Let users choose how Money Market transactions are treated

I'm pretty sure this is not a new idea, but I would like Quicken to let us choose how we want to treat money market transactions that brokers use for sweep accounts. Some brokers code these transactions as cash and some code it as a fund where you buy and sell shares as money comes in or goes out of the account. Some of us like it when the broker handles it as cash and some like it when they treat it like a Fund.

The situation is amplified when we have multiple accounts where these transactions are treated differently. Having accounts at both Fidelity and Vanguard for example. Some may just roll with it being different, but it seems many of us would prefer a consistent representation across all of our accounts. We end up spending way too much time editing the downloaded transactions in the accounts that don't handle the 'cash' the way we'd prefer it to be treated. It's time consuming yet somehow, I'm still doing it. Always hoping one day either the broker or Quicken will offer us a way to choose what we want.

I personally want to see these transactions represented as cash. That way I can easily see the cash available in each account. I like it so much better that I'm willing to change every money market "ReinvDiv" transaction to a plain "Div" transaction in all of my Vanguard accounts ("Reinvest - Income Reinvested" to "Inc - Income (Div, Int, etc.)").

It would be great if Quicken could come up with a way we can chose the option we prefer. Something that would intercept the incoming MMF transactions and change them to cash transactions (and vice versa for those who chose to have it the other way).

Comments

-

Hello @Geobrick,

To clarify the idea, are you wanting Quicken to create an interface that would allow users to essentially tell it "this fund is a Money Market account and I want you to show it as cash" or "the cash amount is actually a Money Market account, and I want you to show it as a fund by this name: XY123"?

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I think Quicken already does this up to its ability to do it. With maybe the exception being handling what Chase is doing (But maybe they can improve on it somehow).

First let me state the impossible case that you somehow think Quicken can handle. If the financial institution doesn't send any Mutual Market Fund transactions, it would be impossible for Quicken to know how to turn the "lack of transactions" into transactions.

That brings me to doing the opposite treating a Mutual Market Fund transactions as cash. When I setup for downloading my accounts at Chase it prompted me asking if I wanted to treat QDERQ as cash, and I said yes. So, Quicken removes these transactions and the buys/sells go to the cash balance. Now here is the rub. I know this question didn't popup on all the different financial institutions I have been with, and got the transactions. So, what triggers this? I would have to guess there is something in the information that they get from the financial institution that lets Quicken know that these are in fact Mutual Market Fund. Without that information it would be asking you for every one of your securities. So, I'm guessing that some financial institutions don't send this information correctly and Quicken has no idea that it is a Mutual Market Fund security.

Maybe they could allow for the user to just specify what is a Mutual Fund security somehow.

Chase on the other hand is just plain strange.

There is the QDERQ fund as I mentioned, but they also have these "back accounts" that are used for various things like cash is moved in and out of them for gathering interest, or holding cash where they are waiting for 3 days for the transaction to complete.

The result is none of these actually show up in the transactions, but when comparing shares they show up as different than what Quicken has until the sell completes in 3 days.

Signature:

This is my website (ImportQIF is free to use):1 -

Yes. I think that sums it up.

It's also about how Quicken enters the transactions for these situations. For those who want to treat it as cash, don't enter buy transactions after a dividend or deposit and don't enter any sell transactions for payments or stock buys. It would work the opposite way for someone who wants it treated as a MMF when their brokerage codes it as cash in the quicken downloads.

0 -

I've seen that come up at times in the past but not for something like the Vanguard sweep account.

I don't know exactly how quicken would implement my suggestion. I would think there's something in the downloaded data where it's coded in a way that quicken understands.

For a Money market, the # of shares are always equal to $1 so for your impossible situation, if the user wants to show the sweep amount as shares in a money fund to match their statements but their broker codes it as cash, it seems to me quicken can create a Reinvest Dividend transaction when cash is received by using the amount to come up with the proportional # shares bought as a reinvestment. In the other situation, Quicken can take an incoming ReinvDiv and change it to just a Div by ignoring the #shares. A more brute force method would be a macro-like script that runs after any update that looks for a specific type of transaction and converts it to the other. Kind of the way the renaming rule works. We'd set up rules for specific money market transactions and tell quicken what to do with them. I'm sure the programmers can come up with something more elegant but I'll except either.

0 -

Coincidently, I just got an email from Vanguard offering a new settlement option called the Vanguard Cash Deposit. It's an FDIC banking product. Right now, it seems to have a 3.7% return which is less than their Federal Money Market. That would probably fix things for me in quicken for vanguard but the cost of switching to a lower rate settlement fund isn't worth the convenience I'd get.

0 -

@Quicken Kristina I would like see the first option you described - Quicken receives money market fund transactions but treats them as cash - for the settlement fund in my Vanguard accounts. I think the user interface would have to let you specify which fund(s) to treat this way, because you can hold money market funds in addition to the settlement fund and users might not want to make an all or nothing decision.

A benefit of this is that it would make the "Show cash in a checking account" option more useful for Vanguard accounts. As it is, if you select this option, the linked checking account balance is always zero, because as soon as cash comes in it is swept into the money market settlement fund.

You can sort of do this manually by deleting all the downloaded Buys and Sells for the settlement fund and converting the monthly Reinvest transaction from a ReinvDiv to a Div. It's a pain so I don't currently do it. One downside of this currently is that if you do a Reconcile Shares, it will complain that there are zero shares of the settlement fund in Quicken.

QWin Premier subscription1 -

I would like to add one thing if this does get implement this (and I think they should) and that is it would be ideal if the user could specify multiple securities to treat in this way. As I described above, Chase has multiple ones that I would like to ignore.

I think the main "short coming" of the existing system is that "Quicken guesses" at which funds fall into this category and probably because of "bad data" from the financial institutions it isn't always right. This seems like a case of realizing that it will never be 100% correct and just allowing the user to specify it.

Signature:

This is my website (ImportQIF is free to use):1 -

I agree, the user should be allowed to choose whether or not the cash sweep is treated as cash or as a mutual fund for EVERY brokerage, not just select brokerages. It might also be useful if users could change this feature "on-the-fly" later, in case they accidentally choose to treat the cash sweep as a mutual fund instead of cash when they configure their brokerage in Quicken.

I am a 30 plus year Quicken user, and this has been a problem for many years with my Vanguard brokerage account. My Vanguard Account in Quicken forces me to use the VMFXX cash sweep as a mutual fund rather than an actual cash sweep. Consequently, every time I download a cash sweep "sales" transaction from my Vanguard Brokerage into my Quicken Desktop Software Quicken forces me to choose whether or not to "specify lots" or not. This should not be necessary because the cash sweep money market fund will always have a share value of $1, and therefore the lots are irrelevant. I even tried manually specifying that this cash sweep fund (VMFXX) is treated as "Average Cost Basis" in the Quicken software. But the Quicken software still asks me to specify lots. I have a very busy Vanguard brokerage account, and sometimes if I have not audited my downloaded Vanguard transactions in a while, I am required to go through hundreds of downloaded cash sweep transactions and specify that I do not want to choose lots—even if I specify automatic download.

There are other likely related problems with tracking cash in my Vanguard Account with Quicken. For many years, I tracked my Vanguard cash separately in my Vanguard account so that I could write checks and handle the cash separately from the investment transactions. (Vanguard no longer allows check writing within Vanguard Brokerages.) But when I did this, the Quicken software required a duplicate of every cash transaction in both my Vanguard Brokerage and the Matching Vanguard Brokerage Cash Account, and I had to manually create the second half of each transaction to balance my brokerage account. This was far too time consuming, so I abandoned this approach.

I contacted both Quicken Help and Vanguard about these issues 7-10 years ago, and I was told that Vanguard did not allow the cash sweep to be treated as cash in Quicken, but instead required that the cash be treated as a mutual fund. This is unlike my Fidelity Brokerage, which gives me the option of treating the cash as a mutual fund or as a cash sweep when I configure a new brokerage in Quicken.

Consequently, even though I love Vanguard and still retain most of my mutual fund assets on the Vanguard platform, I have moved most of my stock trade and cash activities to Fidelity instead of Vanguard, because it is too difficult to track and match my transactions in Quicken with my Vanguard Account. The Fidelity Brokerage is much easier to use in Quicken than Vanguard.

Geobrick noted that Vanguard has a new dedicated cash account. But it is my understanding that this is a separate account from the Vanguard brokerage. Therefore, this will not solve the problem of handling cash within Quicken Vanguard Brokerage accounts. This is a problem that must be negotiated between Quicken and Vanguard and/ or solved by Quicken alone depending on the technical issues. Improving Quicken performance in this regard would be a good business decision given the massive market share of Vanguard.

4 -

I've been doing this for years with a Vanguard account and just today realized there was another option when I purchased SWVXX in a Schwab account and Quicken helpfully popped up a dialog asking me whether I wanted to see all the transactions associated with this sweep security (I really, really don't). I hunted all over for how to do the same thing with VMFXX and wound up here. I download so many updates with features I never asked for and immediately ignore. It would be nice to see an option to treat any "XX" security as a cash sweep and have it be transparent in Quicken.

1 -

AvgGuyJ, I've actually considered transferring my accounts from Vanguard to Fidelity just to avoid this sweep account annoyance with quicken. I realize it's an overreaction. Hopefully quicken (or vanguard) will figure out how to fix this for all of us.

0 -

Just want to promote this request again after having to manually modify money market transactions in several vanguard accounts.

Quicken, please do something to help Vanguard do what Schwab and Fidelity do to treat the sweep transactions as if they were cash. No buying and selling of money market shares and just dividends instead of reinvested dividends.

Many of us consider our money market sweep balance as cash so it would be really nice if quicken was able to do something to help us automate the process or influence Vanguard to change whatever they need to change so that their sweeps are treated as cash (like Fidelity and Schwab..

0 -

I have numerous investment accounts with different brokers, one of which is UBS where I have 15 different accounts. In the past couple of months UBS has initiated change whereby excess cash is now in something called UBS FDIC Insured Deposit Program. Whenever I update, I get the same error message in each account that Quicken shows zero shares and UBS reported a number of shares (equal to the cash balance). I just dismiss this error message but today I finally told myself to search for a solution, which led me here. I also want to promote this request, I have nothing to add as the entire string is well written and clearly explains the issue and the request from the users. Quicken development team please look into this as a Christmas gift to your loyal users 🙂.

1 -

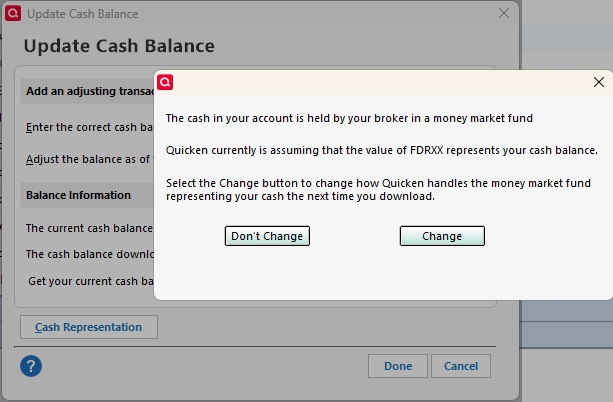

Here is another interesting quirk of the way Quicken currently handles this. Chase uses multiple "cash accounts/mutual funds" for various stages of the selling/buying of securities. Well, I was just doing some selling and buying and a few times a dialog like this has popped up after I have done a One Setup Update:

But the "quirk" to this is that as the money moves around, I get the same prompt for a different security. I have no idea what is in the data that Chase sends that Quicken looks at to make this decision, but clearly there is something in it, and it keeps changing.

To me this just amplifies why this feature is needed. Depending on the financial institution you can go from anything where Quicken isn't told that a mutual fund is "cash" to my bouncing security as cash. This isn't a reliable way to do this. Quicken should ask the user instead.

Signature:

This is my website (ImportQIF is free to use):1 -

Time for a bump for this idea.

Bump.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0 -

Thanks. Can't wait to have a solution for this.

0 -

Quicken partially has this ability. Look at 1 of my 6 Fidelity accounts, under UPDATE CASH BALANCE:

The problem is that only 1 of those 6 accounts has this "Cash Representation" button. In looking at other posts, other people seem to have this Cash Representation button for some but not all their accounts. Seems like adding this selection to ALL investment accounts would go a long way in providing this request to the users.

0 -

The fundamental problem seems to be the Quicken relies something in the data the financial institution puts in the data, as opposed to allowing the user decide which securities should be treated as cash. This causes this inconsistent behavior between accounts and financial institutions.

Signature:

This is my website (ImportQIF is free to use):1 -

This is still a issue in Quicken that makes cash management / tracking problematic especially when the investment account has more than one money market fund that can be treated as cash. I have multiple accounts that behave differently and each tracks cash incorrectly - and in some cases differently than the others. Here are further detail on the issue:

https://community.quicken.com/discussion/comment/20505757#Comment_20505757

0 -

I have this same issue with multiple Fidelity accounts. There are multiple money market funds used in each account, and they all need to be treated as cash in order to be able to reconcile the accounts in Quicken (Classic on Windows 10).

0 -

They seem to be getting close to giving us the ability to do this. It's working for Fidelity (but it always was until the recent EWC+ change). Now the ability to select a fund to treat as cash is available on the "online services" tab of the Account Details settings for all brokerages but doesn't seem fully functional for Vanguard yet. No funds are listed in the dropdown list for choosing a fund to treat as cash.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub