Recently announced Altruist-Plaid-Quicken connection not working

Quicken Classic Premier

Windows 11 Pro

Version R63.21

Build 21.1.63.21

My advisor sent me the following yesterday and I was hopeful that I would finally be able to download transactions for my Altruist accounts. Unfortunately, when I follow these instructions, Quicken still creates the old and limited "Simple Investing" accounts that do not transfer transactions.

Anybody successfully created Altruist accounts using the new Plaid connectivity and can retrieve detailed transactions? If yes, please let me know the steps.

Thanks for any help.

*******

Plaid Core Exchange Overview

Altruist’s integration with Plaid Core Exchange makes it easy for account owners to link their Altruist accounts with thousands of popular financial apps, including budgeting tools like Monarch and Quicken.

Through this integration, account owners can securely share their account balances, positions, and transaction data from Altruist with over 2,600 Plaid-supported apps. Data sharing is fully tokenized, meaning user credentials are never shared with third parties.

Connectivity via Plaid Core Exchange

To connect your Altruist account, simply follow the prompts from within the Plaid-supported app (such as Monarch, Quicken, or another supported app). The connection is always initiated from within the destination app, not from within Altruist.

General steps:

- Open your Plaid-supported app and go to the section where you link a financial account.

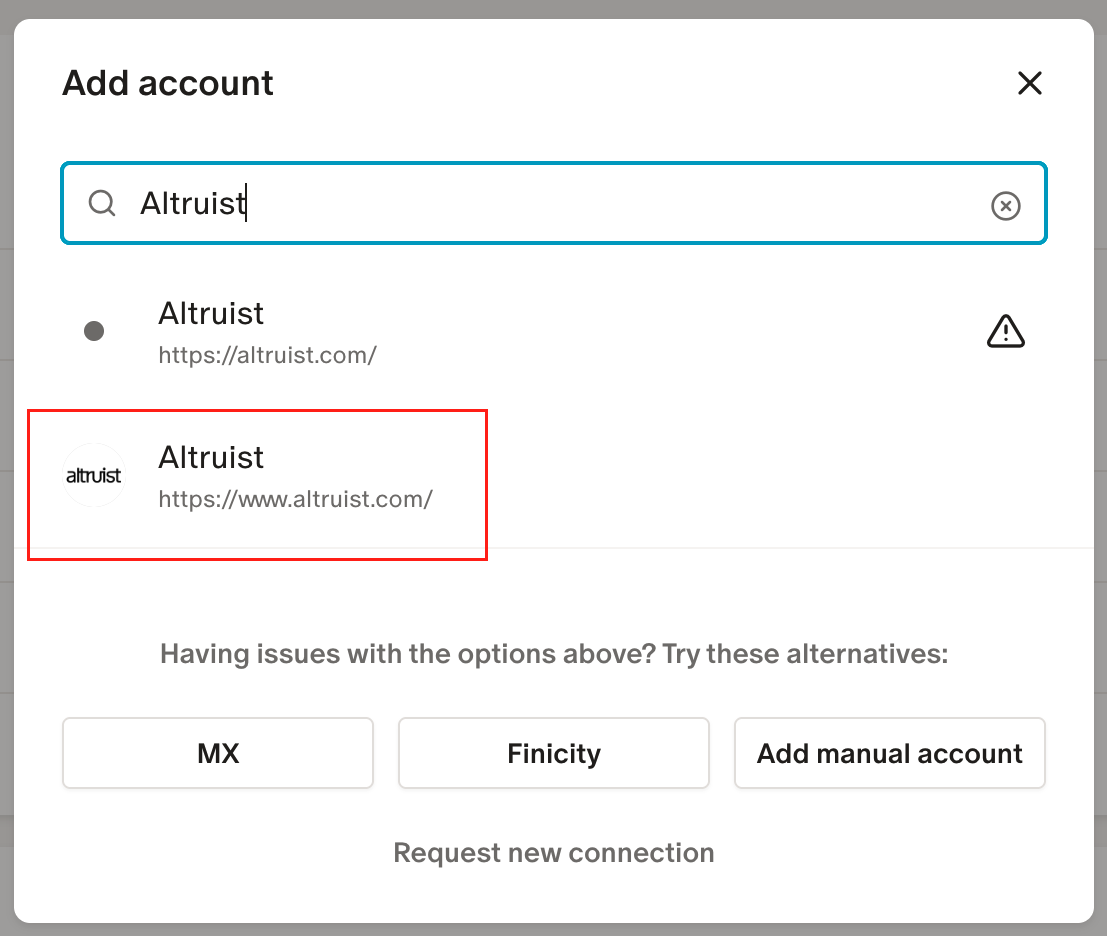

- When prompted, search for “Altruist” [https://www.altruist.com/] in the list of available financial institutions.If you see multiple connection options for Altruist choose the one that maintains the Altruist logo. The alternative connection option works through MX screen scraping, and we do not support or recommend its use.

- Select Altruist and follow the secure login and authorization steps.

- Once connected, account balances, positions, and transactions will begin syncing automatically with the app.

Frequently Asked Questions

Q: What data is shared with Plaid Core Exchange?A: Altruist account, demographic, balance, holdings, and transactions data are shared with Plaid Core Exchange and, by extension, Plaid-supported apps.

Q: Are historical transaction records shared with Plaid Core Exchange?A: Transaction records for the previous 30 days will sync to Plaid Core Exchange and, by extension, Plaid-supported apps after initial connectivity has been established. Individual apps may limit the amount of Altruist transaction data they display.

Q: Are client credentials exposed to Plaid Core Exchange and Plaid-supported apps?A: No. Data sharing is fully tokenized, meaning user credentials are never shared with Plaid Core Exchange or Plaid-supported apps.

Q: Who can initiate connectivity?A: Owners or joint owners of the account can initiate connectivity from within the Plaid-supported app using their Altruist Client Portal login credentials.

Q: Are there any actions required within the Advisor Portal before the account is available to connect?A: The account must be assigned to a household before being available for connectivity via Plaid Core Exchange.

https://app.altruist.com/support/sso?startURL=/s/article/Plaid-Core-Exchange

Comments

-

Hello @MeToo,

Thanks for reaching out and providing that information.

I want to clarify an important point: although Altruist’s messaging states that their integration with Plaid Core Exchange allows connectivity with “financial apps like Monarch and Quicken,” that information is unfortunately incorrect when it comes to Quicken.

Quicken does not use Plaid as its data aggregator. Instead, Quicken relies on Intuit for all account connections and transaction downloads. So even if Altruist is fully integrated with Plaid, it will not enable transaction downloads into Quicken unless Altruist has also established a separate data-sharing agreement with Intuit.

If Altruist wants their accounts to work properly with Quicken (beyond limited "Simple Investing" support), they’ll need to partner directly with Intuit. I’d recommend contacting Altruist and encouraging them to explore this if full connectivity is important to you.

Hope this helps clear up the confusion!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

@Quicken Jasmine could they be referring to Quicken Simplifi? From what I understand Quicken Simplifi uses Plaid as one of their data aggregators, among others. I could be wrong though.

0 -

@Quicken Jasmine can you please confirm that Quicken Simplifi indeed support Plaid connection to download accounts and transactions? This will not solve my issue as I use Quicken Classic but at least I will know if Altruist has a connection to Simplifi.

Thanks for your help.

0 -

@Quicken Jasmine - hope you don't mind me jumping in here but I found some information that might clarify the situation. Please let me know if I have misstated anything.

@Austin@ @MeToo from what I understand, Quicken Simplifi does not currently use Plaid as their data aggregator. It uses Intuit the same as Quicken Classic.

Also, all investment accounts in Quicken Simplifi use the Simple Investment Tracking Method. So even if Plaid was used as their aggregator, it wouldn't make any difference.

From what I have read on Plaid so far, most think it is something to avoid. It seems to have more connectivity issues than Intuit.

Here is what Copilot has to say on the topic -

No, Quicken Simplifi does not use Plaid for its financial data aggregation. Instead, it relies on the same aggregator used by Quicken Classic, Mint, and QuickBooks—which is Intuit’s proprietary aggregator.

This means:

- Your financial institution connections in Simplifi are handled through Intuit’s infrastructure.

- It avoids some of the connectivity issues users experience with Plaid, especially with institutions like Alight 401(k).

- If you're evaluating apps based on Plaid dependency, Simplifi is a solid option for avoiding it.

🔌 Aggregator Comparison

App

Aggregator Used

Plaid-Based?

Notes

Quicken Simplifi

Intuit Aggregator

❌ No

Same backend as Quicken Classic and Mint. Strong with major banks.

Monarch Money

Plaid

✅ Yes

Clean interface, but Plaid can struggle with some 401(k) providers.

Copilot

Plaid (and others via MX)

✅ Yes

Uses Plaid primarily, but MX integration helps with some institutions.

🧠 What This Means for You

- Simplifi is ideal if you're tired of Plaid-related sync issues, especially with retirement accounts or smaller banks.

- Monarch offers a beautiful UI and great budgeting tools, but its reliance on Plaid can be a dealbreaker if your institutions aren’t well-supported.

- Copilot is visually slick and improving fast, but still Plaid-heavy. MX helps a bit, but it’s not a full solution.

🛠️ Troubleshooting Tip

If you’re running into issues with a specific account (like Alight 401(k)), Simplifi might be your best bet. Intuit’s aggregator tends to have better support for employer-sponsored retirement plans.

1 -

@CaliQkn Thanks. This definitely clarify that there is no Quicken product that interface with Plaid. And it seems that this is a good thing as Plaid has a poor reputation.

I will connect again with Altruist customer support now that I have a good understanding of what Quicken use for aggregation.

0 -

Thank you for sharing this information!

Very helpful!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub