How to get to Make Credit Card Payment dialog when there are no uncleared transactions?

Quicken assumes that if you have no unreconciled transactions, then you have no need to go to the Reconcile dialog. It presents this dialog box:

However, my goal is to get to the Make Credit Card Payment dialog box whether I have unreconciled transactions or not:

My methodology that I have used for decades is that I download and automatically reconcile transactions just about daily, so my registers being already reconciled at statement time is typical. But if a new statement has cut, I want to visit the Make Credit Card Payment dialog and enter that payment. Even though I don't actually write a hand written check, this dialog box takes me to my checking account with the full balance already entered. I just adjust the date to the due date (when the automatic draft will occur) and hit enter .. done.

Here's what I have to do now to get there: Ctrl-R to reconcile, get the "No uncleared" dialog, OK that, modify an existing transaction in the register to be uncleared, dismiss the dialog box that asks if I want to change a reconciled transaction, save the transaction, ctrl-R again to get to reconcile, mark the transaction I changed to cleared, finish the reconcile and then I get the desired "Make Credit Card Payment" dialog. Whew! Sure that's just a few seconds, but it sure would be nice if the "No uncleared" box had a "Reconcile Anyway" button in addition to "OK".

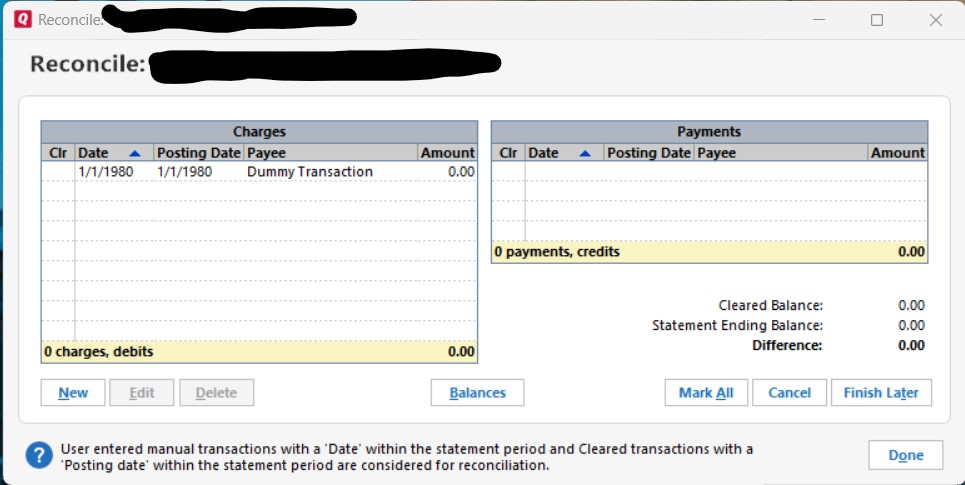

One workaround I've used is to create a dummy transaction of $0 with a date years into the future. Thus, that register will never have no uncleared items. That works, but is a little clumsy. Anyone know of a better way to proceed to the "Make Credit Card Payment" dialog?

Answers

-

Since you are not actually writing or printing out a check for the payment, maybe you will find what I do to be a simpler way to record the payment transactions:

- Create a recurring manual Bill Reminder.

- Credit card payment due dates are in almost all cases on the same date each month so enter that due date (or whichever date you want the payment to be made).

- You can set up the payment amount as a fixed dollar amount or a variable amount based upon prior payments. (The prior payments is the average for a specified number of months, such as the last 3 months or 6 months, so you will need to wait to set up the variable amount until you have enough months of payement history established.)

- You can opt to have Quicken automatically enter the payments into the checking account and credit card registers a specified number of days prior to the due date (great for payments that are fixed from month-to-month) or you can request Quicken to remind you a set number of days prior to the due date so you know it needs to be reviewed and acted upon.

- Each month you can adjust the dollar amount and/or the payment date as appropriate.

This process does not involve the payment popup you have been using. Also the transactions will categorized in both accounts as transfers between and not as "Credit Card Payment" so the transactions are linked. And when the payment transactions get downloaded from the bank and the credit card company Quicken will usually match those downloaded transactions to the Bill Reminders that were entered earlier.

A couple of things that I really like about this process (requires a 1X set up for each of these in each affected account register):

- What I find really nice about this process is that you can set up the account registers to show the Bill Reminder in the registers a set number of days prior to the due date which is very helpful to proactively see what the impact to the account balance will be. To do this, go to Account Register > upper right Gear icon > Reminders to show in register > select the number of days that you want shown. They will also show up on the Bill & Income Reminders tab below the register.

- If you go the route of having Reminders shown in the register I would also suggest that you make sure the Status column is also shown in the register: Account Register > upper right Gear icon > Register columns > check the box for Status > Done. This column will then identify the status of the Reminders that show up in the register: Upcoming, Due, Overdue and Uncleared. Once the payment has been cleared the Status field will go blank.

(Quicken Classic Premier Subscription: R55.15 on Windows 11)

0 -

An alternate approach would be to figure out why you are getting the "no uncleared transactions" message when you initiate a reconcile:

Quicken user since Q1999. Currently using QW2017.

Questions? Check out the Quicken Windows FAQ list0 -

I appreciate your response, but that technique misses a few things. I want the timing of entering the payment to be when I have downloaded statement in hand. I don't want a Quicken reminder to be the trigger for the process because I may or may not have statement available on a particular day. The date of the transaction isn't always the same since automatic payments aren't done on certain days. Also, having the exact amount already filled in is a must have. The only way I know of for Quicken to insert the correct amount to be paid is through the Make a Credit Card payment dialog.

Also the transactions will categorized in both accounts as transfers between and not as "Credit Card Payment" so the transactions are linked.

Make a Credit Card Payment also creates a transfer with linked transactions entered in checking and credit card register.

0 -

The no uncleared transactions is not in error. There are indeed no unclear transactions. I just want to proceed to the Reconcile dialog anyway. But your response made me realize I misspoke above when I stated that one workaround was to keep an uncleared transaction dated years in the future. As the article your linked to says, that wouldn't work. The workaround is actually a dummy uncleared transaction from years ago. Having this transaction sort of reaches my goal as I would never get the no uncleared dialog that blocks going into reconcile.

0 -

I appreciate your response, but that technique misses a few things. I want the timing of entering the payment to be when I have downloaded

statement in hand. I don't want a Quicken reminder to be the trigger for the process because I may or may not have statement available on a

particular day.I think you misunderstand the process. The Bill Reminder automatic entry into the register is simply an option. It is not a requirement. If you do not want the Reminder to do that, then don't set it up with that option selected.

Also, the Bill Reminder notification is simply something which is intended to bring a pending bill to your attention for review. When you get reminded of it you can disregard it, change the date, change the amount or skip it if you wish.

There is nothing about what I'd suggested that requires you to do anything without first having the statement in hand.

The date of the transaction isn't always the same since automatic payments aren't done on certain days. Also, having the exact amount already filled in is a must have. The only way I know of for Quicken to insert the correct amount to be paid is through the Make a Credit Card payment dialog.

As mentioned earlier, what I'd suggested for automatic entry is simply an option, not a requirement. And you can change the dollar amount and the payment date for the manually entered reminders whenever you want, whether before entry or after entry. Nothing requires you to enter the Bill Reminder into your register until you are ready to do so.

The only way I know of for Quicken to insert the correct amount to be paid is through the Make a Credit Card payment dialog.

If you don't want to use Bill Reminders (which are very simple to set up and use and will do everything you say you want), then the simplest way to enter a bill payment manually is to simply enter a transaction into the payment account or in the biller account with a transfer to/from the other account. The Make a Credit Card payment dialog is not needed and, IMO, actually is more involved.

But it is a personal choice matter. If using the Make a Credit Card payment dialog is what you want to continue doing, then go ahead and continue doing that.

(Quicken Classic Premier Subscription: R55.15 on Windows 11)

0 -

Once again, having the transaction created with the full balance already filled in is one of my requirements for the task. I understand that it isn't yours and again I appreciate your response. Also, using the Make a Credit card payment dialog, the source account and credit card account are already known and populated .. much less to enter in the transaction. The only thing I have to touch is the date field. "more is involved" only because of the steps needed to proceed through the reconciliation dialog. If a credit card register had a "Make Payment" button, that would be awesome although the checks that Reconcile does to ensure downloaded transactions and online balance are up-to-date would also be duplicated here. I don't mind going through the one more dialog (Reconcile) to get to Make a Credit Card payment .. I just would like to be able to arrive there without the other gymnastics.

I think I should have been more clear that sometimes a true reconciliation needs to occur if I hadn't reconciled in several days. And I want my process for entering the linked payment transactions to be the same whether there are or are not.

0