What’s Going On Between Fidelity and Quicken?

Comments

-

"ONE RING TO RULE THEM ALL". I have heard that somewhere. And in this case "ONE THREAD TO MONITOR" Would be nice. I am watching these threads,

Is cash handling in a Fidelity brokerage account part of the Fidelity issues I see posted?Problem managing cash in Fidelity account after switch to EWC+ONGOING 9/29/25 Fidelity Investments - 401(k) Unidentified Security during cutoverUPDATED 9/25/25 Fidelity Cut-Over MigrationThis thread was one of my problems, but seems reauthorization is no longer in loop. But never say it's FIXED!

Fidelity CC-901/Reauthorization LoopTwo of my 4 Fidelity Accounts seem to be managing Cash correctly (Both ROTHs), My Brokerage and IRA still show mis-match dialog when I do OSU and accept new transactions. It states Fidelity has my Cash in a Money Market, but really in the Core (Cash) position (which does have a "behind the scenes" MM Fund).

This thread is the longest and if someone could merge the others with it, then perhaps this would be the ONE to post all new or repeat problems and possible solutions others have found working for them.

My "comments" to Quicken:

- A better explanation from Quicken about the Handling of Cash from Fidelity. I did the process of clicking on the Cash Balance within Quicken and selected that I wanted to handle Cash as Cash not as a Money Market Fund. These options are no longer available and the Cash Management option on the Online Services is also no longer present. As you can see from my first paragraph above THIS IS STILL A PROBLEM!

- This is a general comment and I am sure you are hearing this from lots of users. QUICKEN MUST SIGNIFICANTLY IMPROVE IT'S TESTING CAPABILITY BEFORE ROLLING THESE CHANGES OUT TO USERS!!! This is not the first DC to EWC conversion that has required a lot of fixes and research by your user group. Where were those "Lessons Learned". I am a former software developer, application analyst, project leader, IT supervisor, IT Manager and a Director of IT at a Fortune 100 company, and if we only documented Lessons from a prior bad event and did not incorporate that into a 6 Sigma project to improve our development/testing/implementation processes, many of us would not have had the long and lustrous careers that we did have. I have no idea what your internal SDLC (Software Development Life Cycle) is, but it clearly is lacking.

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram3 -

Over a week now with zero downloads from Fidelity. Support center has no ETA on resolution. Its time to contact investor relations and issue a formal complaint.

1 -

It would be most helpful for support to provide the moderators on this community a running list of Fidelity issues and their status such as FIXED, RESOLVING, GATHERING DOCUMENTATION, UNDOCUMENTED and ticket # etc. so that the moderator can post an announcement of the list that we can monitor. I make the assumption that support is organized in keeping track of issues.

Deluxe R65.29, Windows 11 Pro

0 -

This content has been removed.

-

"This discussion thread MUST be the longest (15 pages and adding more every day!) on this discussion board!"

You missed the over-under by a long shot: zzz-Fidelity Updates is at 36!

I'll add on to the requests for the mods to consolidate the list of issues and actions. It seemed there were some attempts to do that for a bit, but it went by the wayside.

I'll also add that if anybody is able to revert to a back-up with the zzz-Fidelity Investments - DC direct connect connection it may well be worth it for you. I have not converted and everything is downloading and tracking just fine. (64.30) I won't be changing until I am forced to.

4 -

I know Quicken was working with Fidelity in early September to get things right and rolled out the switch / options on handling cash balances 9/25. Are they still working to get downloads on track, or what do I do? My wife and I have multiple accounts with Fidelity including taxable and IRAs. A few are fine and 6 we care about downloading are a mess. For the 6, some fail to download anything past 9/12 9:00 pm and some Quicken tells me don't exist. On the ones stuck at 9/12, Quicken shows a successful update but as of 9/12 9:00 pm (despite our having numerous transactions thereafter). I have tried deactivating all accounts and linking them again all at once, deactivating again and tried linking one at a time, deactivated again and tried linking seriatim: adding 1, then linking it and the next, then linking the prior 2 and a 3rd, etc., all to the same effect, a few work and the rest do not.

0 -

You are correct about the two-day delay in the data. The update info in my Quicken Data file is "Holdings at Fidelity Investments as of 10/3/2025 12:00:00 AM."

I do not think this delay existed before this updated connected type in Quicken was introduced.0 -

EWC and EWC+ downloads have always lagged by up to 2 days after DC but it is more common for the lag to be in the 12-24 hrs range. In other words, the EWC+ delay in data downloading is not unique to Fidelity.

This is because of a timing issue that is inherent with the EWC/EWC+ connection method. Intuit (the aggregator) generally connects at night with the financial institutions (FIs) to download. Intuit saves that data on their server(s) where it remains until we do OSU and that data is then downloaded from Intuit's servers into Quicken.

Often Intuit downloads from the FI after the FI has done their nightly update of their servers with the day's transactions data and then saves that data on their server(s). When we run OSU, the data we get is the prior day's data that is on Intuit's servers.

But if the FI has not completed their server updating by the time that Intuit connects with the FI, then what gets downloaded to Intuit is the transactions data not from the prior day but from the day before that….in other words, from 2 days ago. Then when we do OSU we get 2-day old data downloaded into Quicken.

DC generally is more real time so this data delay does not occur. Also, Intuit is not directly involved in the DC OSU process so there is no 3rd party involved in the process.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

2 -

SO, why is Quicken (which is no longer owned by Intuit) using Intuit and EWC+?

DC has worked remarkably well, why move away from it and force pain on Quicken Users? Quicken states it is the FI organizations forcing this, but clearly Fidelity still supports DC, I even have a single Citi Card that still uses DC along with my Etrade Brokerage account.

I am on EWC+ and yesterday, (10/3) I actually received some 10/3 transactions, however instead of the Action being marked as Div and Category _DivInc they were marked as Deposit with NO Category assigned. SO it not just about missing transactions or timing of transactions, its about the integrity of the data coming via EWC+ from Fidelity. I know I have some Backups from Aug, before this madness began, what would be the process of reverting back and how would I ensure I was connected via DC?

Is this where my accounts appear with the zzz- prefix. This prefix did not exist previously or this the prefix used by Fidelity Net Benefits (Which I do not have)?

Would all my other transaction updates from Fidelity and host of other accounts sync up and get me back to an accurate Current State? Seems Risky and Time consuming, but considering the Time we are all spending on this adventure and the Risk of inaccurate Transactions, maybe worth considering. If one were to accomplish the return to DC for Fidelity, is it for not as Quicken will still FORCE the EWC+ conversion on us again?

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram0 -

@Jim_Harman Nope, all one account/one login. Clearly the process is handling accounts differentially.

0 -

I don't get a two-day delay with other institutions using EWC+, usually by 7AM Pacific time everything from the previous day is ready. Hopefully the process with Fidelity will catch up to that.

One tangential question I have on EWC+ is if it is end-to-end encrypted, I've looked for this information and haven't found anything definitive. That is, even though the info is stored encrypted on Intuit's servers do they have the keys to read it, or is it encrypted by the FI first using my keys so only I can read it (the cloud problem)?

Bob

0 -

@Movie Nut

"Is this where my accounts appear with the zzz- prefix. "Prior to the ~7/31 beginning of the cutover, the direct connect was just listed as Fidelity Investments. They added the zzz- as they parallel tracked the DC and W+EWC+. The zzz-Fidelity Investments thread has some instructions on reverting (somewhere in that 36 page thread). Sorry, I don't have first hand experience because I never changed my connection method.

0 -

As mentioned, 1-day delays are most common for FIs that are set up with EWC or EWC+. 2-day delays are not as common but I have occasionally seen that happen with my Citi credit cards. And it happens fairly frequently with my Fidelity Rewards Visa when I am set up for downloading with Fidelity Investments which is not only an EWC+ connection but it is also 1 step removed from the data originating FI which is Elan Financial.

One correction to what I posted above: I'd stated that EWC and EWC+ downloads from the FIs are saved on Intuit's server(s). I believe that is correct for EWC downloads but I just noticed that EWC+ downloads are saved on "Quicken-hosted" servers.

Regarding encryption: I do not know all of the encryption details but Quicken does state that data that is downloaded (regardless of the connection method) and login information (for DC and EWC) is encrypted. EWC+ does not use logins to downloading, it uses rotating security tokens that are managed via the FI through the Authorization/Reauthorization process. You can read more about this in this Support Article: .

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

Just checked my first 401(k) and deferred comp contributions on EWC+ and of course there were issues.

For DC, it simply didn't download two of the purchases so I had to manually add them. For another that was a dividend, it categorized it as a deposit so I had to manually change it to ReinvDiv. And every time I've run a OSU since then it tells me I have new transactions to review and accept but those transition(s) are nowhere to be found. And I get a popup error for "Enter a valid date." when I click on the account.

On the 401(k) side, it listed a few as Uncategorized so I had to manually update them to tell what each purchased. I also noticed that all of the Fidelity-only funds are not getting their prices updated daily so I have to manually look each up and update it. I've had this account for over a decade and those prices would update before EWC+. Really frustrating.

0 -

SO, why is Quicken (which is no longer owned by Intuit) using Intuit and EWC+?

Every personal financial planning/reporting software and app uses 3rd party integrators to gather the financial data from the financial institutions (FIs). Intuit is a 3rd party integrator and when they owned Quicken they designed Quicken to use Intuit's proprietary integration protocols.

Also, we will never know the details of the Quicken buyout agreement between Intuit and Quicken's buyer but I would not be surprised at all if there was a term in there requiring Quicken to continue using Intuit as their 3rd party integrator.

EWC+ is Intuit's and Quicken's response to a relatively new data sharing protocol for the USA and Canada called FDX. There is a very large consortium of FI's that developed FDX to arrive at a common data sharing protocol instead of the mishmash of protocols that have previously existed. (I know in Canada this was an initiative resulting from Gov't legislation. I do not know if there was USA legislation behind this, as well.) The FIs are the instigators behind FDX and data integrators and reporting entities like Intuit and Quicken were included in the process because if they were not it would ultimately mean the end of the data integrators and data reporting companies like Quicken.

You can read more about FDX at:

DC has worked remarkably well, why move away from it and force pain on Quicken Users? Quicken states it is the FI organizations forcing this, but clearly Fidelity still supports DC, I even have a single Citi Card that still uses DC along with my Etrade Brokerage account.

Which connection method(s) a FI supports and does not support is solely a decision owned by the FI. Most FIs (by far) do not elect to support DC because of the costs involved (annual fees due to Intuit). Instead they support EWC, EWC+ and WC which do not come encumbered with annual fees. With the introduction of EWC+ more and more FIs are migrating to it and we've been told that long term it will likely entirely replace DC and EWC.

Yes, some FIs have continued to support DC after they have cut in EWC+ and we have not been made privy to why those FIs have continued to do so but given the annual fees they must pay there must be some business case justification.

Others, like Schwab, have completely abandoned DC after they cut in EWC+. Fidelity is one of those FIs that has decided to completely discontinue support for DC once EWC+ is cut in. And, yes, this is solely a decision that Fidelity has made and owns. Quicken management personnel (development, marketing, sales, customer support) have all directly told me on multiple occasions that Quicken and Intuit will support any and all FIs that wish to continue supporting DC.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

The zzz- prefix is commonly used by Quicken to indicate that the Add Account/Set Up Now listing will soon be obsoleted.

Often, not always, that listing will remain active for those who where previously connected to it before the addition of that prefix but new download connections will not be able to be made with it. This is what we are currently experiencing with Fidelity. Restoring a backup file which still has the DC connection intact allows us to download via DC but new DC connections cannot be made with it as it is not included in Add Account/Set Up Now.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

After upgrading to R64.30 my Fidelity transactions began to download correctly for several days. Now they have stopped doing so. No end of month data from any of my accounts. Last downloaded a transaction on 9/29 and nothing since. What a disaster this has been.

0 -

>After upgrading to R64.30 my Fidelity transactions began to download correctly for several day.

There may be a delay of a couple of days in receiving the data with the new connection.

0 -

Based on the announcement: "NEW 9/24/25 Fidelity Investments - Changes to Money Market/Cash holdings", I "Reset" all of my Fidelity account within my EWC+ Quicken file. Of our 9 fidelity accounts, 7 properly identified the core money market fund and has stopped downloading changes as security changes, yippee! Unfortunately our 2 HSA accounts in the EWC+ file continue to download as security changes.

Then I went back to my DC file backup, made a copy and went through the whole Reauthorization process again, same result.

A clue as to what may be going on is that the 2 HSA accounts that continue to download core money market funds as securities are the only 2 accounts that download core money market transactions as cash on the DC file. Sigh, big improvement for me but I wish it was consistent.

Anyone else running into this?

Quicken Classic Deluxe; Ver R64.30, Build 27.1.64.30; Windows 11 Home – Quicken user since Windows 3

Currently I'm performing daily backups on Quicken files and maintaining 2 identical files, one using the old DC connection method and the other the new EWC+ connection method. I'm doing this to identify and potentially debug issues with online updates.

0 -

First thanks for all the feedback and suggestions. I found a 7/28/2025 Backup file that still had Fidelity connected with DC (zzz-Fidelity account names). On my laptop still running R63.21 Build 27.1.63.21 I restored the 7/28 backup file and performed a OSU. Welllll, that's 2 days of my life I will never get back. I knew I would have quite a bit of work to ensure all transactions processed correctly, but it was a chore. In the end ALL accounts matched between my two files, even to the exact penny on a Net Worth report.

However, I did learn a couple of things, that might help the process in the future, if I REALLY need to do this again. First, before I accepted any downloads, I should have went to my Bill and Income reminders and filled them out with the actual amounts processed and entered them. This would have allowed more Match vs New transactions. Then, I think the proper sequence is to validate the investment accounts, as they sometimes dump deposits into other accounts. I did leave my Checking to last and that was a great decision. And of course a lot of my categorization was missing from the Restored version after OSU.

HOWEVER, what I found was MANY transactions from my Fidelity ROTHs did not download. Mostly 6/23, 6/30, 7/31. This is very disturbing as without doing the full match against Fidelity, I was unaware of these missing transactions. Also many of my other accounts did not download all transactions, so I had to compare against my current EWC+ version 64.30 (I refer to it as Master version file).

On the plus side I did discover a couple of transactions in my Master version that Fidelity/Quicken did not process correctly, a stock split on 8/5/25 and I still had some Cash in a MMF which I removed.

Would I do it again, NOT SURE but like @SeaSilver8, I will run dual updates on the 2 identical files, one using DC for Fidelity and the other the new EWC+ for awhile.

Does anyone think it would be safe to update my laptop version 63.21 with the DC connections to 64.30, or would that automatically convert the DC connections to EWC+.

Has someone from Quicken taken the suggestion of creating "One thread to rule them all" on this Fidelity EWC+ problem that incorporates the incorrect handling of CASH, missing transactions, inconsistent OSU results, etc, etc, etc.

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram0 -

@Movie Nut I'm running 64.30 with DC - no problem doing that.

1 -

I typically attempt to perform an online update prior to the 9:30am EDT, prior to when major US markets open. This morning my DC connection file downloaded transactions in about 5 of my 9 Fidelity accounts, but the Quicken files using EWC+ did not download any transactions. This is the first time this has occurred to me. I waited a while and using a backup, reattempted the online updates with the same results. I plan to reattempt backups tomorrow.

As an retired Software Engineer & Manager, it is sad that a project primarily changing a connection type would be so unstable after all these months since being released to the public. This ultimately may incorporate some improvements for users, but the user experience during the transition has not been pleasant. I wonder if there has been an uptick on subscriptions not being renewed as a result.

Quicken Classic Deluxe; Ver R64.30, Build 27.1.64.30; Windows 11 Home – Quicken user since Windows 3

Currently I'm performing daily backups on Quicken files and maintaining 2 identical files, one using the old DC connection method and the other the new EWC+ connection method. I'm doing this to identify and potentially debug issues with online updates.

1 -

@Movie Nut I checked my travel laptop and it also was using Quicken Deluxe R63.21 Build 27.1.63.21 I ported a backup of my DC connection file to that laptop and the update performed as expected.

I then updated to Quicken Classic Deluxe to R64.30 Build 27.1.64.30 performed the same update on a backup DC file and it had the same results.

It worked for me, hopefully it will also work for you. Just remember to click the "Remind Me Next Time" button and have a backup.

0 -

@SeaSilver8 Thanks, I will follow your steps this afternoon. Your help is greatly appreciated!

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram0 -

test 1

0 -

Could not agree more:

QUICKEN MUST SIGNIFICANTLY IMPROVE IT'S TESTING CAPABILITY BEFORE ROLLING THESE CHANGES OUT TO USERS!!! This is not the first DC to EWC conversion that has required a lot of fixes and research by your user group. Where were those "Lessons Learned"?????

It's like Quicken never learns and (over the 30 years we've used it) have no sense of comprehensive testing and Beta Testing with (test/guinea pic) testers. While I understand 'part' of the problem is with Fidelity (whom I've been with for 20 years), based on the volume of Fidelity clients across the world and Fidelity's capitalization, one would think Quicken would have created a Tiger Team to deal with this, even if they have to storm Fidelity's front door.

Additionally, I remain SO DISAPPOINTED that Quicken NEVER emails users when a (REAL!) fix is implemented. They have our email addresses! One always has to call in and 'hope' they get the 'right' agent and the 'right' answer. As a minimum, Quicken should email users who actually take the time to identify and problem or force a new case to be opened. Hasn't happend in the 30 years I've notified (initially Intuiut) Quicken about problems.

Time to contact Investor Relations!

1 -

RoofHousehold,

Could not agree more. Schwab conversion ring a bell??? That took like 4 months? to work?

0 -

@RoofHousehold Word…

0 -

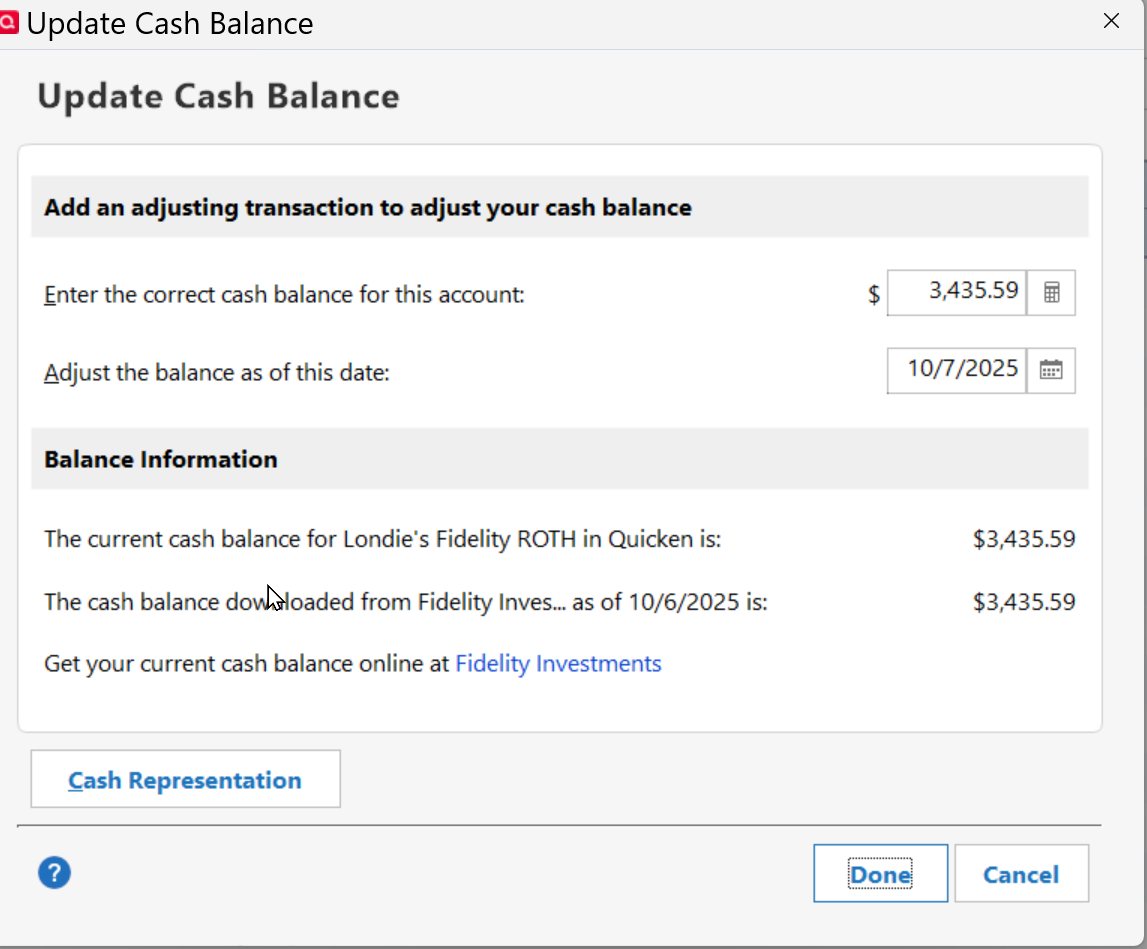

HOLLY COW! Did Quicken and Fidelity finally fix the Cash vs MMF issue.

Prior to any OSU updates today, I Backed up my DC file and then upgraded my Laptop to R64.30.

I then performed OSU on both my DC and EWC+ files tonight (6:45pm pst). On the EWC+ file, when I selected each of of my fidelity accounts, on 3 of my 4, I was prompted for the decision on how I wanted Cash treated. I selected CASH and it appears my accounts now show the balance I have been looking for. One example below:

Notice the "Cash Representation " button is back.

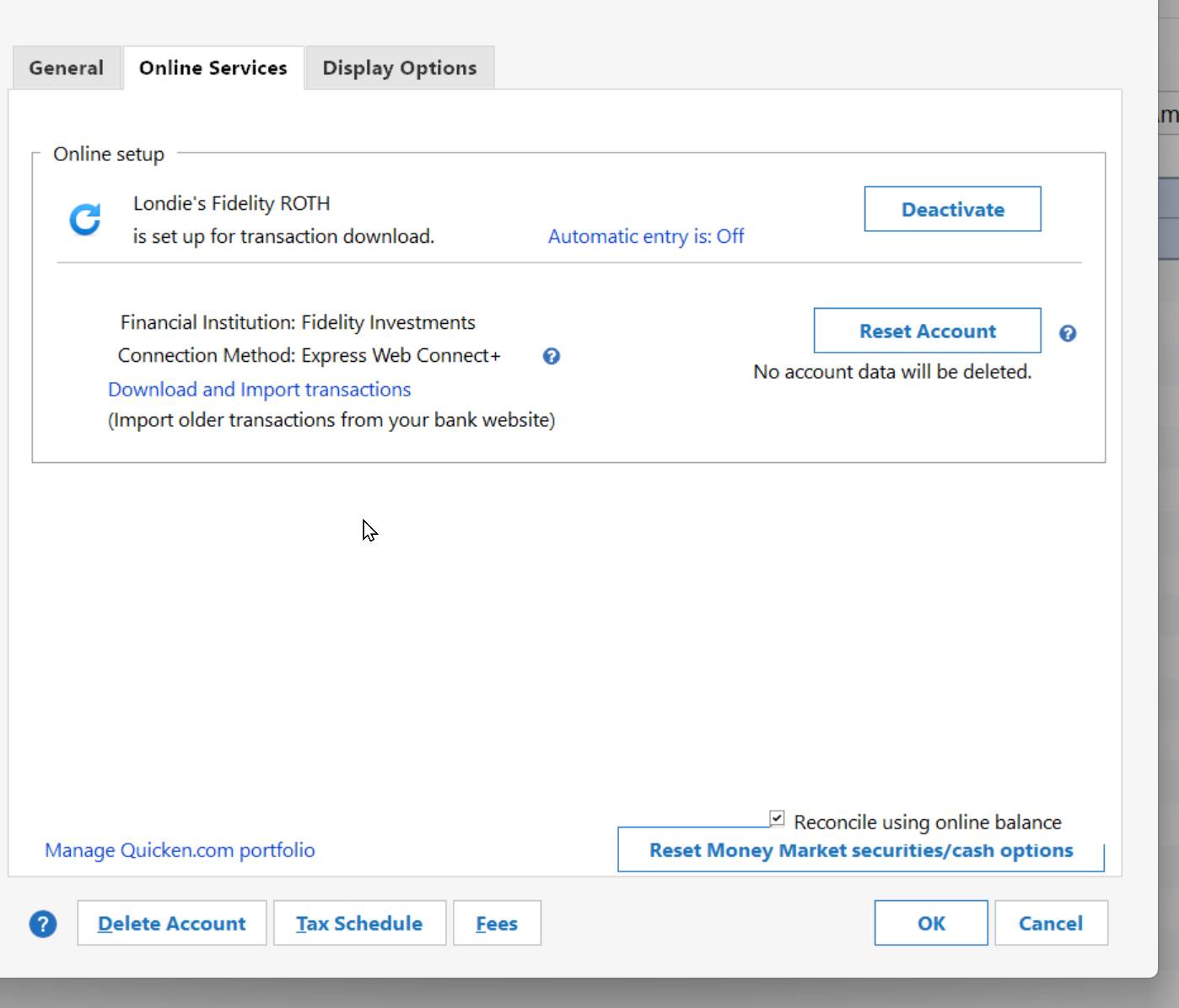

Also the "Reset Money Market securities/cash options" is back on the Online Services tab.

My Fidelity Brokerage account is still missing the "Reset Money …." and "Cash Repre…." buttons.

On the DC file, the OSU processed correctly with the same transactions as my EWC+ file, but none of the Cash Options appear on any of those Fidelity accounts

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram1 -

@Movie Nut Thanks for letting us know it's working for you.

I'm going to wait until a few more start to report that it's safe to convert to EWC+ before I try it out (after backing up my current file).

0

Categories

- All Categories

- 60 Product Ideas

- 34 Announcements

- 239 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub