zzz-Fidelity Updates

Comments

-

Not sure if they'll be able to fix (we'll see). Perhaps more likely is to delay the mandatory migration.

0 -

Thanks @Boatnmaniac , I stand corrected.

-1 -

You are welcome. I wasn't criticizing you. I just wanted to let you know that it seems there have been several fixes put in place very quickly….much more quickly that we typically see with other EWC+ transitions done by other financial institutions. Like you, I was very concerned at first with how long and painful this transition process might take but so far I'm pretty pleased with how quickly some things have been fixed. That tells me there is a strong commitment by all the parties involved (Fidelity, Intuit, Quicken) to having a successful transition as quickly as possible. (Well, that's what I keep telling myself so I can sleep at night. 😏)

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

On Wed July 30, 2026, OSU had Fidelity Investments back again and I used it in place of the ZZZ-Fidelity investments choice from Tue, 7/29. ZZZ-Fidelity Investments had updated my accounts OK on July 29th. On Thu July 30th, I was prompted to authorize Fidelity Investments connection and selected the accounts I wanted to be updated and linked to my Quicken accounts.

As previously reported here, only wrinkle was that the new connection changed my accounts Tracking Method to "Simple - Positions Only." For each account, I changed this back to "Complete Investing - Positions and Transactions" (Edit/Delete Account: Account Details, General Tab). OSU has worked OK on Wed 7/30 and today Thu 7/31. I've noticed no loss of functionality so far.

Windows 11 Home / Quicken Premier Subscription - Quicken user since the last century0

Windows 11 Home / Quicken Premier Subscription - Quicken user since the last century0 -

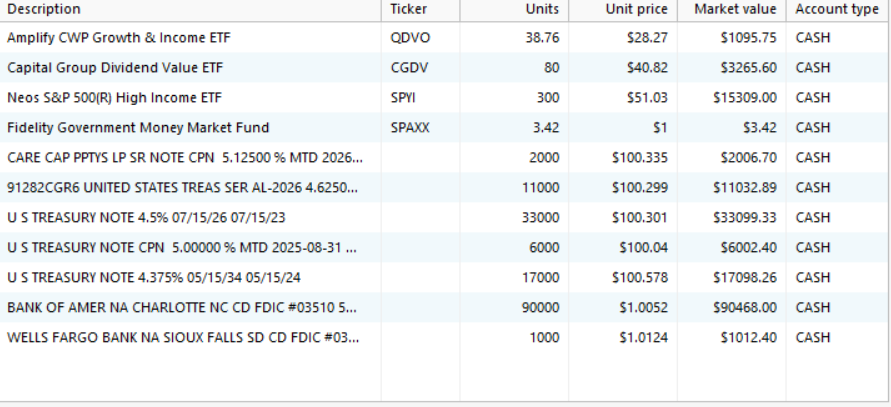

One step update just finished——-Only one issue——-All CD's (Over 20) are now priced at $1.00 instead of $100

I still have to edit price history for each CD and change to $100 or my net worth is incorrect.

If I change the price to $1.00, then I need to also change shares. The problem doing this will screw up my estimated income since EI is based on shares

0 -

Quicken OnLine——The units are all incorrect for Fixed income.

Market Value correct

The Treasury bonds are downloaded at the $100 price with correct shares. ($33,099/100.30=330 shares)

The CD's are downloaded at $1.00———This is wrong and needs to be fixed

Hopefully this example will help

2 -

I've been a Quicken user for a couple of decades - and this is really a complete mess. Luckily - I create a back-up every day due to continued OSU issues that seem to happen with every 'enhancement'.

Yesterday-31Jul25 - Quicken automatically updated my online method of connecting to Fidelity from DC to EWC+. I suspected something was amiss in my files when some of them didn't show transactions - but I decided to let it roll on a day. This morning - 01Aug25 - I updated my Fidelity accounts (I have over a dozen..) via the EWC+ method, and no transaction history downloaded. I knew that there were transactions at the end of the month - and could see them all online via the Fidelity web site.

I went back and restored my file to the 30Jul25 backup - and then simply used OSU via the original DC method - and all of the 31Jul25 transactions were there. I don't know if/when I will be able to not use the DC method for updating - but that's my intention until someone at Quicken decides to actually confirm that the EWC+ connection method supports downloading account transactions.

If anyone out there in the community has additional thoughts or comments - or anyone from Quicken wants to learn more about this - I'll monitor responses to this post. Thanks.0 -

It really looks like the migration from DC to EWC+ for Fidelity is not ready for prime time.

Deluxe R65.29, Windows 11 Pro

0 -

I did change OSU to EWC+ and initially it downloaded past transactions for only one of my Fidelity account. Every update was keep brining same transactions even after restarting Quicken. So I had to deactivate in Quicken, unauthorized Quicken in Fidelity site then reactivated in Quicken. Now I don't get any NEW transactions for ANY of my Fidelity accounts; I know there are new transactions in Fidelity……

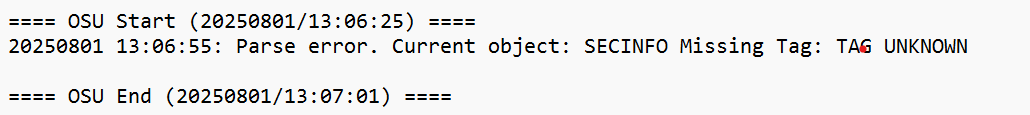

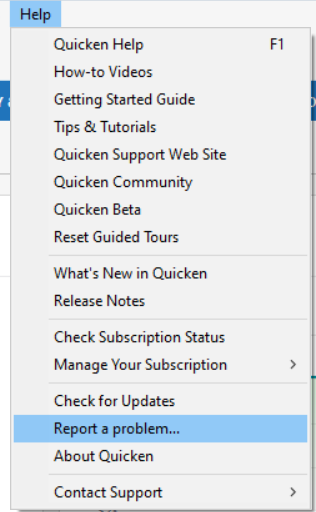

I see following message in CONNLOG.TXT which I have sent to Quicken using Help ⇒ Report a Problem..

0 -

I have always specified "Complete - Positions and Transactions" on my Fidelity accounts. After converting to EWC I too got the duplicate transactions and had to manually deleted them and I'm still using "Complete" tracking. Thought all was okay (balances correct) until I clicked "Done" and was greeted by a mismatch of shares for the core position/SPAXX. Seems Quicken is no longer defaulting the SPAXX position to cash as it was before in DC. And the cash from dividends is now being recorded as SPAXX shares and not being deposited in to my separate "Cash" checking account. I know some may like tracking cash as a SPAXX position but I prefer the old behavior where SPAXX/core position just displays as "Cash". The balances are correct if I add the Cash and SPAXX position together in Quicken. Is there a way to get that old behavior back or did I miss a step in the conversion process?

0 -

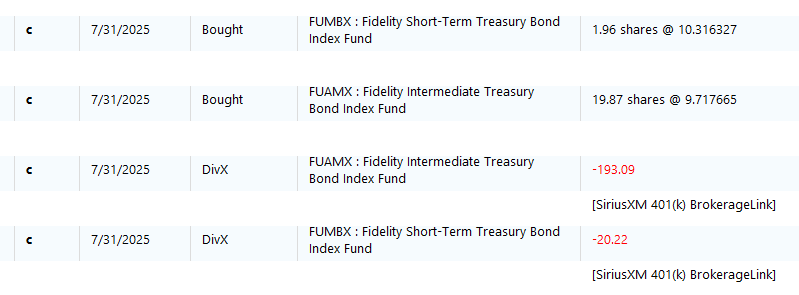

Rounding of OSU share holdings : This morning's OSU revealed an issue with "rounding." End of month interest/dividends/etc all posted in Quicken with "rounded" share holdings to two decimal places for the transaction resulting in holding mismatches between Fidelity and Quicken results.

For example, one mutual fund's dividend in Fidelity was 3.326 shares, Quicken entered as 3.33 for the transaction. Another example, dividend in Fidelity was 1.451 shares, Quicken entered as 1.45 shares.

Previous share holdings in Quicken are three decimal places which matches Fidelity, Quicken seems to now round the downloaded value to two decimal places. Fidelity shows three decimal places.

Windows 11 Home / Quicken Premier Subscription - Quicken user since the last century1

Windows 11 Home / Quicken Premier Subscription - Quicken user since the last century1 -

You said, "Yesterday-31Jul25 - Quicken automatically updated my online method of connecting to Fidelity from DC to EWC+. "

I don't understand how Quicken could automatically change from DC to EWC+. To update with DC, you need to enter your password from your vault or directly. EWC+ uses tokens. To change connection methods, you'd need to respond to the prompt to log into Fidelity's website with your credentials so they can create the token.

I've wasted far too much time being an involuntary beta tester. Quicken should withdraw this update immediately.

0 -

I did get duplicate transactions on my Arizona 539 Education Accounts. Transactions had taken place on July 18th and were re-downloaded with OSU this AM (Aug 1). The dups had the share amounts rounded to two decimal places vs the original three. I just deleted them. But had a mess with other accounts with the share rounding issue.

Windows 11 Home / Quicken Premier Subscription - Quicken user since the last century0

Windows 11 Home / Quicken Premier Subscription - Quicken user since the last century0 -

I too like the "cash" in the Fidelity accounts to be shown as available cash and NOT SPAXX. All my Fidelity accounts worked this way before the conversion to EWC+. During the conversion process, one of my accounts (an HSA) actually asked me if I wanted the "sweep account" to be treated as cash or not (this account uses FDRXX and not SPAXX). I said Yes and that account is still working the way it was before. The other Fidelity accounts, which use SPAXX, never asked me and are now treating my cash as SPAXX shares. This is VERY PAINFUL since I have a lot of dividend stocks and then transfer the dividends to my personal checking account about once a week. Having to "buy" SPAXX shares and "sell" them every day is going to be a HUGH pain.

Since Quicken asked me how to treat the FDRXX, that means there is some setting/configuration that tells Quicken how to treat these sweep accounts. I have looked but have not been able to determine how to setup the SPAXX to be treated as cash in my remaining Fidelity accounts like before. Could someone from Quicken explain how to do this? Providing this information would at least solve one more of the "problems" with the EWC+ conversion that many people are running into.

1 -

Hello All,

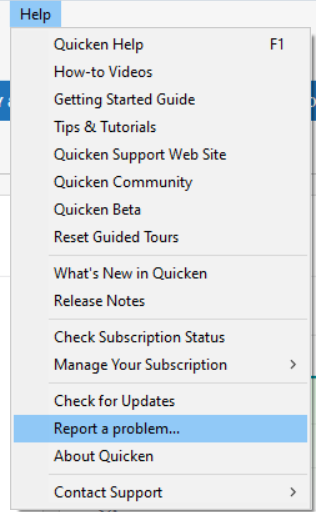

For those encountering missing transactions, duplicate transactions, and/or incorrect transactions, please provide the following information:

- How did you go through the transition to Express Web Connect+ (EWC+)? What steps did you follow?

- Did you deactivate/reactivate your accounts? Did you go through the fix-it flow? If you got the reauthorization prompt, did you use the Reauthorize button?

- For missing/incorrect transactions, what is the date range for the affected transactions?

- How many transactions are missing? How many are there, but incorrect?

- Please navigate to Help>Report a Problem and send a problem report with log files attached.

- Please include a screenshot of the problem transactions, as they appear on the financial institution website.

- Please also include a screenshot of how the problem transactions appear (or don't appear, if they're missing transactions) in Quicken.

- If you fill in the missing transactions manually, please send the logs before manually entering the transactions in your Quicken.

- Problem Reports allow a maximum of 10 attachments. If needed, you can unselect any files with OLD in the file name to make room, or you can send a second problem report with the additional attachments.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

-1 - How did you go through the transition to Express Web Connect+ (EWC+)? What steps did you follow?

-

I downloaded my 401(k) transactions for dividends & reinvestment. Not only is Quicken rounding to 2 decimal places for shares instead of 3 as mentioned above, but also downloads a Bought and a DivX transaction for each security. This results in a negative cash balance, which should be zero. How about fixing this to a ReinvDiv transaction, or at least a Bought & Div (not DivX). Used Reauthorize button to transition this account to EWC+.

0 -

Quicken Team:

Can you please fix the new Fidelity downloads (Connect+) back to three decimal places. This needs to match Fidelity. We've been downloading since 1996 with three decimal places so mutual fund shares, ETFs, etc. can reconcile with Fidelity's share balance This is causing a massive problem and the rounding is even correct in most situations. I am having to fix each downloaded mutual fund transaction manually.

Also, on another note, Fidelity Netbenefits has to be added back in as an institution so 401k shares can be downloaded correctly. Don't want to resort to manual after doing it this way for 15 years.

2 -

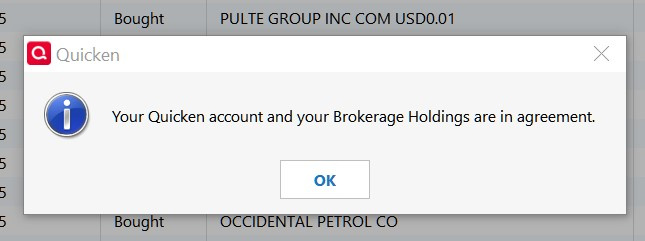

Another confusing thing was that Reconcile Shares said the Quicken account & brokerage holdings were in agreement before & after manually adding back the 3rd decimal place on the shares.

2 -

BREAKING NEWS!!!!!!!!!!!!!!!!!!!!!!!!

Spoke with the escalation team today after level 2 and 3 agents had to escalate case

Got a Ticket Number—-Very exciting!

They are working to fix these issues and ask to give 4-5 business days

3 -

Great news! Thank you, Gary.

When you actually get to speak to humans, please ask them to move the August 20 date out at least another month. There's no way they will find, fix and retest all of these problems in 2.5 weeks.2 -

Hello @CaveCreek & @nchop,

The issue with downloads being rounded incorrectly (eg 2 decimal places instead of 3) has already been reported to our teams for further investigation and resolution. If you would like to contribute to that investigation, then please navigate to Help>Report a Problem and send a problem report with log files attached. Please make sure to reference CTP-13955 in the problem report.

Thank you!

(CTP-13955)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Kristina Does the team also have the "CDs being converted to incorrect units" problem sufficiently reported? That is a major problem that must be fixed, and seems very easy to identify and rework.

0 -

Ray - When I went to initiate OSU on 31Jul25, the program asked me to 'reauthorize' all my Fidelity accounts. In working through that process, my previous method of connecting - DC under the 'zzz-Fidelity' accounts - was 'converted' (?) to EWC+ and the 'zzz' was no longer there.

When I restored my backup copy, I was able to still use the 'zzz-Fidelity' accounts update method via DC - and yes, it utilized my stored username and password to complete those updates.

I've since gone online today (01Aug25) using the previous 'zzz-Fidelity' accounts DC update method - and everything is still behaving normally. I would strongly echo the messages of others on this thread that this update is definitely not ready to be rolled out in its current form and should be delayed until further tested and verified.0 -

When fixing this, should make sure tbills don't have the same problem as CDs. They currently show up in Quicken in units of 1/10th of a bond, e.g., 1 bond shows up as 10 shares. Changing that, like changing CDs, is likely to cause chaos.

1 -

Deleted by author

Barry Graham

Quicken H&B Subscription0 -

Also for my accounts with cash, the cash balances are now showing as a mismatch in shares - so for example if I have $5 in cash, it's showing that I should have 5 FIDELITY GOVERNMENT MONEY MARKET shares but I don't have any.

I can see this is going to be the main issue here. The share misbalances can be fixed but if Quicken is now expecting a share balance to match the cash balance, which wasn't the case before, then this will be a problem.

Barry Graham

Quicken H&B Subscription0 -

I disabled updating Fidelity and updated the rest of my accounts. After backing up, I then updated Fidelity. I didn't get prompted to change connection methods (which I'd have refused). It updated with DC. After accepting 2 transactions, Quicken popped up the account is in agreement. This happened on both Fidelity accounts. I have a 2nd data file with the same accounts. It updated the same.

The option to compare is not greyed out in my Quicken. However, when I knew I had the wrong security for a transaction, compare said the website and Quicken accounts were in agreement. So it didn't work. Maybe it's greyed out because it doesn't work or maybe it'll reveal too many real or imaginary problems.

0 -

@Quicken Kristina Can you please take a minute to explain how changing the authentication process causes all sorts of issues in the downloaded data? To an uninformed layman, it would seem that there are two steps: (1) verify who you are, and then (2) process your data from Fidelity as required to download it to Quicken.

Clearly you are changing EVERYTHING in part (1). However, once that is finished and you know which user you are dealing with and authentication is successful, it would seem that NOTHING would need to change in part (2). Yet, somehow, CD quantities and prices are different, amounts are rounded differently, etc.

It would be a big help to us Quicken users if we perhaps could understand WHY this conversion is so much harder than it seems it ought to be. In addition to helping us understand what Quicken is dealing with during such transitions, it might also be helpful in figuring out what sort of errors to look for.2 -

Fidelity updates no longer working for me either. Went through the dialog box to map Fidelity accounts to Quicken accounts. Each Fidelity account now displays the correct "Last download" date (today) using "Express Web Connect+" BUT recent transactions are not posted to the account. I do not have a recent backup to revert back to "direct connect". So best for me to just wait for a fix?

0 -

Why is this conversion hard? Seems to me Quicken isn't spending enough of our subscription dollars on testing.

0

Categories

- All Categories

- 56 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub