downloaded investment transactions

Each month on the 15th, Schwab generates a cash dividend transaction for roll over an IRA account managed by Schwab. This transaction is the amount of interest that Schwab maintains in a money market for this account. Each month the transaction in Quicken as a zero amount. I then have to logon to Schwab to get the amount and put it in the transaction. I have reported this each month for the last two years. It does not happen for a ROTH account, only a roll over IRA.

[Edited - Readability]

Comments

-

Since the transaction occurs of the 15th I'm assuming this is either the Schwab Government Money Fund or, maybe, the cash in the Investment Account is (invisibly) swept into Schwab Bank, and it's actually the Bank that's paying the interest?

Which one is it, or is it some other money market fund?

0 -

the transaction from Schwab for the cash interest from a roll over IRA account again had a amount of zero. this has been going on now for over 3 years. I report this every month. it is the interest in a money market fund within the account. Roth IRA account are working fine those transactions have an amount in the transaction.

0 -

"it is the interest in a money market fund within the account."

That doesn't actually name the fund but since the transaction occurs on the 15th of the month I now know that it's the Schwab Government Money Fund, either SWGXX or SNVXX, as the Schwab Government Money Fund is the only Schwab-named MMF that uses the 15th of the month as the pay date.

"this has been going on now for over 3 years"

And that fits neatly into when Charles Schwab began implementing a new connection method for downloads into Quicken, using a Express Web Connect Plus (EWC+). As part of Schwab's conversion from the Direct Connect downloading method to EWC+ Quicken announced that ALL Schwab money market funds would henceforth be treated simply as "cash."

This position was obviously wrong for any Schwab money market fund that wasn't a "sweep" fund, like the old Schwab Value Advantage MMF's where you actually had to initiate buys and sells in order to convert the MMF from a dollar-denominated security for "real" cash.

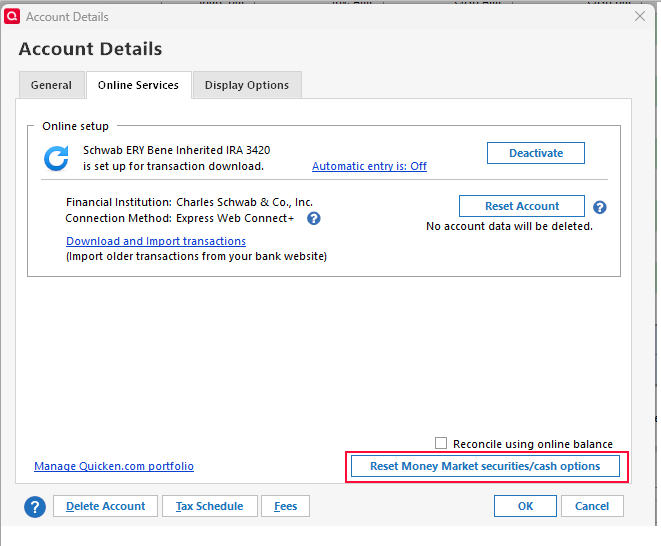

In response to this Quicken changed the handling of Schwab MMFs, allowing the user to dictate how MMFs were going to be treated in downloads, as either "security" - with Buys and Sells and Dividends - or as "cash", invisibly mingled with any "real" cash in the Quicken Account. Since your MMF is a true "sweep fund" It sounds to me that you might have your Schwab Government MMF labeled as a "security" instead of "cash."

So, first step in trying to fix this: Edit the Account and see if you have the ability there to make the change from security to cash.

0 -

I do not have that option on the screen in my quicken? please tell me why the ROTH accounts work and the roll over IRA accounts do not? all 4 accounts are set up ths same in quicken.

0 -

There is something that the financial institution sends for each account that tells Quicken which security to allow of using as cash. Evidentially, Schwab is inconsistent on sending this information, and it has caused many people grief.

The real solution would be to allow the user to select which security(s) should be treated as cash in Quicken.

There is an idea for this, but it will need a lot more votes even to be submitted for consideration.

Signature:

This is my website (ImportQIF is free to use):1 -

you people are making this issue bigger than it has to be. why is the transaction that quicken creates have an amount of zero. forget everything else why is the amount zero in the transaction? the amount is correct for a Roth IRA zero for a regular IRA why?

0 -

I'm not sure either of us can answer your question definitively. Certainly I can't. There just does seem to be a certain amount of inconsistency in Schwab Accounts where Schwab money market funds are held.

I think you have the best chance of getting an answer from Official Quicken Support . I'd suggest a phone call and requesting an escalation if you can't get an answer from the first rep you speak to.

0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub