zzz-Fidelity Updates

Comments

-

Made the mistake of attempting to reauthorize my Fidelity accounts this morning. Followed the Quicken-recommended options. Big mistake. Cash balances wacky, Multiple share balance mismatch messages. Total Charlie Foxtrot.

Reverted to a backup file, did the update without reauthorization, and the Fidelity "zzz" direct connection accounts updated properly. With the end of the month looming with the reinvestment transactions, I'm going to stay with DC until reports here are more positive or I am forced to change. Why is nothing ever seamless?

Note to Quicken: a FAQ specific to the Fidelity reauthorization would be very helpful including some guidance around how to handle the Fidelity-designated cash position money market fund for each account. Just a thought.

Premier R63.21, Win11 Home

5 -

I also followed Fidelity recommendations early this morning to reauthorize my six accounts. OMG——What a complete disaster!!!!!!!!!!!!!!!!!!!!At least 20-30 duplicate transactions downloaded for each account. I had to manually delete each one. Wait——It gets better!!!!!!!!!!!!

I noticed that my Quicken balance was 25 million + more than I should have. WTF???????????????????????

I started to troubleshoot each account and fixed income investments shares were brought over incorrectly. I spent over five hours today fixing everything

zzz is not showing any longer and back to Fidelity web connect

2 -

-

Some of the other issues I encountered were:

Not properly linking to my existing accounts (wanted to create new ones).

Not properly matching specific securities, despite having their symbols. I had to manually match.

Downloaded dupe transactions already cleared (some big, some small). Ended up having to manually delete all the downloaded transaction.

While this list appears small, it does not convey the effort to finally get this squared away. I have only 2 accounts so the first one was easy. However, over the 24 years I've had this Fidelity account, I gone through quite a few securities, many still active. It appears the Fidelity changed many of the long names, even if the symbol remains the same. These got "flagged" and I had to manually match them. Of course, I missed one and it threw everything off. So restore from backup and try again.

Finally, accounts match, balances match, symbols match, no stray/extra/orphaned securities, but a whole bunch of downloaded transactions. Scroll back through the register to check and see they are dupes. Of course, I missed one, threw off the totals again. Restore, try again.

Last pass through and all appears well. A few extra, Close Quicken, reopen, run OSU, resulted in complete error free connections and zero new transactions. We'll see how it goes tomorrow.

2 -

Have you tried restoring a recent backup file from before today's date?

Try updating that file and when prompted to reauthorize decline it. Eventually we'll be forced to make the transition but as mentioned several times in this thread try to delay making the transition for as long as possible. Maybe Fidelity/Intuit/Quicken will be able to fix the EWC+ issues before we are actually forced to make the transition.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

3 -

No need to restore recent backup——-Everything is working back to normal after spending 5+ hours this morning fixing each account. Yes—I have complete tracking.

This was a nightm

3 -

Thank you for coming back to share!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

-2 -

Just bit the bullet and let Quicken convert some of my Fidelity accounts.

Quicken did not recognize most of the accounts, and I had to re-link them. And I had to specify the account type: Brokerage, IRA or Keough, or 529. Where is the 401(k) choice? I chose IRA or Keough for these. And maybe get rid of Keough? Who uses these anymore?

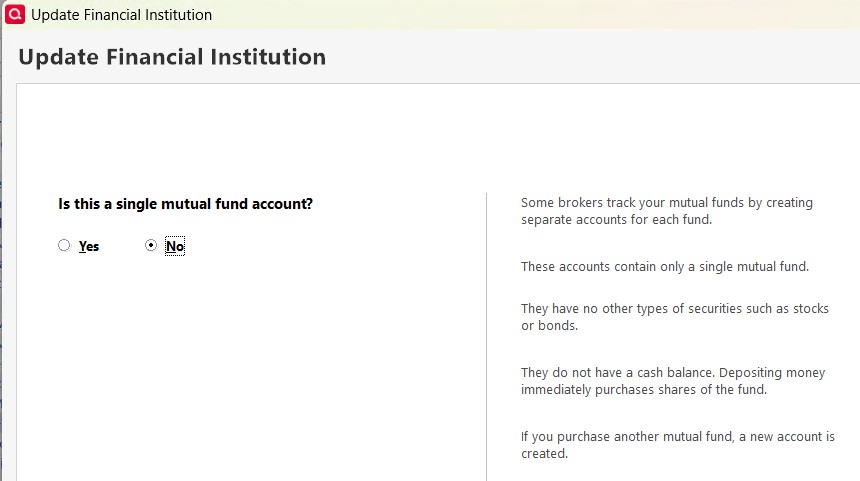

During the update to several accounts, I get this:

I have no idea which account this is referring to.

After this I see I have a bunch of duplicate transactions downloaded in most of the accounts.

Come on, Quicken, this is no way to treat your customers, making them waste time cleaning things up.

0 -

On a positive note, now it seems Fidelity is properly tracking its money market funds (at least SPAXX & FDRXX), so I let them treat them as securities and not as "cash balance." Should save me from having to delete the downloaded sales of these in the future since there were no matching purchases.

0 -

Oh and it looks like they've combined Fidelity Investments and Fidelity NetBenefits so all the accounts are under Fidelity Investments.

0 -

I too got the ZZZ prefix on my Fidelity NetBenefits account in Quicken. Thanks for the quick response. Later in the day, I did get a message to reauthorize the accounts for update in Quicken. After performing the reauthorization, everything seems to be back to normal.

Thanks

Rick Peno

1 -

I engaged an investment advisor several months ago. He moved two of my Schwab accounts to Fidelity. Unfortunately, he moved the portfolio to Fidelity, liquidated all securities, then created a new portfolio. To correctly show short and long term losses, all trades had to be moved. What a nightmare to find and fix errors. It would have been better to liquidate the portfolio at Schwab, move the cash, and then purchase the new portfolio.

I noticed the zzz prefix appear this week. I've found that using Tools > Online Center >Holding tab and clicking the Compare to Portfolio says they match, even though at the time I knew they didn't. I had to download the portfolio from Fidelity, create a Quicken report, and compare them side-by-side to find the mismatches. Does Compare to Portfolio work?

If Quickens update changes from Complete to Simple Investing (or if I can't update two data files), I'll be very upset. Fidelity is the only institution of my nine that still uses Direct Connect. Are they that behind in technology?

0 -

ANOTHER MAJOR PROBLEM FOUND WITH UPDATE!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

I started this thread yesterday when I reauthorized my six accounts. It took me over 5 hours to delete duplicate transactions and fix other issues. All my accounts agreed with Fidelity holdings.

This morning I clicked Online Center—compare to portfolio—OH BOY!!!!!!!!!!!!!!

All fixed income shares are messed up. I'll give you one example

Treasury Bond—Fidelity shows 256,000 shares

Quicken shows 2560 ($100 per share correct!!!!!!!)

If I accepted the 256,000 shares at the current price, the bond would be recorded $$$$25,600,000 (million)

This is really "F" up——Quicken has really done it this time

0 -

I got the Fidelity reauthorize popup in Quicken for the first time today. I selected Remind Me Next Time to skip the reauthorize.

OSU downloaded transactions to the Fidelity account without problems. I hope the Remind Me Next Time option sticks around a while.

I was wondering: Is there anyone who has reauthorized and had no issues with changes in securities, Complete Tracking and other discrepancies or are problems occurring for everyone that reauthorizes?

Deluxe R65.29, Windows 11 Pro

0 -

All, I switched to the new connection method this morning and had no issues with our Fidelity brokerage or IRA accounts… full transaction details stayed intact. No need to stay on the direct connection method. The process was seamless and all looks the same except the zzz-s are gone! Sorry to hear others are having issues. I hope it all goes well for those who have not updated yet.

1 -

For those who have not yet seen it, there is a new Announcement regarding this connection transition: NEW! 7/30/25 Fidelity Cut-Over Migration . For me the most notable thing it says is:

Fidelity will begin an optional cut-over migration on 07/29, followed by a forced cut-over on 08/20.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

From the posts on here, it sounds like many are not experiencing an improved connection as stated in the notice.

Hopefully, a lot of the reauthorizaton issues happening will be resolved.

Do you recommend doing the reauthorization, or postponing until forced?

Deluxe R65.29, Windows 11 Pro

0 -

OMG!!!!!!!!!!!!!!!JUST FOUND ANOTHER MAJOR ISSUE THIS MORNING!!!!!!!!!!!!!!!!!!!!!!!

All my CD's(Over 20) that have always been priced at $100 a share on Quicken, have to be changed to #1 a share with shares also changed.

Example—-Quicken shares—650 @ $100====$65,000 (This has always been downloaded from Fidelity)

Now Fidelity is showing——65,000 shares @ $1===$65,000

I had to change every CD shares and unit price

0 -

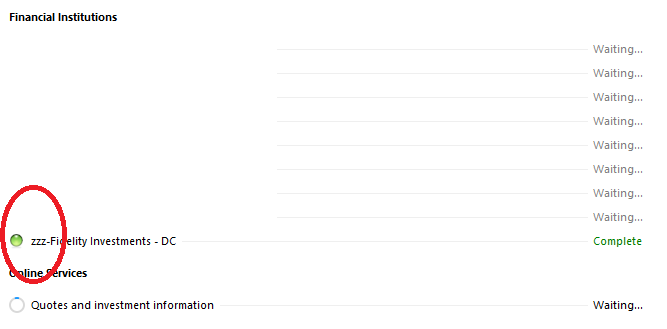

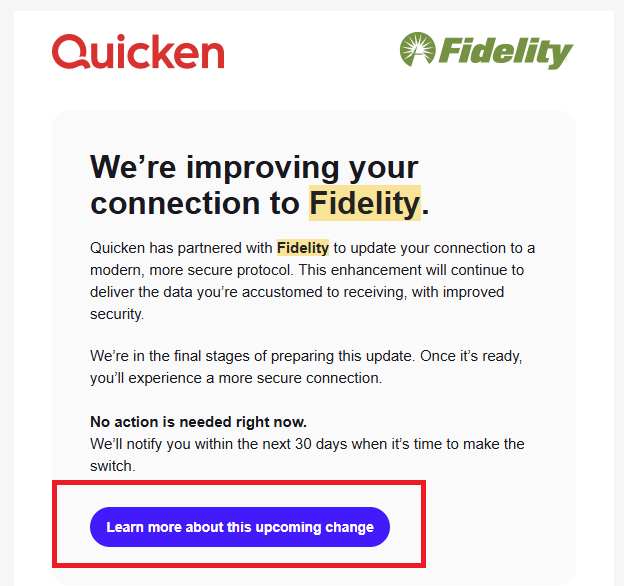

Yesterday I noticed a prefix on the Fidelity account during OSU. (attached)

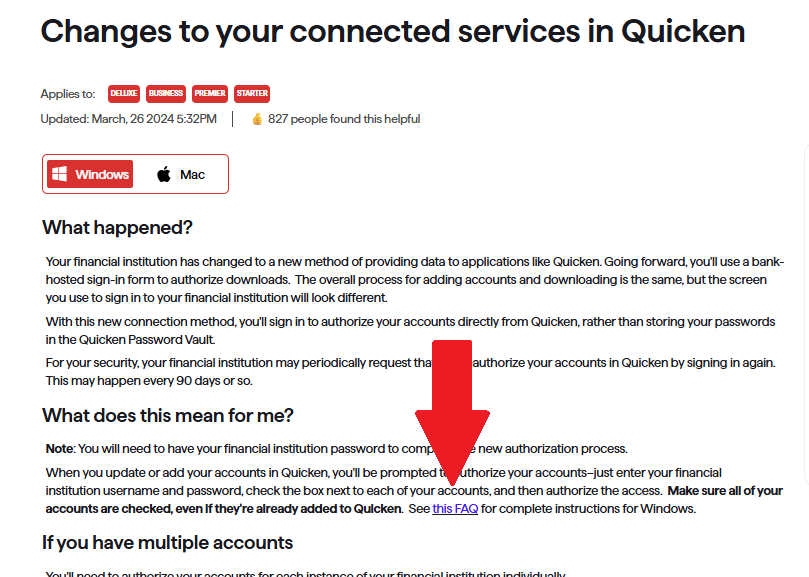

I assume it's related to the connection type change announced via email on 6/30/25. (attached)

When I click the button at the bottom of the email I'm taken to an article explaining the change. When clicking the "this FAQ" link in the article (attached) I'm lead to a non-existent page (also, attached).

Additionally, the email stated we'd be notified with more information within 30 days. Today is 7/31/25 and no further information has been received.

Please, advise.

Quicken user since 1991

VP, Ops & Tech in the biometric space

0 -

Found another problem——-I mentioned above that Fidelity downloaded shares for CD's at $1 a share.

For years the share price was $100. I changed all my CD's to the new share balances

Now, estimated income is millions over since the shares have changed.

0 -

OMG at the issues being reported. I'm very sorry for the unfortunate ones that have to be the guinea pigs but I think I'll wait until forced to change the connection.

Quicken user since 1991

VP, Ops & Tech in the biometric space

0 -

Quicken is downloading Prices for all my CD's at $1.00 and change instead of $100 and change.

Fidelity shows all current CD prices at $100—$103

Quicken downloading these at $1—$1.25

0 -

Yes, the zzz- prefix to the financial institution indicates that the connection is going to be changing and it is very much part of the the EWC+ transition.

Yesterday (7/30) an Announcement was posted with more information (including schedule) about this transition: NEW! 7/30/25 Fidelity Cut-Over Migration .

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

I'd be surprised if Quicken (or Fidelity?) improved anything about the conversion process between now & 8/20. I recommend you convert when you have the time to clean things up.

2 -

Hello All,

Thank you for continuing to share updates and for joining this thread with more information.

We appreciate it!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

-2 -

Gary, not only will your CDs be messed up, but if you change things to $1/share and adjust your number of shares purchased (like I did), it will mess up your Net Worth also! The previous prices of the CDs still show as $100/share and with 100x more shares, it appears that my Net Worth went down by half in the last few days. So, if you do update your CD prices and number of shares, you will also have to "correct" your previous share prices from all the CDs to get the Net Worth back in line.

0 -

Quicken, this is a real mess. Luckily I had a backup to revert to my Quicken file before I went through the reauthorization process. We pay a hefty subscription fee to use Quicken. As a customer we deserve better, much better. I've already contacted my Fidelity rep to see what he can do.

0 -

bmbass——My problem now is Fidelity is downloading all CD's at $1 even though the price is $100 on their positions page. If I change the shares to agree with the total cost, then estimated income for each CD is overstated by substantial amounts.

Quicken has created a real mess!!!!!!!!!!!!

0 -

Ooooookey——————doke!!!!!!!!!!!!!

I have a simple fix for my 20+ CD's

After the Quicken download, I click on each CD, edit the price based on Fidelity's closing price.

This should only take me 30-45 minutes each morning

2 -

They already have made significant improvements since the initial roll-out just 2 days ago. Still lots of room for improvement, though. Some of the notable issues that have been fixed or improved upon just since 7/29 include:

- Initially, converted investment accounts offered Simple Tracking only with no option to select Complete Tracking. Now most accounts are defaulting to Complete Tracking and if Simple Tracking is implemented it can be changed to Complete Tracking.

- Initially, some were forced to convert to EWC+ but now that is optional (until 8/20). When prompted to reauthorized just click on "Remind me later" which closes the reauthorization prompt.

- Initially, no investment accounts were showing accurate data. Now, there are quite a few reports that the conversion seems to be working well with no issues observed. For me, 6 out of 9 investment accounts (in a test file) are have no issues that I've been able to ascertain. Of the 3 that had data issues, two were because 1 transaction in each file dated 7/15 did not download….everything else looks good. The other 1 account is missing the Cash Balance which wouldn't be so bad if the Core Account MMF shares were downloaded instead but that has not downloaded, either.

- Fidelity Credit Card: Initially was not included in the reauthorization downloads. Now it is. (Although for some users the Opening Balance transaction dollar amount was changed and there have been some duplicate transactions downloaded. But these are long term issues that sometimes happen whenever there is a connection method change so I would not classify them here as unique to this Fidelity.)

My recommendation is to delay conversion until 8/20 or when it's being reported that all of the issues have been resolved.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

3

Categories

- All Categories

- 56 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub