Another Schwab Issue: SWVXX is a SECURITY, it is NOT CASH [Edited]

Tom Young

Quicken Windows Subscription SuperUser ✭✭✭✭✭

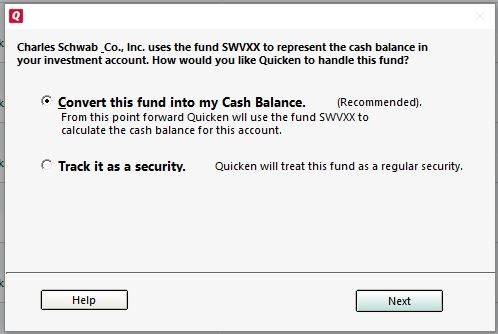

For some reason today, more than a month after the change over from DC to EWC+, after completing my OSU I got this pop-up notice:

The statement that Schwab "uses the fund to represent the cash balance in your investment account" and the Recommendation to "Conver this fund into my Cash Balance" are both wrong. SWVXX (Schwab Value Advantage - Investor Share) is a security with a one-day settlement process. Using the "Recommended" option will result in a placeholder in your Quicken Account resulting in a "ready cash" figure that is wrong.

3

Comments

-

having a similar issue with SWGXX -could see transactions but could not find the account. Schwab explained that these are sweep accounts for unused cash. SUre messes with my reconciliation process.1

-

Funds with symbols ending in XX are technically money market funds. It's not an issue unique to Schwab for MMFs to screw up cash balance. Vanguard handles them correctly as a security. Many FIs do not and some are in between. MS for instance, downloads transactions associated with MMFs, but does not report them as a Holding. Go figure.

Hours wasted trying to get it sorted out with MS. Ultimately went with a short-term fund that does not end in XX to avoid the annoyance. When used as a cash sweep though, you are probably screwed.

Adding- you can verify it is a Schwab failure to construct a proper OFX download. Go to the OFX log and look for the Holdings section; you will see the security is missing from the holdings table data set. Easier than looking in OFX log is Tools>Online Center, Holdings tab, Compare to Portfolio button. It will let you know if Schwab is reporting the XX fund as a holding.0 -

I like the behavior of treating the sweep fund as cash. I thankfully don't use Schwab, but the same thing happens at Fidelity. My sweep fund is SPAXX, which Quicken helpfully treats as cash.Do you really want to see every buy and sell of the sweep fund? I sure don't.This is not an error, does not result in placeholders, and does not cause reconciliation issues. It's a feature, not a bug.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0 -

As I understand it, the new EWC+ protocol does not use the OFX log file. I don't think under that protocol (or any EWC protocol?) OFX log information is available to the user.markus1957 said:...

Adding- you can verify it is a Schwab failure to construct a proper OFX download. Go to the OFX log and look for the Holdings section; you will see the security is missing from the holdings table data set. Easier than looking in OFX log is Tools>Online Center, Holdings tab, Compare to Portfolio button. It will let you know if Schwab is reporting the XX fund as a holding.0 -

I will add, I think @Tom Young's main point was about the language used in the popup message. The MM fund is a security, definitively. Since I am not a Schwab customer (thank you very much), I can't comment on how well one option vs the other tracks.

But certainly if over the years, the user has treated that fund as a security, they would need to continue to do so now. For a new client, it might be a valid popup question; but not for someone already committed one way.0 -

As you need to execute a Buy or Sell of this fund and and there's a one-day settlement delay, treating it as "cash" in your Quicken Account is going to cause problems. If sweeps into or out of the fund are handled automatically by the broker then call that fund cash will cause no harm.

0 -

Rocket J Squirrel said:I like the behavior of treating the sweep fund as cash. I thankfully don't use Schwab, but the same thing happens at Fidelity. My sweep fund is SPAXX, which Quicken helpfully treats as cash.Do you really want to see every buy and sell of the sweep fund? I sure don't.This is not an error, does not result in placeholders, and does not cause reconciliation issues. It's a feature, not a bug.If you have a true sweep situation - which is not the case with SWVXX - then treating the fund as cash is fine. With SWVXX the customer has to initiate buys and sells and wait a day for settlement. The point is it's not cash so following Quicken's recommended method will result in a placeholder and misstate the "available" cash in the Account.ADDED: It's seems like this must be an error on Quicken's part as I've had transactions in SWVXX in some of my Accounts between the time of the conversion until today and they were downloaded correctly as Buys and Sells. While Schwab's site shows both SWVXX and true cash in a section of their "Positions" screen called "Cash & Money Market", they are spelled out separately. It's simply not true that that Schwab "uses the fund to represent the cash balance in your investment account".1

-

Ah I see. It's different if you have to manually buy & sell.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0 -

To the extent, transactions for the XX MMF are being downloaded and the Holding is being recognized in the download, I don't see the problem. As I said before that is not the case for all FI treatment of MMFs.

This might be a feature to work around the FIs that don't handle MMFs correctly and/or provide the option for users to treat MMFs as cash. A valid argument can be made for either case in Quicken, treating MMFs as cash or as a security. The question becomes, Does it really work? My guess is that it doesn't, so it really doesn't matter which option you choose. You didn't happen to click the Help button?

- Your brokerage may use a money market fund to represent the cash balance in this account (quicken.com)

0 -

markus1957 said:A valid argument can be made for either case in Quicken, treating MMFs as cash or as a security.Certainly that's correct for a real "sweep" situation but it doesn't work if you must initiate buys and sells in the MM fund.Going the "recommended" route, Quicken showed I had $XXX,XXX of "cash" in the account. But if I bought a stock with a cost of $XXX,XXX, figuring settlement of the trade would end up with me having $0 of cash in the account, what's really going to happen is I'd end up with a margin loan.2

-

I have been treating SWGXX (and other sweep accounts) as cash for years. It is my preference but since the recent change it has switched back to a buy/sell which I have been simply deleting from the transaction download list allowing cash to balance without SWGXX listed as a holding. Would appreciate if anyone could tell me how to get the box referenced in Tom Young's initial post. I was given this same option years ago (for SWGXX) and selected the adding to cash balance option but haven't been given the same option since the recent change.0

-

Since the Schwab Government Money Fund is really used as a sweep fund, (sweeps happen without your intervention), treating that fund as cash makes sense. You might be able to change this by following this "Help" entry:hongolito said:Would appreciate if anyone could tell me how to get the box referenced in Tom Young's initial post. I was given this same option years ago (for SWGXX) and selected the adding to cash balance option but haven't been given the same option since the recent change.

1 -

If nothing else, I think the wording of the dialog could be improved.

"...uses the fund XXXXXX to represent the cash balance" would be clearer if it said "... uses the fund XXXXXX to hold the cash balance"QWin Premier subscription0 -

Thanks Tom Young for your earlier suggestion. I haven't been able to resolve the issue yet but I totally understand your point concerning SWVXX actually being a security and SWGXX used commonly as a sweep. A shame I didn't get the dialogue box instead of you. It seems the dialogue might trigger a change in one of the security attributes so I have gone into "edit security details" and changed SWGXX from a mutual fund to cash. Of the attributes I can control, that seems like the only one that may have the desired effect. Won't know for sure until another SWGXX transaction occurs on Schwab.0

-

Clearer yet:

- "[Financial institution's] XXXXX fund is a money market fund.""

- Delete the "[Recommended]" in the first selection as Quicken clearly doesn't know if XXXXX is "traded" or "swept."

- First selection to read "If cash in the Investment Account is automatically swept into and out of XXXXX then this option is recommended and Quicken will use this fund in its calculation of cash in this account.

- Second selection to read "If you must initiate trades in XXXXX then this option is recommended and Quicken will treat this fund as a regular security"."

5 - "[Financial institution's] XXXXX fund is a money market fund.""

-

Referring back to my yesterday's comments, by changing SWGXX from a mutual fund to cash in "edit security details", SWGXX transactions occuring in Schwab are now being treated as cash and not being downloaded to Quicken as a security transaction. This is my preferred approach as, in my situation, SWGXX is being used by Schwab as a sweep fund and not a security. As I did not receive the dialogue box referenced by Tom Young at the beginning of this string and as SWGXX was switched to a security during the recent Quicken changes, this seems to be a functional approach to switch back to treating sweep accounts as cash.2

-

You set the Security Type for SWGXX to Cash (that is not one of the default types) and now downloaded transactions for SWGXX are recorded as the cash balance of the account? I wonder if that works for sweep funds in other brokerage accounts.hongolito said:Referring back to my yesterday's comments, by changing SWGXX from a mutual fund to cash in "edit security details", SWGXX transactions occuring in Schwab are now being treated as cash and not being downloaded to Quicken as a security transaction.QWin Premier subscription0 -

I read somewhere that the handling of sweep accounts may be depend how the brokerage handles the same. I know only Schwab so really can't comment on other brockerages. In Quicken: Tools/Security list/select security/edit details/select "cash" under type.-1

-

Tom Young's characterization of SWVXX best fits the way I use it. Unfortunately, I accepted the "recommended" option to treat it as cash. I can't find a way to reverse that decision, even though SWVXX still appears on the Security List. I tried the update share balance function, which allowed me to enter the correct number of shares, but, when updating the account with Schwab, Quicken still seems to treat SWVXX as part of the cash balance. I'd be grateful for any ideas.0

-

When I accidentally checked the box to convert SWVXX into my cash balance (which it should not be), then the funds in SWGXX (which I would like treated as my cash balance) no longer appear in Quicken. I'd really appreciate some guidance in how to undo this mistake.0

-

I think I found a way to undo the selection of SWVXX as cash rather than a security. Within the given account to to Actions (Ctrl+Shift+N) > Update Cash Balance. In the popup there should be a button "Cash Representation". Click on the button and it will inform you that Quicken is treating SWVXX as your cash balance. Click "Change" and then "Done". Now click "Update Transactions" again, confirm SWVXX should be treated as a security if prompted, and then you should be good to go. At least it worked for me. Still very annoying that Quicken keeps throwing all these impediments our way--I just want my old Quicken back...9

-

I agree with everyone who says "Schwab MMF is a SECURITY and should be accounted for as such"0

-

Many thanks to Lars88. Great directions. I hope to see no more gratuitous entries downoaded to 'correct' my cash balance.0

-

Except on my account Lars88 instructions didn't take - it still shows cash instead of SWVXX starting on the 21st. Do not know what started this entire fiasco with Quicken and Schwab but is sure wish they would straighten it out. I have better things to do with my time that fixing all of the 'issues' generated by the changes that Schwab and Quicken have foisted on us.1

-

@Lars88 THANK YOU ... those instructions resulted in the offending dialog to reappear but this time I chose Security. In my case, I did have to delete the placeholder entry Q created to move all current SWVXX to cash as well as delete the entries which turned a recent dividend into cash. The Schwab ReinvDiv entry for that dividend was correct since it is considered a Security, however, the conversion Quicken created to convert to cash had to be deleted along with the placeholder. All is well again! When Schwab actually changes how the SWVXX works, THEN and ONLY THEN ... should Quicken follow suit.0

-

Thanks for responding to my comment, I wondered about that, also wonder if I need to delete the placeholder b4 I make the security vs cash change. I have made the change without deleting the placeholder, NO joy. will delete now and see what happens. Well I deleted the placeholder, and NO SWVXX showed up so in Quicken that cash amount no longer shows up and I am all the poorer. Wonder how I get it back. Luckily in this ONE account I do not have any subsequent dividends that need to be adjusted. But I have one more account that I need to change.0

-

When I look at the register my Share Balance for SWVXX is correct, but the value of the account is not correct (missing the value of my SWVXX). And when I look at the holdings for that account NO SWVXX shows up after the 21st, and the total value there is also missing the SWVXX value. there is NO place that I can see that SWVXX was sold, but I do not know how to get it back into my account. I can't believe ALL of the issues with these changes, this is just one I have experienced and wasted a lot of time. Sorry I decided to pay for my annual subscription instead of looking for a replacement for Quicken.1

-

This morning my quicken account portfolios are missing all funds for SWVXX. They just disappeared! Any ideas why that would happen?0

-

Look at your holdings for the accounts, you can backup the dates to see when they went away. Mine disappeared on two accounts because I followed Quickens recommendation. Still trying to figure out how to completely back out of that mistake. I followed the advice of this thread, but ended up having to do a placeholder on the one account to add the SWVXX value back, not ideal. The other account has a linked checking account and I can't adjust Cash Balance in the Investment account, says to do it in the checking account, but there is NO command to adjust Cash Balance in the checking account, so it still is using SWVXX wrong. Today updating another account, even though I didn't say yes to their recommendation, Quicken went ahead and changed and lost my SWVXX funds.0

-

Good afternoon and I'd like to join this thread. My specific question is about SWGXX (not SWVXX.) since the conversion in November the cash sweeps have resulted in transaction downloads using SWGXX. To keep my cash amount in sync with the correct amount (posted on the Schwab website) I've simply been deleting the SWGXX transactions and that course of action has been working. In the last two weeks I've deleted several as we've had numerous (dividend, ST and LT Cap Gains) distributions. I haven't got any pop-up notice like Tom Young did several weeks ago. So, has anyone had any success in eliminating SWGXX transaction downloads for cash sweeps?1

This discussion has been closed.

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub