gain/Loss | 1,595.91 |

12/3/25 | Investments:Realized Gain/Loss | 5,588.21 |

12/2/25 | Investments:Realized Gain/Loss | 0 |

12/2/25 | Investments:Realized Gain/Loss | 0 |

11/24/25 | Investments:Realized Gain/Loss | 4,564.45 |

11/17/25 | Investments:Realized Gain/Loss | 4,660.66 |

Quicken transaction report has the above Gain/Loss entries that do not appear in the transactions tab or in Fidelity transactions online or the Fidelity download. When I click on these transactions in the transaction report in Quicken, there is no link to any actual transaction in Quicken, unlike the rest of the Quicken transactions.

Then, I found these 3 transactions in Quicken transaction tab and transaction report with 0 in amounts. The correct amounts are in the far right column from Fidelity reports. When I updated the 0s with the correct amounts and share prices from fidelity, no changes in Quicken market value occurred.

12/5/25 | Fidelity IRA Investments:Add Shares | $0.00 |

| |

|---|---|---|---|---|

12/5/25 | Fidelity IRA Investments:Add Shares | $0.00 |

| |

12/5/25 | Fidelity IRA Investments:Add Shares | $0.00 |

|

All of the other amounts in the portfolio from both Fidelity and Quicken match. I can't figure out where the extra cash is coming from in Quicken, nor do I understand why these gain/loss transactions are not in Fidelity, or why the add shares transactions are 0 in Quicken but reported correctly in Fidelity.

I have Quicken mac 8.4.2 Premier, if that matters.

I would appreciate any help in fixing this or understanding where the extra cash is coming from in Quicken.

[Edited - Readability]

Comments

-

Hello @daverph,

Thank you for letting us know you're seeing this issue. To help troubleshoot, please provide more information:

- You mentioned that the cash balance being off has been a long-term issue. Do you remember when that issue first started? Was it always off by that same amount (until yesterday)?

- Have you disconnected and reconnected your Fidelity account for any reason between 8 Nov 25 and 7 Feb 26?

- If you have, please check to see if any placeholders were added, since that may be the cause of the issue. For information on placeholders, please click here.

- Was your file ever converted from a Windows file or an older (pre-subscription) version of Quicken for Mac?

I look forward to your reply!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

1 - I don't know when it started, I started to try and find out where the imbalance was coming from back on 9/23/25. Today the cash amounts are in balance, but now the total amount of the ira is off by $-230,642.06 in quicken.

When I look at portfolio holdings in both quicken and fidelity 2 ETFs are showing losses in quicken today that aren't in fidelity: XLK -37,588.80 and XLY -20,988.72

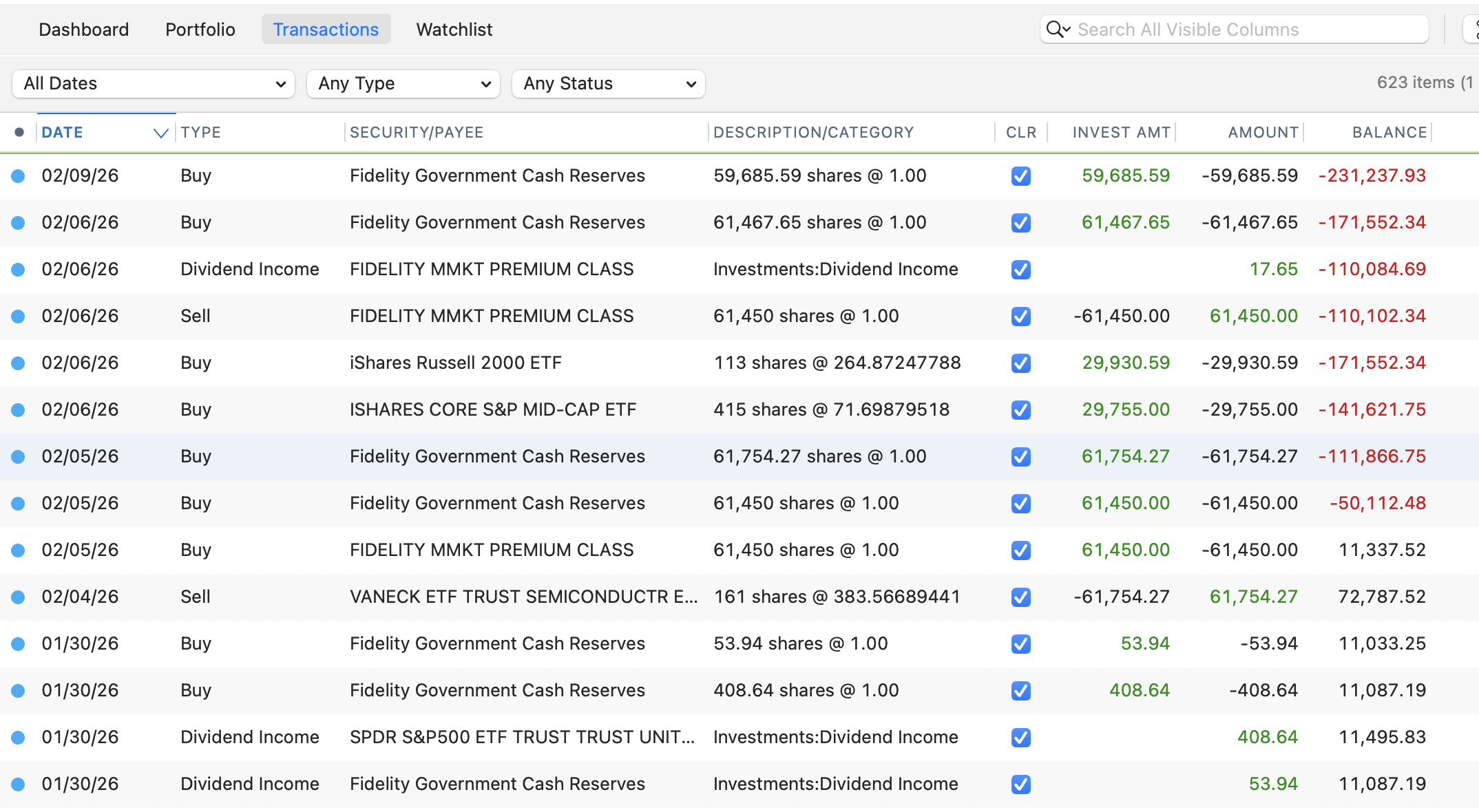

Recent transactions in quicken that don't show in Fidelity

Quicken transactions

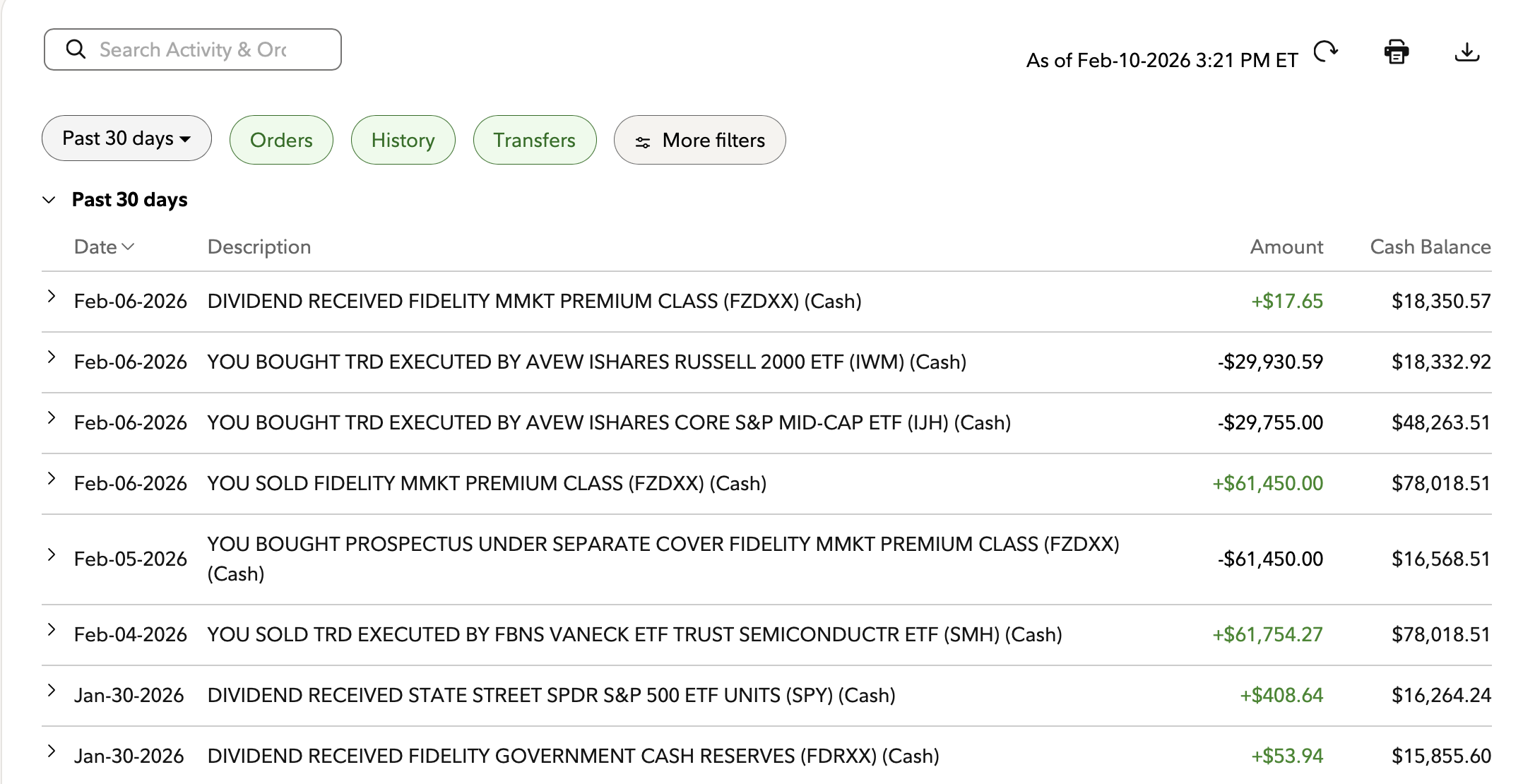

fidelity transactions

Hope you can make sense of this but I can't. How can the quicken transactions show as CLR when they aren't in fidelity?

2 - No haven't disconnected, never used placeholders

3 - This IRA was created after I started to use the subscription version, but I have used quicken for mac since version 1. When I brought the file into the subscription version accounts were mostly balanced, never had discrepancies like I have going on now.

Thanks for your help!

0 -

Thank you for your reply,

Typically, for a transaction to show as cleared in Quicken, it would either need to download from the financial institution, or you would need to manually mark it as cleared. Did these transactions appear after you updated your accounts? Are these transactions the reason your account value is so far off?

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

As of today, quicken shows my cash balance in the IRA as -231237.93. There were 4 cleared transactions in Quicken for BUY FDRXX totaling 244,357.51 were not in Fidelity, two dated 2/5, 1 dated 2/6, and 1 dated 2/9. I never cleared any transactions manually. These transactions appeared after syncing if that's what you mean by updating my accounts.

I went into those quicken transactions and zeroed the amounts and shares. I looked back into January's quicken transactions and found 4 more BUY FDRXX totaling 4823.35 that were not in fidelity and zeroed them out as well. Now the total IRA balance is short in quicken by 428.90, and the cash portion of the portfolio in quicken is 407.64 less than what shows in fidelity FDRXX, which is where it was back in November. It would be nice if it everything balanced but there are only so many hours in a day.

How is this happening, and will this ever be fixed?

2 -

I find I regularly have to enter Adjustment transactions in my investment accounts (Fidelity and T. Rowe Price) in Quicken to reconcile the cash balance. This is an area that Quicken can and should spend some quality assurance testing and development on. Quicken could be a really useful tool for tracking investments, but it lags behind other tools (e.g., Empower) due to these download issues.

0

Categories

- All Categories

- 54 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.1K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub