Investment Account with Many Transactions - Poor Performance

I have an investment account that holds several SMAs. The account has been open since April 2021. The register has 14,783 transactions as of today. Needless to say, register performance is suffering. It currently takes 39 seconds for a Lot Identification on a Sell transaction to be entered into the register after I click OK. That's too much time waiting around given there are 30-50 sales a month so I am trying to figure out how to proceed to improve performance.

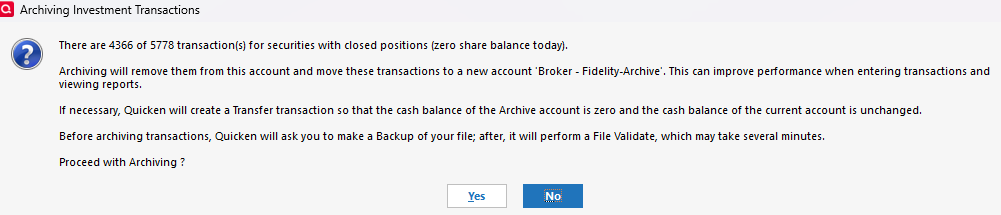

I know there is the Closed Position archive option (How do I archive investment transactions?).

I also discovered an older thread where a poster suggested the following approach:

When I find the decay excessive (per my standards), I open a new account, use Shares Transferred to move existing holdings to the new account leaving all historical in the older account for later review, and possibly correction if needed. I do not bother with 'closing' the older account. Though the option to archive has been available for a while, that also is a tool I have not used. I don't see the need, in my usage.

I'd appreciate more feedback from users about which option might be best. Preserving the accounts intact and starting a "new" one appeals to me but obviously Quicken recommends the archiving solution. Curious about others' experience. Thanks!

Answers

-

Use Archive, as described in this thread

https://community.quicken.com/discussion/comment/20501016#Comment_20501016?utm_source=community-search&utm_medium=organic-search&utm_term=archive

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

I consider user preference. I suspect your older post reference refers to one of mine. My procedure predates the existence of the Quicken-programmed ‘archive’ process.

I last used my process 1/1/21, soon after the archive process was introduced. I wasn’t ready to make a transition to that process. As it stands now with respect to my most active long-standing account, I have a pre-2021 account, a 2012-2020 account, and a 2021+ account. That seems pretty easy for me to manage.

Those who have used the archive process seem satisfied with it. I suppose my first quandary with it is that there seems to be no clean line (date) of demarcation with it. That seems potentially confusing to me. Second, there appears to be no clean way to merge or combine two separate archival accounts. Is it necessary to do? Is it cleaner to do? How often do you need to archive? Mostly, I don’t know.

Again, for my account, I have typically run my process when the account bogged down with 8-10,000 transactions -well below your 14,000. Clearly, your account is accumulating transactions faster than mine does. Should that factor into your choice? Maybe, maybe not.

1 -

I thought of another possible factor which is that removing closed positions may not actually change the register transaction number that significantly. Does it only archive the lots that you no longer hold ANY shares of the stock? So let's say the account purchased 4 shares of a stock and then sold 2 shares and still has 2. It would not archive ANY of those? Is there a way to run a report to see how many closed positions there are? I looked in the Investment Transaction report customization and couldn't find anything that looked useful.

I exported the transactions to excel and ran some COUNTIFs and got this breakdown:

- 3104 Purchase transactions

- 3475 Sell transactions

- 4985 Dividend transactions

- 767 Tax transactions

- 1033 Fee transactions

So even if I do the closed position archive and it eliminates 50% of the Buy/Sell transactions (which is a wild estimate, I have no idea of how many positions are closed) I will still have over 10k transactions in the account. It the performance decline just because of the transaction number (of any kind?) or do positions have some specific bearing on register performance?

I guess this means I need to use the new account strategy if I really want to see improved performance. Unless anyone has any other ideas?

0 -

You can back up your data file, then try the archive and see what impact it has on your performance. If you don't like the result, restore the backup.

Please let us know what you find.

QWin Premier subscription0 -

I believe the entire holding in the security needs to be closed for that security to be archived. But the archive process also extracts the dividend-type transactions including reinvestments and (I would expect) any MiscExp transactions associated with that security. So if fees and taxes are tied to a closed security, they would (could) also be archived.

You can certainly back up your file, archive, and then restore if you don’t like the results.

0 -

Quicken's archive process worked reasonably well for me this week, in an account with a very high level of trading activity. I was glad to see that even though I "hid" the archive from my account list, I am still able to use it for current-year reporting. The register is still slower than I would like, when entering transactions, but it's much more tolerable.

I create a new Quicken file each year, and at the end of this year, I will probably also apply the procedure in which I transfer open positions (and their cost bases) to a new account. This workaround has worked smoothly for me in the past (I have done it every couple of years in the past). Unlike many users (I suspect) I will then delete the old account from the current-year file; doing so allows me to delete a large number of option securities with expired CUSIPs (options are a significant contributor to the transaction volume indicated in this screenshot).

0

Categories

- All Categories

- 56 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub